Did you know that in order for a long options trader to be profitable they need to pick the direction and timing of the move perfectly?

Yikes.

No wonder premium buyers start every trade at a disadvantage.

And what if the stock trends sideways for longer than expected?

Well, let me tell you this – Theta is not your friend.

Theta is the vampire of options traders, slowly sucking out all the value of the options over time.

But what if I told you there is a way to cash in on a sideways market and make time decay work in your favor?

Only in options can a trader take a neutral position that pays off… regardless of the direction the stock moves!

This is one of the major reasons I chose to trade short options as my “edge” in the markets.

There are endless combinations of strategies that I can deploy to reach my desired outcome.

One of my favorite ways to capitalize during these market conditions is to trade a short call or short put….

But what if I sold them both together to double up on my returns?

This position is called a short straddle and is an easy position to use once you learn how to stack the odds in your favor.

Want to learn how to stack the odds in your favor, set up the perfect straddle, make adjustments, and take wicked profits?

The Short Straddle

Now I know what you are thinking but I promise… there is nothing to be intimidated by.

Even though this strategy has a complex-sounding name, it is actually quite simple once you understand it further.

Definitions: A short straddle is a combination of selling a call (bearish) and selling a put (bullish), both with the same strike price and expiration.

When sold together, they produce a position that predicts a defined trading range for the underlying stock.

Let’s see how we can:

- Setup the perfect straddle

- Defend and adjustment your position

- Lock in wicked profits on your trades

- Stack the odds in your favor by legging in

Now before you run off and start selling calls and puts, there is some basic information you need to understand first.

How To Setup The Perfect Straddle

One major advantage when using a straddle is that they are easy to get set up quickly.

Why?

Most option strategies require you to pick the right strike price and expiration from an almost infinite list of choices.

Straddles, on the other hand, are set up relatively the same to one another.

Since you don’t have to “figure out” what strike price or expiration month to trade on, this makes trading a straddle more straightforward.

There are two types of straddles:

- Long Straddle

- Short Straddle

For the purpose of this article, we are going to focus on the short straddle.

So…

A short straddle consists of selling a call and put at the same strike at the same expiration month.

Since the success of a straddle relies on the movement and volatility of the stock, it’s ideal to place your trade on the nearest expiration monthly options.

When trading a short straddle, you think the stock is going to stay at its current price.

For these reasons, long or short straddles are typically placed on at-the-money strikes.

To Recap:

- Short straddles for stationary prices

- Place trades using at-the-money (ATM) options

- Select the nearest monthly options expiration

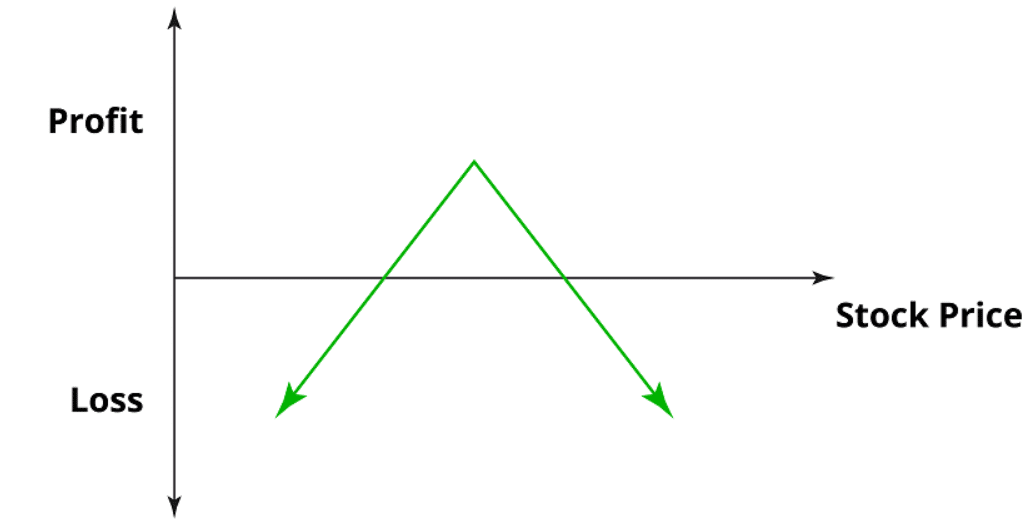

Here is a sample payout diagram for a short straddle.

Short straddles make a good strategy if a trader believes the underlying is not going to move or remain range-bound during the option expiration period, typically 30 days.

Let’s take a look at an example trade on stock XYZ.

First, we need to assume a few key things:

- We are short an at-the-money straddle on stock XYZ.

- XYZ is trading at $50 and the at-the-money call and put are trading for 2.50 each, or a net of 5.00.

- Breakeven to the upside and downside is set to 52.50 and 47.50, respectively.

