Long weekends are always a great way to get rejuvenated for the week ahead, but I’m always itching to get back into my routine.

There is always a good amount of uncertainty that goes into carrying positions overnight…let alone an extended weekend.

This is even worse when the markets are making knee-jerk reactions to any blip of news that comes out.

This is why I let my proprietary trading strategy determine the direction I am going to take for my trades.

There’s no reason to get tied up in mind games with the markets, it’s best to let mathematics and the forces of nature do their thing.

When I harness the power of Fractal Energy it gives me an advantage I simply don’t want to pass up…

Today, I am going to pull back the curtains and let you see exactly how Fractal Energy controls the markets.

Why Do I Trade

One question I get asked a lot is, “Why do you trade?”

As a business owner and entrepreneur, I am always on the hunt for ways to increase my wealth across a diversified group of businesses.

It’s reported that the average millionaire is reported to have at a minimum 7 sources of uncorrelated income in order to continue to build steady wealth – regardless of the economy.

From building several multi-million dollar companies and working with entrepreneurs from all over the world, I’ve found one thing that is common among them.

They all have investments in the financial markets that go beyond a buy-and-hold strategy.

This shouldn’t come as a surprise, but it takes a strategy to make money in the financial markets, or you’re just gambling.

But wait a minute… doesn’t that mean I am always at my computer actively trading?

No way! On top of running several businesses, I am a husband and a father.

So, the time I allocate to anything must be worth my energy and must be a form of passive wealth building.

I thought trading is risky?

Well, it depends on your style of trading.

For myself, I make sure what I do has a defined edge in the markets! To fit my business plan, I require a system that I can manage in under 1 hour per week that offers low-risk profits!

I can’t afford to be glued to my computer screen, chasing a recent biotech high-flyer stock for 250% gains. That works great for some, but not wealth builders like me.

That’s why I created my passive income-generating algorithm for trading stocks.

It’s a reflection of myself and my business style that aims to collect steady profits in any market condition.

And what I wanted to achieve is a business in the stock market and getting paid to trade.

This means I want to be the “house”, and unlike many traders, I will focus on credit strategies instead of debit strategies!

Without waiting anymore time… let’s talk about Options Profit Planner and how it can turn your trading business around in as little as 1 week!

Options Profit Planner

Trading is a zero-sum game, where you have money transferring hands between that of winners and losers.

I can tell you two things… I hate losing and hate giving away money!

That’s why I came up with a way that can give me an edge over the market competitors. I wanted to even the playing field and make sure I am generating income for my business.

What was this edge? Simply reviewing a stock chart doesn’t tell the entire picture… you need tools that help you decipher exactly what is happening in the stock market!

By combining chart patterns, technical analysis, and fractal energy I found a way to give me an edge against the competition.

Going crazy with indicators rarely works for traders. Instead, I hand-selected only the best to include into my trading strategy for Options Profit Planner.

The proprietary Technical Analysis combination for Options Profit Planner is made up of:

- Fractal Energy Indicator

- Bollinger Bands

- Candlestick patterns

- Fundamental Analysis screeners

And that’s it! There is no reason to make this more complicated than it needs to be.

Looking to learn more about my proprietary Fractal Energy Indicator? Get access to Fractal Energy here!

The Power Of Combining Indicators

Combining indicators is a bit of black magic. Get it wrong, and you will watch your trading account continue to take losses.

It’s something called, “analysis paralysis”, where you get stuck and can’t make heads or tails of a trade. When that happens you will routinely get stuck on the wrong side and end up taking a loss on your trade.

Fractal Energy

Fractal Energy is the cornerstone indicator of Options Profit Planner and its power is used to pinpoint key market reversals.

The power of fractals allows me to tap into the core of a stock and determine the strength of its price action and how much “life” is remaining in a stock’s trend.

Fractal Energy is made up of two key components:

- Fractals – The greatest mathematical equation that explains the length of a coastline.

- Energy – The amount of potential energy or power stored in a stocks trend.

