I have always wondered how the Federal Reserve seems to have perfect timing when it comes to trading the markets…

Maybe they know something the rest of us don’t… or they have access to secret information… or indicators that showed them the “perfect time” to buy a stock.

But after closer inspection, it seems they actually might have the Fractal Energy Indicator working for them…

So let’s take a look at how this indicator may be helping the FED and how it can drive powerful moves in the markets.

What Is Fractal Energy

The Fractal Energy Indicator is a measure of the internal energy of a stock and signals to the trader the likelihood of trend or chop in the near term.

The power of fractals allows me to determine the strength of trends and how much “life” is remaining in a stock’s movement.

There are 2 main components of Fractal Energy:

- Markets Fractal Pattern

- Fractals are found throughout everything in nature, from plants to shorelines… and even the financial markets!

- The Internal Energy

- Energy is the term used to describe the stored or potential energy of a stock. Potential energy is like a spring that is compressed, that is ready to erupt when you release the force that is keeping it held together.

So by combining those two different components you create a single indicator that is able to successfully determine the strength or weakness of a trend on any stock.

And in this article, I want to take a closer look at how the FED seems to be using the power of Fractal Energy and buying huge amounts of corporate bonds once they signaled a buy alert.

Corporate Bonds

Corporate Bonds are always an interesting asset class when it comes to the financial markets.

And one headline that caught my attention was what the FED bought in the midst of the worst economic collapse we have ever seen.

The headline I saw was….

“Federal Reserve Discloses Holdings of $1.3 Billion in Exchange-Traded Funds”

– TheWallStreetJournal

But wait… now you are probably wondering two questions…

Why would the Federal Reserve possibly be interested in the US Stock market?

What tools are the FED using to get their buy signals?

And I think they know something about Fractals.

Let’s take a closer look!

US Dollar Bond

There are many reasons to buy U.S Dollar ETF bonds overstock for a large corporation or government agency, such as the Federal Reserve.

Three main reasons are:

