The week ended with a ton of uncertainty.

Fueled by the president testing positive for Covid-19.

During this period of heightened volatility, traders will move in and make emotional decisions. Or even get chopped up from the violent up and down swings.

But what if I told you there was a way to profit off the volatility.

And it didn’t include stressing yourself out or taking crazy amounts of risk.

Something that even pays above average returns.

These opportunities exist right now, let me show where and how I’m finding them.

Options Profit Planner

Many traders focus on trading stocks, but very few trade options.

Options allow traders a number of unique trading strategies that are based around probabilities and statistics.

And options are an extremely popular way to place a trade in a stock without having to dish out a lot of capital.

One major benefit of options is that it allows the trader to gain tremendous leverage by trading large amounts of stock cheaply.

Another reason options are popular is the ability for a trader to receive a steady stream of income if designed to do so.

This type of trading style is called credit trading

and it is considered to be one of the most steady and consistent ways for an options trader to make money.

So… if you are trading options, it is a must to learn how to trade credit spreads to generate income.

But one of my favorites (besides credit trading) is that a trader can adjust their risk parameters to meet their needs for trading the markets.

Two examples would be limiting losses to the downside, and being able to capitalize in a sideways market. Both are not achievable by trading stocks themselves.

Next… let’s take a look at this in more detail.

The 2 Primary Trades

First, let’s review the risks associated with trading a stock…

Remember, if you are long a stock, this is assumed to have unlimited gains and unlimited losses associated with it.

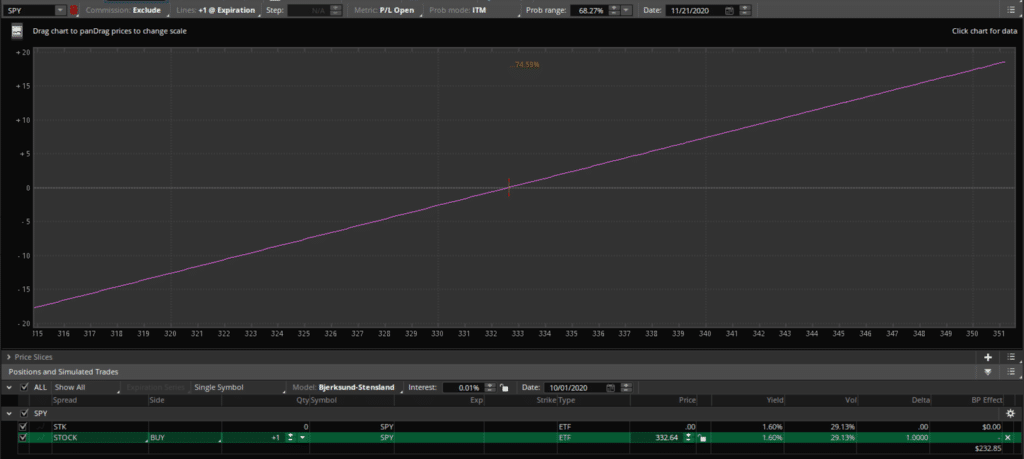

Here is a stock risk diagram for your reference.

Source: Thinkorswim

So, as you can see above, there are significant risks associated with trading long stocks directly.

And with the markets moving 10% each day, I doubt anyone would want to buy a stock and watch their account flip that quickly on them.

The solution?

Well there are a few choices for a trader to make when seeking an alternative for a long stock.

These choices are:

- Trade a Credit Put

- Trade a Credit Put Spread

Let’s take a look at how each one of these trades can offset losses when trying to get long a stock in these types of markets.

What Are Credit Spreads

Credit spread strategies make you money while debit spread strategies cost you money.

And when you are a business owner, you want money coming in and not going out.

But that’s not the only thing that separates the two types of spreads.

A credit spread involves selling a high-premium option while purchasing a low-premium option in the same stock and option type.

A debit spread involves purchasing a high-premium option while selling a low-premium option in the same stock and option type.

The Credit (Naked) Put

One of my personal favorite strategies to trade is a credit put or naked put.

This is the only way to capture the maximum amount of profits trading credit strategies since this position doesn’t require the purchase of protection like a credit put spread.

And like other credit strategies, the credit put allows a trader to be paid up front for selling the option.

Plus trading credit puts you can generate returns in up, down, or sideways markets!