- Max profit 5.00

Defend and adjustment your position

When it comes to short straddles, you don’t want to make too many adjustments to your underlying position.

One of the only ways to defend a short straddle is by buying insurance on your position when you place it.

I tend to believe that stocks “stair-step” as they head higher, and “fall out of bed” going down.

Hence, it’s best to add protection to our downside more than our upside if you don’t want to be assigned stock on your short puts.

One way to achieve this is to “shop” for cheap puts in our underlying stock at the same expiration as the short straddle.

The puts I would suggest searching for puts with a delta in a range of 0.02 – 0.05.

These options are cheap since they are that far out of the money and are built for insurance purposes only.

Options with deltas of 0.02-0.05 will sit at the same value quietly, until the time comes when the stock sells off and volatility explodes.

Once that happens, these insurance options will also explode in value potentially offsetting your entire risk on the short straddle.

When looking to purchase insurance for your position, it’s best to only spend approximately 5% of the total credit on your initial short straddle. (Yes, this little amount of money should be plenty to offset all risk from a large move.)

Pro tip: For those who are even more conservative traders, you can apply this same technique to purchasing calls to protect your upside risk as well.

One adjustment that is strongly advised against is “chasing the underlying” by rolling their positions. This can lead to locking in losses and increased risk by taking a bad position based on fear.

Lock in wicked profits on your trades

Knowing when to take profits can be very difficult for many new traders.

I would say that it is almost harder than knowing when to cut the losers and walk away.

That is wild… since making profits is the only reason we trade in the first place.

And when trading short straddles, the goal is to take quick profits and turn over your capital for the next trade.

One rule of thumb is the 20% profit rule.

On short straddles, you are looking at taking profits when you reach approximately 20% of your credit as a profit.

The idea is not to hang onto these trades until expiration.

Remember – there is too much risk trying to predict the future, let alone 30+ days out!

Many times a stock will head sideways for a brief period (creating a flag pattern or consolidation pattern) for technical traders, before making their next leg higher (or lower).

And because so many technical traders are searching for this consolidation to trade as a breakout, this will cause the sideways action you are looking for as a short straddle trader.

With consolidation comes breakouts. And you never know when they are about to occur.

Suddenly, the bears (or bulls) may take control of the stock and send it ripping past your breakeven prices.

This is why it’s important to take profits quickly instead of riding out the entire length of expiration on the straddle.

Stack the odds in your favor by legging in

One of my personal favorite ways to trade options is by legging into the position.

Why?

Because I can capture profits on both sides of the trade and stack the odds in my favor with ease.

Let’s take a look at how this works.

