It’s a jungle out there.

There is a nasty bug still at large, the west coast is on fire, and the Gulf coast got hit with yet another hurricane.

And Gronkowski came out of retirement to join Brady on the Tampa Bay ‘Bucs

… it sure is wild out in 2020!

But remove everything negative, and what are you left with?

Today is still today and the markets are still open

Then if you remove the noise of market earnings reports, Fed meetings and almost anything on CNBC… you’re left with smooth, identifiable, and tradable fractal energy patterns

But what is Fractal Energy?

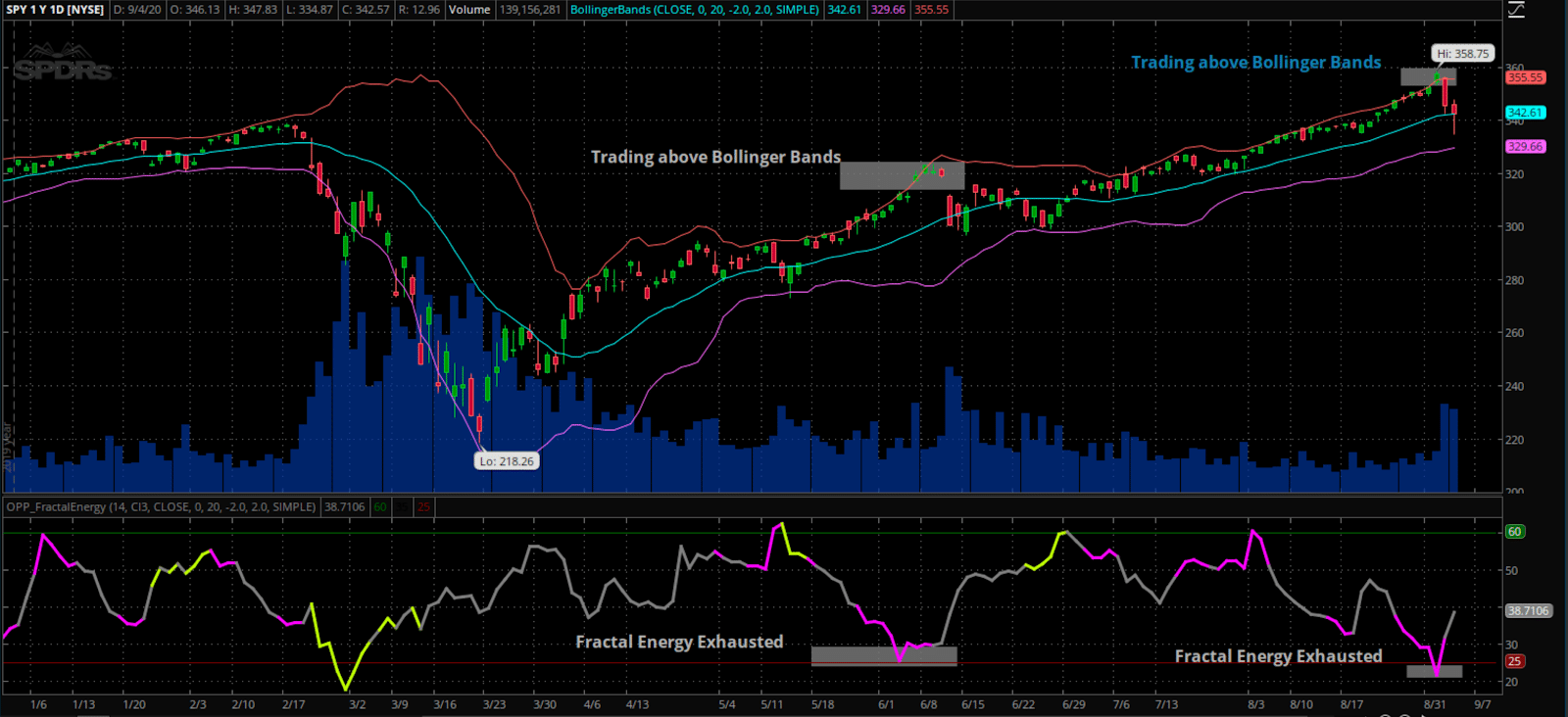

And recently, the Fractal Energy indicator has accurately identified the market bottom in March, and now again at all time highs in the SPY.

