The Coronavirus fears have sent stocks and treasuries into a downward spiral. And with a botched oil deal over the weekend, oil prices are tanking across the globe.

The market continues to get smacked around, with no bottom in sight.

But… is this selloff an opportunity to finally get long the markets or is it a time where investors should start putting their retirement accounts into cash and gold?

I rely on my fractal energy indicator to get an accurate read on the market.

Fractal Energy

Fractals make up everything around us including the universe. They are so powerful they can describe numerous mathematical oddities seen in nature, such as coastlines and snowflakes. These models are useful in modeling structures in which patterns recur at progressively smaller scales, and in describing seemingly random or chaotic phenomena found in nature.

And this extreme power is exactly why I use them to help predict the stock markets!

What I see is this…

The markets are due for a bounce, it’s just a matter of when.

On the monthly chart, things seem to be wrapping up and the Fractal Energy Indicator is showing that the markets are starting to charge back up for a move higher.

Source: Thinkorswim

Here’s what I see in the charts…

Overall, I see two main things happening…

- The uptrend is still intact

- Indicator is charging back up

So… once this is what I’m thinking…

There may be another pullback, but it should be short lived. And since we are approaching the major trend line there should be a healthy bounce combined with a fully charged Fractal Energy.

With these two things, we should be looking at higher markets ahead…

Now wait a minute… before going out there and buying stocks and call options, these markets could still give us a head fake and go lower.

So that’s why you need to get long safely… without having to sleep with one eye open about what could happen to your account.

Next… Let’s take a look at one strategy you can use to get long these markets all while not worrying about your positions every minute of the day.

Stocks Vs. Options

Safety is something that you need to live with as an options trader.

Taking unnecessary risks and not listening to your safety rules is one of the quickest ways to hurt your trading business.

One way to get long the markets is to buy stock.

And that is absolutely the wrong thing to do in conditions like these.

In the blink of an eye, these crazy markets could totally blow past any stop order you have with your broker and you will never be able to exit.

So don’t let false information fool you… trading stocks is definitely not safer than trading options.

What do I mean?

Let’s take a look at two risk profiles of stocks vs credit put spreads to see this easier.

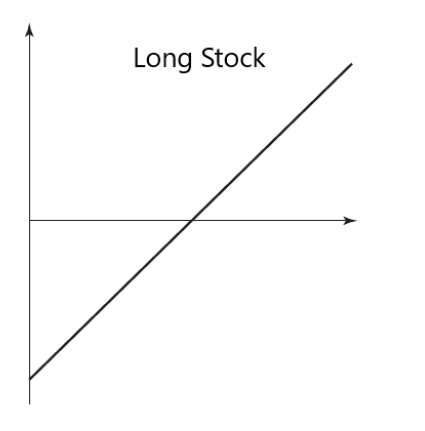

Long Stock:

- Profit: Unlimited

- Losses: Significant, but limited (assuming the stock only goes to $0)

Here is a risk diagram diagram of the long stock for reference:

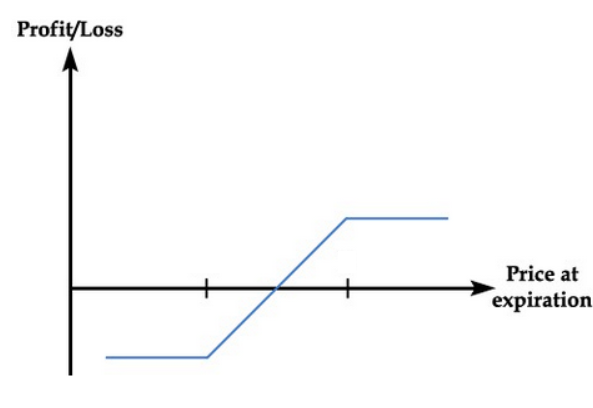

Short Put Spread:

- Profit : Limited

- Losses : Limited, not significant

Here is the risk diagram of the short put spread for your reference:

So, as you can easily tell…this means that as a stock trader, you have more risk than an options trader would have!

Why?

By utilizing the power of options you can start to do a number of things, such as trading a credit spread.

Next… let’s take a look at using credit spreads to help us go long the markets.

Short Put Spreads

A credit put spread, or a bullish put spread, is an alternative strategy to go long a stock or outright buying calls.

This trade is said to be significantly safer than trading stocks and easier to trade than worrying about call options.

Why do I like trading the credit put spread?

Because it combines two of my favorite things, collecting a premium, and maintaining a safe trade!

Before we begin, let’s look at a basic short put to understand the risk associated with this trade.

The short put:

- Neutral to bullish trade

- Limited profits

- Unlimited losses

- Requires high margin from broker to trade

Unfortunately, one of the biggest problems with naked puts is the capital requirements and the fact you can have significant losses on your account from trading this strategy.

So what’s the solution?

Trade a spread!

The credit put spread:

- Neutral to bullish trade

- Limited profits

- Limited losses

- Significantly lower margin requirements from broker to trade

So… how do you make a spread trade?

This is how it works.

- First, you want to trade a short put, either out-of-the-money or at-the-money in order to collect premium on the trade.

- Second, you want to purchase a further out-of-the-money put to provide protection to the downside risk you have on.

And once the credit put spread is established, the premium you receive from the sale of the short option is yours to keep!

