Today I’m going to teach you about a conservative options strategy which allows you to profit when a stock rises.

One that brings down the cost of your stock purchase, improves your odds to profit, and allows you to collect income along the way.

If you haven’t guessed by now, it’s the covered call.

And I’m going to walk you through the mechanics of the strategy right now.

The Covered Call Strategy

A covered call is an options strategy that allows a trader to collect additional income on a stock that is in their portfolio.

This strategy is considered a mildly bullish strategy because the upside of the trade is capped from further gains. This is unlike a long call option or long stock position which has unlimited upside potential.

When establishing a covered call position you would want to target a stock you own or plan to own in your portfolio.

Next, you want to select a strike price of a call option that is either at-the-money (ATM) or out-of-the-money (OTM).

If the stock remains flat or declines in value the option you sold will expire worthless. This means that you will get to keep the premium you received when they were sold.

For example,

I was assigned on my UCO short puts, and now I own stock of UCO at $15.

I have two choices I can do, I can’t either hold it and wait for a rally or sell the position at a loss.

But what if there was a better choice.

Let’s take a look at an example of how I can use covered calls to collecting income on the way up to boost returns.

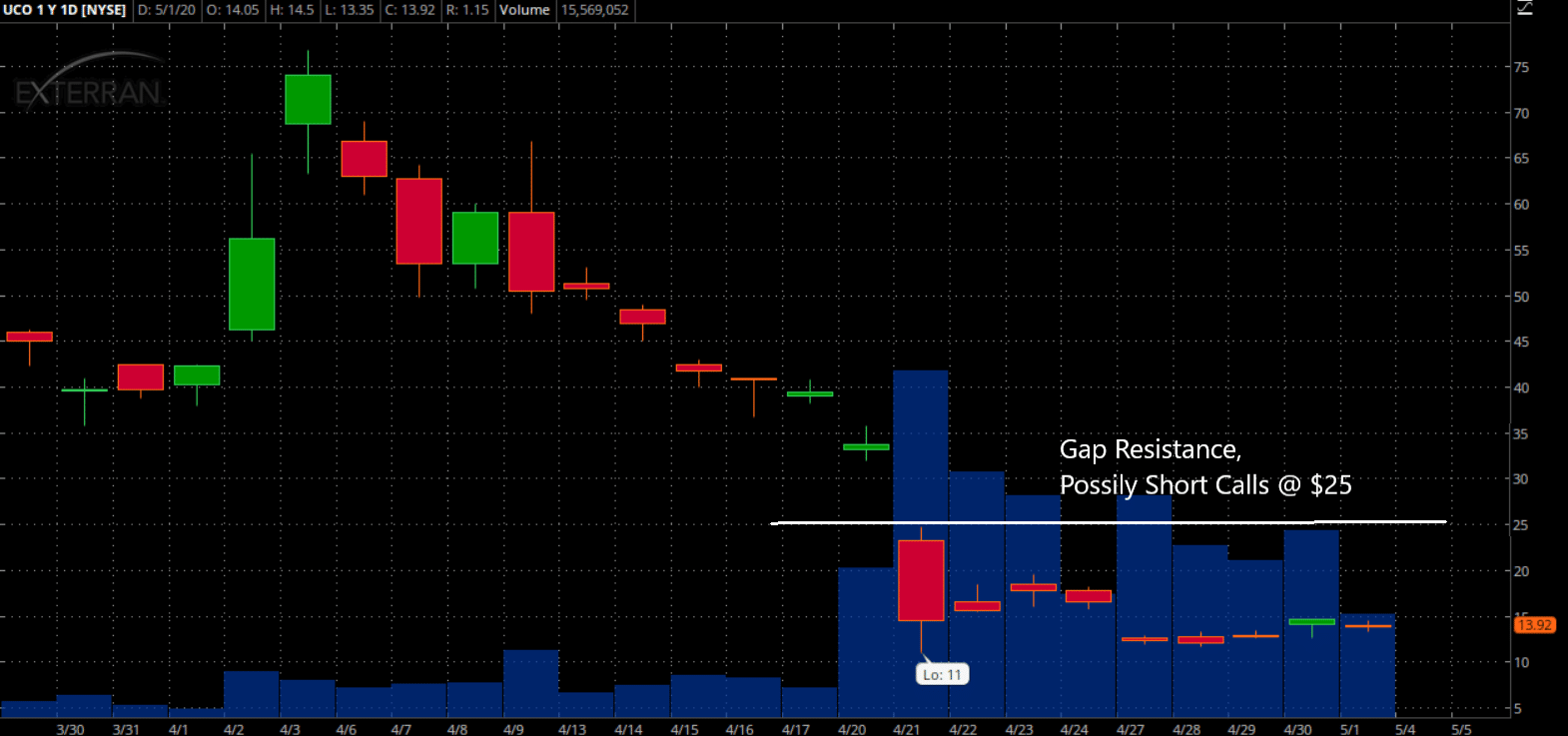

Source:Thinkorswim

Selling the calls for the Covered Call can be done for a few reasons:

- Expecting a slightly bullish, if not bearish to neutral in the upcoming weeks or months

- Technical level expected to suppress stock price in near term

And at $20-25, the pivot and gap on the chart should provide some level of gap resistance on the stock. This level would make it a good level to sell calls on and collect income for the long trade as it’s expected to not break that trading level.

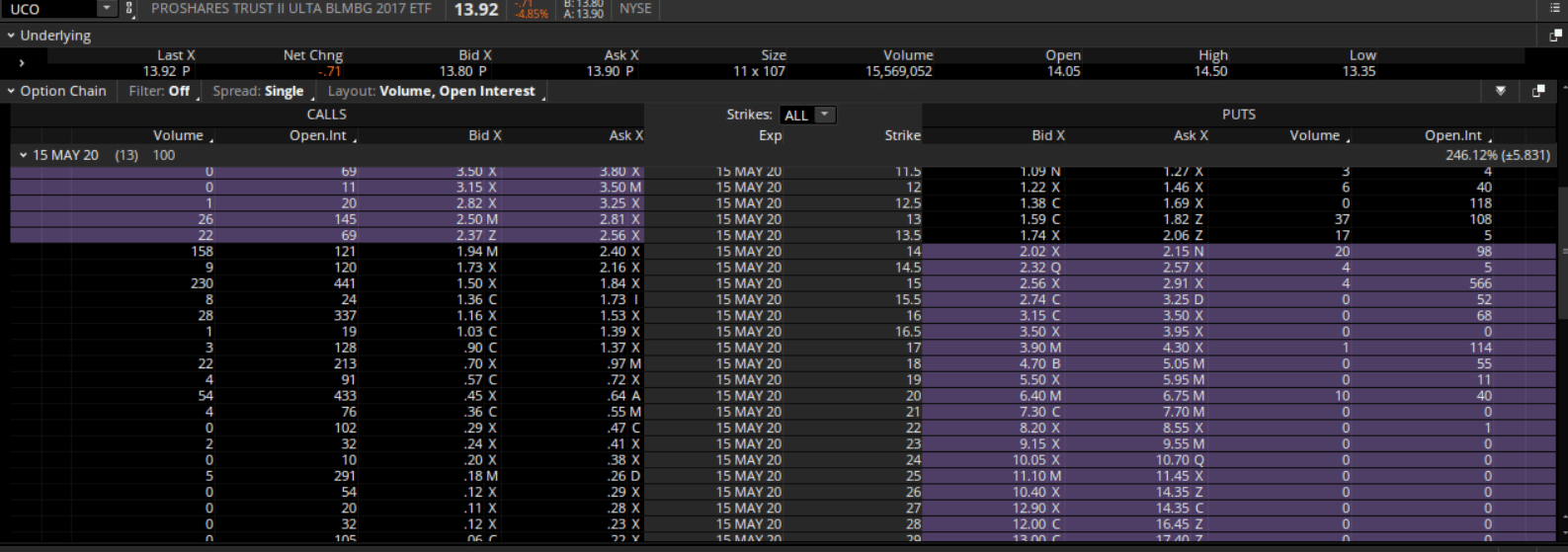

Here’s what the options chain will look like on that trade

Source: Thinkorswim

Breakdown Of The Trade

First, I always like to know what returns I can see from my trade.