So let me show you exactly what Fractals are and how you can them to your technical trading “tool belt”

Fractal Energy

As a trader, spending hours going through stock charts and looking for patterns is just part of the day in the life of a professional trader.

To cut down the work that I have to do every day, I only focus on stocks that meet qualifications set by the Fractal Energy Indicator.

When looking to understand what price action is doing you need to reference information other than a basic stock chart to get a true edge in the markets.

And by having an indicator such as the Fractal Energy indicator you can determine stocks that are charged to run or exhausted and ready to stall out.

But first – What are fractals?

The power of fractals allows me to determine the strength of trends and how much “life” is remaining in a stock’s movement.

There are 2 main components of Fractal Energy:

- Markets Fractal Pattern

- The Internal Energy

By combining those two different components you create a single indicator that is able to successfully determine the strength or weakness of a trend on any stock.

Fractal Energy and the SPY

Before placing any trades, I always check the broader market direction and the Fractal Energy indicator on it.

Source: Thinkorswim

Source: Thinkorswim

And quickly looking at the chart above, you can see Fractal Energy pinned the market top earlier in the year once the indicator signaled an exchasted market.

And then shortly afterwards, the stock plunged lower towards the lower Bollinger Bands.

But the Fractal Energy indicator has not been exhausted until recently

In this chart you can see two key factors that unfolded:

