I have a secret that I’d like to get off my chest: I like to win.

It doesn’t matter if it’s a friendly game of trivia or the ultra-competitive world of triathlon racing.

But here’s something cool about the stock market and options trading in particular—you can stack the odds in your favor when you implement certain strategies.

I’ve yet to post a losing trade since launching my premium service in four months! If you’re not a client yet then click here to join.

How about an options strategy that gives me better odds than the House… I’m talking 60% chance of winning (or even better)

Who wouldn’t want to slap on trades like that?

What about generating cash flows on assets you own?

Why not collect cash flows outside of dividends?

If you Answered ‘Yes’ to any of the above—congrats—you’re like me, and you like money!

Now, I’m going to share with you one of those strategies that has helped me garner an impressive four month streak without a trading loss—the strategy is called a covered call—and you’ll love the way I trade it.

Writing Covered Calls

At this point I am sure you are asking…

What is a Covered Call and what does it mean to ‘Write’ one?

Writing a Covered Call means that you are selling the right to own a security at a specific time and price while collecting cash for this option.

This means the buyer of the option gets the right to own your security on or before the expiration date at a predetermined price, called the strike price.

As a result of selling “Writing” the call contract, you will be collecting the premium at the time of sale.

What about the risk if the stock continues to rise?

Since you already own the stock in a “Covered Call” you are inherently protected.

So if the stock continues to rise past the strike price there will be no additional loses.

The call option is assigned and you would deliver the stock you already own.

You would be reaping the additional benefits of both the writing of the call contract in addition to the increased value on the stock.

Here is a little known fact: Income from covered call premiums can be 2-3x higher than just collecting dividends for income.

Simple, right?

How to Write A Covered Call

First, it’s best to find a stock that has been performing well.

This is all relative, for instance…

If you are a short-term swing trader you may look for 1-2 weeks of gains. Whereas if you are a long-term swing trader, 1-2 months of gains is best.

Tip: It’s important to only pick stock you are willing to sell if you are assigned.

But don’t select a stock that has performed too well.

This way you can minimize the chance of facing assignment of those call options.

It also means that you won’t be missing out on further gains if you sold a call too close to the current market price.

It’s a balance, a yin and yang… not too far, but not too close.

That… just right sweet spot.

Picking a Strike Price

First, and this may seem obvious to some, but you want to sell options that are only Out of the Money (OTM).

Never sell options that are either At the Money (ATM) or In the Money (ITM).

This may lead to significant losses and change the product you are trading all together.

It is most successful if you select options that are either a set percentage away from the current market price or strike prices that align with key technical levels in the stock chart.

Choosing an Expiration Date

This depends on the time horizon of your trading style.

Typically it is best if you chose 30-45 days out.

One example where you might want to select a different expiration date is to avoid earnings or key economic number.

It is most successful if you select option expiration dates that are Monthly option contracts.

Try to avoid weekly contracts and LEAPS if possible.

Pulling the trigger

As a general rule of thumb, it is best to try to collect on about 2% – 4% of the stock value in premium.

In business, time is money and the same goes for trading options.

The further you go out in time, the more an option will be worth.

Unfortunately, the further you go out in time, the harder it is to predict what the stock might do.

Also be aware that sometimes options are valued higher for another reason.

Such as earnings or recent world events.

It’s always important to keep a close eye on the marketplace and news to see what may be affecting the price of the stock and options markets.

An old adage, if something seems too good to be true, it usually is.

