Have you ever found yourself saying:

“I would love to own AAPL but it is far too expensive right now.”

“I won’t buy stocks because I only buy things that are on sale.”

“I want to buy $5,000 in stocks but I don’t have enough funds in my account.”

Luckily there is a way to do all of those things, and more, just by selling options.

Options give a trader two distinctive advantages over trading normal stocks.

- The power to dictate what price you will pay for a company and at what discount.

- The ability to get paid to wait for the stock to come to the price level.

Options traders can take advantage of the many great opportunities that are normally off-limits to equity traders.

What Is An Option?

Definition of an option: Options are financial instrument that are derivatives based on the value of an underlying security. An option contract offers the buyer the opportunity to buy or sell the underlying asset.

There are two types of options:

- Call Options – Allow the buyer to buy the asset at a specific price on a specific date.

- Put Options – Allows the buyer to sell the asset at a specific price on a specific date.

All option contracts all have specific expiration dates by which the trader must exercise their option.

There are two types of option traders, a buyer and a seller.

- Option Holder gas the right to buy or sell the underlying asset at a specific price.

- Option Writer is obligated to buy (or sell) the underlying asset if the contracts are assigned.

Call and put options are the two foundations to a wide range of strategies designed for hedging, income, or speculation.

Buying Vs. Selling Options

Buying options is a lot like placing bets at a casino or horse race.

The idea is the better (option buyer) only needs to pay a little upfront for the bet in order to hopefully win on the future event.

For example, a gambler wants to place a bet on a horse to win for $5.

They have paid $5 for a bet that the horse will come in first place by the end of the race.

If the horse wins first place, the better will receive the winnings on his trade.

This is much like buying speculative options on equity stock.

For example, a trader wants to place a bet on AAPL to trade over $100/share by next week.

The trader paid $5 for a weekly $100 strike call option.

The trader is betting that AAPL will be at or above $100 at the end of next week.

If AAPL trades at or higher than the strike price, the option buyer will receive the winnings on his trade.

But what are the odds that either buyer wins?

Very slim! The odds are well under 50% for gamblers at casinos.

It’s even worse in the stock markets as the odds are closer to 33% for option buyers!

It’s important to remember that the games are set so the house odds are always better than the gamblers odds.

The casinos are in the business of making money after all.

Remember… the house always wins.

Let’s continue to see how we can put 66% odds of winning in our favor!

The Problem With Buying Options

Let’s take a look at a hypothetical example trade.

Suppose a trader is bullish on AAPL that is currently trading at $50 and thinks the stock price will go above $75 in a few months.

The trader has 2 choices at this point that he can do to implement this trade.

Choice 1: Buy the stock

Choice 2: Buy a call option

Here is an example of the capital tied up on each trade.

Ex 1) Buy the stock – Trader has to purchase 100 shares of AAPL @ $25/share. This ties up $2500 in trading capital.

Ex 2) Buy the option – Trader has to purchase the $25 call at $1.00 x 100 shares. This ties up only $100 in trading capital.

As you can tell, trading capital goes further with options as the trader doesn’t need to tie up large sums of money to gain exposure to equivalent stock exposure.

Long stock and long calls have very similar payout diagrams. One similarity is they have unlimited upside profit potential.

The biggest difference is the downside risk.

Call buyers have limited downside risk whereas stock ownership has unlimited downside risk.

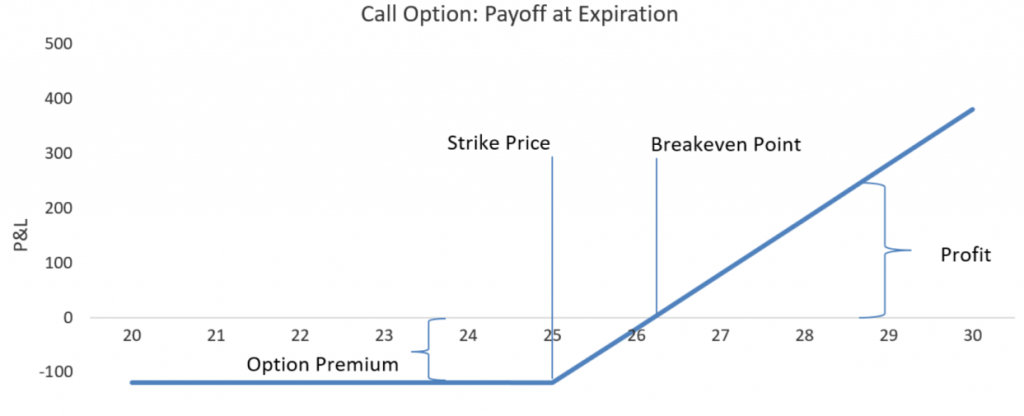

Below is an example profit diagram for a call option.

