Trading options is more than a black and white strategy… and they can be as easy or complex as you make them out to be.

Now I am sure you are thinking… “buying a put or calls are ‘easy’, I do it all the time…”

And you’re right.

But did you know that it’s possible to have better odds of winning than just going to the casino?

And typically, when you buy options, a lot of traders believe there’s only a 33% chance of winning.

Yuck… That is a strategy I don’t want to trade. I want a strategy where I have the 66% chance of winning as the house does.

Which is why I love trading credit strategies over buying options.

This is a strategy that I’ve been trading for a long time, and in my opinion, it’s one of the few strategies that are reliable, scalable, and simply profitable.

And it puts the house odds in my favor with a 2 out of 3 chance to land profits.

For me, I’m using Fractal Energy patterns and credit spreads every day to profit off the markets, and I want to teach you how you can do this for yourself.

Ready to learn more about how to generate income instead of gambling your money away every day?

How I Traded ET For Huge Profits

You see, I don’t like to gamble and spend money on a trade that I could win big on…

Why?

As a gambler, these companies don’t want to make you rich… instead, they are in the business of taking your money

And they don’t care… they are not your friend and they aren’t there to help you

This is a cut-throat industry, and only the strong traders will survive.

But luckily I have a strategy that puts the odds of the casino to work for me and the odds of winning in my favor.

You see, instead of only winning 33% of the time as a buyer of a stock or options, I have a 66% chance of winning by selling options.

And compared to those other debit strategies, a credit strategy lets you profit if the market goes up, down, or sideways.

Which is exactly why I find this strategy to be so appealing to me.

Now, I recently closed out this trade for monster gains… and I want to show you how I did it

Now, there are two things that I target in this trade… the Fractals and technical indicators for support and resistance.

This allows me to identify the support and resistance levels of the stock to make a determination about how a charged fractal energy will impact the stocks new trend.

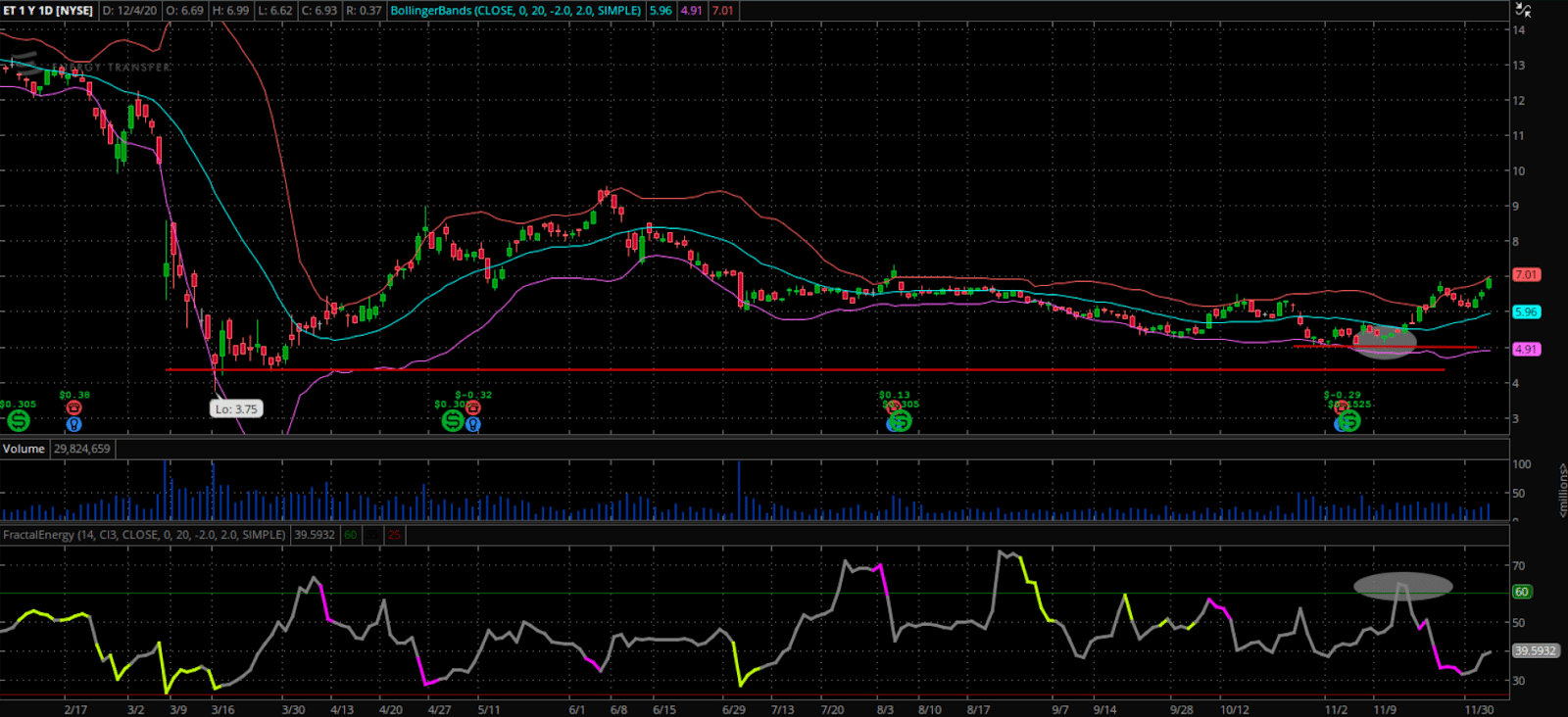

In this situation, it’s all about the 52-week low and the Fractal Energy.

Why?

Because the 52-week low is a major physiological trading level for every investor and trader. And there are a lot of buyers at these levels, which can cause a stock to reverse direction with a lot of momentum.

And the Fractal Energy is telling me that buyers are piling into the stock as the values climb above 60.

Once I saw this I knew I had to get into the trade.

So I placed this trade on ET and my subscribers were the only ones to find out about this trade

The Trade:

ET – I sold the Jan ’21 $5 put for $.50

So I decided that I was going to sell the puts for $50 per contract and alerted my members.

And then I added a spread trade to this as well in order to double up the returns of the stock without taking massive downside risk.

The Trade:

ET: I sold the Jan ’21 $5/3 put spread for $.40

Recently I closed both of these trades out for nearly 100% profits each.*

You seem, by trading options, even if the stock went up, down, or sideways – I could make money on this trade with almost anything that the market threw at it.

Recently, I’ve locked in gains on those two trades.

And if you were to buy the options or the stock, you would have possibly been stopped out by the choppy nature of the markets.

Now if you sold the spreads, you would have made up to 100% returns on your trades no matter what direction the stock went in.

And when the Fractal Energy got to the elevated levels, I strongly suspected that the stock was about to take a leg higher.

Which it did!

But you see, I don’t always know the direction the trend is going to head in… which is why I turn to technical indicators to give me that heads up

The Bollinger Bands are a frequently used technical indicator that gives me an idea of where the stock wants to head in.

Now the Bollinger Bands act as the ropes in the boxing arena, where they push the stock back into its center.

And when you combine credit spreads with the power of fractal energy and technical analysis, you can get the trifecta – winning combination on your hands, in my opinion… if you know how to use it to your advantage.

0 Comments