The stock market isn’t an easy place to make money.

Sometimes it can feel like you’re in the middle of an African safari, where the hunter can become the hunted— in the blink of an eye.

And if you’re not watching your back, you’ll have your profits snatched from your hands before you know what happened.

Because many traders are just bait for the HFTs and Market Makers waiting to take their money!

And the only way to combat this is my changing the way you execute your trades

Now let’s talk about the different types of orders you can use and how they will turn around your trading in the blink of an eye.

Trade Execution and Order Types

Many new traders struggle to understand why they might be losing money when they bought a stock and it went higher.

Unfortunately, not having a solid understanding of market execution principles can lead to confusion and a loss of money.

The trade idea

Take an example trade where a stock XYZ is trading at $100 and a trader wants to go long, with a target of $110

The trade execution – entry

In order for the trader to get this trade, they might send a market order to buy the stock. The execution broker filled the trader at $107, the offer at the time of the trade.

The trade execution – exit

Noticing that the stock ran to $110, or the target price, the trader executed another market order to exit this trade. The execution broker filled the trader at $107, the bid at the time of the trade.

The outcome

The trader lost money! They bought the stock at $107 just to sell it at $105, even though on the chart it went from $100 to $110!

Has this ever happened to you? I am sure it has if you trade market orders frequently!

Let’s take a look at the post trade review to break down how this could have been avoided.

Post trade review

Now let’s take a look at what happened.

Sometimes executing with a market order could work, but in many cases, it does not. In this example, the trader ended up buying the stock for $107, which was the offer price at that time!

Then as the stock increased in price from $100, to $110 as the trader expected, they are going to sell out of the position for a 10% profit per share on this trade.

Once the market order is submitted, the execution broker fills the trader at $105, which was the bid at the time of the trade.

Now, you might be furious that you just lost $2/share instead of making the 10% profit you wanted to land.

And this happens because of market orders.

You see, a market order just tells the broker you want to buy this stock no matter what the price is!

[ Pro tip: Never reference the last price, but only look at the bid or ask prices to know where a market order will fill you at. ]

And if you want a stock that badly, a market order will do the trick! But since you bought a stock trading with a last price of $100, with an offer of $107, the market order filled you at $107.

Next, when you went to take profits with the stock trading with a last price of $110, the bid was $105. This means your market order will fill you as fast as possible, and fill the price at $105 instead of $110.

You see, you are having your profits stolen from you just by using a market order!

These are the types of orders HFT’s love to search for and the algos will hunt down your orders and make sure to take as much money as they possibly can from you.

The solution?

Only use limit orders to trade instead of market orders!

Let’s take a look at what the bid-ask spread is how it can hurt you.

Options Bid-Ask Spreads Can Hurt You

I always wondered why there has to be a spread between what you can buy an option for and what you can sell it for.

But the simple answer is that trading is a business and someone needs to make money.

Typically, the people who are selling options are the ‘casinos’ of the stock market. These guys are the market makers and the HFT firms looking to sell stock insurance to options buyers.

Unfortunately, many new traders do not even think about the bid-ask spread when they are trading.

And when you ignore the bid-ask spread, you are possibly turning a winner into a loser just by paying the spread.

Let me show you what I mean.

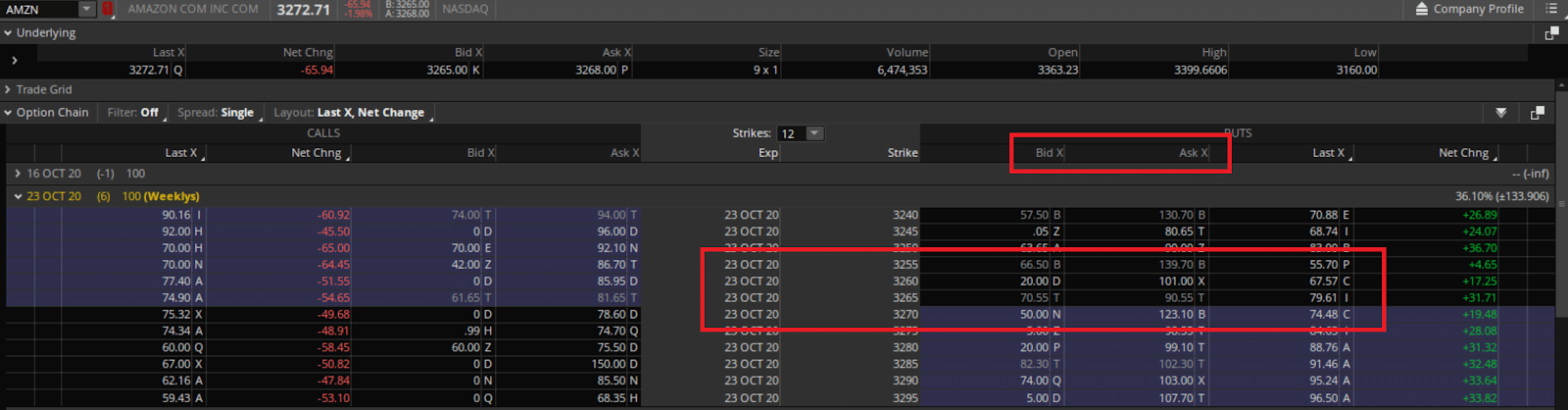

So you wanted to buy those hot Puts on AMZN. Good luck with that! Here’s what I mean.

