Most businesses fail because they don’t have a plan. The same can be said about the majority of traders who don’t make it.

It all starts by having a cornerstone strategy to build your business around.

My trading business is based on exploiting inefficiencies in the market… taking advantage of investors emotions (fear and greed)… and utilizing a trading strategy that has a proven mathematical edge.

I think that it is possibly one of the best ways to generate consistent income.

My secret to steady income is applying an options strategy called spread trading!

And today, I’m going to teach you the nuts and bolts of this game-changing options strategy.

Selling Options For Income

What is credit trading?

Credit trading is a strategy where you sell options in order to collect a premium and generate income for your business.

Maybe you’ve dabbled in the world of options but never found a strategy that works for you…Or perhaps, this concept is entirely new to you.

No matter who you are, you can benefit from one of the most successful income options trading strategies… just as the pro’s do!

Luckily, selling options for income is far easier than you might think it is.

It’s one of the few strategies where you can get the direction wrong and still win!

Warren Buffet, who is possibly one of the most successful investors of all time, uses this strategy to generate additional income for his business!

Why Does Warren Buffet Use Option Income Strategies

A put selling strategy is one of the most effective options income strategies a trader can leverage for their investment business.

Don’t believe me?

Just look at this headline about Warren Buffett who is commenting on selling puts throughout the market collapse!

That’s right…the most famous investor in the world, Warren Buffet, uses a put-selling strategy.

Buffett made huge sums in the wake of the 2008-2009 financial crisis using options to generate massive income for his portfolio.

To understand how he made this investment and generate those returns, it’s best to first learn how options work.

Let’s take a look at what an option is…

What Is An Option?

What does the word option mean? It means to have a choice or an option about what to do with the underlying security. An option is also a form of security to invest in, or trade, just like a stock.

Option Definition: An option gives you the opportunity to buy or sell a stock at a certain price at or before a specific date.

Basically, you are buying the option to buy or sell the underlying stock at a specified price.

Options come in two main forms: A Call option and a Put option.

Depending on which option you chose, you’ll have the right to either buy or sell the underlying stock at the set price (the strike price). The Strike price is a determined price that you can buy or sell the underlying stock for. Regardless of the current market value.

Now, let’s take a look at how calls and puts work a little closer.

Call Options

Here is a look at the monthly options for Feb 21 2020 for AAPL, which is currently trading at $319.61.

If a trader is bearish on AAPL, they would look to sell call options.

Source: Think-or-Swim

On the left side is a list of the Calls available to trade, with puts available on the right.

If a trader was to sell a call option, remember, they are expecting the price to decrease.

As the stock dropped and stayed below the strike price (the middle number) by expiration, the trader would keep the premium sold.

For example, if a trader was bearish and wanted to collect money as the stock decreased in price, they would be selling the 320.00 calls at $5.00.

The trader would collect the $5.00 when they sold it, and if the stock closed lower than $320.00, they would keep the entire amount of that option that was sold.

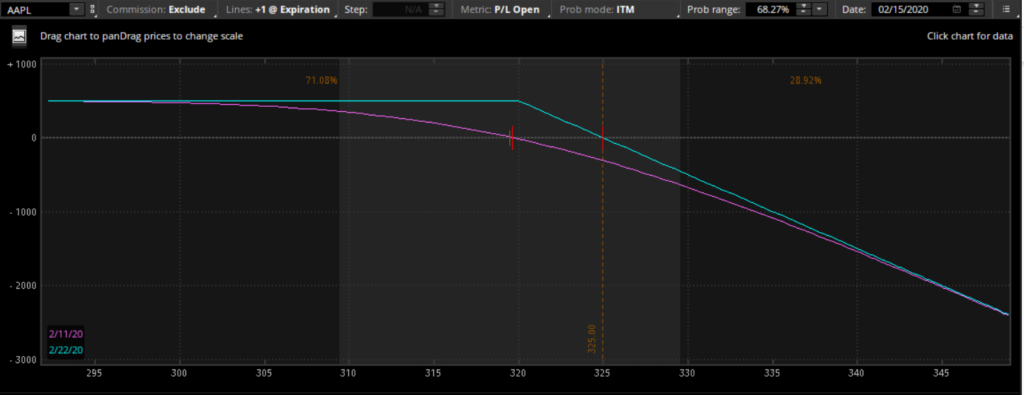

Here is what the short call risk diagram looks like:

Source: Think-or-Swim

Put Options

Now looking at the same table, let’s see how that same concept works for selling put options.

If a trader is bullish on the stock, they would look to sell put options instead of calls.

As the stock increased and stayed above the strike price the trader sold (the middle number) by expiration, the trader would keep the full amount of premium sold.

For example, if a trader was bullish and wanted to collect money as the stock increased in price, they would be selling the 317.50 puts at $4.20.

The trader would collect $4.20 when they sold it, and if the stock closed higher than $317.50, they would keep the entire amount of that option that was sold.

