Do you dream of steady and profitable returns month after month?

How about high percentage returns of over 70% without having to buy a single share of stock or options contract?

If you raised your hand and said: sign me up I don’t blame you.

After all, who doesn’t want the odds in their favor when they’re trading, right?

That’s why so many professional traders decide to sell options and collect the time premium is a core strategy.

You see, the problem is that many novice option traders approach them by focusing on a single dimension— price.

However, I’m here to tell you that you’ll need to have greater knowledge than that to succeed in trading options. Specifically, you’ll need to know the role that time and implied volatility play in the pricing of an options contract.

That’s why I’m going to spend some time with you going over implied volatility. Master this, and each options trade you put on will have edge— no joke.

As a special bonus I’ll be teaching you a simple strategy that absolutely crushes it if you know implied volatility works.

What is implied volatility

Implied Volatility (commonly referred to as volatility or IV) is one of the most important Greeks to understand when trading options.

IV is determined by the current price of the option contracts on a stock. It represented as a percentage that indicates the annualized expected one standard deviation range for that stock.

For example: If a stock is trading at $100 with an IV of 20%, the stock would be expected to move 20$ over the next year in any direction.

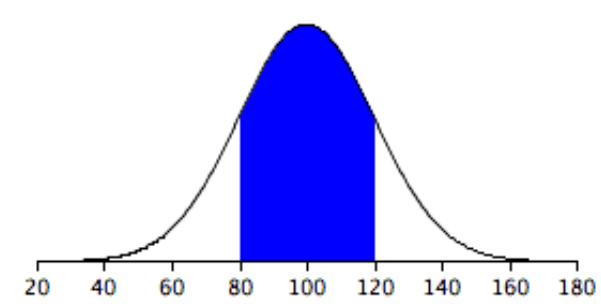

One standard deviation

In statistics, one standard deviation is a measurement that aims to capture the expected outcome of a price. The measurement of one standard deviation is approximately 68.2% of all stock prices will fall within this range.

For example: A stock is trading at $100 with an IV of 20%.

It means that there is a 68% probability that the stock will fall between $80 and $120 within the next calendar year.

This is a great tool for traders and gives valuable insight to what statistics project what the stock should do in the future.

Implied volatility

There are many ways to apply IV to your trading of stocks and options. Far too many than I can even list here.

For those who are interested in more information take a look at the CBOE page for detailed examples.

On the other hand, historical volatility is a measure of the stock’s actual volatility over time.

The key difference is that HV looks back over the stock’s historical prices rather than the future volatility implied in the options markets.

There is an interesting way to compare historical and implied volatility to give a trader a useful way to understand how much expected volatility is being priced.

In general, if implied volatility is higher than historical volatility it gives some indication that option prices may be high. If implied volatility is below historical volatility, this may mean option prices are discounted.

But that is not the end of the story. Traders must also compare implied volatility now with implied volatility in the past. This helps traders understand whether implied volatility is high or low in relative terms.

If implied volatility is higher than typical, it may be expensive, making it a good a sale; if it is below its normal level, it may be a good buy.

Specifically looking at the case where IV is greater than normal showing that options are expensive is exactly what to look for.

Since IV is a mean reversion strategy, a trader should focus on finding high-value options to execute a short trade on.

Those kinds of setups will put the house odds in your favor time and time again.

First, it is important to know what mean reversion is and how it applies to this strategy.

What is mean reversion

Implied volatility has a mean-reverting tendency – meaning there are periods when it moves away from its historical average and then reverts back to the average.

A reversion to the mean involves retracing any price back to a previous average.

In options it is thought that as price strays far enough away from its longer-term norm it will revert back to an average value.

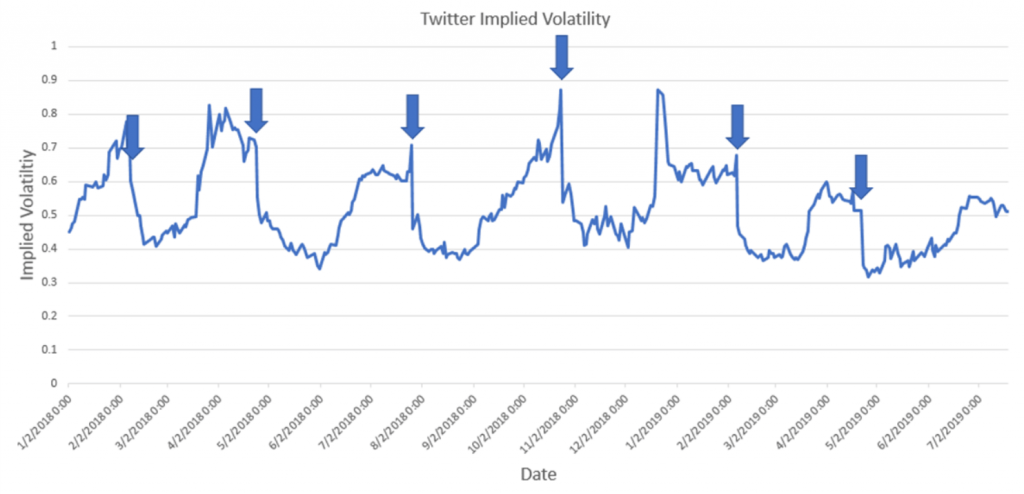

In this example above, you can easily see the 6 points where implied volatility spiked and relative to historical values suggested that it should revert back to its long-term average.