- SPY could not trade and stay above the upper Bollinger Bands

- The Fractal Energy is severely exhausted

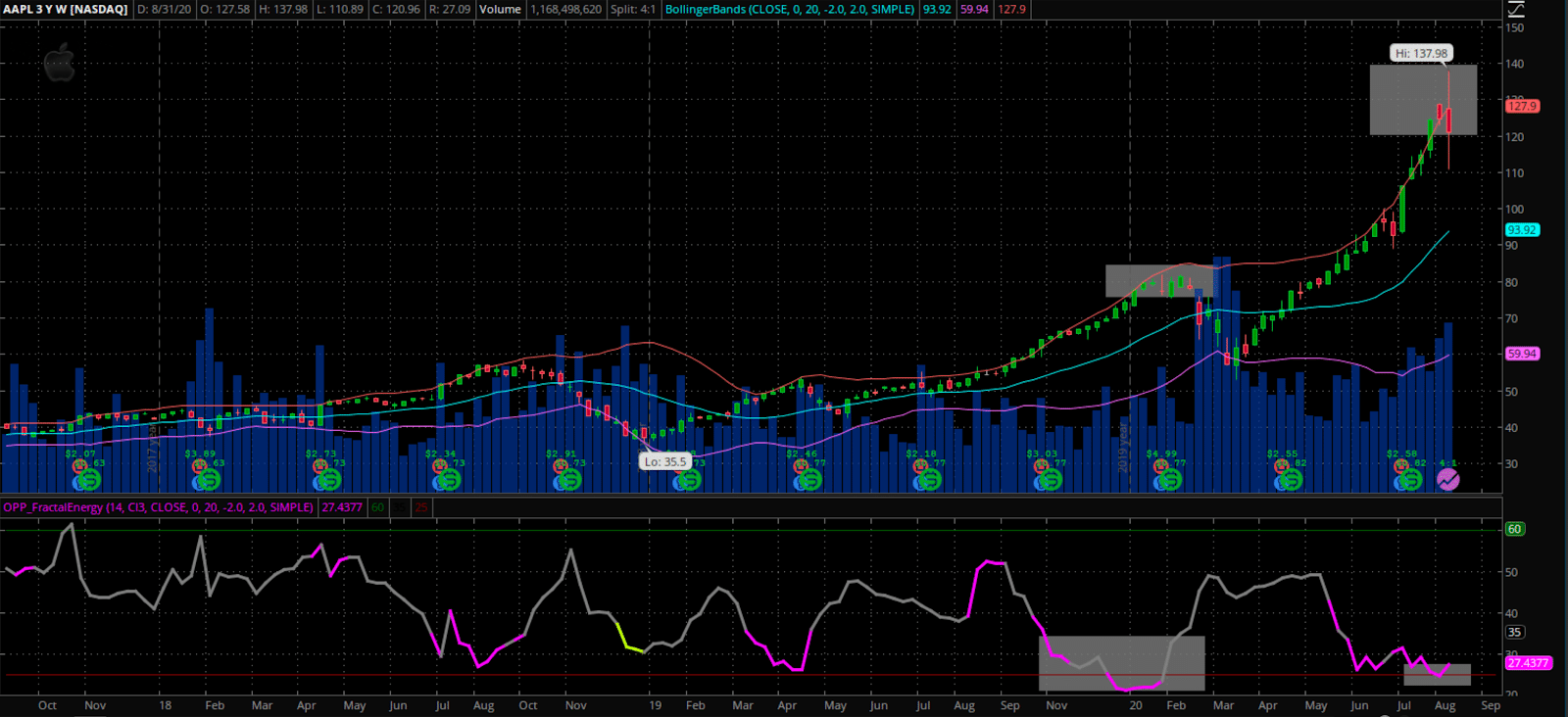

Fractals on the AAPL

Even though I look at Fractals on the SPY to gain market sentiment, Fractals can be used on specific stock to gain an edge to what the underlying energy

Here is an example of the Fractal Energy on the SPY’s predicting the last market top

Source: Thinkorswim

You can see that the Fractal Energy Indicator was signaling exhausted energy to AAPL forming at the beginning of 2020.

And then shortly afterwards, the stock plunged lower towards the lower Bollinger Bands.

In this chart you can see two key factors as how the trade unfolded:

- Price couldn’t break above the resistance level at $325

- The Fractal Energy Indicator was severely exhausted

From the technical analysis viewpoint, the failed breakout was a large bearish signal for AAPL. Then combined with the internal energy, or Fractal Energy showing that it was weak, it was the perfect setup for AAPL to sell off!