Source: Thinkorswim

Right away, what a crazy spread those options are!

Those 3260 puts are 20 bid x 101 ask!

And if you sent a market order, the HFT’s would be giggling with excitement as they filled you at the worst price possible!

In this example, you would be filled for $101/contract when the last was $67/contract!

Then if you went to exit your trade thinking you just made $30 / contract, you would be filled at the bid of $20!

This means you would be taking a massive loss on the trade of $80/contract!

Remember, since options prices are multiplied by 100 to account for the number of shares of leverage, that is a $8,000 loss instead of a $4,000 profit!

Now do you see how the bid-ask spread can hurt you?

Let’s review market orders vs limit orders and why you should always use limit orders to trade options that have a wide bid-ask spread!

2 Main Order Types: Market And Limit Orders

Different order types can result in a vastly different outcome in your trading, and it’s important to understand the difference between them.

Here I am going to focus on the two main order types: market orders and limit orders – and how they differ and when to use each one.

It helps to think about order types as a distinct tool, that is suited for its own purpose.

Whether buying or selling, what’s most important is to identify what your goal is as a trader.

Many times traders just want to get their stocks filled immediately, and other times they are willing to hold off for the right price.

This means, having your order filled quickly (possibly at a very bad price), or controlling the exact price of your trade (and missing the trade, entirely!)

What is a market order and when do I use it?

A market order is an order type to buy or sell a stock at the market’s current best available price. A market order is an order type to guarantee execution but it does not guarantee a price at which you will buy or sell the option.

Market orders are optimal with the primary goal is to execute the trade immediately, when you cannot wait for the price to be perfect!

Many times momentum traders that are in a hurry to buy or sell a stock during extreme market movements will want to use market orders.

Otherwise, it’s best to use a limit order to make sure you are executing at the exact price you want to buy or sell a stock at.

Now, a stock’s quote typically includes the highest bid for sellers and the lowest offer for buyers, and then the last trade price.

[ It’s extremely important to remember that you cannot be guaranteed a fill price at the last trade price! This is just a point of reference of where a stock just traded, but not a guarantee of a fill for future trades ]

This is especially important in illiquid stocks and options where the last price can become “stale” from inactivity, but the bid and ask will “drift” around with the current market condition. Therefore, when placing a market order, the current bid and offer prices are generally of greater importance than the last trade price. What I mean is that if a stock is trading at $100 that you want to go short, but the bid is at $50 and the offer is at $60, you will not be able to sell the stock at $100 anymore, but instead only $60.

Now, if you have no choice but to trade a market order, these orders should only be placed during market hours and cancelled by the end of the day. If they are left in the market, they could fill at the open of the next trading day, which could be significantly higher or lower than the stock’s prior close.

Between market sessions, there are numerous factors that can impact a stock’s price, such as earnings releases, company news, economic data, or an unexpected event in an entire industry, sector or market as a whole.

What Is A Limit Order And How Do I Use Them?

A limit order is an order to buy or sell a stock with a restriction on the maximum price to be paid (when buying), or the minimum price to be received (when selling).

And if the order is filled, it is only filled at the specified limit price or better. However, there is no guarantee that the order will be executed and filled.

A limit order is only appropriate when you think you can buy at a price that is lower than the current price – or sell at a price that is higher than the current quoted price.