Here are some common risk formulas you would want to keep track of.

Credit Put spread P/L Calculations:

- Maximum profit (reward) = net premium received

- Maximum loss (risk) = higher strike – lower strike – net premium received

- Maximum loss (risk) = B/E – lower strike

- Breakeven = higher strike – net premium received

Now… let’s take a look at an example trade.

The Trade – A Credit Put Spread

In this example we are going to take a position in the markets since we believe they are oversold and a reversal should be coming.

Remember, you can create any distance between strikes you’d like, this is just an example trade to illustrate the reduced risk you will have.

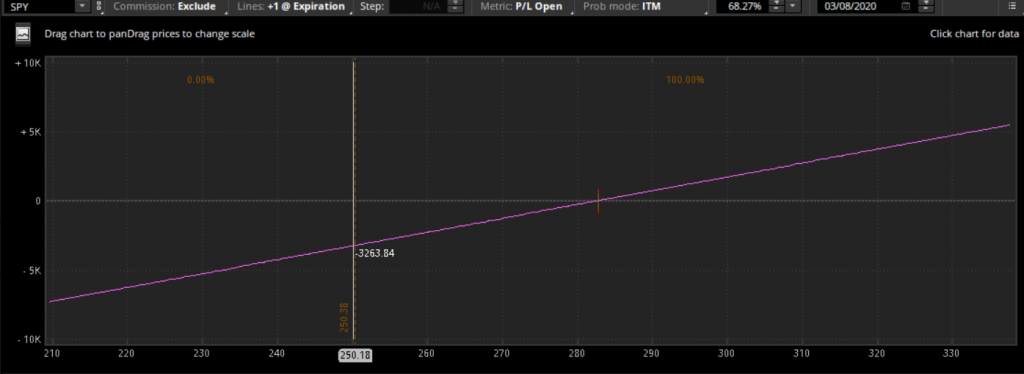

The trade:

- Sell 1 SPY 17 APR 20 265 Put @ 6.06

- Buy 1 SPY 17 APR 20 221 Put @ 1.32

Since this is a bullish put spread, we are looking for the markets to head higher in the future.

Credit spread details:

This spread is executed for a net credit of $4.74 (which is the $6.06 net credit collected less $1.32 paid for downside protection.)

If the markets close above $265 (the higher strike) you get to keep all of the premium collected.

If the markets close below $221 before expiration (the lower strike) you will end up at a max loss on this trade.

Here is a sample risk diagram of this trade.

Source: Thinkorswim

I bet you are thinking, what if I just sold the puts uncovered and collected more money up front.

Well you can! And that’s another one of my personal favorite trades!

But remember, it just requires far more capital to handle a trade like this. Also, the risk-to-reward ratio sometimes doesn’t make sense for that type of strategy in these markets since things are moving quickly.

So what can happen to this trade? Let’s take a closer look at the different scenarios you might encounter.

Scenario 1: The stock drops significantly and closes at $200

- Close position out at max loss if possible

- If short put is assigned, you will need to sell shares or exercise your long puts to cover this stock

Scenario 2: The stock drops slightly and closes at $250

- Close position out at partial loss

- If short puts are assigned, you will be assigned 100 shares at $265

- Sell shares at market price of $250

- Net loss will be credit – difference in stock price = 474 – 1500 = -1,026

Scenario 3: The stock rises significantly

- You will not exercise your 221 puts

- You will not be assigned on your 265 puts

- All options expire worthless

- Collect max profit of $4.74 net credit

As you can tell from these 3 scenarios, using credit put spreads works in your favor when you expect the stock price to rise. Ideally a move above the upper strike of your options sold is ideal in order to collect full premium.

Let’s take a look at the max loss at $250 if you owned the shares of SPY directly.

Source: Thinkorswim

So this means that by trading a credit spread instead of buying the stock outright, you only lost $1,026 instead of $3,263… and this just gets worse the lower the stock trades!

That type of unlimited loss is precisely why trading spreads actually pays off… since a dollar saved is a dollar earned in a zero-sum game of trading.

Wrapping up

For the majority of the time, when a trader looks to go long the markets they usually only consider buying call options or buying a long stock.

And that is not always the best trade for them. Due to higher than average fear (implied volatility) in the markets currently, buying options is actually a losers game.

That’s why when trading a credit spread a trader is able to receive 90% of the same benefits as a long stock trader all while eliminating the blow out risk you face in the event of a massive price move in the underlying stock.

Advantages of credit spreads

- Spreads can lower your risk substantially

- The margin requirement for credit spreads are substantially lower than uncovered options

- Not possible to lose more money than margin requirement held in account.

- Credit spreads require less monitoring than some other types of strategies.

- Spreads are extremely versatile due to the range of strike prices and expirations that are available for the trader to select.

- Little to no monitoring of position required, as typically wait for expiration to close trade.

Disadvantages of credit spreads

- Your profit potential will be reduced by the amount spent on the long (covered) leg of the spread

- Spread trading carries risk of being filled on the short option only, leaving you with an uncovered position.

With a little bit of creativity, you can make options work for you in no time.

Either from saving money, reducing losses, or even generating an income for your portfolio, options are perhaps one of the most exciting ways to trade the financial markets.

So what are you waiting for? In as little as 5 minute, you could be up and running with weekly trade alerts and generating some serious income for your porfilio!

0 Comments