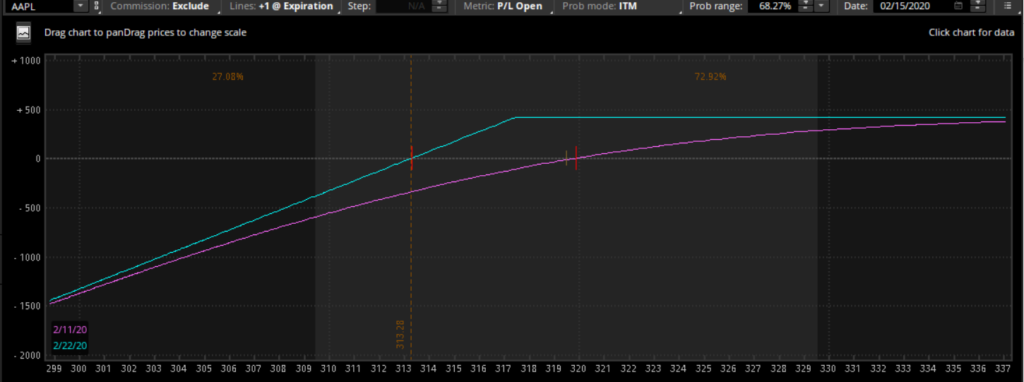

Here is what the short put risk diagram looks like:

Source: Think-or-Swim

Using Option Income Strategies

Instead of buying a stock or call option if a trader thinks it’s undervalued, option writing traders look to sell the stock (or option) when they are naturally over-valued in order to take the counter move.

For instance, when a stock sells off, two things occur that will impact the price of the option.

First, as price decreases, puts will begin to inflate in price as long-term investors are buying puts in their Protective Puts strategy.

As the put prices are increasing and selling in the underlying stock increases, this drives up a pricing metric called Implied Volatility.

This IV begins to drive up the cost of the puts even further, in turn making them more expensive, and accelerating this vicious circle of buying and selling.

When a stock is in the middle of a sell-off, the options puts have an elevated IV and premium, and that is exactly what an investor like Warren Buffet is looking for. Implied volatility measures the amount of fear and greed priced into an option. When implied volatility is high, option prices become overvalued. And this attracts investors like Buffett.

For utilizing an options selling strategy, the trader needs to identify a reason to go short, instead of just selling anything they find.

As a technical trader, this is where I turn to a proprietary set of metrics to filter out and narrow down the number of stocks to look at.

Next… let’s take a look at a sample trade that I recently took utilizing the short put trading strategy.

How To Trade Using This Simple Options Strategy

Trading options for income is a relatively simple strategy, but can seem complicated at first glance.

Let’s take a look at how this works a little closer.

Source: www.tradingview.com

Based on a proprietary technical screener, I was able to identify a great stock that should have found a bottom and is ready to rally higher.

To go long I have three choices:

- Buy the stock and tie up investment capital

- Buy calls and have a 33% or less chance of winning the trade

- Sell puts and have a 60% or more chance of winning the trade with 100% ROI

My choice is with #3 since selling puts allows me to stack the odds in my favor and return 100% on the trade. If Warren Buffet was taking this trade, he would pick #3 as well!

So what’s my risk on this trade?

Since $5 is an all time low on GSKY and seems that it has a strong technical support level, I would feel comfortable owning stock at $5 if I was assigned.

So, if price falls to $5 by expiration, I have established it is ok that I purchase shares at this price. And if the stock price is to head higher in the future, I will be able to keep the premium on the trade.

This means that GSKY could remain unchanged, rally, or even drop $1.79 per share or 36% and this trade will still make money!

The key to this strategy is that a put seller wants to own the shares when they’re less expensive… and sellers are also willing to receive income if the price does not drop to their entry level.

The best part of this strategy? It’s a win-win for the trader.

It’s a win if the trader buys the stock at a reasonable price (a 36% discount) or keeps the premium from his buyer for selling the option.

Either way, the put seller gets something he wants.

Now…

I’m not saying this is entirely risk-free.

Let’s go over what risks are still out there for the trader to deal with.

Risks: What Are They

Despite how picture-perfect this strategy sounds, it does come with some risk.

For example, if GSKY tumbles well below $5 you are still on the hook to buy the stock at that price, even if it drops to $2.

And since each option contract is worth 100 shares, the losses can add up substantially if you are not careful…

Which is why it’s best to set exit rules and risk parameters to adjust your position when things get problematic.

When you sell the put, your payoff is straightforward… if the stock goes higher, stays the same, or drops in price (up until the break even) you will make money.

If the strike price is $5 and the price drops below $5 per share by expiration, you must purchase the stock at that strike price. Regardless of the currently underlying price.

Breakeven is where you lose money on your position after premium is collected. The breakeven price is calculated by taking the strike price and subtracting the price paid for the contract.

Here is a breakout of the trade:

Max profit = $0.50 (the premium collected)

Breakevens = $5 – $0.50 = $4.50 (strike – premium collected)

Max loss = limited (to the stock going to $0)

Putting It All Together

Selling puts is one of the cornerstone credit spread strategies that I run my trading business on.

To me it’s important that I can determine exactly what my income stream will be each and every month and collect income off of trading great stocks.

The benefit to this strategy?

Well… There are many as I uncovered earlier.

But the main benefit to selling puts is that it allows me to set the price I would like to buy the stock for. It’s like going to a car dealership and picking my own price for the new sports car on the lot!

First, there are a few steps you should take before selling puts.

- Find a stock you actually want to own. I use a stock screening tool to find the best stocks to own.

- Decide on an entry price that you feel comfortable buying those shares for. This can be based off of technical patterns.

- Evaluate the options to see if they are cheap or expensive

- Set risk parameters and know when you roll out the options or exit the position all together.

Once you have completed those stops, you are ready to begin selling puts to generate consistent income for your options trading business.

Final thoughts

The one major benefit to selling options is that it allows a trader to win whether the market moves up, down, or sideways.

And it’s important to remember that there are some risks associated with options trading… this is not a “holy grail” strategy after all…

But, if you understand these risks and how to keep your account safe – selling options is possibly one of the most lucrative systems a trader can use.

P.S. According to a major options exchange research, selling options is one of the few strategies that can actually outperform a buy and hold strategy over time.

So what are you waiting for? Click here and start selling puts with Options Profit Planner!

0 Comments