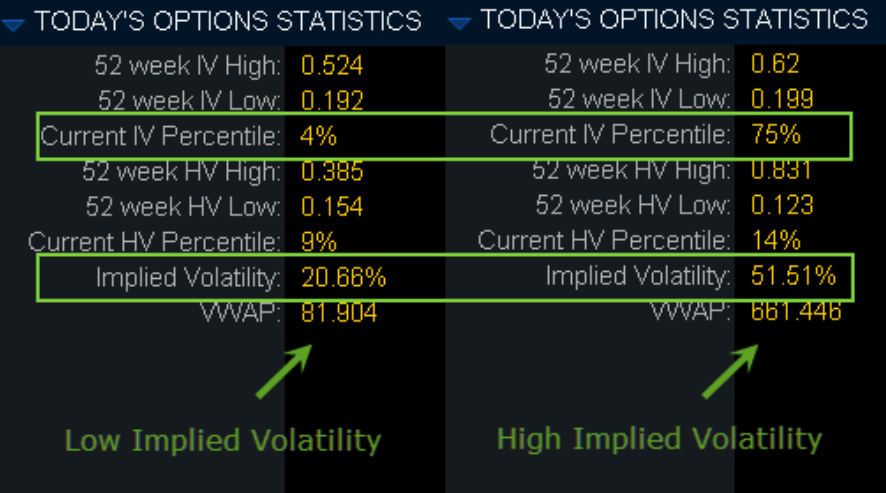

Another way to determine low vs high IV levels is to use a built in statistics tool found in Think Or Swim. (Make sure to check with your respective brokerage for their IV statistics)

As a general rule, some traders will sell credit spreads when IV is between 67% and 100% percentile of its 52-week range.

Key points:

- Mean reversion suggests asset prices and historical returns revert to long term average levels

- Mean reversion has led to many investment strategies in options trading

- Mean reversion tries to capitalize on extreme changes in the price of a security, assuming it will revert to a previous price.

The strategy

There are many reasons a options implied volatility may deviate from its averages.

Some examples include upcoming earnings announcements, fed announcements or an upcoming merger and acquisition.

The key is to recognize when implied volatility is high compared to its historical highs.

When it appears to be extended compared to past values, options traders should structure a trade accordingly.

For option traders looking to capitalize on the falling IV levels, the future direction of the stock price does not carry much weight.

In general, if a stock option indicates a period of high implied volatility, a trader should consider shorting those options to gain exposure to short volatility.

Some suggested trading strategies for periods of high implied volatility include covered calls, naked puts, or credit spreads.

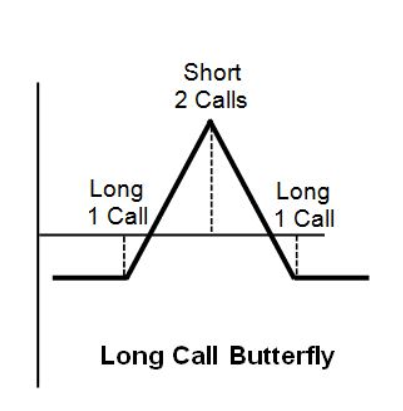

One credit spread that is popular in shorting volatility is a butterfly credit spread.

A butterfly has an advantage for trading short volatility since it is a more risk-averse alternative to a short straddle.

A short straddle which has unlimited losses to both the upside and downside is considered a more advanced trading strategy.

So, for many traders a long butterfly is a more appropriate strategy. The advantage is an extra long call that kicks in if price increases beyond the upper breakeven price.

Final thoughts

Remember traders… everything needs to be placed into context.

Implied Volatility trading is no different.

Just because you believe IV is low…it will always find a way to keep going lower.

There are a few things to remember about Implied Volatility:

- Bearish markets increase volatility

- Bullish markets decrease volatility

- Implied Volatility is a proxy for emotions of the underlying market and can be erratic

- It’s possible to align the underlying stock direction to the IV level to combine stock movement with shorting IV

- Implied volatility trading comes with built in entry and exit prices for your trade.

The more quantitative tools you have at your disposal to help make trading decisions, the better off you will be.

This is one more tool you can place in your tool chest when trading short options.

One last thing…

Since starting my service here at Raging Bull—I’m undefeated.

That’s right, 5 months of non-stop win after win.

The Option Profit Planner is an absolute must-have for anyone who is serious about trading options and generating an additional source of income.

0 Comments