Trading is stressful, and life as a full time trader is pretty demanding.

The hours are long, the pressure is intense, and you risk your own hard earned money with every trade you place.

But what if I told you that it doesn’t have to be that way? And I’ve been asked over and over, How is it possible to make huge profits with less pressure?

Believe it or not, it’s actually possible to return consistent profits without the stress and headache of a typical day trader.

And by using this strategy you can make steady profits in nearly any market condition!

So how do I do it?

I answered these three questions – and so should you….

- Do I want to make money or spend money?

- How often do I want to have a winning trade?

- Is my trading a business or a hobby?

Now for me, I want to make money instead of spend money, have the odds of winning in my favor like a casino, and focus on growing my assets as a business.

And successful traders typically have a well defined edge in the markets – and I knew I had to have the same for myself…

Options Profit Planner

Every business starts with an edge in the markets

And no matter how small this edge is, it is well defined and precisely executed to generate maximum returns for the business.

The same goes for trading… you need to define your edge and execute it flawlessly to generate income for your account.

The Options Profit Planner system is broken down into 3 parts:

- The Scanner to locate stocks to trade

- A Credit Strategy to put the odds of the casino in my favor

- Fractal Energy to determine the energy of the stock

The Scanner

The scanner aims to separate the good from the bad stock…

So when I trade a stock, I want to feel comfortable owning it for a long period of time in the event an options trade goes wrong.

And to protect my asset, I only want to trade certain spreads on high quality stock that I feel turning into a longer-term investment.

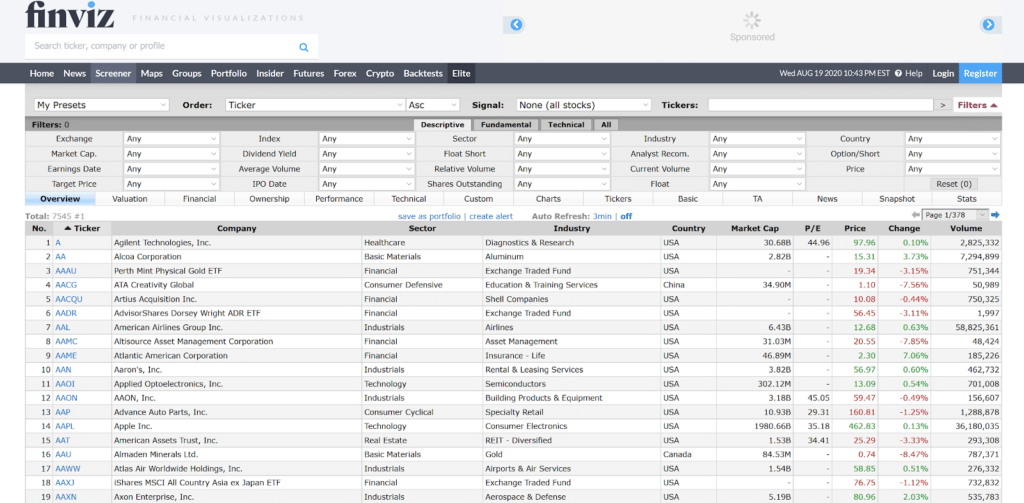

In order to locate these stocks, I turn to FinViz to get this information.

With thousands of stocks to trade each day, it’s easy to become overwhelmed with selecting what to actually put your money into.

But you won’t stand a chance against the other sharks of Wall St. if you just pick random stocks to buy…

So the first step I take is with by looking at my scanner in Finviz

Source: Finviz.com

And this scanner is absolutely free for you to use so you don’t have to worry about any expensive subscriptions to pay for access!

Credit Spreads

As an options trader, I don’t want to go to the casino…

Instead, I want to BE the casino!

And I do this by trading credit spreads instead of debit spreads.

Option sellers take maximum advantage of the option time decay theory, commonly known as Theta Decay.

OTM options lose value quickly and become worthless at expiration.