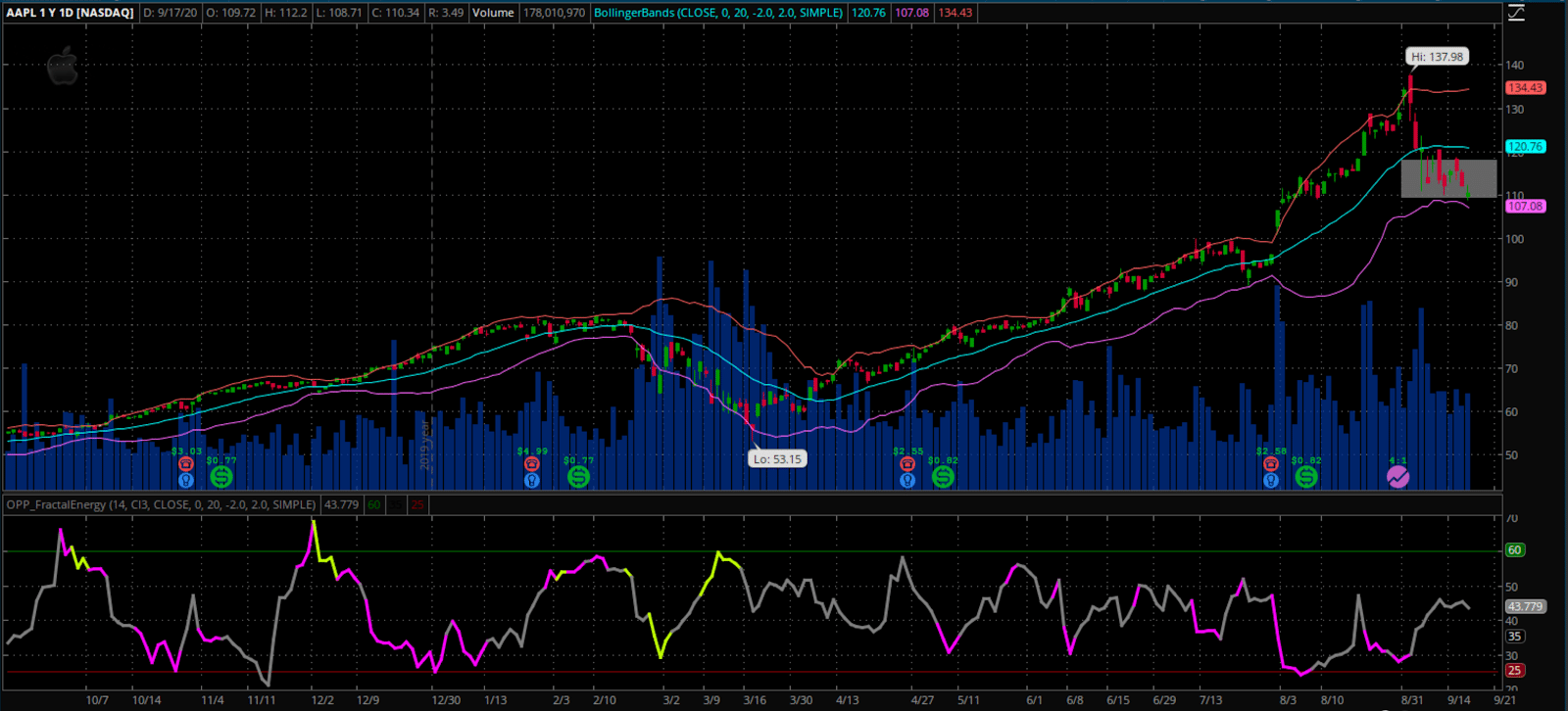

What Does Fractal Energy Have In Store For The Next Move

Fractal Energy has shown to be powerful when identifying key market sell offs and bounces once the indicator becomes exhausted.

But what about when it’s in nomansland?

