At some point, stocks will be a buy, but when?

Your timing will make the difference between picking the bottom and catching a falling knife.

However, there are some option strategies that you can implement today—which will boost your likelihood of success.

With implied volatility in options being sky high, you deserve to give this strategy a serious look.

Naked Puts

The Naked Put is an options strategy that lets investors collect premium by selling an option, which are typically at-the-money or out-of-the-money.

For example, suppose you aren’t happy with the cost of AAPL at $200 per share. And you would be more interested in getting long the stock only if it came down in price.

After doing research on the stock, you decide you are going to sell the $150 put options since that is the price you feel comfortable owning the shares if you are assigned the stock.

As a result you immediately receive $200 in options premium, since the $150 put options are sold for $2.00 per contact.

This means, if AAPl drops below $150, you will buy 100 shares of that stock at your desired price.

How does this work?

Well all options come with two main criteria:

- Price obligation

- Time to expiration

Price Obligations

An obligation on selling put options is if the price falls below your strike, you will be required to own that stock (at the strike price), as the sample trade above.

Let’s take a look at a quick example…

Source: Thinkorswim

Each option contract has an associated strike price at which buyers and sellers agree upon buying and selling stocks.

The value of the contract is what the markets are pricing the options at and are subject to change based on the supply and demand on that stock or option contract.

Options Expiration

Every option has a time and price associated with them and adjusts in price based on a number of underlying factors.

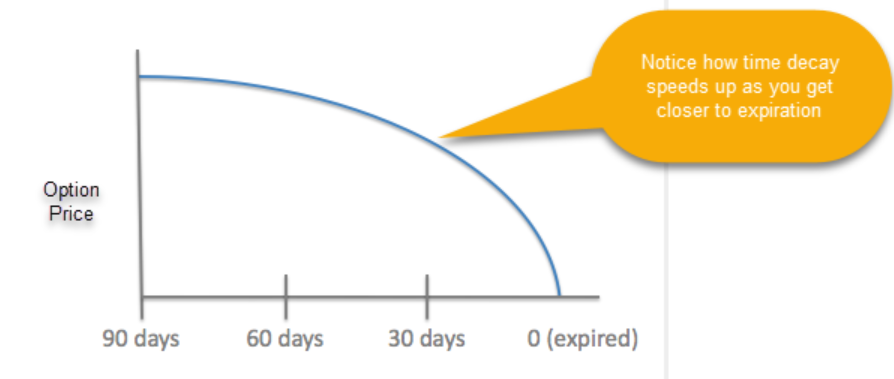

One of the factors is time decay, and it is based on how much time is left on the options. Typically, the value of a weekly call option is cheaper than that of a monthly all option.

For example, a weekly option that is expiring on Friday of this week has 5 days of time value added to the options price.

Theta is the value of time in the options contract, and the longer the amount of time, the more time value an option will have.

Each day that passes, the value of these contracts will decrease by 1-day value of Theta. Also, it is important to know that Theta will speed up the closer you get to expiration.

In the chart below you can see how rapidly the option price decreases with less than 30 days until expiration.

Pro Tip: It’s a must to trade 90 days (or more) before expiration making sure to work with the flat-ish part of the curve.

Example Trade

Let’s take a look at a sample trade on NFLX that after researching the stock identified a price we would feel comfortable selling a put contract at.

Here is the chart and the price at which we would try to sell puts at.

Source: Thinkorswim

And here is a sample option risk diagram of this trade.

Source: Thinkorswim

Trade Breakdown:

- Sold 10 NFLX 17 APR 20 250 puts for $17.50 per contract.

And this option is currently trading around $3 per contract.

Meaning… in just a few more days I will be able to capitalize on a 100% gain on this trade!

It’s that simple of a trade! By only using 1 option I am able to place a great position on NFLX and return 100% of my capital in a few short weeks!

This trade is aiming to capitalize on the extended markets along with the increase of implied volatility in the markets when trading near its lows.

But I am sure you are asking… why would I want to sell puts that far out of the money?

Well because I feel confident that if NFLX was to get down to that price I would like to own the stock.

And by selling puts you can get paid upfront for telling the markets you would like to own stock at that price.

What do I want to happen?

- The market to rally

- The market to continue to sell off and I get to own NFLX at a great price

Wrapping up

The good news is that there are many trades you can place every day based on market conditions. And as the markets continue to sell off more and more of these trades become available for you to take advantage of.

One benefit of trading the naked put is that you are able to generate steady and consistent income. This strategy lets you place the house-odds in your favor compared to going long an option. This is unlike long options, where you have very little odds of having a winning trade.

So here is a quick breakdown of the pros and cons of trading Naked Puts

Pros:

- House odds in your favor of over 60%

- Ability to purchase stock at a significant discount

- Can win in a up, down, or sideways market

Cons:

- Limited upside gains

0 Comments