To find this, you want to divide the premium collected by the value of the stock position.

For UCO: 45/1390 = 3.2% additional ROI on this trade

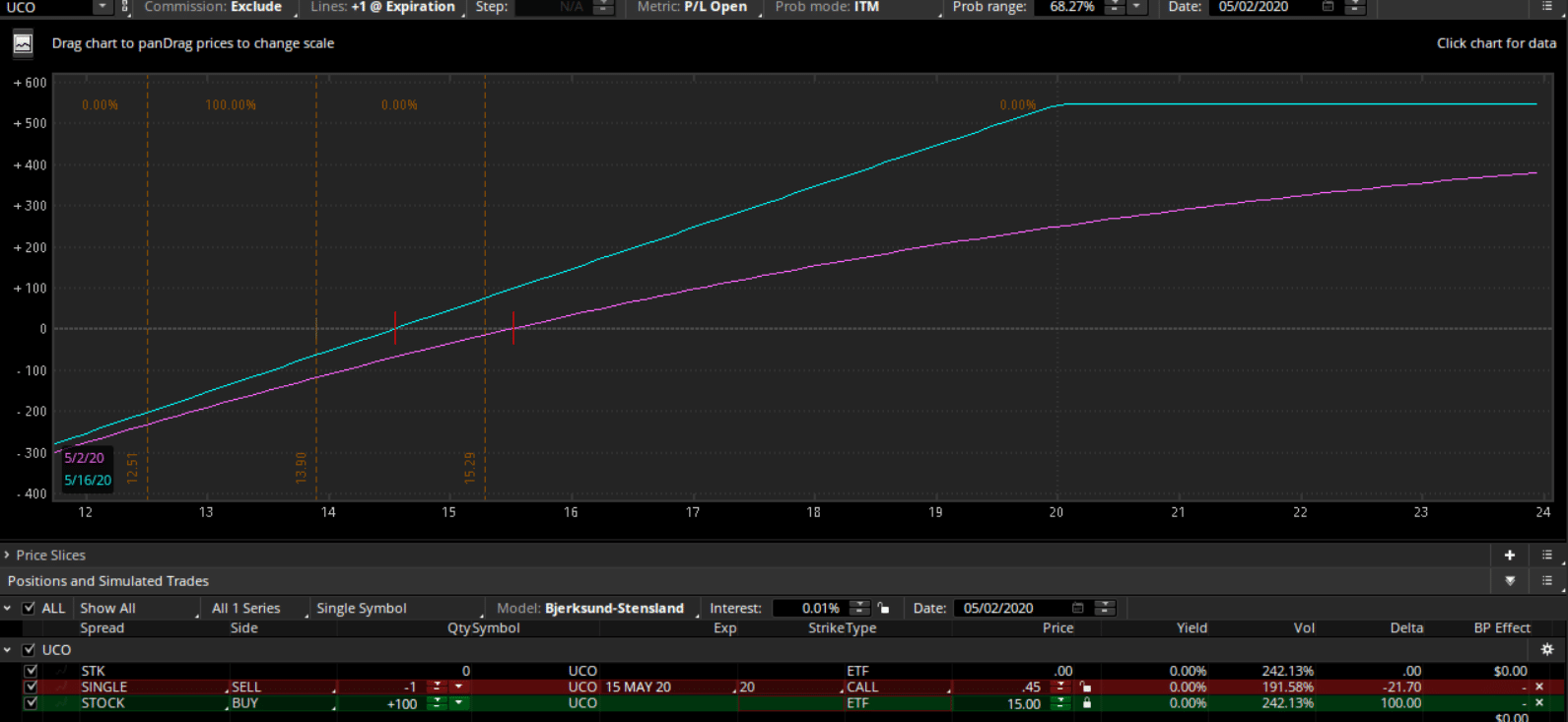

Here is a risk diagram of this trade.

