There is much more that goes into a trading system than just buying and selling stocks or options.

When it comes to building your trading business, you must have rules in place as a way to keep yourself accountable, and keep you from making expensive mistakes.

Having a system is essential if you want long-term success in the market. But a system is only as good as the trader who executes it.

If you don’t have a handle on your “trading emotions” (fear and greed) and can’t stay disciplined—you will likely lose money regardless of how great your system is.

When it comes to the importance of keeping level emotions, Warren Buffet had this to say: “Only when you combine sound intellect with emotional discipline do you get rational decisions.”

Does he know something we don’t?

The answer is right here…

Along with what we know about Buffet, if we look at the Forbes 400 Wealthiest Americans, it’s pretty easy to see they all made their wealth in similar ways… by owning businesses, finding great investments, and buying and selling real estate…

The common denominator being ownership. Letting your money work for you. This is what Buffet knows that we don’t…

The truly wealthy own assets and let their money work for them.

So wouldn’t you want your trading business to work for you, and not the other way around?

Of course you would!

That’s why I am going to share a few simple rules I developed in Real Estate that will help you achieve real wealth creation.

Now pay attention because these same rules are the cornerstone of the Options Profit Planner system!

First Rule

Invest for the long term

Flippers are not investors! Remember that money takes time to grow.

You might make a lot of money flipping houses, but you won’t build a fortune that way. In order to give your money time to work for you, you must invest for the long term.

Look at it like a snowball rolling down a hill. Over time it starts to build on it’s own, needing very little effort from you anymore… that’s the goal.

Second Rule

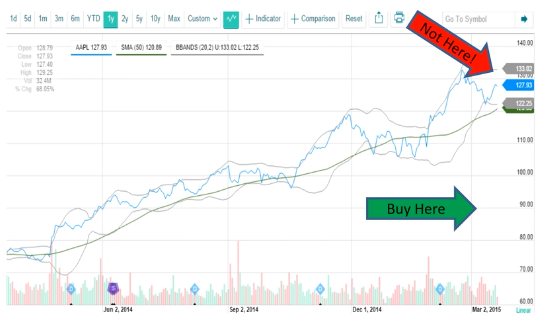

Buy Low, Sell High

For this you must be very careful with you purchases. There’s a saying… you make your money when you buy not sell and that’s exactly the truth here…

Only purchase great, well-managed properties below market value.

This allows you to Buy Low and Sell High. Not the reverse! Which often happens to traders and investors when they let emotions affect their decisions…

Not everything in front of you will be a good value. In order to find the right opportunities, you must be patient and keep emotions in check.

Third Rule

Invest for cash flows

Consistent cash flows are the key to making sure you always have a steady income and business growth!

And the power of compounding those cash flows can grow your wealth exponentially, if done properly.

So how do you do this with the Options Profit Planner?

It’s easy when you follow these three steps!

- Committo the stock you chose to trade!

- Find a discountedhigh-quality stock.

- Use it to generate cash flow!

So let’s talk about putting all this to work for YOU.

Ever hear of the MLS? Well if not, it’s basically a market scanner for homes that’s packed with all the information you could ever need to narrow in on what you are looking for…

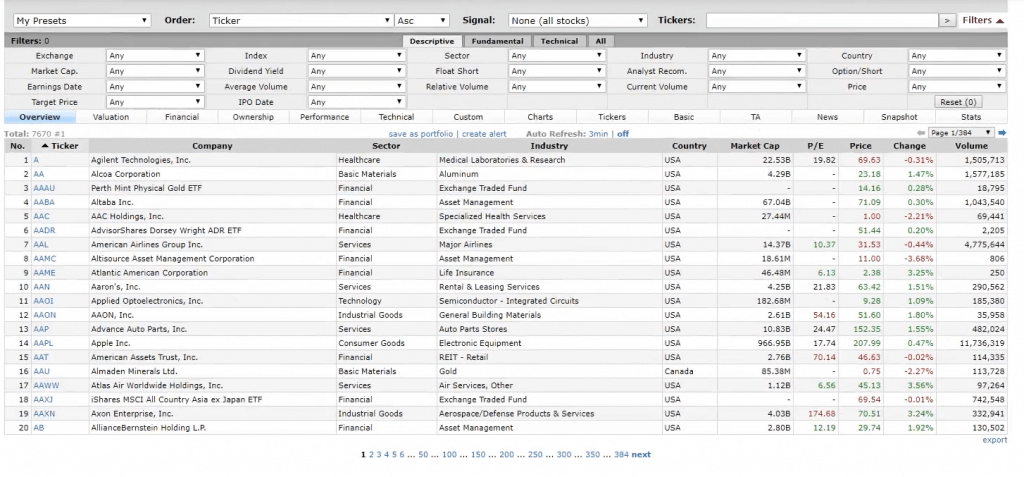

Now I bet you are wondering… Does the stock market have something like this? Sure does!

So how do you go about finding your own stock market version of the MLS to find the best opportunities to buy low and sell high?

This is where a stock screener like FinViz comes in handy. It is your own personal (and free!) MLS… for stocks!

In this free stock “MLS” you can filter out all the criteria you want to narrow in to at the top. Once selected a report is generated with all qualifying stocks below. Talk about powerful!

But we have a problem. If you notice, there can be hundreds or thousands of possible stocks listed! So what do we do now?

Now it’s time to put my formula into action and show you the secrets to finding great “properties.”

This formula was created with huge results from my real estate business! Following the simple “100 / 10 / 3 / 1” you can achieve results just like I do.

And in our next correspondence I’ll teach you how it works.

0 Comments