One thing that may not stand out immediately is that in order to earn a profit on the options, the options must exceed the breakeven price.

Basically… in order for a trader to profit on call options, they need to get the direction more than just right.

If the trader gets the direction right but fails to surpass breakeven price they will lose money!

Once a trader starts to factor in commissions, fees, spreads, and other costs to operate your trading business the breakeven is actually much higher.

Remember, the stock market is a negative sum game.

It doesn’t make sense to keep stacking the odds against you.

What is the solution?

Buying options is an uphill battle and the premiums to establish a position make turning profits extremely difficult.

That’s why we turn to selling options to put the house odds in our favor.

Selling Options – Becoming the house

Selling options is a lot like being the casino.

The house has a small but well-defined edge.

The long term goal and realize they will sometimes take losses, both small and large.

Another analogy is that selling options can be compared to running your own stock market insurance company.

Like any tool traders may use, there is a time and place to sell options.

A trader must maintain a solid understanding of current news and understand that market events may significantly impact a stocks price.

When correctly utilized, selling options is a sophisticated way of entering into equity trades or generating income for your portfolio.

Covered vs Naked Options

There are two fundamental choices a trader has when looking to sell options.

A trader must determine if they wish to be covered or naked on their position.

When you are selling an option, a trader is covered when they have a corresponding position on.

This can be from either an offsetting long option or using the underlying stock.

Being covered or naked can have significant impacts on the risk/reward profile for trade. It also significantly changes the risk profile of the traders business.

Remember… Uncovered options pay the most to the trader, but also come with the largest losses.

Choices For Short Options

Traders who seek out ways to put the house odds in their favor tend to focus on naked options since that is what they have probably heard about from the news.

They are the most popular choice but tends to come with the most risk.

Some strategies to choose from include:

Covered Calls

Arguably one of the most well-known option selling strategy both investors and traders turn to.

A covered call comes in two variations.

- Bullish/Neutral

- Traders owns the underlying stock and sells an out-of-the-money call.

- Bearish/Neutral

- Trader owns the underlying stock and sell an at-the-money or in-the-money call.

Covered calls are a great way to generate added income when owning the underlying stock.

The benefit to this strategy is that a trader is able to maintain a long position while selling the call options.

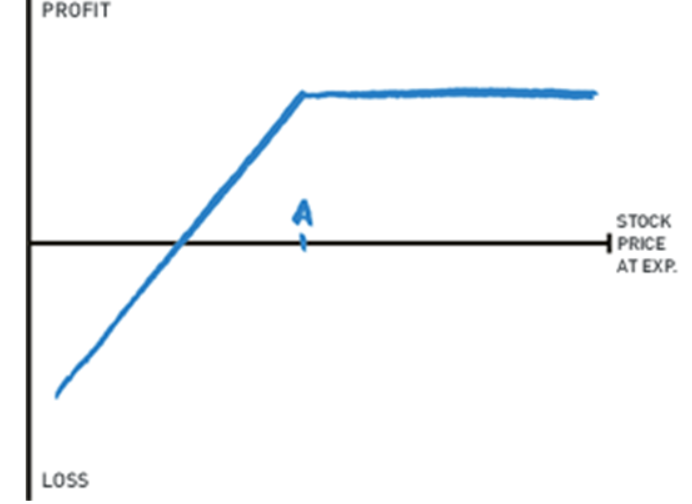

Naked Puts

This is the go-to strategy selling options for many professional traders.

It’s believed to be a high risk strategy that is deployed when the trader is very bullish on the underlying.

Selling naked puts has one distinct advantage for the trader.

Naked puts allows traders the opportunity to purchase a stock at a discount.

Even though the chart looks like unlimited losses, the value of the asset going to $0 is the theoretical max lossl.

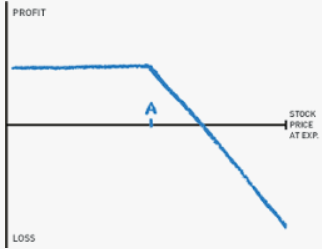

Naked Calls

The infamous Naked Call, or the “Widow Maker” has stamped its place in trading history time and time again.

These trades are one of the most feared strategies that are available to use to generate income.

Most recently, a firm called OptionSellers has around $200 million of assets under management. Then overnight Nat Gas spiked and the firm lost all their funds because they were trading uncovered “naked” call options on Nat Gas.