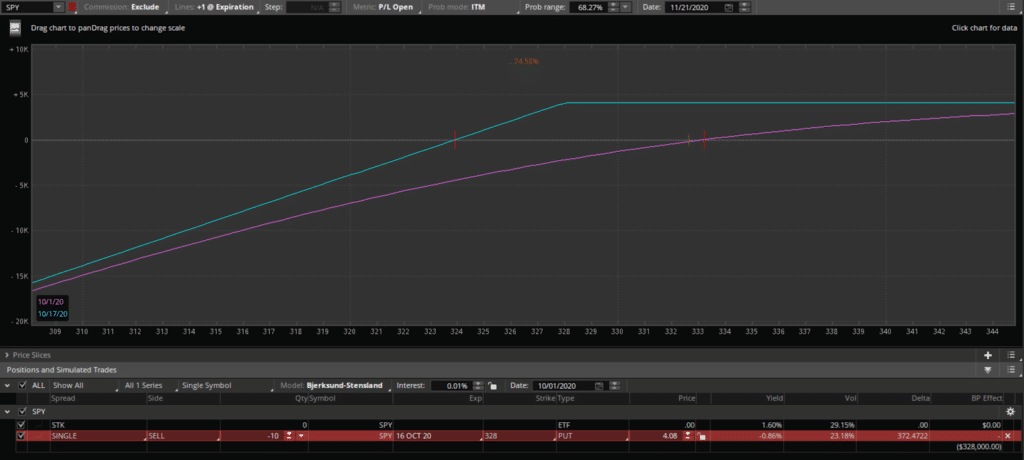

Source: Thinkorswim

As you can see from the image above, with the SPY currently trading at $333 you have room all of the way down to $324 on the SPYs before you need to worry about losing money!

But there is one perk of trading short puts that nobody really talks about…

And that is being able to determine the price you want to pay for owning shares in a company.

This means that if the stock dropped beyond your strike price, you could keep the credit you sold the options for and have stock delivered at the price you selected.

Sounds like you can “have your cake and eat it too” type of strategy?

Well, it’s got some fantastic characteristics to it, but it’s not for the faint of heart.

Which is why I want to show you a safer, credit put spread trading strategy that you can use instead.

The Credit Put Spread

A credit spread is a directional strategy that requires a trader to buy an option that is at a nearby strike and sell an option that is at a further strike.

The credit put spread is a fantastic trading strategy that allows traders to take advantage of a sideways, bullish, or slightly bearish market environment.

And with proper strike selection you can vary how much income you will receive for the trade.

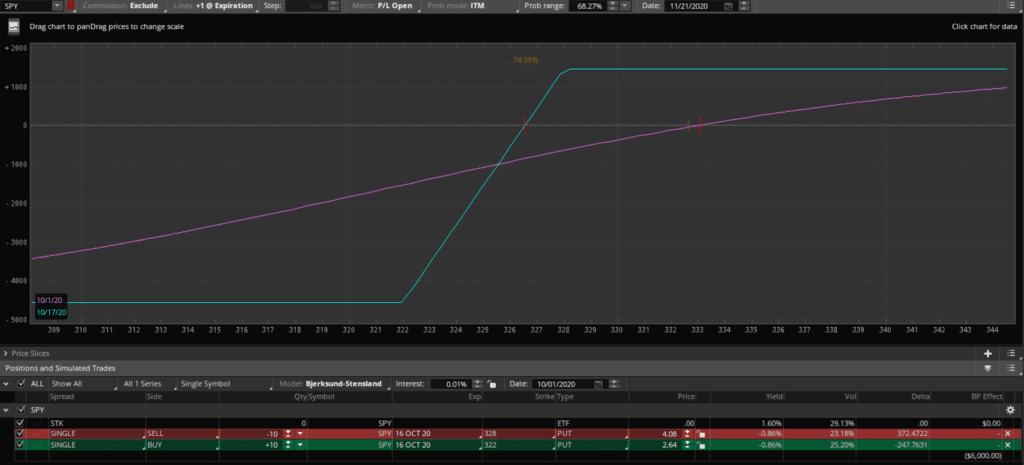

Here is an example of a credit put spread on SPY for your comparison.

Source: Thinkorswim

As you can notice, this strategy offsets all of the downside risk a trader will face.

This strategy is known as a Credit Put Spread and is created by selling a higher valued put and buying a lower valued put as downside protection.

Here is the trade:

SLD : Spy 10 16 OCT 20 328 Puts @ 4.08

BOT : SPY 10 16 OCT 20 322 Calls @ 2.64

This means a trader will collect the maximum profit of $1444 on this trade if the SPY rallied and closed above the upper put strike of $328 on or before October 16th!

Now you might be saying, can’t you do that with a Short Put as well?

And you can, but if you notice, the downside is limited to the total loss of the trade minus the credit collected.

Whereas a Short Put could theoretically be “unlimited” losses, but more of a significant loss if traded incorrectly.

And with a Short Put, risk management rules are much more strict and this could be a challenge for many traders to monitor closely.

Pro tip: To achieve the same position, a trader can buy a stock and simultaneously trade a short call and long put. This position is known as a Collar Spread

Personally, I would rather trade the credit put spread over a short put for many reasons, but here are my top 3

The top three reasons:

- Allows you to trade without the capital required of owning stock or margin for short puts

- Has a limited loss to an unfavorable downside move unlike short puts

- Similarly to a short put, this trade allows me to collect income for the trade if it moves downward, upward, or even stays the same price.

Putting It All Together

Let’s take a look at some pros and cons to trading credit spreads and short puts

Pros:

- 100% ROI can easily be achieved on both strategies

- Casino-like odds in your favor as a seller (60% or more!)

- Limited downside risk when trading the Credit Put Spreads

- Can win in up, down, and sideways markets

- Lower capital requirements vs owning stocks

Cons:

- Limited upside gains on both trades

It’s easy to see how the pros of trading this strategy significantly out-weight the cons!

0 Comments