- Exposure to a broad range of U.S. investment-grade corporate bonds

- Access to 1000+ high-quality corporate bonds in a single fund

- Use to seek stability and pursue income

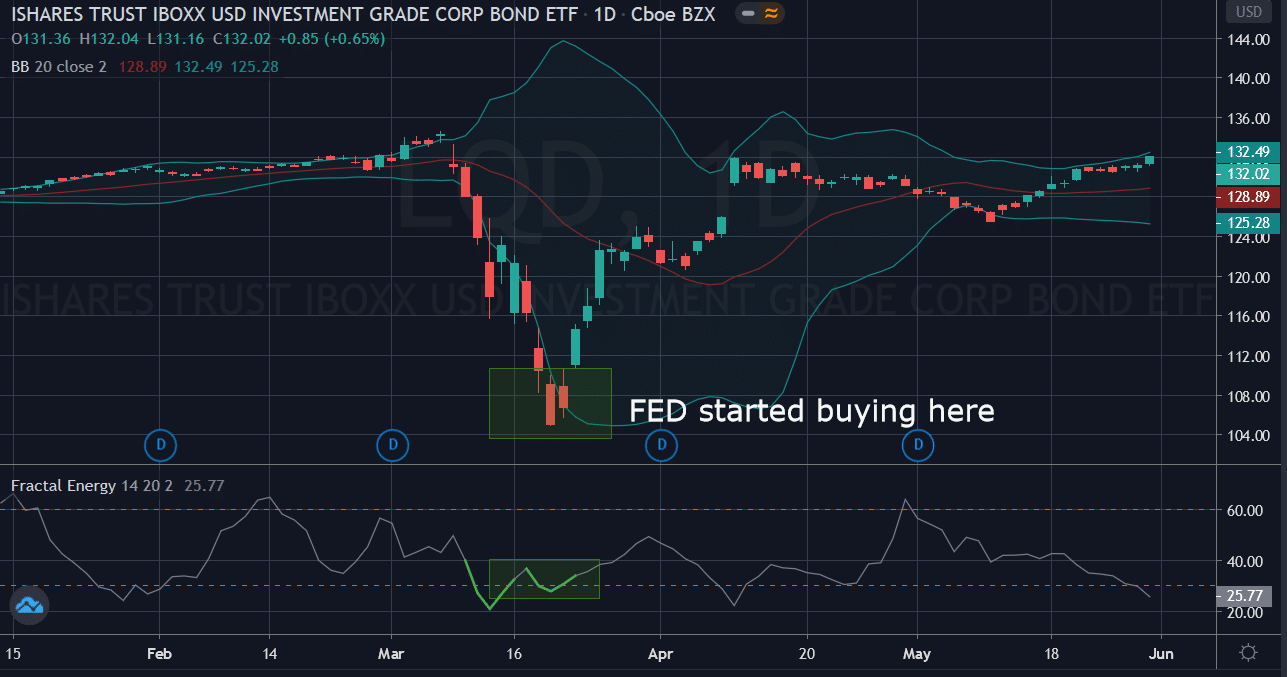

According to an announcement by the FED, they purchased 2.52m shares with a market value of $326.28m starting the program in March 2020.

Source: Tradingview

The Fractal Energy Indicator Reading:

It was interesting that right when the FED started their ETF buying program, Fractal Energy was also signaling to buy the ETF.

The Fractal Energy was signaling the current trend was oversold and charging up for a reversal.

Intermediate Term Bonds

There are many reasons to buy Intermediary corporate bonds overstock for a large corporation or government agency, such as the Federal Reserve.

Three main reasons to buy VCIT?

- Seeks to provide a moderate and sustainable level of current income.

- Invests primarily in high-quality (investment-grade) corporate bonds.

- Moderate interest rate risk, with a dollar-weighted average maturity of 5 to 10 years

