It’s been a wild two weeks in the market thus far—dominated by headlines of geopolitical tensions.

But despite the whipsaw action the market has experienced—I stay true to the core—and rarely let the news drive my trading decisions.

And for some to hear that… It’s shocking.

I don’t need a Bloomberg terminal, a squawk box, or half a dozen monitors to execute my strategy.

And neither should you!

You see, the tools I apply to tell me what to trade are far superior than any screaming mad man on the tv.

These tools I developed will tell you a far truer story than the fake news they are spitting out…

As a professional business owner and investor, I can tell you less is more.

I can narrow in on the stocks I want to trade and place all my orders all while spending only 15 minutes PER WEEK.

How do I do this?

By putting the odds in my favor each and every day.

For example, today, I’m going to teach you about a strategy that when executed properly—will give you some of the best risk to reward setups out there.

Want to learn a little known but powerful credit spread that takes advantage of markets that move either up or down?

The Short Butterfly

This strategy profits if the underlying stock is outside the wings of the butterfly at expiration.

What is it made up of?

This strategy can be comprised of calls, puts, or as an iron butterfly, using both calls and puts.

For this article, let’s focus on the Short Call Butterfly.

The Short Call Butterfly is a credit spread that consists of two long calls at the middle strike with one short call at each of the lower and upper strikes.

The upper and lower strings (or wings) must be equal distance from the middle strike price (the body), with all of the options having the same expiration date.

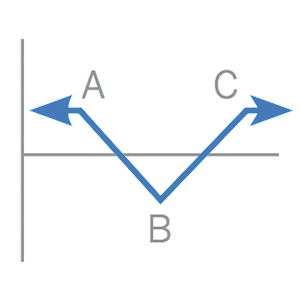

Here is a sample payoff diagram for the Short Butterfly.

As you can notice, at points A and C you will receive a max profit and at points B you will see the max loss on this trade.

Characteristics of a Short Butterfly

A short butterfly is a net credit trading strategy. Meaning that a trader will be paid up front to take this risk.

This is a great addition to a credit put spread or credit call spread strategy since it removes the requirement to pick a direction in which the underlying stock is going to move in.

Profits

Maximum profits for a Short Butterfly is obtained when the underlying stock price rally past the higher strike or drops below the lower strike price by expiration.

If the stock ends up at, or below, the lower breakeven price, the options will expire worthless and the trader will keep the initial credit when entering the position.

Alternatively, if the stock ends up at, or above, the upper breakeven price, the options will expire worthless and the trader will keep the initial credit when entering the position.

However, if the stock at expiration falls between the two breakeven prices the trader will suffer the max loss on the position.

Limited Risk

The formulas for calculating the maximum loss are:

Max Loss = Strike price of long call – strike price of lower strike short call – net premium received.

The max loss occurs when the price of underlying equals strike price of the long call.

Breakeven Points

There are 2 break even points for the short butterfly position. These breakeven points can be calculated by the following:

Upper breakeven = strike price of higher strike short call – Net premium received

Lower breakeven = strike price of lowest strike short call + Net premium received

Volatility

An increase in implied volatility, with all else equal, will have a neutral to slightly positive impact on this strategy.

Time Decay

Days until expiration decreasing, with all else equal, will have a positive and negative impact on this strategy.

Positive Impact:

If the strike price is aligned past either breakeven threshold, time decay will be forcing the trade to realize its gains.

Negative Impact:

If the strike price is inside the body of the butterfly, time decay will be forcing the trade to realize its losses.

Assignment risk:

The short calls that form the wings of the butterfly are subject to exercise at any time, while the investor decides if and when to exercise the body.

The components of this position form an integral unit, and any early exercise could be extremely disruptive to the strategy.

There are many factors to consider when short options that may negatively impact the strategy.

It is best to remain aware of the situation when a stock is being restructured or there is a capitalization event.

Such events are mergers and acquisitions, spin offs, or special dividends as this could significantly move the underlying stock price and cause early assignment.

Expiration/Pin risk:

This strategy at expiration will continue to carry risk.

If at expiration the stock is trading right at either wing, the investor will be facing uncertainty as to whether or not they will be assigned on that wing.

If the stock is near the upper wing, the investor will be exercising their calls from the body and is fairly certain of being assigned on the lower wing, so the risk is that they are not assigned on the upper wing.

Likewise, if the stock is near the lower wing the investor risks being assigned at the lower wing.

The real problem with assignment uncertainty is the risk that the investors position when the market opens after expiration weekend is other than expected, subjecting the investor to events over the weekend.

Although the risk might be small, it is still present as you could be long/short stock through major events without realizing this.

Conclusion

As with everything, this strategy comes with some major trade offs. And that’s ok!

The short butterfly is a fantastic position to trade if you believe there is going to be a market move and you are uncertain about the direction.

Another added benefit is this is a credit spread, therefore able to be utilized in a positive cash-flow trading system!

Pros of a Short Butterfly

- The risk is capped.

- Credit spread so you receive capital up front.

- Bi-directional profit opportunity

- Less risk than long straddle

- Narrower breakeven compared to a Long Butterfly

Cons of a Short Butterfly

- The returns are capped

- Unlike short calls, if the stock does not move you will have max loss

- Potential for large commission rates with 4 legs being traded.

0 Comments