This is one of those times in trading where I am happy to not make money.

You read that right, and yes, you are not going crazy.

I am actually happy that I did not make money… And what a relief that is.

Watching the guests on CNBC yelling about a market collapse just makes my head spin. It is never fun hearing fellow traders who are getting smacked around in this volatile market.

One bit of advice…

Just stay calm, cool, and collected during market sell-offs.

It’s natural, normal, and even expected— especially when it’s at all time highs and overextended.

So what are your possible choices after market moves like this?

- Sell all of your stocks. That’s stupid, don’t do that!

- Buy more stock. That’s smart, just be careful not to catch a falling knife!

- Buy insurance. Sounds complicated?

This may surprise you but I actually chose to buy insurance when the markets are at all time highs.

And now I’m looking like a genius.

If you have a long-term portfolio and are not up on hedging strategies— I’m talking about techniques you can implement right now to protect you from a market sell-off or even worse—a collapse—then today’s trading lesson couldn’t have come at a better time.

What Is A Hedge

To clarify, I like to consider a hedge as insurance.

Similar to insurance with monthly premiums, a hedge in the options markets costs money as well.

When people hedge, they are essentially insuring themselves against unknown future events that could be harmful to their trading account.

Remember, although hedging doesn’t prevent any losses to your account if a negative event occurs, it does in fact help offset the loss.

Times Of Chaos, Many Lose, Few Win

Some events that happen when I am trading really stand out. Some I will never forget.

One event in recent memory was for the record books.

It was a quiet evening in the winter of 2018.

I vividly recall a trading friend of mine calling at 8pm asking if I saw the news and was alright.

He wanted to know if I was involved in a short vol trade that almost closed his firm down.

Thankfully, I was not.

I am talking about the volatility explosion in 2018 which left bodies lying in the street.

Headlines read,

“The XIV security, which had fallen roughly 85 percent in after-hours Monday, closed down 93 percent Tuesday.”

There was a body count for this explosion in volatility, literally, as hedge funds collapsed leaving traders and investors bankrupt.

Although, there is something to be said about carrying these “lotto tickets”.

“Texas hedge fund plucks millions from investments designed to benefit from turmoil and volatility.”

For many this can be a perfect opportunity to make money.

Like betting on the most unlikely horse to win the race every time.

Sure, the payout is great, but you will lose almost every bet and bleed to death from papercuts.

That’s not the right way to approach these sharp sell-offs at all.

To me, a simple hedge it a more straightforward approach than trying to find a way to make profits on chaos or that Hail Mary bet.

I like to keep my portfolio as smooth as possible to let my cash flows continue to come in.

Therefore, to maintain my trading plan it’s actually better to think of hedging to reduce losses than making wild bets like some do.

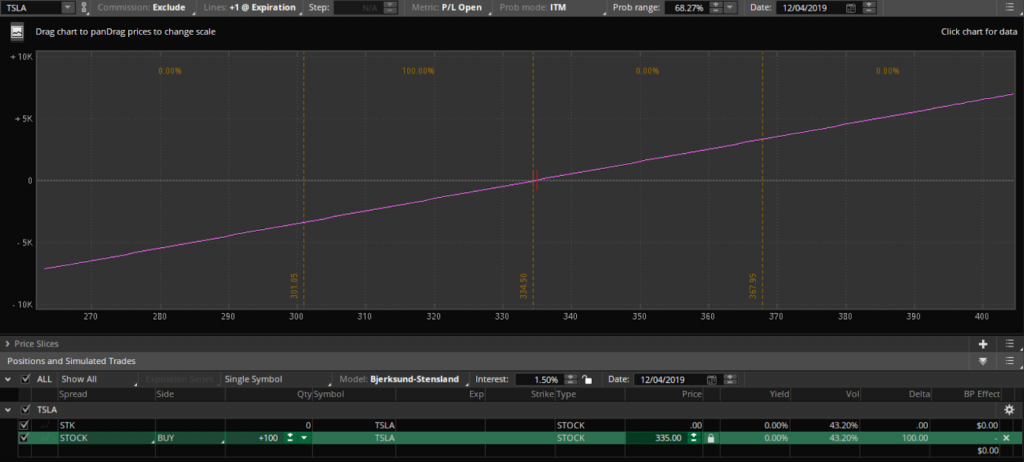

Long Stock Risk Profile

Typically in trading an unhedged stock has a linear risk profile.

For every dollar the stock increases, you gain an equal amount.

