After two days of intense selling pressure traders will be looking for signs that point to a bounce.

Looking at my number one indicator, the Fractal Energy plot on the S&P, it appears there is in an exhaustion range on the daily chart and as we know, is into exhaustion on the weekly and monthly charts as well.

It doesn’t look very promising that the coronavirus will get better in China any time soon — and it’s causing major blue chips to question how this will impact their company going into this earnings season.

So far we have seen Apple issuing a rare earnings warning saying that it would not meet quarterly revenue expectations of their iPhone sales due to the virus.

With all of this uncertainty in the markets, it’s challenging to get a foothold on what trades to place from fear of getting it wrong.

And that’s ok, it’s understandable to be questioning the markets in times like these.

But I’ve got some good news that can help you out.

Over here at Options Profit Planner, things have been steady and smooth with the portfolio and I’ve witnessed little volatility in my account even with all of this action going on around me.

And I am actually on the lookout for adding new trades to my account too. With implied volatility on the rise – it’s actually starting to show trading opportunities for those looking for expensive options to sell.

So today let’s talk about how implied volatility is on the rise and how it makes selling put spreads extremely profitable in market environments like these.

Background on how options are price

As an options trader, it’s good to know the basics of what actually makes up the price or value of the option you are actually buying and selling.

There are many components of the pricing model that determines the cost, with some factors being:

- time until expiration

- price of the underlying security

- Implied volatility (or known as, the fear number)

Out of all of the many ways options are priced, one of the most influencing factors is fear or the implied volatility of the markets.

But it doesn’t have to be complicated.

Simply put, the more fear that is in the markets (or as a stock is trading lower), the more expensive options become for traders to buy.

As you can tell the increase of volatility has significantly increased the cost of the options prices.

Selling options when prices are high

Similar to a stock trader who likes to buy low and sell high, an option trader specializing in selling options typically seeks a sell high, buy low strategy.

And that is what implied volatility does for options pricing, it gives the trader the opportunity to sell expensive options.

But I take it one step further…

By using a proprietary scanner I developed to find and and seek out stocks that naturally have increased options prices.

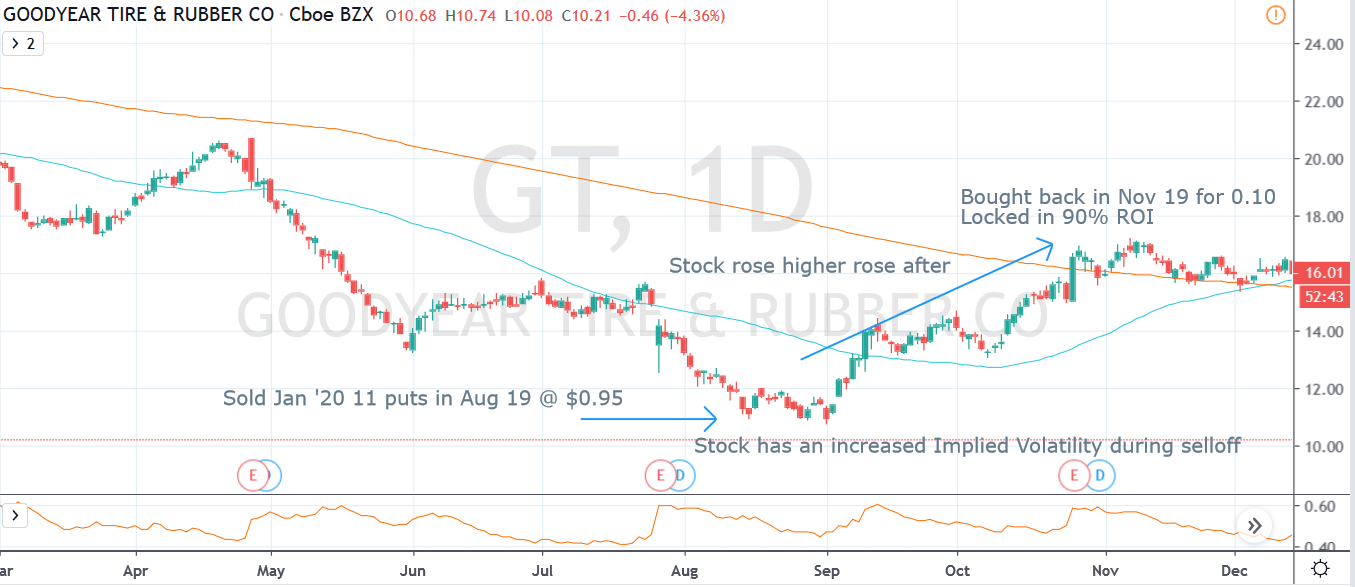

Let’s take a look at a recent trade that was flagged by this system and generated a perfect setup to sell puts on.

Source: Tradingview

Source: Tradingview

So this is a sample chart of GT shows this pattern exactly.

Let’s breakdown the simple strategy a little bit more:

- Begin with scanning the market for setups using strong fundamental filters on FinViz

- Locate bottoming patterns, like support and resistance levels, double bottoms, etc

- Wait for stocks to trade lower than Bollinger Bands

- Sell put spreads below the lows, looking for a 5-15% ROI

- Exit when the spread drops to $0.10 or lower

That’s it!

Following a strict system and plan for trading, it makes it extremely simple and easy to manage trades like this each and every week.

Wrapping up

Remember, it’s important as an options trader to sell high and buy low.

And one way to find expensive options is from using a set of screening tools designed to locate and identify price patterns that focus on specific properties of the way options are priced.

Using these tools, we are able to quickly identify stocks that have a higher price due to fear in the markets and this opens up opportunity to some incredible profits.

The combination of Fractal Energy, Bollinger Bands and a stock screener is all you need to get into the action with Options Profit Planner!

0 Comments