One thing I enjoy more than a Friday is when I collect money from my real estate investments.

And the only thing that I enjoy just the same is when I close out a profitable trade.

Now let me tell you, there is a great income strategy that I use to seek out and bring these stocks to me every week.

It’s the same thing that I use to generate a second income for my family in a safe, predictable,and repeatable stock income trading strategy.

And this strategy can be scaled up or down to fit your risk and income levels that you feel comfortable with.

Unlike buying options, this strategy is specifically designed to provide a steady stream of income without having to spend a single penny.

You probably don’t believe me. I didn’t at first too. But I’m proving it’s all real, and highly lucrative – right here. Free.

The kind of consistent cash that lets you easily pay down debts. Obliterate most money worries. Even secure yourself an early retirement.

It’s almost unfair once you know how to use this strategy.

Ready to learn how this strategy works?

Options Profit Planner

Buying options is always a betting-mans strategy… and not one that I feel comfortable with when it comes to maintaining a steady income to provide for my family.

These credit strategies are specifically designed to target the moment of a stock based off of its Fractal Energy and technical indicators.

So what are these strategies?

- Credit Put Spreads

- Credit Call Spreads

- Credit Puts

- Covered Calls

What Is A Credit Spread Options Strategy?

A credit spread option is when a trader takes two or more options and together, sells the total premium they produce to generate income.

Now I know this may sound confusing, but let me explain the concept of how to write an options contract.

Instead of buying puts or calls, you will actually want to trade 2 more more contracts for a net credit.

So, if you were to take a bullish bet on the markets, you could either buy a call, or sell a put spread.

Let’s take for example, you wanted to go long the markets and use put credit spreads, you would want to sell a higher premium put contract, and buy a lower premium put contract for protection to the downside.

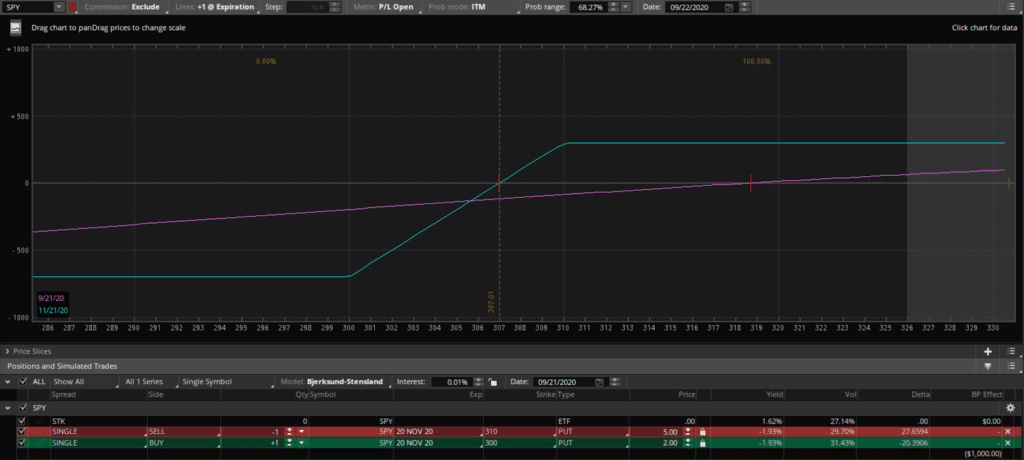

And in order to do this with the SPY trading at $330, you would need to sell a $310 put at $5.00 and buy a lower $300 put at $2.00

In other words:

Sell : SPY 20 Nov 20 $310 Put @ $5.00

Buy : SPY 20 Nov 20 $300 Put @ $2.00

Simultaneously, I am buying an out of the money (OTM) put option and writing (selling) an OTM put option with a higher strike. Since the higher strike is closer to being in the money (ITM) it sells for more money. Combining these trades I collect a credit of 3.00 (or $300). The option I am selling would bring in a credit of $500 but I have to use the credit to pay the $200 for the second option.

Since you are simultaneously buying and selling two Out of the Money (OTM) contracts, this might sound strange at first.

Take a look at the risk profile of this trade.

The risk parameters of this trade are

Max Profit : $300

Max Loss : $700

Breakeven : $307

The graph above does a good job of visualizing the trade. The x-axis is the price of the SPY on expiration. The y-axis is the profit based on the possible outcomes of the final SPY price.

As a reminder, option pricing is the price of one share, but every contract is quoted in a multiple of 100 shares. So when the price of the option says $5.00, it means that you will actually collect $500 per single trade.

Now… Why do I trade these strategies?

I don’t like guessing the market direction.

Only Fools Try To Guess The Market Direction

Meaning you don’t have to be 100% accurate with your timing or your market direction.

If the market drops from $330 to $315, you will actually still return a profit on this trade.

And you will generate returns all the way down to $307 where the breakeven on the trade is set.

Of course, I saved the best for last. if the stock is to rally from $330 to $350, you will return 100$ ROI compared to buying a stock, where you would only return 6% ROI for the same move.

As a quick side note, the SPY does not drop more than 5% often. Take a look at, How Often the SPY Falls More Than 5% in a 30-Day Period and Why You Should Care to learn more.

So why do I like this style of trading so much?

Well, when you are collecting a premium or a credit, you only have to worry about an extreme move in the underlying stock. In this example, I do not necessarily care if the price of the SPY goes up, down, or sideways just a little bit. I just really care if the SPY drops below it’s breakeven price where I will start to lose money.

I don’t need a crystal ball to tell me where the market is going. I just need to make sure the market doesn’t have wild swings or falls under my breakeven price that I set on my trade.

The Best Stocks To Trade Credit Spreads On

In this example I used the SPY, which is an ETF for the S&P 500, which is the largest 500 stocks in the markets.

We can place credit spread option trades on just any stock, but however, some are better than others.

And when selecting an underlying stock, you want to make sure there is plenty of volume in the options markets, plus make sure they have great fundamentals in order to trade only healthy stocks.

Just click here if you are not sure how to find what stocks have a great fundamental outlook

Volume, often related to liquidity, is key to this type of trading.

The main reason is without liquidity the gap between the bid and the asking price can be rather large. For example, if you can buy an option for $1.00 but you can only write an option for $0.20 the math would not work out. You really want the bid and ask prices to be very close together.

Now, most traders like high volume ETF’s, and my personal favorite is the SPY.

Here is a short list of other popular stocks and ETF’s to trade credit spread options on.

Top Stocks and ETF’s:

- SPY: ETF S&P 500

- QQQ: Nonfinancial stocks listed on NASDAQ (mainly tech stocks)

- IWM: ETF Russell 2000

- AAPL: Apple

- NFLX: Netflix

- AMZN: Amazon

- GOOGL: Alphabet (Google)

- XOM: Exxon Mobile

- TSLA: Tesla

Now I know the list above is short, but I need to only focus on a select few stocks in order to place trades, and let the fundamental screener take care of the rest of it.

Trading Options And Collecting A Credit Is Key

Now do you see the power of trading a credit spread instead of a debit spread? I hope so!

There are many benefits of trading this type of strategy, like the ability to generate steady income, trading with the odds like a casino in your favor, and making money if the markets go up, down or sideways.

Personally, I find this strategy so liberating and stress-free to not have to constantly worry about the direction of the markets every time I want to trade.

And when trading credit spreads, you often can build a strategy where you can only lose in the case of a drastic or extremely large move in the underlying stock price.

So, are you ready to take the leap and start generating a second income for yourself in as little as 1 month?

Click here to join the Options Profit Planner today

0 Comments