The same goes for losses as well.

For every dollar the stock decreases, you will lose an equal amount.

Here is a standard risk profile of your account after purchasing a stock.

In this example, we bought TSLA at $335.00.

As you can see from the image above, there is a potential substantial losses as the stock price falls.

Think Of Hedging As Insurance

Hedging means that an investor has identified a threat and engaged in protecting their account against a loss from an adverse price movement of an asset.

Many times, investors are just trying to survive major market events rather than a bear market cycle.

So that means most hedges have short duration times and have an almost immediate outcome.

Therefore, hedging can be considered as the purchasing of “insurance” for a financial portfolio with the intent to offset an unfavorable movement in the underlying price.

Basically, hedging is easily compared to purchasing an asset that could rise in price equal to another asset that is falling in price.

This secondary asset used for insurance (the hedge) is typically stock options.

Using Options As A Hedge

It’s nearly impossible to hedge stocks with other stocks.

The only choice for investors is to hedge their stock portfolio using options.

Even though options are considered “voo-doo magic” by many investors, these instruments can provide significant advantages to controlling risk.

Depending on the investors viewpoints of the market, there are many hedging opportunities to choose from.

Some basic hedging strategies are covered calls, protective puts, call spreads, put spreads, or more complex, such as a collar.

Don’t worry about the fancy names… it’s easier than it sounds.

The truth is once you understand the basics options can be a great way to hedge against and potentially eliminate all risk in certain cases.

In this article we will focus on using the most simple strategies, such as; protective puts, covered calls, and collars.

The Protective Put

One of the easiest hedges against a significant price drop is through the purchase of a put option on a stock that you currently own.

Think of this as purchasing insurance on your car.

Just like insurance is protection to the value of your asset, a put option is protection to the value of your stock.

How does a protective put work?

First, an investor will have ownership of a stock and is looking for downside protection.

Second, an investor purchases a put option on the underlying stock.

Typically, an investor wants to purchase a put option that is far enough into the future to cover the event risk.

The purchase of a put option allows the investor to sell a specific stock at a set price on or before a certain time, or expiration date.

How does this work exactly?

As the price of the underlying stock falls, the investor has now locked in a “floor” at which limits all additional losses of the asset from that point forward.

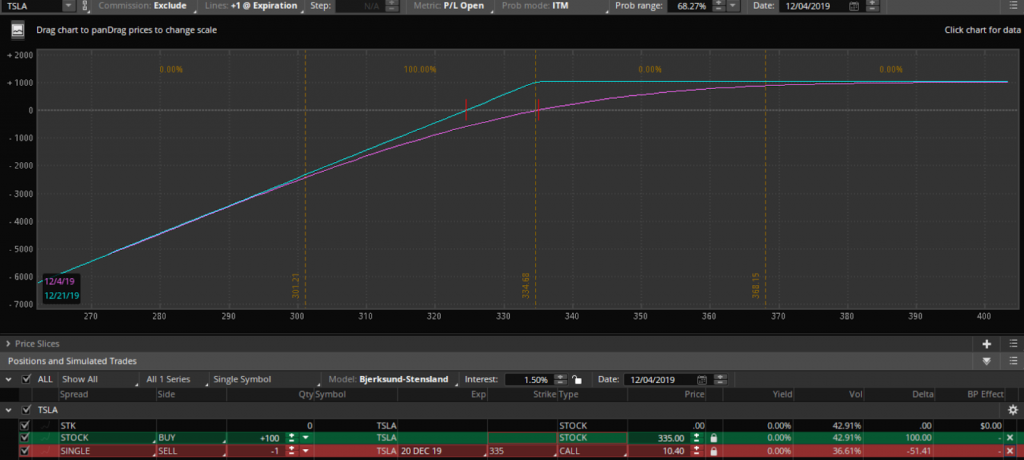

For example let’s purchase a put option to protect our TSLA stock.

In this example, we bought an At The Money 332.50 put option for $10.05 per contract.

Since we only have 100 shares of TSLA, we bought 1 option contract that cost $1005.00.

Immediately one thing stands out. I hope that is how there is now a “floor” in your downside risk profile.

This new position that is created by purchasing the put option along with the stock is called a protective put.

In our example above, in the event TSLA sold off to $300, an unprotected account would lose $3400 on the equity, and with the protective put would lose $1255.

This means that if the underlying stock price fell, the investor could sell the stock at the put’s strike price and therefore reducing the risk taken by purchasing the underlying stock.

