While many traders are still trying to figure out what to do with this whole sector rotation “thing” that’s happening…

I’ve been on the hunt for trading opportunities right now, and I can tell you one thing is working for me…

Fractal Energy

And it has kept me focused on stocks to trade without trying to predict what sectors to trade.

You see, I don’t really care if there is a rotation going on … instead I only care on what Fractal Energy is telling me

And I’m utilizing this pattern to uncover some of the hottest trading setups in high quality stock

In this market environment, I’ve relied on just these two indicators and patterns and not much else

It’s the same technique that I’ve been teaching traders and using for over a decade…

So it’s time to learn how to utilize this same strategy to your advantage

How I’m Finding The Best Trades Right Now

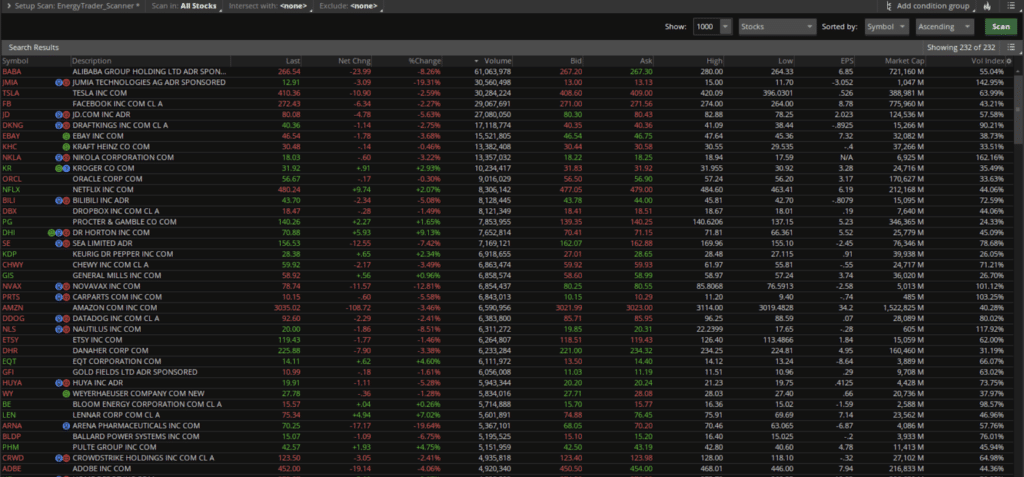

It all starts with narrowing my focus

And the easiest way to do this is by utilizing a scanner and filter for Fractal Energy

For the most part, I want to look for stocks that are trading near the lower Bollinger Bands and have a charged Fractal Energy with stocks that have higher trading volumes.

This is important because as I only trade short options, and I want to make sure that I don’t get assigned stock on a thinly traded name, just to realize I can’t exit the trade easily.

That’s not great risk management for a trader… right?

[Not sure what to trade? Keep an eye on my watchlist for the best Fractal Energy trading opportunity!]

Fractals Lead The Way

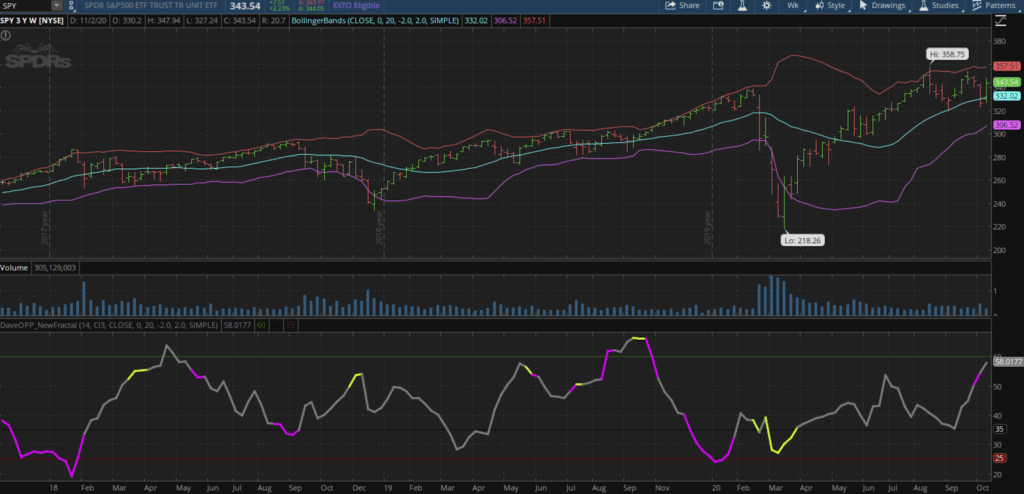

Fractal Energy does more than just pick stock for me… you see, Fractals are actually a market sentiment indicator that I use to determine what the major markets are thinking