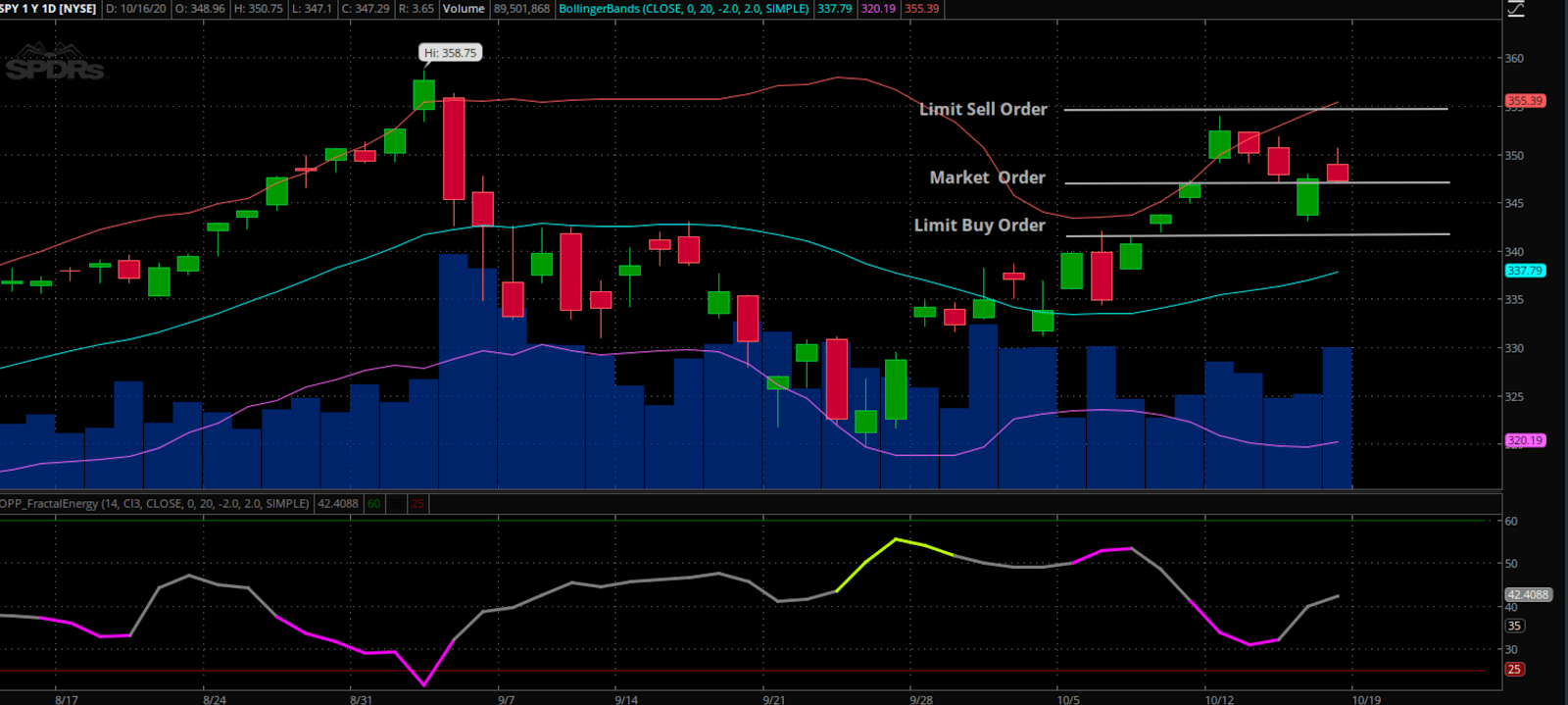

Source: Thinkorswim

The above chart illustrates the use of market orders vs limit orders. In this example, you can see how the buyer will place a limit buy order below the current market price. Alternatively, the seller will place a limit sell order above the current market price.

Key points about the order types

- Market Orders: Used by a trader who needs to buy or sell a stock as quickly as possible

- Buy Limit Order: Used by a trader who wants to buy a stock when price drops to a desired level

- Sell Limit Order: Used by a trader who wants to sell a stock when price rises to a desired level

Note: even though a stock may reach a specified limit price, your order may not be filled because there may be other orders in front of yours. This queue is governed by First In – First Out execution principles.

Added bonus: If you want to buy a stock at $135 with a limit order, you can actually be filled at a better price! If the market moves quickly and cannot fill you at $135, you are then filled at an equal to, or better price, but never worse! The opposite occurs for selling shares as well.

Types Of Orders

Now, there are even more detail when it comes to the types of orders you can actually place to help control slippage and execution quality of your limit orders.

Without getting into too much detail, here are the 6 main order types you can choose from.

8 main order types:

- AON (All or None)

- DAY (Day Orders Only)

- FOK (Fill or Kill)

- GTC (Good till Cancelled)

- IOC (Immediate or Cancel)

- MOC (Market on Close)

- OTO (One Triggers Other)*

- OCO (One Cancels Others)*

*These are actually combination order types that are used for more advanced order execution control compared to the primary 6 order types.

Wrapping Up

So there you have it, don’t be a sucker and stop feeding the HFT’s!

Instead, fight against these sharks and don’t let them take advantage of your execution prices by utilizing the power of limit orders!

And if you are efficient at limit orders, you can increase the profitability of your trading and by a significant margin too.

As an example, if the volatility is high or spreads are wide in a stock, you could actually end up losing money on a trade! All because of the bid – ask spread.

So if you find yourself stuck getting bad fills and losing money on your trades – consider switching over to limit orders instead of using market orders!

It’s exactly what I do in my trading!

If I end up missing a trade that runs away from me I just remind myself that there are more stocks out there and I am OK waiting for the next opportunity to come across my desk.

Click here to sign up to Options Profit Planner now

0 Comments