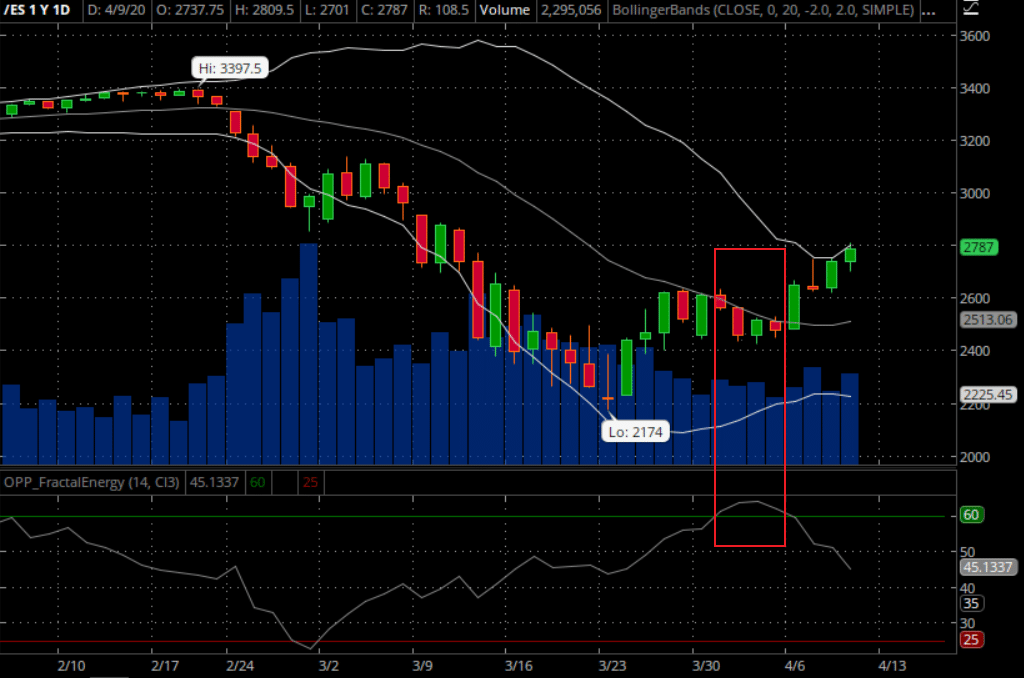

Here is an example of the S&P500 e-mini futures contracts and how Fractals impacted the movement of the entire market.

Source: Thinkorswim

In this example, the Fractal Energy indicator goes into a “charged” zone when it’s value exceeds 60.

When the value of the indicator exceeds 60, it is considered “fully charged” and a large, outsized move is expected in the near future.

This trade breaks down

- Fractal Energy indicator reached new highs, signaling the markets have enough energy to continue trending

- Once the stock moves, energy will be depleted. The slower the depletion the better.

What happened?

Well, the stock broke out from the consolidation pattern that it was forming and pushed higher over the following week.

Unfortunately, you can’t look at any trading signal alone. Let’s take a look at how Candlestick Patterns can be used with Fractal Energy and how to use them to improve the chances of a winning trade.

Candlestick patterns

Another form of technical analysis is being able to understand candlesticks and the patterns formed by price action on a chart.

When looking for chart patterns, there are many options for a trader to choose from. One of the most popular continuation patterns used by traders is the triangle pattern.

Here is an example of a triangle pattern in the SPY.

Source: Thinkorswim

What I Expect For The Week Ahead

Last week, I discussed the possibility of a triangle setup occurring on the S&P chart. When looking at the Fractal Energy, it is possible to see a fully charged Fractal Energy as the pattern finished its formation. I am expecting the energy to make the stock to explode in the direction of the triangle pattern.

And that is exactly what we got.

So, now that we see prices rallying after the breakout, the price action is telling us a slight pullback might be coming.

Therefore, I will be setting up to sell puts or puts spreads on the fade across the broad markets and any stock that meets my minimum requirements.

Wrapping up

There is a lot of headline risk in the markets recently and with uncertainty over a cure for the virus, it’s hard to know exactly what to do.

That is why I let my proprietary trading strategy determine the direction I am going to take for my trades.

There’s no reason to get tied up in mind games with the markets, it’s best to let mathematics and the forces of nature do their thing.

When I harness the power of Fractal Energy it gives me an advantage I simply don’t want to pass up… going UNDEFEATED OVER THE LAST 8 MONTHS!

0 Comments