What another wild week that just wrapped up!

One day we are up almost 4% and the next we are down. It’s impossible to predict any sort of market direction when daily swings are that large.

And these types of sudden changes in direction lead to fear and panic from traders and investors.

But one thing is always certain – panicking when the markets are selling off leads to one thing… always trading in the wrong direction.

And to be truthful… that is hard not to do in times like these.

For many— just the thought of losing money completely freezes them in their tracks— and any logical thinking quickly disappears.

So what’s the solution when buying calls and puts that are jacked up in price from implied volatility?

It’s one of my favorite trading strategies…

I’m talking about my favorite strategy called the credit spread and I will explain everything you need to know to put them to work.

Trading Credit Spreads

Trading with a high implied volatility is one of the most challenging things a new option trader can do.

When Implied Volatility, or IV, is higher than average, it can be nearly impossible for a trader to make money on this trade.

Why’s that?

Well to understand how this works, let’s take a quick look at how Implied Volatility impacts options prices.

Implied Volatility

It’s best to think of volatility as the raw emotion of the option traders on the stock.

Each stock is its own mini-market, having their own environment where factors will change the pricing of the options independently of what the major markets or even underlying stock is doing.

And one of those factors is fear, which causes options traders to jump into the markets and buy put contracts as protection.

And as more traders keep jumping in prices just continue to rise driving up implied volatility.

This means the higher the implied volatility – the more expensive an option costs.

For example:

Let’s say AAPL is trading at $200 per share and you are bearish on the stock based on market conditions. So you buy an at-the-money puts at $200 strike that expires in 30 days.

This is an example of what the price of those options will cost at different implied volatility levels:

At 25% volatility, $4.62

At 40% volatility $6.75

At 75% volatility $11.00

As you can tell there is a huge change in the price of the option when implied volatility is increased.

It’s important to remember that implied volatility is driven by supply and demand.

So… that is exactly what market we are currently in today.

A market that is placing extremely high demands for put options, causing both the implied volatility and price of the contracts to rise.

And that is exactly why a trader doesn’t want to panic and buy put options, but instead, think clearly and logically to trade what’s in front of them.

In this case with the markets reacting to a virus breakout, credit spreads will be your best strategy to go with.

Let me explain…

What Are Credit Spreads

Credit spreads are an options strategy where you buy and sell options that are

- The same type

- The same expiration

- Different strike prices

There are a lot of benefits with trading Credit spreads.

Traditionally, they are helpful in directional trades using options…

Credit spreads are unique as they allow options traders to remove a majority of their risk in that position.

There are two major types of credit spreads:

- Credit put spread: A bullish option strategy

- Credit call spread: A bearish option strategy

When looking to go long or short the markets and negate the problems associated with increased Implied Volatility, credit spreads are one of your best choices.

Let’s discuss why in more detail…

Credit Call Spread

A credit call spread is an alternative to a long put strategy, in that both will allow you to short the markets.

A credit call spread is a much safer alternative to buying long puts since it removed the impact of volatility from the price of the options.

3 main characteristics of a long put option:

- Defined risk

- Unlimited profits

- Highly Susceptible to changes in volatility

3 main characteristics of a credit call spread:

- Defined risk

- Defined return

- Not susceptible to changes in volatility

Since implied volatility is so high, we are left with only trading a credit call spread to go short the markets.

In order to trade a credit spread you would look to simultaneously purchase and sell options contracts of the same type, on the same underlying security, across multiple strike prices.

Once a credit put spread is established, the premium you receive from the sale of the short option is greater than what you would pay for the options purchased.

The Formulas:

Maximum profit (reward) = net premium received

Maximum loss (risk) = higher strike – lower strike – net premium received

Maximum loss (risk) = B/E – lower strike

Breakeven = higher strike – net premium received

Let’s see how this looks with sample trade.