The Naked Call is an unlimited loss as an asset increases in value. Unlike a Naked Put, Naked Calls are unlimited loss trades.

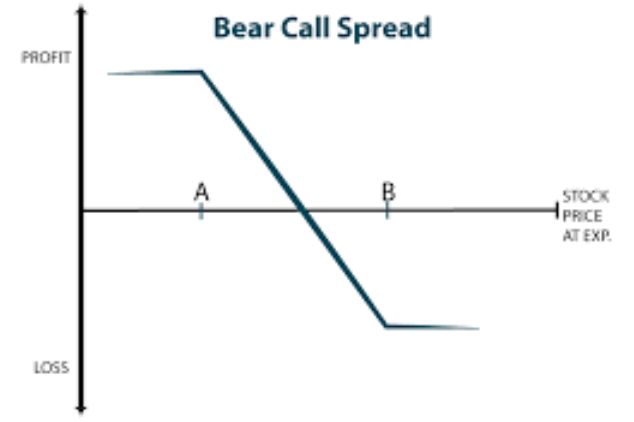

Credit Call Spread / Bear Call Spread

A credit call spread is a type of options strategy used when a trader expects a decrease in the value of an asset.

The credit call spread is placed by simultaneously purchasing a call option at a higher strike price and selling a call option at a lower strike price in the same expiration month.

This is considered a limited-risk trade since the selling of the call option is covered by the purchasing of a higher-strike call option.

The main advantage to a credit call spread is the reduced risk of losses compared with both a naked call or short stock trade.

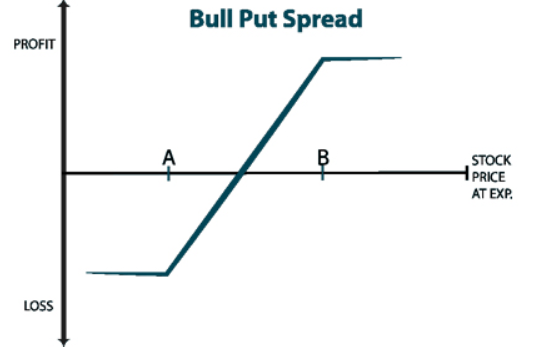

Credit Put Spread / Bull Put Spread

A credit put spread is an option strategy that is used with traders expect a rise in the price of an asset.

The credit put spread is placed by simultaneously purchasing a put option at a higher strike price and selling a put option at a lower strike price in the same expiration month.

This is considered a limited-risk trade since the selling of the put option is covered by the purchasing of a lower-strike put option.

The main advantage to a credit call spread is the reduced risk of losses compared with both a naked put or long stock trade.

Pros vs. Cons

Depending on the type of trader, there are many benefits to both buying and selling options.

There are many different option strategies to choose from and each has unique risk associated with it.

Pros to selling options

Smooth Return Stream

Selling options is one of the most reliable and stable sources of returns in the markets.

Premium selling strategies tend of have extremely high win rates and are a great way to grow trading capital over time.

Winners Mentality

Most traders tend to feel better when they are winning rather than losing. This makes sense that traders would benefit from a system that has them winning a high percentage of trades.

This boosts confidence and leads to less “second guessing” the trade. This confidence tends to lead to smaller losses compared with traders who are buying “lotto tickets”.

Cons to selling options

No “Grand Slam” trades

Selling options tends to be “singles and doubles” type of trading.

The knowledge that a big grand slam is right around the corner keeps traders coming back to their screens every day, waiting for that huge opportunity in the markets.

Unfortunately, option sellers won’t have this rush of excitement like hitting it big at the casino.

Potential of large losses

Another huge negative is the potential for large losses. While this is a remote possibility, it does still exist depending on the underlying security traded.

Traders can mitigate their risk to large losses by trading credit spreads rather than naked options.

This is the “best of both worlds” as the trader can play the house odds while maintaining a controlled and limited risk profile for their account.

Final Words

To summarize, premium selling is known to generate wildly profitable and extremely smooth equity curve.

- There is the risk of an occasional large loss, but this is mitigated with the use of credit spreads instead of naked options.

- The return of a premium selling options book is that of a mean reversion stock trading system, with a large number of small wins with the occasional ‘fat tail’ trade.

- Selling Naked Puts is one of my favorite strategies since it allows me to purchase stocks at a discount and get paid doing so!

Want more proof that selling options is the only way to consistently make money?

My trading account that’s open to all premium members has gone almost 5 months now with no losing trades!

Looking to get actionable trade ideas and signals in as much as 15 minutes per day trading?

0 Comments