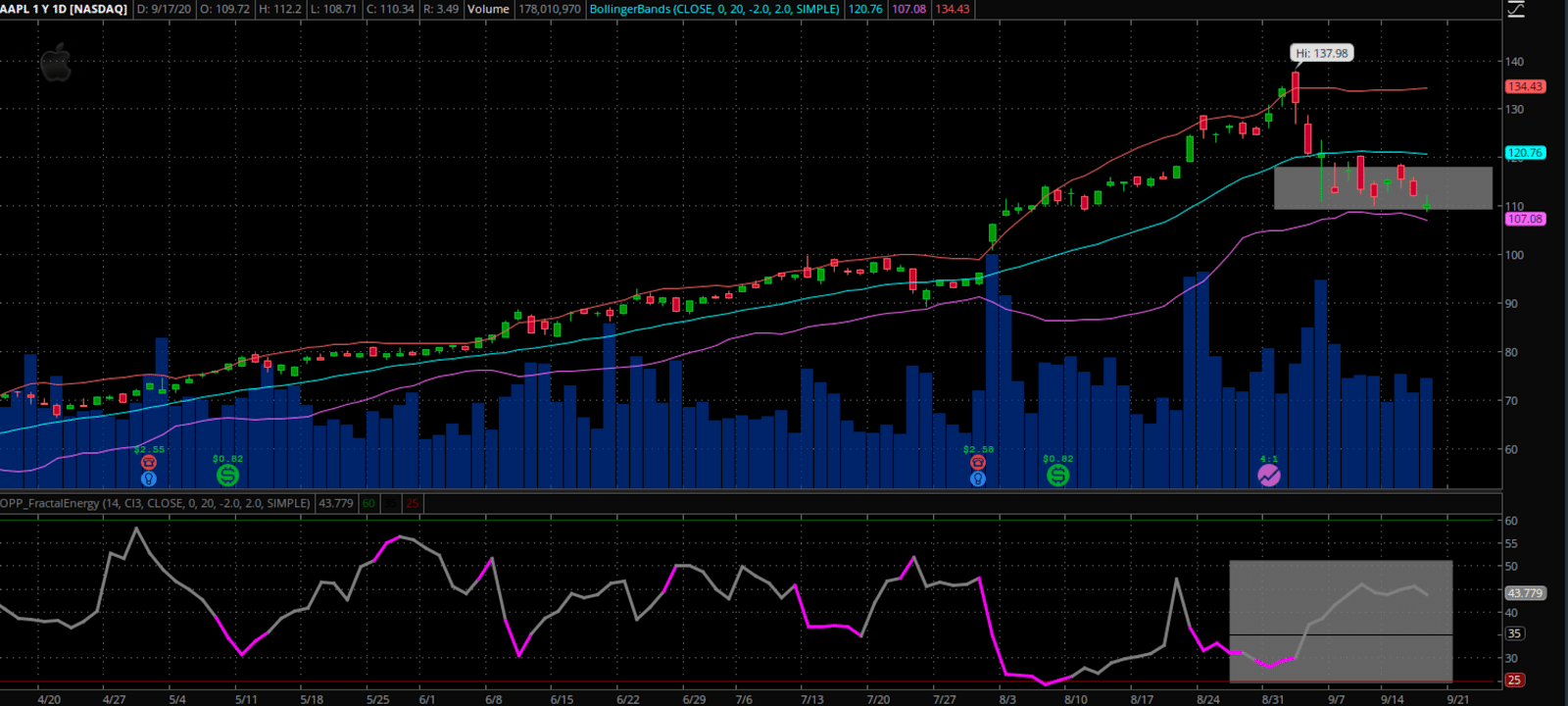

Source: Thinkorswim

As you can see from the stock chart, AAPL is in a weird spot now where it is range bound between the lower Bollinger Band and the middle simple moving average.

But in actuality, it’s not in a dead zone in the charts.

Source:Thinkorswim

Taking a look at the Fractal Energy, you can see it’s finally out of the exhausted zone

And this middle area between charged and exhausted is the charging zone.

This is where the stock and fractal energy is gearing up for a next move.

And that’s exactly when I want to be involved in this trade.

So as the stock is trading in a sideways rage, it’s actually charing up its internal Fractal Energy for an explosiving move

But one thing we don’t know is the direction of the trade.

Which is why I trade credit spreads, to take advantage this downward to sideways price action.

Credit Spreads For The Win

Fractals are the inner workings of the markets, from what the whale investors are thinking on any given day to the market specialists on the floor of the exchanges.

Which is exactly why I based my credit spread trading strategy together with Fractal Energy!

I needed an edge in the markets that told me when to sell credit spreads in order to generate income for my trading business.

My go-to trading strategy is the credit put spread or a naked put in order to get paid upfront to own a stock at a discount!

The Credit Put Spread is a neutral to bullish options trading strategy.

It aims to capitalize on both sideways or upward price movement of the asset and theta (time) decay.

What does that mean exactly?

It means that you receive the cash upfront …

That’s right, you get paid to take that trade!

The Odds Are Stacked In Our Favor

Option sellers take maximum advantage of the option time decay theory, commonly known as Theta Decay.

OTM options lose value quickly and become worthless at expiration.

This allows traders to not have to worry about correctly predicting the market direction or timing the market perfectly to generate income.

We can take advantage and be the house with odds in our favor on every trade

Don’t forget that an option buyer needs to be right about direction and time!

Remember traders, there are many ways to make money in this market and selling options is one of my absolute favorite go-to strategies.

Key Points:

- Credit Put Spreads profit if the stock goes down, stays the same, or goes up

- Limited risk

- Puts the house odds in your favor

- Allows you to get paid to take risk

Wrapping up

Fractals are the cornerstone of Options Profit Planner

When it comes to placing a trade, I always make sure there’s an edge by leveraging the power of the internal energy of a stock and pattern.

And I always make sure that I utilize a strategy of selling options or spreads to focus on generating a steady flow of income for my trading business.

But what’s extremely important to remember is that there is a strategy for both going long and short stocks that are available to you.

Plus Credit Spreads give unique advantages to traders over debit spreads, with the most important being that you are paid upfront to place a trade!

0 Comments