If you can connect the dots, then you can use this trading plan to fill your account with cash.

I’m about to tell you the secret to making nonstop win-after-win trades every month.

Don’t believe me? Since starting this service I have yet to have a losing position.

That’s right… almost 6 months of straight of rain makin’

And the best part, I’m able to do this by spending just 10-15 minutes per day.

Do you know what the major difference is between traders who live a good life and those that struggle month to month?

An edge in the markets.

The pros have a trading plan that works!

They’ve invested money and time to discover trades with a verifiable edge.

If you’re uncertain of what an edge strategy looks like… you’re in luck… because I’m going to share with you one of my favorite option strategies.

Selling Options

Before we begin…

Did you know that most traders are always trying to score big … driven by the burning desire to hit it big.

They are addicted to the thrill of the game as they continue to look for that next explosive trade.

And then the game is over.

Why?

Because 90% of traders who buy options without having an edge lose money.

It’s a fool’s errand.

Buying options is a lot like gambling at the casino.

You’re betting for a specific outcome with odds of winning a mere 25% to 40%!

This is why it’s the strategy at Options Profit Planner to focus on short options strategies and see get those house odds put into our favor.

So let’s review…

The Problem With Buying Options

Buying options is almost worse than buying or selling stock outright.

When a trader buys a stock, they have time on their side and only have to pick the correct direction.

If a trader buys options they need to have time, direction and distance all chosen correctly with nothing on their side to help them.

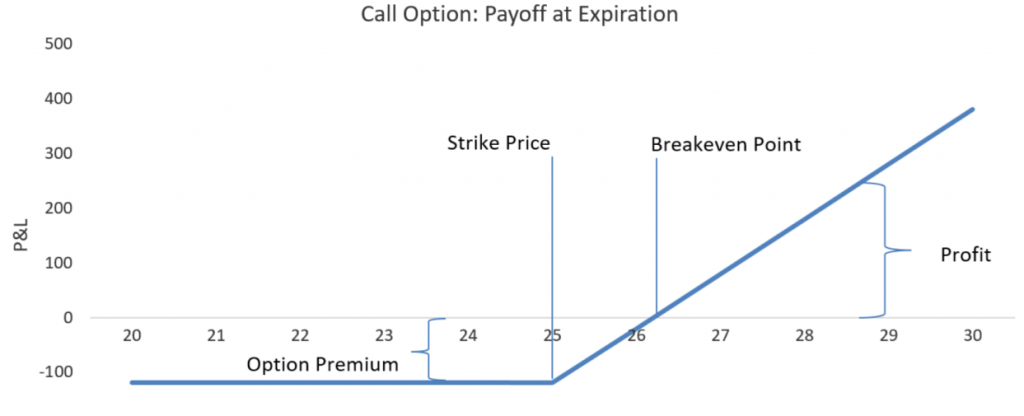

Here is an example payout diagram from a long call option at expiration.

As you can see, the trader can only profit from the trade if the stock increases in value(direction), before a specific time (expiration), and by a set amount (breakeven).

Factor in commissions, fees, spreads along with other costs to operate your trading business the breakeven is actually much higher.

So what’s the solution? To be the seller of options (the house) instead of the buyer (the gambler)!

This article is going to cover selling deep in the money (ITM) puts.

For a more comprehensive breakdown on the different strategies Click Here To Read… Selling Options To Boost Your Income

The Problem

One of the most popular short trading methods is selling out-of-the-money (OTM) put options.

Don’t worry – there is nothing wrong with this strategy!

It’s not the right tool for all of the jobs…

Let’s assume this is a trade you want to place on Twitter.

You have a price target on TWTR of $40 ( or higher ) in the next month based on your technical analysis of the stock chart.

How do you capitalize on your idea?

Your Options

You can choose from a variety of different strategies.

Let’s take a look at the 4 common answers to this problem.

- Buy the stock

- Buy a call option

- Sell (credit) put spread

- Sell naked put

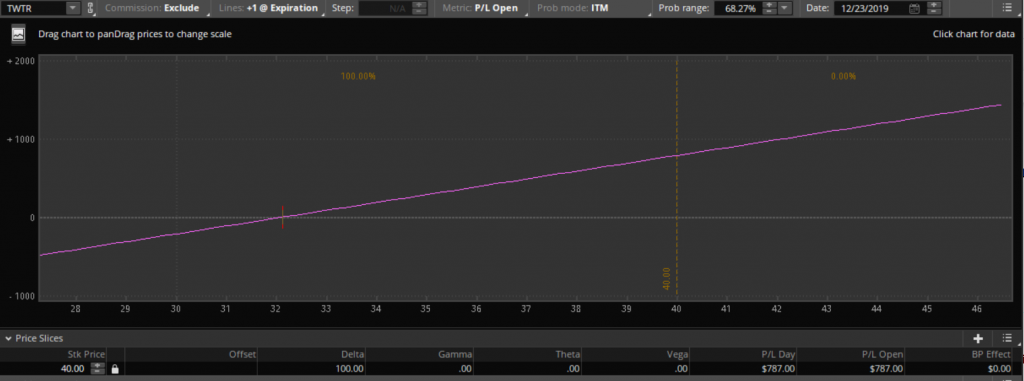

1 – Buy The Stock

This is the general answer to all questions when you ask someone what to do when you expect the stock to go higher.

This Trade:

- BUY 100 shares of TWTR at $32.13

Pros Of Long Stock:

- Profit on trade at $40.00: $787.00

- Profit on overall trade: Unlimited

Cons of Long Stock

- The cost to place this trade is approximately $3,213

- Risk-on trade: Unlimited

2 – Buy A Call Option

This is another very common strategy when a trader believes a stock is going to increase in value.

