The only trade I will take is one where I get paid upfront.

Why? Because the odds are in my favor when I sell options instead of buying options.

Selling options is very similar to being a casino and making money off the hopeless gamblers… it puts you on the right side of the trade right from the start.

Options give a trader two distinctive advantages over trading normal stocks.

- The power to dictate what price you will pay for a company and at what discount.

- The ability to get paid to wait for the stock to come to the price level.

Options traders can take advantage of the many great opportunities that are normally off-limits to equity traders.

So let’s take a look at how options traders can get paid to own stock by utilizing this one simple options strategy.

What Is An Option?

An option is a financial tool that is based on the value of the underlying stock.

An option contract offers the buyer the opportunity to buy or sell the underlying asset.

There are two types of options:

- Call Options – Allow the buyer to buy the asset at a specific price on a specific date.

- Put Options – Allows the buyer to sell the asset at a specific price on a specific date.

Note: All option contracts all have specific expiration dates by which the trader must exercise their option.

There are two types of option traders, a buyer and a seller.

- Option Holder has the right to buy or sell the underlying asset at a specific price.

- Option Writer is obligated to buy (or sell) the underlying asset if the contracts are assigned.

Call and put options are the two foundations to a wide range of strategies designed for hedging, income, or speculation.

The Short Put

Selling options is a lot like being in a casino and is the go-to strategy for selling options for many professional traders.

In this example, we are going to be focused on selling put options to generate income.

A short put is also known as a “naked put” and is a way to take a neutral to long position in a stock.

Selling naked puts has one distinct advantage for the trader….they allow traders the opportunity to purchase a stock at a discount!

The Trade

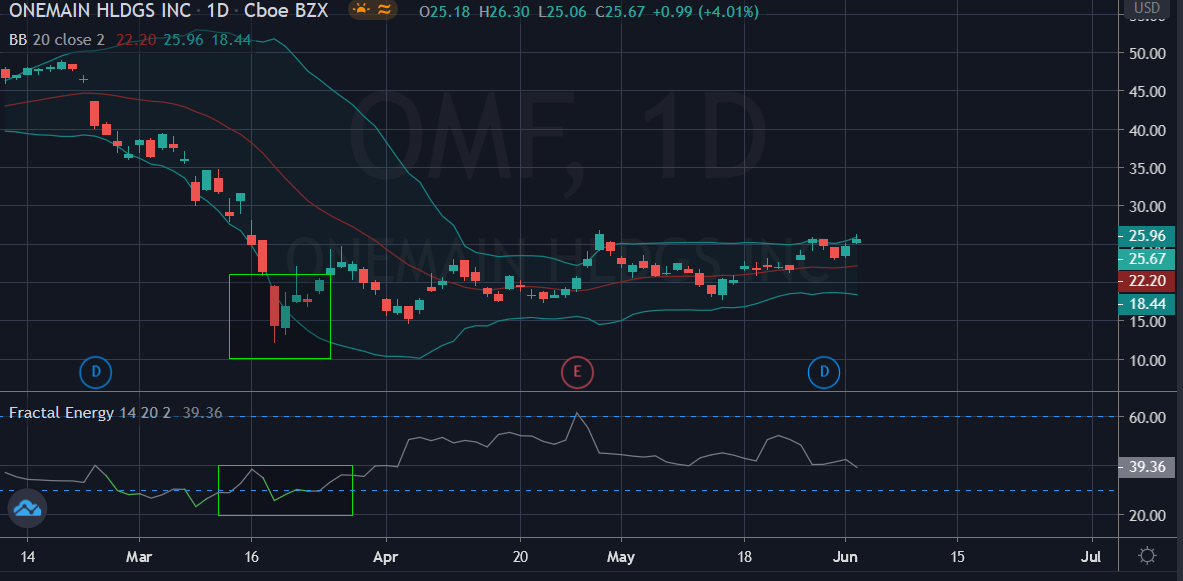

Let’s take a look at a recent trade in OMF and see how a position in short puts works.

Source: Tradingview

Two things you can see from the trade above

- The Fractal Energy is exhausted and signaling the trend should be ending

- Price is under the Bollinger Band and should bounce back inside the Bollinger Band range

Now since we don’t think OMF is going to call back below the 52-week at $10, so it is a good level to sell the puts at.

