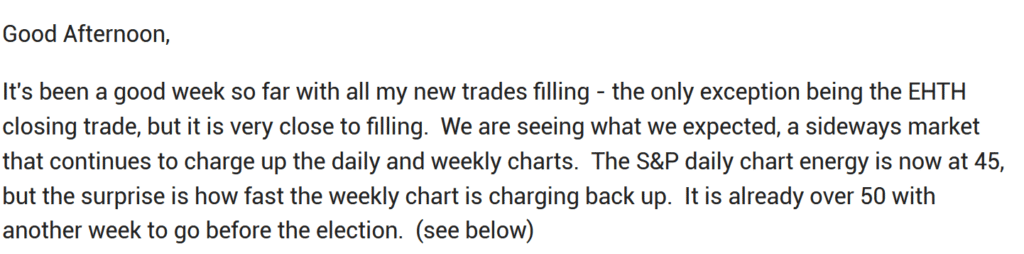

All last week I pointed out that the markets need to charge their energy .

Thus far, stocks have been bleeding red as fear and uncertainty are taking over the headlines.

Source: Finviz

But despite a massive sell-off, my account is actually outperforming.

And while many traders fear:

Various factors in the economy combined with a virus outbreak

The political landscape feels like it’s going to boil over

Earning season… it’s been pretty abysmal to put it nicely

My fractal energy indicator has been steering me in the right direction.

I want to show you my gameday playbook and how I generate income even in the toughest of market conditions out there.

Focus On This One Key Concept When Volatility Spikes

It was an ugly week in the markets, and an even more difficult day today.

But when the dust settled we were left with only a few things… tomorrow is another day, and if you made even the slightest profits, that’s a huge win.

Now I don’t need to bore you with that “what could have been…” nonsense, but instead, I want to share with you exactly what happened for my Options Profit Planner members.

It all started last week…

And what did the chart look like?

Source: Thinkorswim

You see, in order for the Fractals to become charged… the markets need to drop!

So this is what I did…

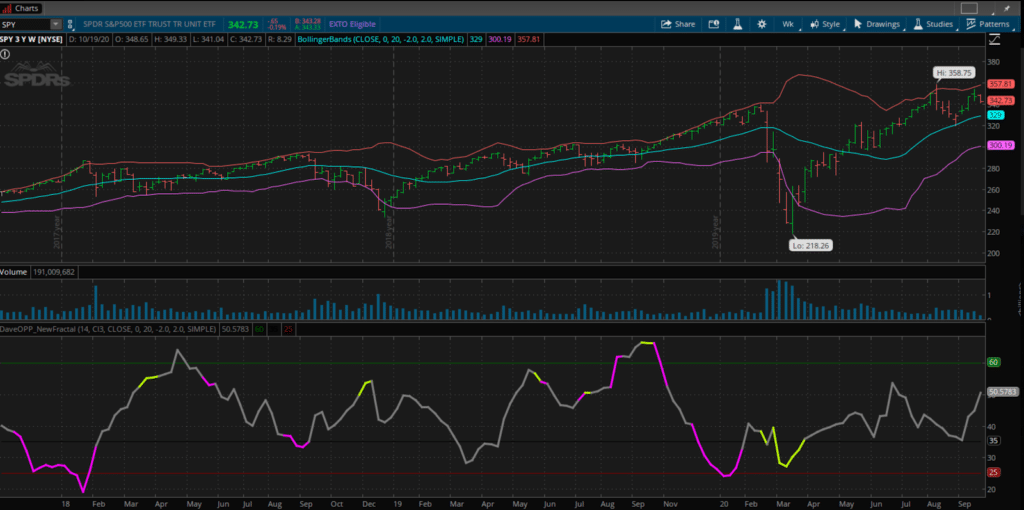

I knew the markets were going to most likely trade sideways if not lower in the weeks heading into the election.

So as a credit trader, I am going to trade a weekly Iron Condor on the SPX.

The SPX Trade

Here’s what I priced out to trade for this week

The SPX Iron Condor:

SELL 30 Oct ’20 $3280/3275/3540/3545 Iron Condor for $.70 or better

Why did I trade this?

Well, I am looking to take advantage of some sideways markets and increased volatility this week with this trade as I don’t believe we will start trending until after the election next week.

Well, that’s exactly what happened!

Source: Thinkorswim

Source: Thinkorswim

Just check out how fast we fell as the Fractals were trying to become energized again.

Now it’s time to lock in profits for a slick +75% profits on this trade!

You see, by trading a credit spread, I didn’t have to spend any money on this trade!

Instead, I was able to collect the credit that was given to me when I initiated this trade and generate cash flow for my trading business… and the best part, it was nearly stress free!

Because I have a system to trade confidently and efficiently in these crazy markets.

Coming Up Next

Lucky for you, just because I made money on the SPX trade doesn’t mean I’m done with my stock picks!

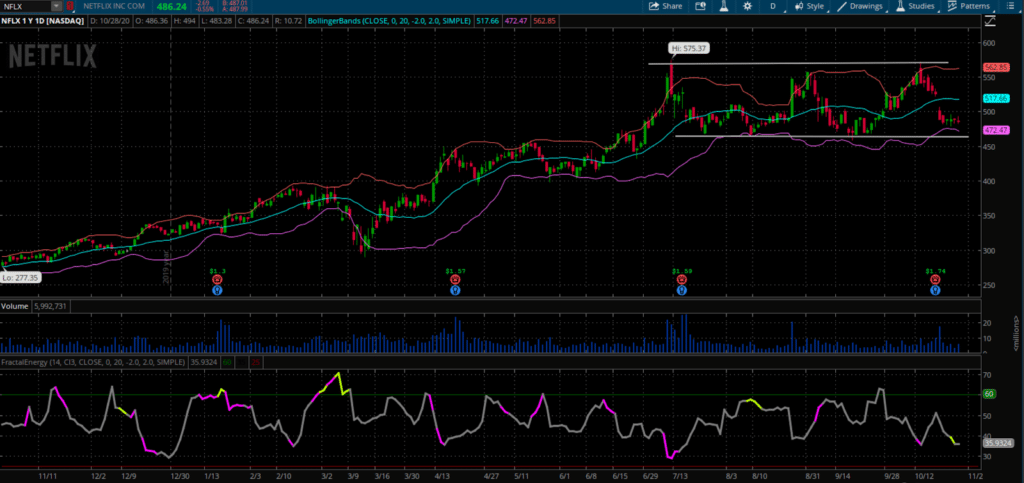

I’m constantly on the lookout for my next trade…and I’ve got this one FAANG stock right in my crosshairs

Source: Thinkorswim

Now just because it’s on my radar doesn’t mean I’m going to take the trade.

And this is only one of the many stocks that are on my watchlist for next week.

Listen, there are plenty of opportunities out there, but I want to show you how to unlock a stress-free style of trading for generating income.

And with a strategy like this, timing and accuracy can take the back seat, since you are selling into the fear and anxiety of many traders when volatility ticks up.

Sign up for real-time updates, alerts, and more now!

WE MAY HOLD SECURITIES DISCUSSED. RagingBull has not been paid directly or indirectly by the issuer of any security mentioned in the Services. However, Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication.

0 Comments