Next…

Sample Trade

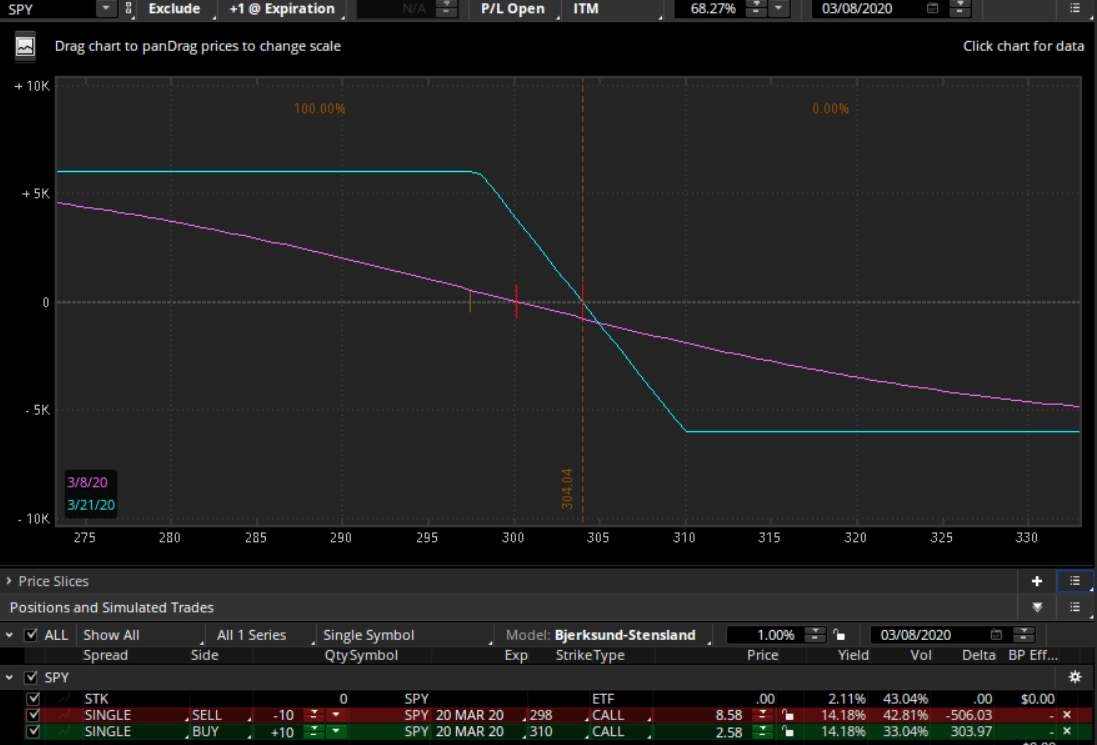

Here is a sample trade in the SPY’s.

This example is to illustrate the point of a credit call spread allowing you to take a short trade in the markets.

SELL SPY 20 MAR 20 298 CALL @ 8.58

BUY SPY 20 MAR 20 310 CALL @ 2.58

Source: Thinkorswim

Source: Thinkorswim

What’s really great about a trade like this is that implied volatility will not impact it at all.

And as a trader this is wildly important to monitor since it could suck all the premium out of your options faster than you can blink some days.

On this trade, let’s take a look at the max win/loss.

Wrapping up

For the most part, if a trader wants to trade short the markets while using options, there is only a small advantage when doing so, and it might not be right now.

For the most part, when trading a credit spread, a trader is able to receive 90% of the same benefits as a long options trader, but eliminates many other market risks/

Advantages of credit spreads

- Spreads can help lower your risk substantially

- Credit spreads require less monitoring than some other types of strategies.

- Spreads are extremely versatile due to the range of strike prices and expirations that are available for the trader to select.

- Little to no monitoring of position required, as typically wait for expiration to close trade.

Disadvantages of credit spreads

- Your profit potential will be reduced by the amount spent on the long (covered) leg of the spread

- Spread trading carries risk of being filled on the short option only, leaving you with an uncovered position.

Ready to start harnessing the power of credit spreads to take a directional bet on the markets without buying expensive implied volatility?

0 Comments