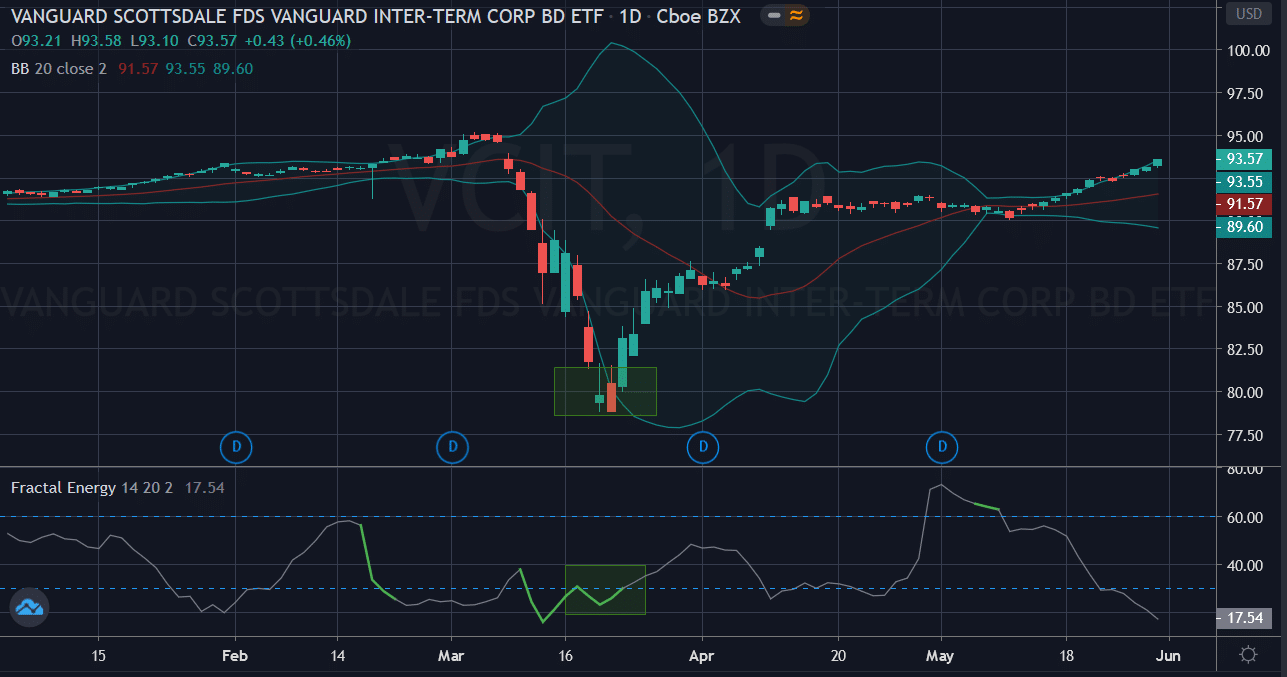

According to an announcement by the Federal Reserve, they purchased 2.48m shares with a market value of $228m starting in March 2020.

Let’s take a look at what the Fractal Energy looks like for this ETF.

Source: Tradingview

The Fractal Energy Indicator Reading:

It was interesting that right when the FED started their ETF buying program, Fractal Energy was also signaling to buy the ETF.

The Fractal Energy was showing me that the current trend was oversold and charging up for a reversal and release of direction to the upside.

Short Term and High Yield Bonds

And the story is similar for the riskier bonds, such as the Short Term and High Yield Bonds that hit their books as well.

Now let’s take a look at each pattern and see if they have a similar pattern as the other examples.

Two examples of this are when the FED decided to trade these two positions…

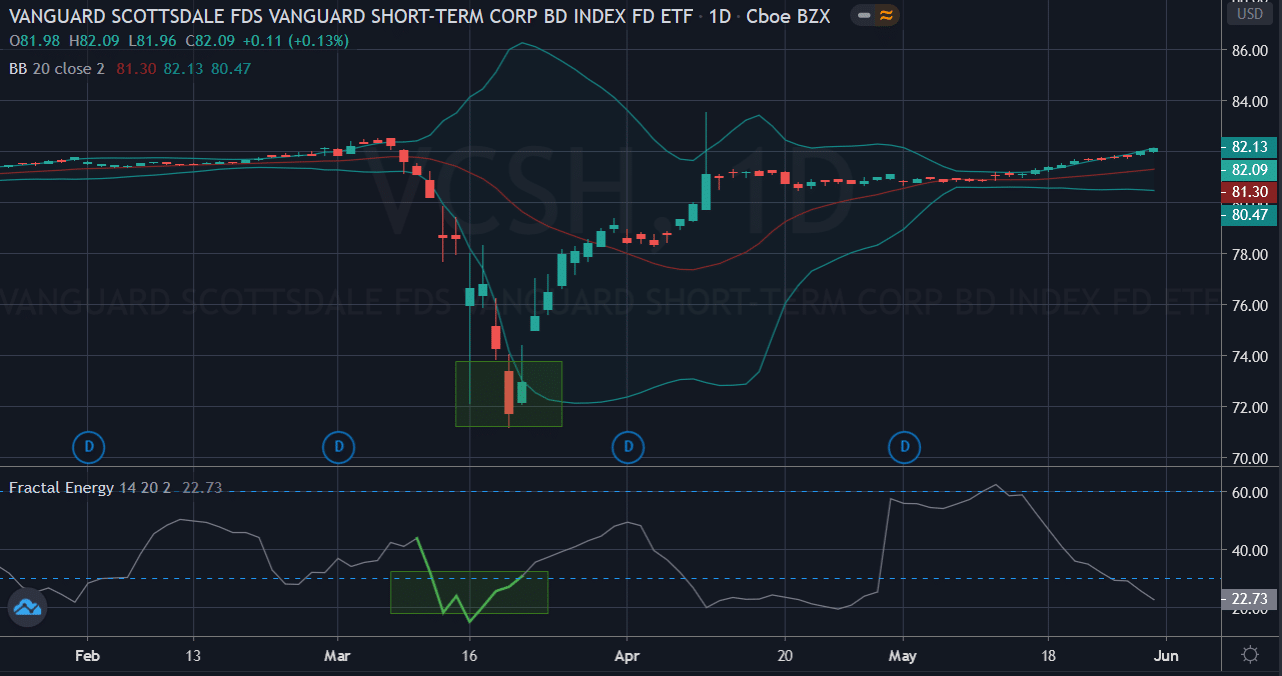

VSCH

The advantage of trading Vanguard Short-Term Corporate Bond ETFs:

- Seeks to provide current income with modest price fluctuation.