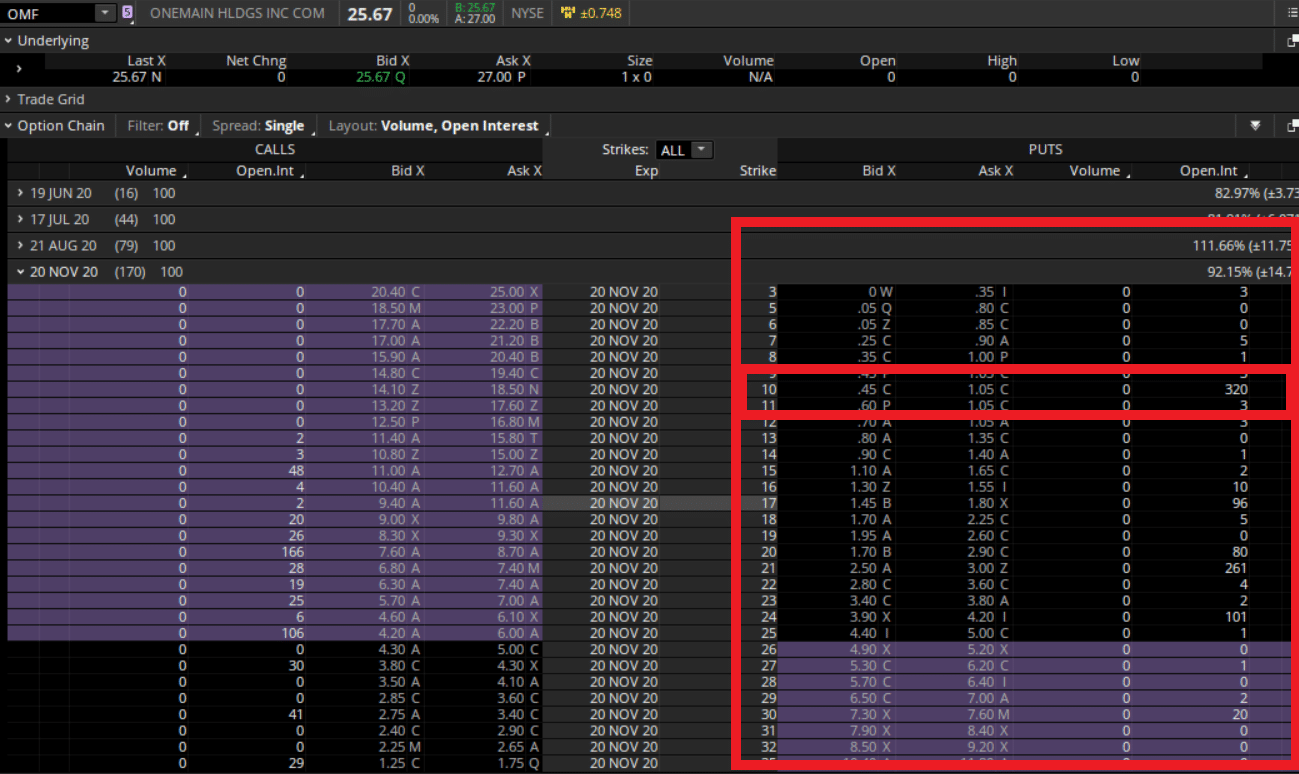

Source: Thinkorswim

By selling the $10 options around $1.00, a trader can get the price of the stock at the specified strike price.

That is due to the built in stock ownership advantage naked put sellers get from a strategy like this.

This means that if they were to expect this short term decrease in price to send stocks higher in the future, they would let their short put be exercised.

When they are exercised, the trader would then be assigned the stock OMF at the strike price.

Pros to selling options

Smooth Return Stream

Selling options is one of the most reliable and stable sources of returns in the markets.

Premium selling strategies tend to have extremely high win rates and are a great way to grow trading capital over time.

Winners Mentality

Most traders tend to feel better when they are winning rather than losing. This makes sense that traders would benefit from a system that has them winning a high percentage of trades.

This boosts confidence and leads to less “second guessing” the trade. This confidence tends to lead to smaller losses compared with traders who are buying “lotto tickets.”

Cons to selling options

No “Grand Slam” trades

Selling options tends to be “singles and doubles” type of trading. The knowledge that a big grand slam is right around the corner keeps traders coming back to their screens every day, waiting for that huge opportunity in the markets.

Unfortunately, option sellers won’t have this rush of excitement like hitting it big at the casino.

Potential of large losses

Another huge negative is the potential for large losses. While this is a remote possibility, it does still exist depending on the underlying security traded.

Traders can mitigate their risk to large losses by trading credit spreads rather than naked options. This is the “best of both worlds” as the trader can play the house odds while maintaining a controlled and limited risk profile for their account.

Final Words

To summarize, premium selling is known to generate a wildly profitable and extremely smooth equity curve.

But it has many benefits that are associated with a strategy like this one.

Three of the best are:

- There is the risk of an occasional large loss with selling a naked put, but this is mitigated with the use of other options trades to offset.

- The return of a premium selling options book is that of a mean reversion stock trading system, with a large number of small wins with the occasional larger-loss trade.

- Selling Naked Puts is one of my favorite strategies since it allows me to purchase stocks at a discount and get paid doing so!

0 Comments