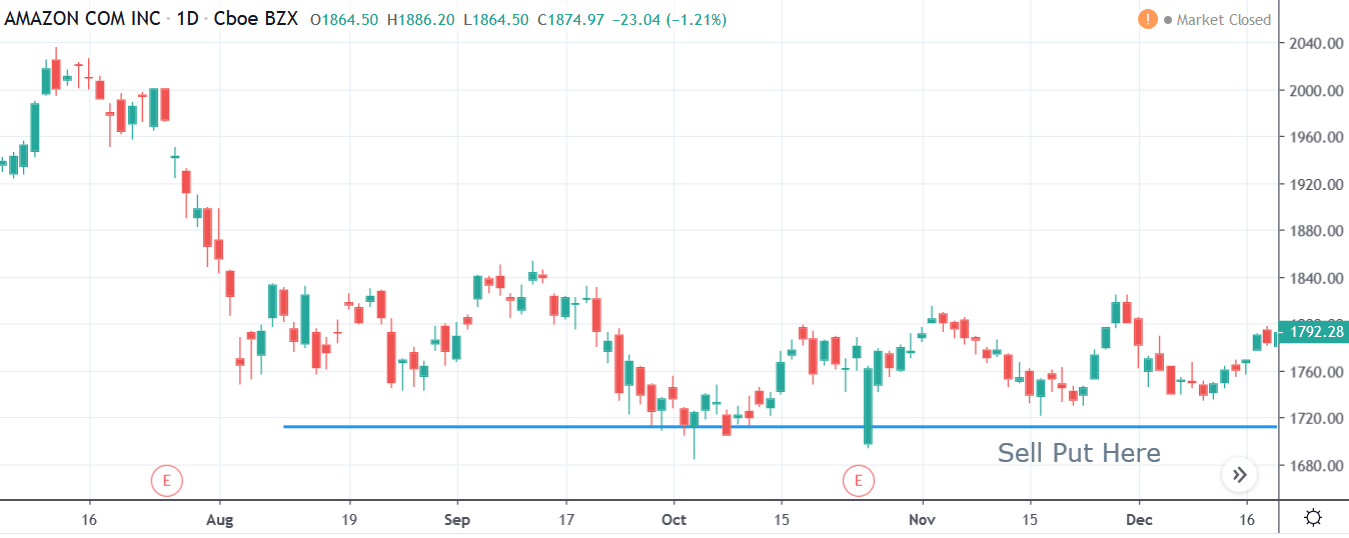

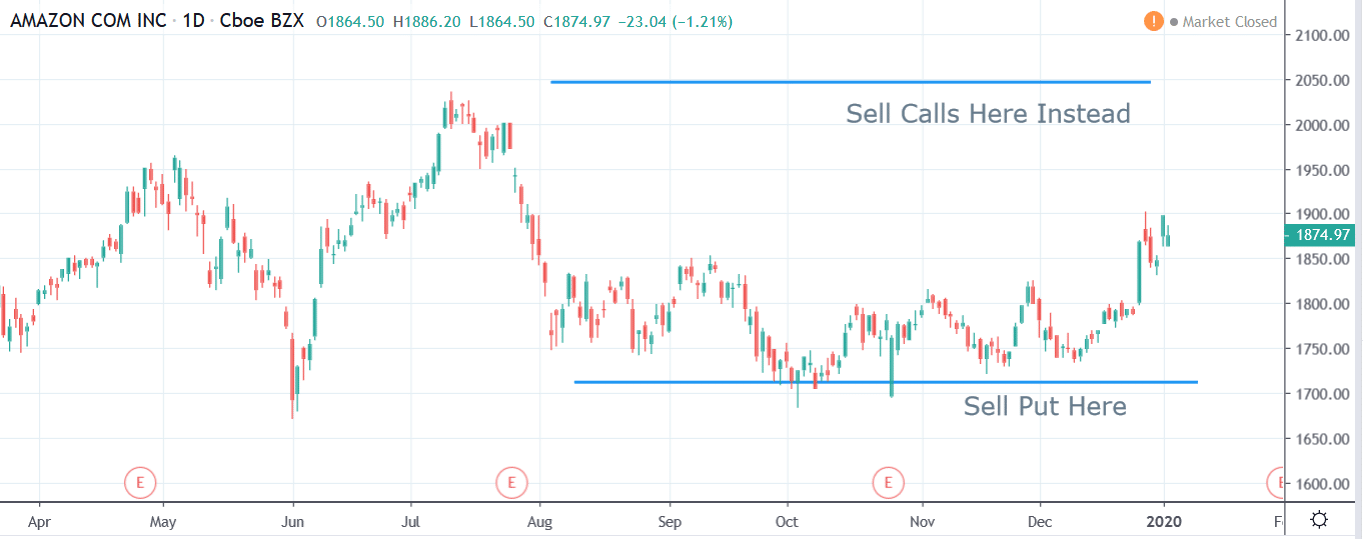

Here is a sample trade-in AMZN.

First, I notice the stock is trading near lows that stretch back towards June about 6 months ago.

The trade?

First, Look to sell a put below the support level in AMZN for 30 days expiration or greater.

Now I could sell the calls at the resistance above, but AMZN has been in a range for a while and it’s unlikely to stay here.

To many, this might seem like a fantastic trade…

But the odds are against you for an upcoming breakout occurring. Technical traders are HUNTING for patterns like these!