The NR Trade

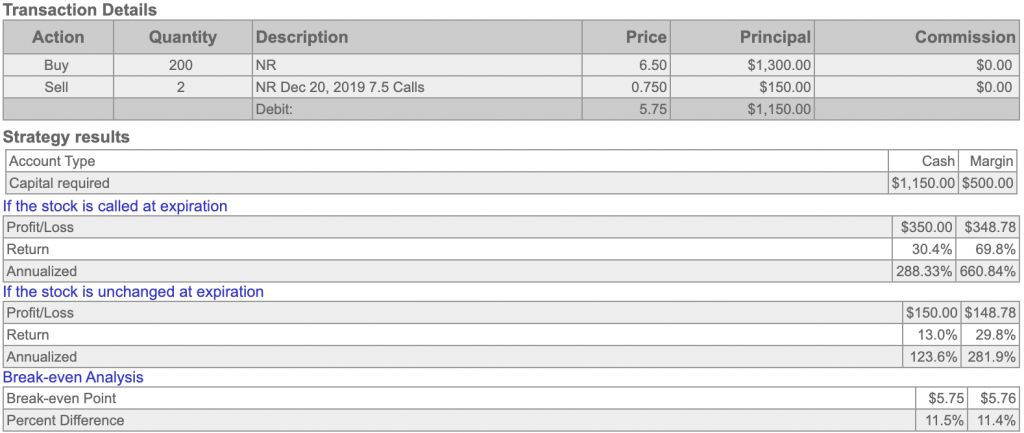

Let’s take a look at a Covered Call that I traded in NR that is coming off my books for a max profit.

Trade breakdown

- BOT NR at $6.40 near summer lows. I was eyeing this stock for a while now and the price was too good to pass up.

- NR has a significant rally over the course of the next week. The Call Options exploded in value.

- Sold 2 NR Dec ‘19 $7.50 calls @ $0.75 ea. against my 200 shares. This opened the Covered Call position

- Remain bullish on NR and it’s in my investment portfolio. Looking for short-term cash flows!

- The stocks had an unfavorable earnings, causing the stock to drop to $6.02. This allowed us to purchase the stock back at $0.05.

Trade Statistics

This is where things get very interesting.

Let’s take a closer look at some of the trade statistics that I calculated using the Covered Call calculator from IVolatility.com

Incredible!

This is one stellar example on how the House Odds really kick things high gear.

We Spoke about 3 possible outcomes earlier.

If the stock goes up, sideways, or down.

Let’s see our payout for each.

The stock is called at expiration

We would collect our premium on these call options and deliver the stock as required.

We would collect $350, or a return of 30.4%, or an annualized return of 288.33%.

The stock is unchanged at expiration or slightly down

We would collect a our premium on these call options and NOT deliver the stock.

We would collect $150, or a return of 13.0%, or an annualized return of 123.6%.

Breakeven

Our cost basis for this trade was around $5.75, or about 11.5% lower than where the stock was initially purchased. For the long-term investment that I plan on this stock, it allows me to reduce risk, lower my break even price, and most importantly, allows me to maintain my core position.

The House Odds

Remember when I asked if you would like the house odds in your favor?

Well, that is exactly what you get when you sell options, and a Covered Call is not any different!

Typically when you purchase an option, you can win with only 1 out of 3 possible outcomes. What terrible odds!

For example, if you were to purchase a call instead of trading a Covered Call, you could only make money if the price of the stock was to increase in value.

What could you do to raise the odds of winning?

Trading a Covered Call could potentially increase your odds to over 50%!

Let’s compare the trades:

Buying Stock or a Call Option

- Share price must rise to make profit

- Chance of profit is 33%

- Risk Unlimited

- Reward Unlimited

Selling a Call – Covered Call

- Share price can drop, stay the same, or rise to make profit

- Chances of profit over 70%

- Risk Limited

- Reward Unlimited

Which trade would you pick?

I mean it’s almost too obvious, but I am picking the Covered Call with:

- Odds of over 70%

- Limited Risk

- Reward unlimited

For me, this is a much safer way to go.

The house always wins, right?

The Best Times to Sell Covered Call:

- During Periods of Market Strength. If you expect the market to stay flat or slightly down for a while, selling calls will generate income from the options markets during this period of flat trading

- Invested in slow-growth companies and need a boost to the dividend payment that you see quarterly

- Stocks become overvalued and you cannot decide to sell or continue to hold. Selling a call gives you “breathing room” to decide what to do next

Did you know if you are someone who wants unlimited upside profit potential with limited downside risk, there are strategies for that too.

Option strategies are my personal favorite and they give you the flexibility to profit in almost any type of market!

What are you waiting for?

Click here to watch a training that digs deeper into my trading philosophy and option strategies.

0 Comments