- Invests primarily in high-quality (investment-grade) corporate bonds.

- Maintains a dollar-weighted average maturity of 1 to 5 years.

Purchased 2.78m shares of VCSH with a market value of $226m

Source: Tradingview

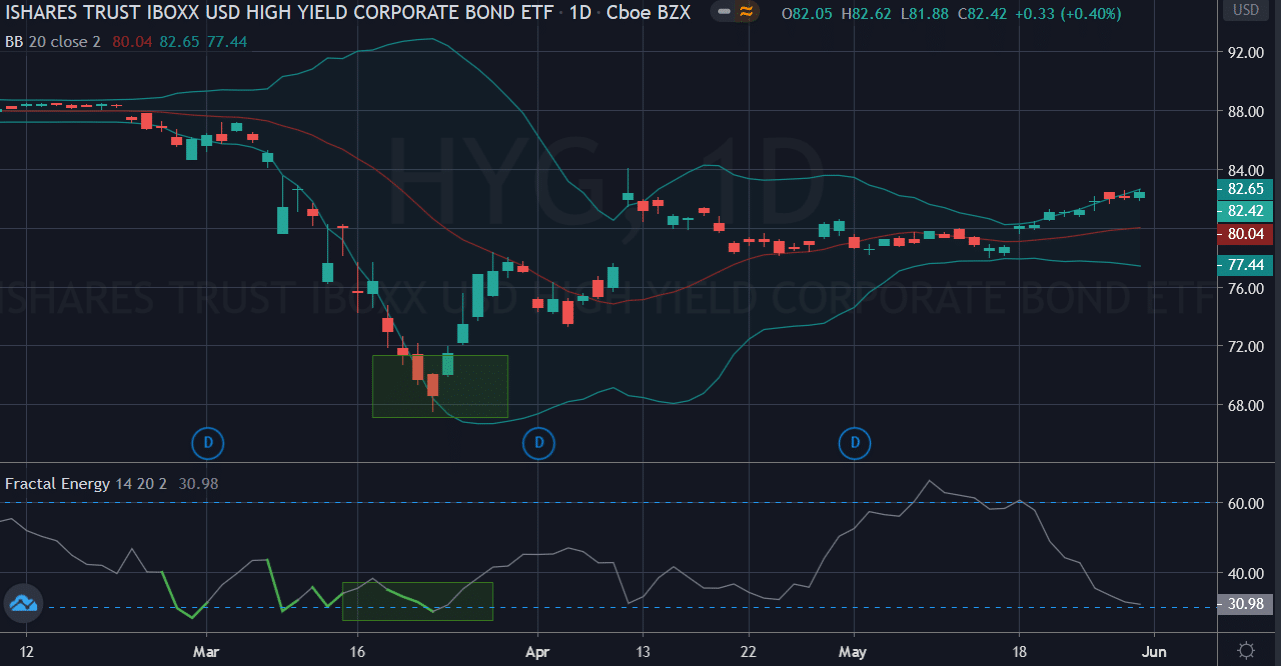

HYG

The advantage of trading the High Yield Corporate Bond ETF is:

- One of the most widely used high yield bond ETFs

- Exposure to a broad range of U.S. high yield corporate bonds

- Use to seek higher income

The Federal Reserve went and purchased 1.25m shares of HYG with a market value of $100m.

Here’s what it looks like on the charts…

Source: TradingView

Wrapping Up

It’s kind of wild to think about the amount of money that was spent by the Federal Reserve over the course of a month!

And the FED doesn’t just go around and toss money into stock without a signal at which it’s a good value for them to make money too!

From the looks of the charts above, the FED might have gotten lucky with their investment… or maybe they know something about the Fractal Energy of a stock.

0 Comments