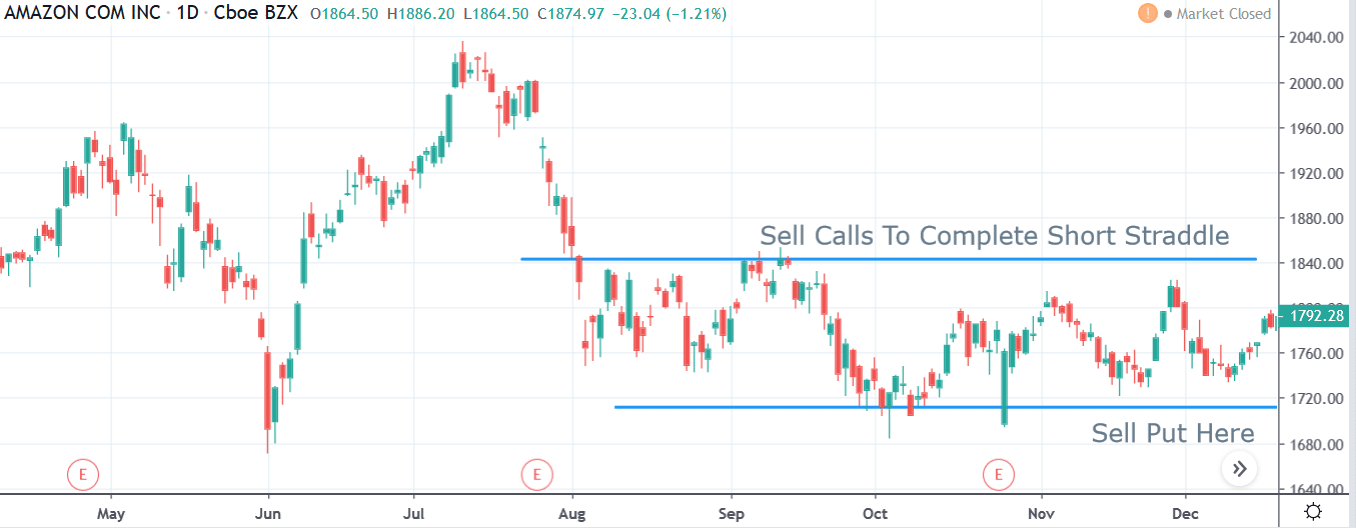

Look what happened shortly after the short puts were traded.

See what I mean?

It’s better to wait until AFTER the move higher to sell the calls to complete the short straddle.

Did you also happen to notice how tight the profit range was for that short straddle?

Remember, the tighter the range, the lower your odds are for a successful short straddle.

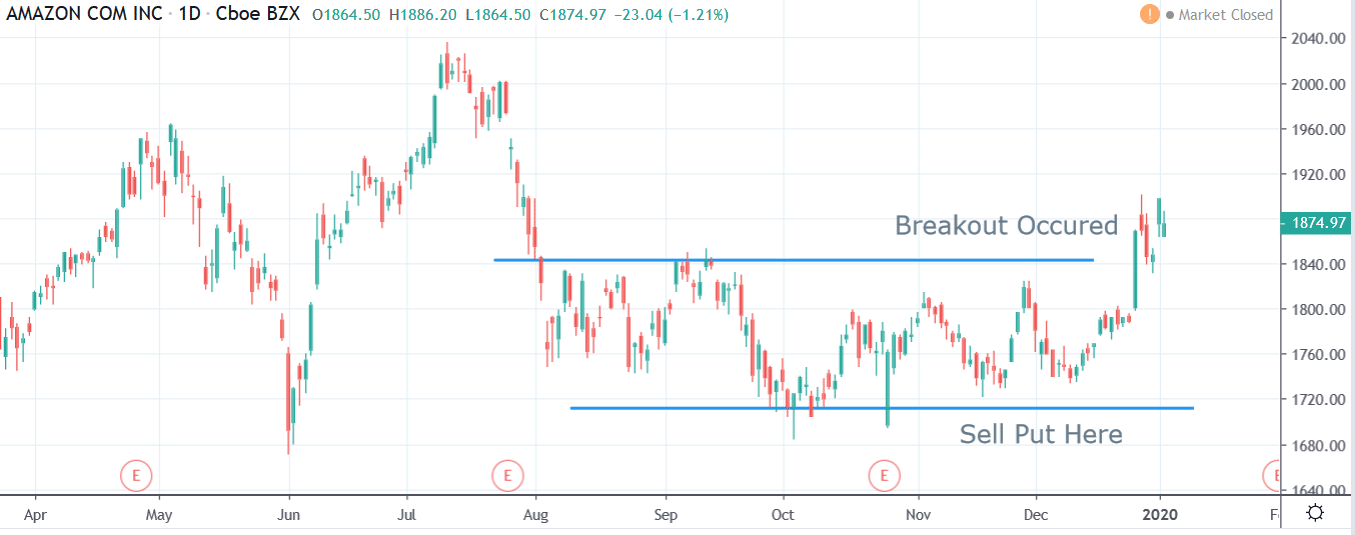

Now that the breakout has occurred it is smart to look for an expanded trading range.

One that stands out is the high’s that span back 6 months as well.

Highs and lows, when reviewed by technical analysts, are areas of support and resistance for future price action.

So… Why not sell calls up there instead after the breakout occurred?

This is what I mean…

Do you notice the difference?

The likelihood of success on this trade is significantly higher than the other short straddle.

Why?

Because we stacked the odds in our favor by legging into our trade.

Remember, short straddles are typically always placed at the same time, targeting the ATM calls and puts.

By waiting until the breakout we then allow the ATM calls to “move” higher in the chain and expanding the breakeven on the short straddle.

Conclusion

As you already know, there are many ways for options traders to make money in the markets with an edge.

What you learned:

- How to set up the perfect straddle

- How to defend your trade and make adjustments to your position

- Lock in wicked profits on your trades – quickly!

- Stack the odds in your favor by legging in using technical analysis as your guide

Like many pro traders, it’s important to have a lot of tools in your toolbox.

This is needed in order to keep you at the top of your game and profitable in any market condition!

To begin adding even more tools to your trading toolbox and start making steady profits, come join me at Options Profit Planner.

You can start making money immediately and consistently.

Don’t believe me? Well, I haven’t had a losing day since starting this service!

0 Comments