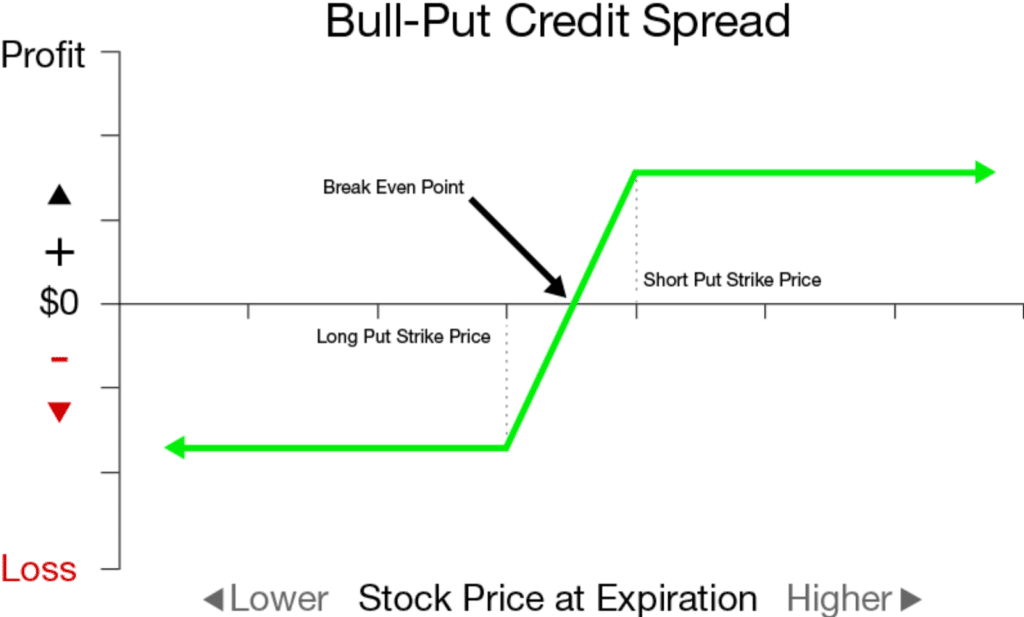

Now what do one of these strategies look like?

I know this might look scary, but it’s a lot more simple that you might think.

In order to create this strategy, you would want to sell a higher valued put, and buy the lower valued put as protection.

What does this give you?

It allows you to collect a net credit on the trade, which is the difference between the two puts.

But why do I like this trade?

Plus when you generate income from collecting premium, you can steadily return close to 100% returns each and every trade.

Remember traders, there are many ways to make money in this market and selling options is one of my absolute favorite go-to strategies.

Key Points:

- Credit Spreads can profit if the stock goes down, stays the same, or goes up depending on a Call or Put Spread

- Limited risk compared to Naked Puts and Naked Calls

- Puts the house odds in your favor compared to buying Options or Stocks

- Allows you to get paid to take risk unlike stocks

And you see, when it comes to placing a trade, you need these 4 things

- To have the stock selected

- A price range identified

- An indicator to show you strength of the stock

- And an options strategy to tie it all together.

Fractal Energy

As a trader, spending hours going through stock charts and looking for patterns is just part of the day in the life of a professional trader.

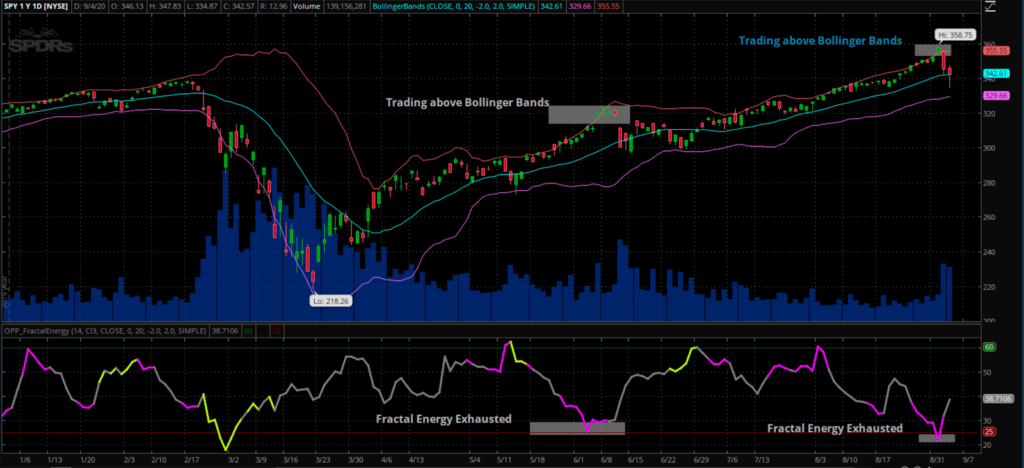

To cut down the work that I have to do every day, I only focus on stocks that meet qualifications set by the Fractal Energy Indicator.

When looking to understand what price action is doing you need to reference information other than a basic stock chart to get a true edge in the markets.

And by having an indicator such as the Fractal Energy indicator you can determine stocks that are charged to run or exhausted and ready to stall out.

But first – What are fractals?

The power of fractals allows me to determine the strength of trends and how much “life” is remaining in a stock’s movement.

There are 2 main components of Fractal Energy:

- Markets Fractal Pattern

- The Internal Energy

By combining those two different components you create a single indicator that is able to successfully determine the strength or weakness of a trend on any market or stock.

Here are two examples of the Fractal Energy impacting one of the largest markets and most well-known stocks out there.

The SPY:

Source: Thinkorswim

Wrapping Up

If anyone says trading is simple, you need to question what they are telling you.

I know this market is crazy… and even overwhelming to many.

But you need to trust the tools you use in order to trade it safely.

And three of those tools are the Stock Screener, Credit Spreads, and Fractal Energy indicator.

Once they are combined, these three tools are some of the best a trader can deploy in almost any market condition.

When looking at these strategies combined, this really is where statistics and probability really shine and make for a highly profitable trading opportunity.

Not only do I trade using an indicator that tells me 95% of the time price will stay inside a range, I also combine it with an options strategy that can pay me 100% ROI on my trade if timed correctly to the markets.

So… to recap what makes this trade a really high probability winner.

- You can never scan for all of your stocks to trade. You need to use a tool such as Finviz to help narrow the field down to something you can trade.

- Trading credit spreads can pay me 100% returns, which cannot be done when buying calls or even the stock outright.

- Using Fractal Energy to tell me when stocks are going to be charged or charging to determine what is coming up for the stock

Click here to learn how I use the Fractal Energy to determine what stock is ready to explode

0 Comments