The Covered Call

In the event an investor believes the stock is only going through a short period of negative performance, a better alternative to the protective put is a covered call.

Since an investor is aiming to protect against a slight drop in asset price compared to a significant price drop there would be a different option strategy to use.

In this case, the investor would sell calls against the underlying stock they own.

The premium that the investor collects from the sales of the underlying stock call options will provide cover against the slight drop in stock’s share price.

One major downside is that if the investor is incorrect with the size or duration of the poor stock performance, the investor could see significant losses.

Let’s take a look at TSLA and see what a covered call does to the risk profile of the long stock.

In this example, I sold 1 335 At The Money call option for $10.40.

As you can immediately notice there is no longer a “floor” to your downside risk and instead a “ceiling” to your upside gains.

And that is ok!

This will allow the trader to capitalize on short periods of market uncertainty and even get paid to take this insurance!

In this example, if TSLA stays above 324.50 the investor will keep all profits on the covered call. Another benefit is they will also maintain their total long position in the underlying stock in the event the price moves higher after the call expires.

The bottom line, covered calls do not offer insurance like protective puts.

So what happens if we combine the best of protective puts and covered calls?

The Collar

A final way to successfully hedge stocks by using options is to utilize a little known strategy called a collar.

In this case, the investor simultaneously purchases an out of the money put option and selling an out of the money call option.

This is known as a hedge wrapper, aimed to protect against large losses to the underlying asset while allowing an investor to also capitalize, although limited, if the stock continues higher.

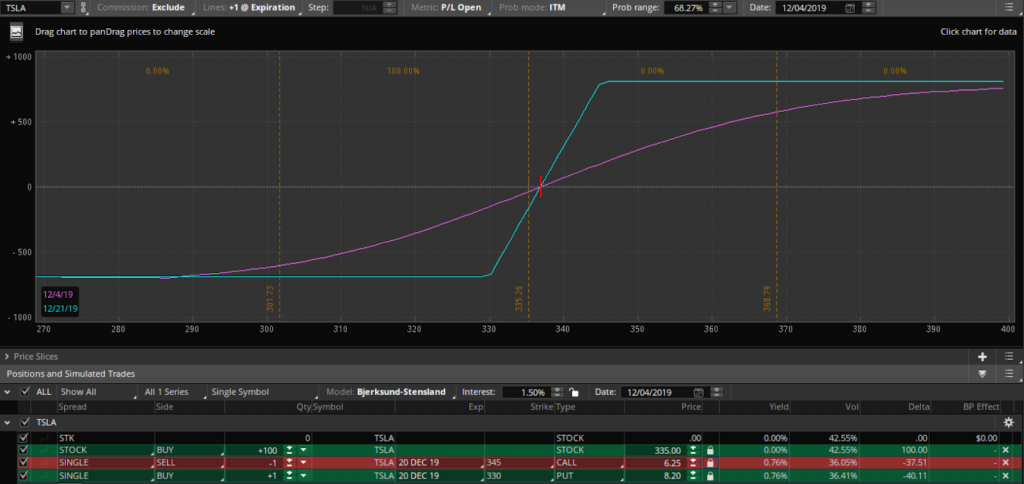

In this example let’s apply a collar to TSLA.

Here is the overall trade so far.

We BOT TSLA at 335.00

We BOT a Dec 19 ‘20 330 Put at 8.20

We SLD a Dec 19 ‘20 345 Call at 6.25

This new combination is called a Collar, and has a combined benefit of both limited losses and maintaining profits in the event the trade rallied.

The collar will result in a limited max loss of $695.00 and a limited max gain of $805.00.

Final Thoughts

It’s important to remember that hedging is not meant to provide investors with added profits during times of uncertainty but instead protection from significant losses to their account.

As a result, prior to using a hedge to protect investments, an investor should determine what benefits a hedge will provide them and if the cost is acceptable.

In the event of a major stock sell-off, having protection to unlimited downside risk always justifies the potential loss in profit that might have been gained if the event does not occur.

All together, it can actually pay investors when they place insurance on their investments when utilizing a collar or covered call.

To have the most protection in catastrophic events, nothing beats the power of a protective put.

Let me know how you utilize strategies like these to keep your account protected!

Take The Next Step!

I’ve developed a trading system that produces steady and reliable results. Don’t believe me? Then check out this training I put together? You’ll see first hand how I’m able to beat the market returns by spending as little as 15-minutes a day.

Click here to watch

0 Comments