When it comes to trading strategies, I make sure generating cash flow is on the top of my list.

By defining my income, I will always be able to plan for the future without having to take oversized bets to achieve my profit goals.

Having stability in business is paramount to my success.

Allow me to share with you some tricks that I use during every trade which allows me to score huge winning streaks.

When you learn this, you’ll be kicking yourself for not starting earlier.

Options Profit Planner

It’s all in the name … I like to plan for profits using options!

And that doesn’t mean going around and buying lotto tickets on random stock.

Instead, I use a slow and steady strategy to win the race approach to my investing and trading strategy.

Focusing on quality stocks that I feel comfortable holding for the longer term if things don’t work out as I planned.

And when trading an option selling strategy, this can always be a possibility, especially when I am dealing with a Naked Puts strategy

So let’s go a little more in depth with

- How this strategy works

- Why I choose to trade Naked Puts and not Naked Calls

- How to offset the loss of being assigned stock with selling Covered Calls

What Are Options

Options are a financial instrument that gives investors the right, but not the obligation to purchase a security, at a specific price and date in the future.

And for this right, the investor will pay a cost, or premium, at which the seller feels is a fair value to exchange these contracts.

Now let’s take a look at price obligations…

Price Obligations

An obligation on selling put options is if the price falls below your strike, you will be required to own that stock (at the strike price), as the sample trade above.

Let’s take a look at a quick example on the SPY’s quick…

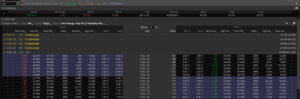

Source: ThinkOrSwim

Each option contract has an associated strike price at which buyers and sellers agree upon buying and selling stocks.

The value of the contract is what the markets are pricing the options at and are subject to change based on the supply and demand on that stock or option contract.

Options Expiration

Every option has a time and price associated with them and adjusts in price based on a number of underlying factors.

Factors that influence pricing are volatility, time until expiration, and underlying price changes, or IV, Theta, and Delta.

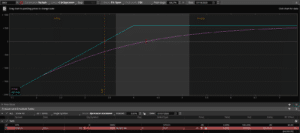

Let’s discuss how Theta impacts options pricing and how it’s one of the most important greeks towards option sellers.

Theta

One of the factors is time decay, and it is based on how much time is left on the options. Typically, the value of a weekly call option is cheaper than that of a monthly all option.

For example, a weekly option that is expiring on Friday of this week has 5 days of time value added to the options price.

Theta is the value of time in the options contract, and the longer the amount of time, the more time value an option will have.

How this works…

The Strategy

Let’s assume that the trade we are about to take is a Short Put on SMSI that expires next month.

In general, we know that the market pivot around the Bollinger Bands tends to be extremely strong areas of support for a stock.

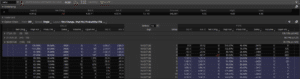

Source: ThinkOrSwim

Looking at SMSI, the Fractal Energy is above its upper limits showing that we are set up and energized to trend.

And combining that with Bollinger Bands, we know that the markets are more likely to find support and trade higher into the future.

Which allows us to trade a short put.

Let’s take a look at options contracts.

Source: ThinkOrSwim

At the time I placed the trade, I was able to sell SMSI at $0.60 and now it’s time to start looking for defense positions.

The Trade

And this is the trade that I could place on SMSI when it was trading near its lower Bollinger Band with Fractals that are charged up.

Source: ThinkOrSwim

- SMSI : Sold the Oct ‘20 $4 put for $0.60

This trade is aiming to capitalize on a market where it should find support from the lower Bollinger Band and combined with Fractal Energy, should start to trend higher.

But why sell a Naked Put that close to At The Money?

If I get assigned this stock I feel comfortable owning the stock at this price and believe that it can go up in the near future.

Which makes this trade almost risk-free.

And by selling puts you can get paid upfront for telling the markets you would like to own stock at that price.

What do I want to happen?

- The market to rally

- The market to continue to sell off and I get to own SMSI at a great price

Wrapping up

So here is a quick breakdown of the pros and cons of trading Naked Puts that should give you a better indication of what an options selling strategy can do for you!

Pros:

- Huge returns of 75% to 100%

- House odds in your favor of over 60%

- Ability to purchase stock at a significant discount

- Can win in a up, down, or sideways market

Cons:

- Limited upside gains

0 Comments