This Trade:

- BUY 1 x 17 Jan 20 $33 Call at $0.67.

Pros of Long Call:

- The cost to place this trade is approximately $67.00

- Profit on trade at $40.00: $637.00

- Profit on overall trade: Unlimited

Cons of Long Call:

- Risk-on trade: Limited to $67.00

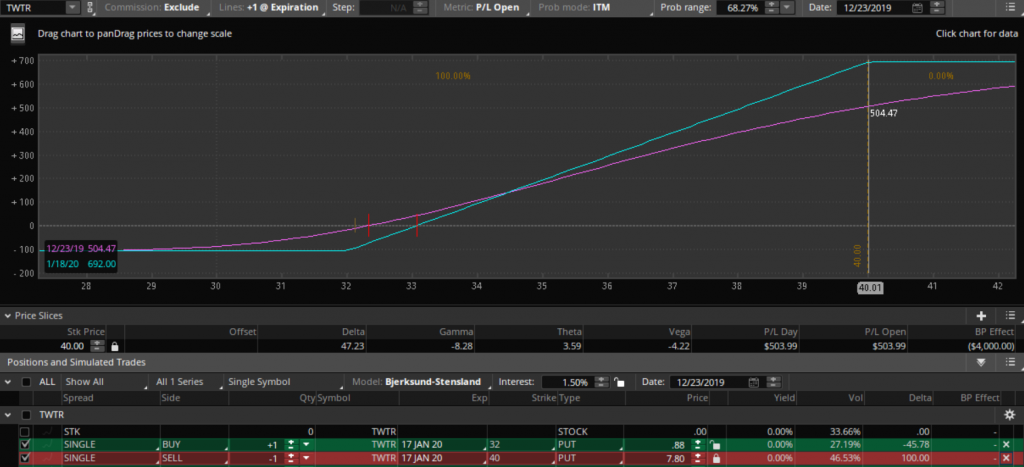

3 – Credit Put Spread

This is where the selection starts to take a turn and get interesting.

Instead of selling a typical credit put spread, let’s take a look at what happens when we sell a deep-in-the-money (ITM) put spread.

This Trade:

- SELL 1 x 17 Jan 20 $40 PUT at $7.80

- BUY 1 x 17 Jan 20 $32 CALL at $0.88

Pros of ITM Credit Put Spread:

- Profit on trade at $40: $692

- Maximum loss on trade: $108

- Covered, no assignment risk

Cons of ITM Credit Put Spread:

- A large amount of capital for margin requirements

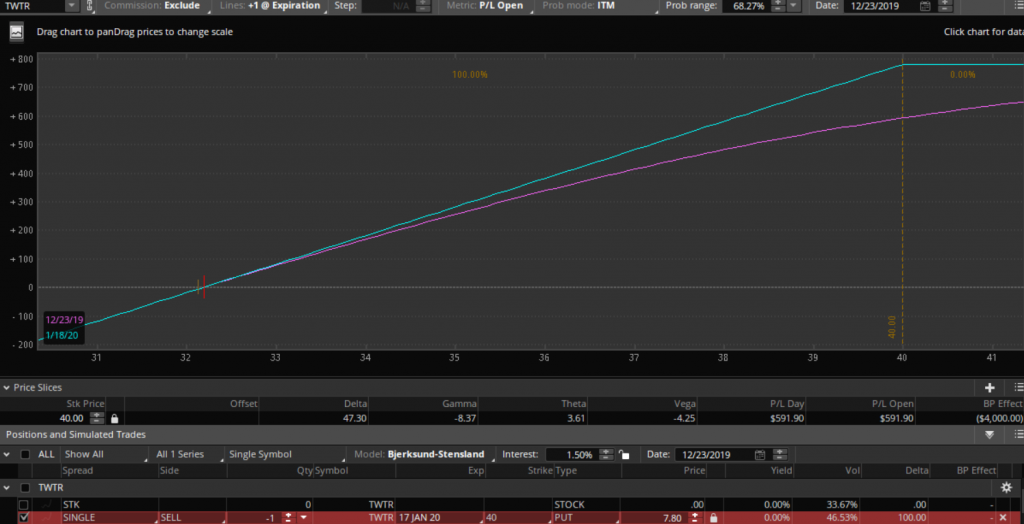

4 – Naked Put

A final solution to this trade is to sell the expected target price on TWTR.

Since selling puts is a bullish strategy, a trader needs to make sure that the stock is going to increase over time.

If confidence is high that stock will rise to $40, then a trader is able to collect the most amount of premium and get long stock at a target price for further profits.

This trade:

- Sell $40 puts at $7.80

Pros of Naked Puts:

- Easy to manage the position

- Buy stock at a target price $40

- Max Profits at $40: $780

Cons of Naked Puts:

- Assignment risk is very high

- Unlimited losses

- Higher margin requirements

Final Thoughts

Selling options is always a risk that many traders don’t feel comfortable taking when they start trading in the markets.

With the proper education and guidance, this is a fear that is shortly overcome.

Selling options truly places the house odds in your favor and is widely used as it provides a trader with a consistent income stream.

The winner in the contest above is the Credit Put Spread trade.

This position gives the best of both worlds and removes much of the risk associated with the naked puts.

By trading an ITM Credit Put Spread, a trader is able to capture a large premium in the option along with reducing all downside risk associated with short options trading.

This will all occur while still outperforming both the long call and the long stock at the target price of the stock at expiration.

Now it’s time to get out there and turn yourself into the casino – once and for all!

And if you need a trading partner, someone to navigate you, then consider signing up and becoming a paid-up member of my Options Profit Planner service.

0 Comments