Source: Thinkorswim

The covered call has two calculations, the max profit a trader can receive and the breakeven on their trade.

Like a long stock position, the loss to the downside is the same.

Two main levels you need to be aware of:

- Max Profit : Premium received + (Strike – Stock Price)

- Breakeven: Stock price – premium received

Now that you understand those two numbers…

How do you get to keep the entire premium?

You can only keep the full premium if the stock closes at or above $20 at the expiration date.

In this case, you will collect the premium received plus the increase in the underlying stock price.

This is the Max Profit calculated above, and will be $0.45 / contract

In other words, the max profit potential from this trade is 45/1330 = 3.2% additional profit in 12 day! That’s an annualized profit of over 60% per year if you collected 3.2% every 12 days!

As you can see, this strategy has the potential to significantly increase your returns on the stock position you currently have on.

Additionally, by selling calls against your long position, you are essentially hedging your bets on the trade.

If a stock was to sell off and go against you – the short calls will offset some of the losses on the initial stock trade.

Ways The Covered Calls Make Money

There are 2 ways the Covered Call strategy makes money:

- Stock stays flat or declines

- Stock trades higher

As you can see, this strategy has more than one shot at winning and that is extremely appealing to many traders.

And if you are a new options trader, you have only had the luxury of having a single way to win trading stocks.

Additionally, the worst fear many stock traders have is actually the loss of potential profits instead of risk to the downside.

That is where a Covered Call strategy is not an ideal trade. If you are extremely bullish on your stock, it is not recommended that you trade this strategy.

Why?

Well, the short call above your market price is going to limit your profit potential and cap your returns until the options expire or you exit your calls early.

That’s one of the biggest risks to a Covered Call trader.

Hold on… but what about the downside risk?

It’s essentially the same as owning the stock itself!

There is no added risk to trading the covered call to the downside versus owning stock.

Trade Management

Trade management is difficult, even for the most experienced traders…and is even completely overlooked!

That’s why I put together the 7 rules in trade management that are available to you when trading a covered call and find yourself in a spot where you need to make a quick decision.

The 7 rules in Covered Calls trade management:

- Expiration: Do nothing and let your options expire worthless.

- Assignment: Do nothing and let your stock be called away at or before expiration.

- Close-out: Buy back the covered calls (at a gain or loss) and retain your stock.

- Unwind: Buy back the covered calls (at a gain or loss) and simultaneously sell your stock.

- Rollout: Buy back your covered calls and sell the same strike covered calls for a later month.

- Rollout and up: Buy back your covered calls and sell higher strike covered calls for a later month.

- Rollout and down: Buy back your covered calls and sell lower strike covered calls for a later month.

There you have it…those are my 7 rules in trade management for the Covered Call strategy.

Wrapping Up

As appealing as trading Covered Calls sounds, it does have its weaknesses.

It’s best to remember:

- Covered Calls do not work for extremely bullish positions as it will limit your profit potential

- Covered Calls do not prevent your account from having major losses like a Protective Put strategy would have

What are some other strategies other than a covered call?

Maybe you would prefer looking for a risk-defined strategy that is mildly bullish? If yes, consider the income generating strategy called a credit put spread.

The bottom line is this… as with most options strategies, there are many pros and cons to consider before placing a trade.

And it is best if you take the time and understand exactly what risks you are potentially placing yourself in when trading this strategy before hitting that send button.

Now, if you are ready to jump into options trading with covered calls or need guidance when making your first step, click here to learn more details about the Options Profit Planner!

0 Comments