And last week I was warning that the markets had built-up Fractal Energy from a prolonged sideways action in the stock

I warned traders to keep an eye on the price action surrounding the election and the Fractal Energy that is storing up

And I warned that we were on the precipice of a major market move as seen in the weekly chart above

You see, when Fractal Energy becomes this charged the markets needs to respond in one way or the other as energy is released from the system

In my recent email:

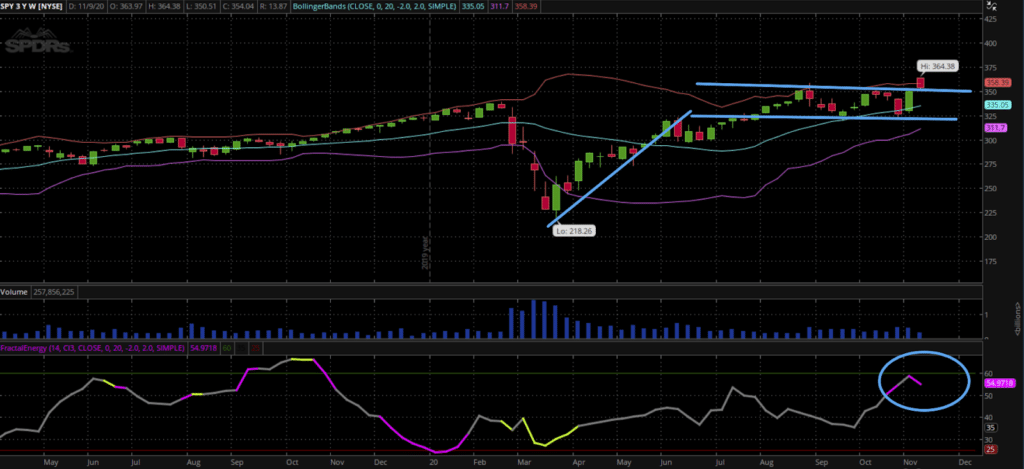

“I cannot say this loud enough – we are on the precipice of a major move. I am still predicting it to be an uptrend, but I want to see it release and confirm the direction before I go in big with positions. I expect that to start over the next two weeks.”

I wish I could have gone back and warned everyone else about what was soon to happen

You see, typically with this pattern, after the period of consolidation, it breaks out… and now that Fractal Energy was charged up, it could run even higher

Why is this setup so important?

Well, during periods of consolidation, you have buyers and sellers taking their stakes in the stock

But sellers always have more to lose than the buyers do

Why?

Well, because short trades have unlimited losses, and brokers know this… and when losses become too significant, they “call” their shares back and cause the trader to buy their trades back, locking in their loss

And this buying back of shares is the fuel to the flames of a short squeeze

Now… I don’t know if there are short squeezes of short sellers up here in the SPY but I can only speculate based on what technical analysis is telling me.

Wrapping Up

Then when Fractal Energy is showing me a stock is “charged”, then it seems that there is a strong trend imminent

And that’s exactly what happened in the markets

You see, just like the Army Rangers, Fractals Lead The Way…

Fractals are typically the first indicator to alert me to a new market breakout

In other words, this alerts me to when demand exceeds supply, and causes momentum higher, squeezing the shorts.

Fractals are the cornerstone of Energy Trader

When it comes to placing a trade, I always make sure there’s an edge by leveraging the internal energy of a stock, Fractal Energy.

And I trade then using credit spreads to give me a unique advantage over the average trader… meaning I can generate returns instead of spending money… and I’m paid upfront to trade!

0 Comments