Thinking about selling options?

I know it sounds complicated but from my experience it’s easier than it sounds..

You see, options are less complex than they are made out to be.

In fact, you’ll be surprised at how much money can be made by just mastering the basics.

Include technical indicators which provide an edge and you’re in business.

But there is one topic in options trading that simply can’t get glossed over.

I’m referring to implied volatility.

And in a second, I’m going to explain why it’s so essential in everything you do with options.

If you’ve ever dreamed of having five, six, or even seven-figure option gains…then you must pay close attention.

Implied Volatility Dominates Option Prices

Implied Volatility or IV represents the expected volatility over the life of the option contract for the specific stock.

For example, a 30% IV means that the stock is expected to raise or fall by 30% between now and the expiration date of the option contract.

In other words, the greater the demand or supply, the larger the trading range of a stock is.

And this increased range kicks up IV even further, resulting in options to have a higher price and even overpriced premium due to market makers and traders not being able to determine a “fair market value” for the asset.

Volatility is a dangerous part of the option pricing model, and volatility explosions or volatility collapses have caused traders to go bankrupt overnight.

Here is an example of how a volatility explosion can help a long option trader, but hurt a short option trader.

Let’s assume stock XYZ was trading at $50 and the Implied Volatility started to go crazy due to traders buying and selling options based around an unknown outcome.

Think of it like going into the recent presidential election, nobody knew what direction the market was going to take, so bullish investors bought options, bearish investors bought puts to protect their downside, and gamblers started stepping in hopes to make a quick buck.

You see, this activity increases the IV of a stock without even impacting the stock price!

Just check this out…

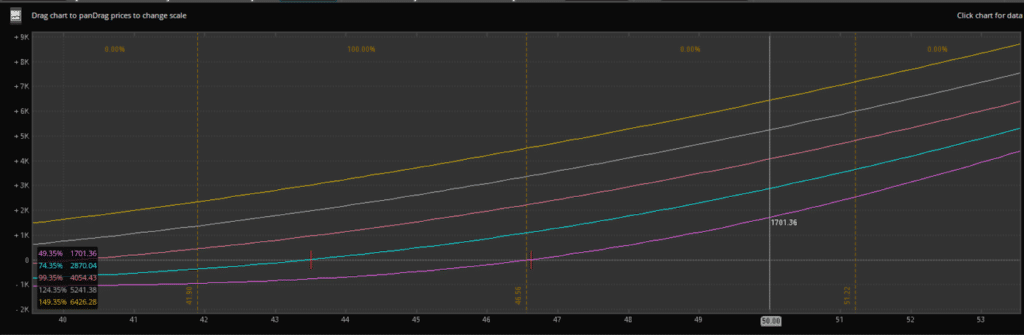

You see, if you follow the $50 strike price (highlighted on the vertical line), the profit of buying those calls explodes for every 25% of increased IV

Currently, the IV is around 49%, and the expected profits for the stock at $50 is $1700, but if the IV was to spike to 150%, you would have a profit of approximately $6500 without a single move in the stock price.

And if you were an option seller, selling options at 150% and buying them back at 50%, you could collect that income simply by the “vol crush” or decrease of excitement in the stock that occurs.

But IV is not created equal, each strike price will also respond differently to IV changes. Options with strike prices At-The-Money (ATM) are the most sensitive to changes in IV, while options that are further In-The-Money (ITM) or Out-of-The-Money) OTM will have less sensitivity to implied volatility.

Now let’s take a look at how you could apply implied volatility to your trading.

Here’s an example of how IV can impact options prices

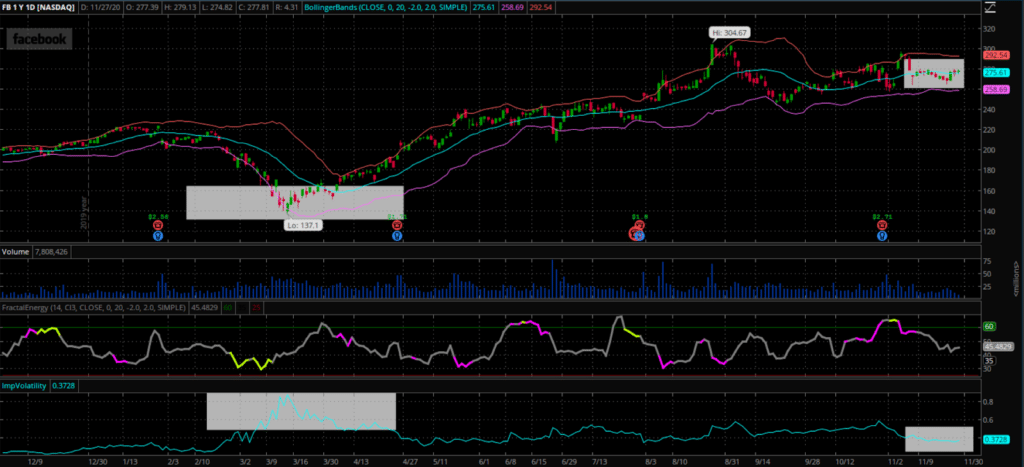

When looking at this chart, you can see the plot of IV at the bottom. The first highlight was in the middle of the COVID-19 outbreak, and as the stocks were trading lower every day, the Implied Volatility was exploding.

And recently, as FB is trading inside its Bollinger Band and trending sideways, the IV is actually slowly decreasing.

Still not sure what you’re looking at ?

To me, there are 2 things that stand out.

- The highest reading of IV was when the market was at its low

- The lowest reading of IV does not necessarily mean highest price on the chart

Note: Because each stock has a unique implied volatility range, these values are not to be compared on another stock’s volatility.

Four Things To Consider

- Make sure you can determine whether IV is high or low prior to getting into a trend reversal trade. Remember, as IV increases, options prices are becoming higher.

- If you come across periods of high volatility, it is most likely caused by some external force. It’s best to check for reasons that may be causing IV to be elevated, such as, mergers, earnings, or other announcements.

- When you see options trading with high implied volatility levels, it’s best to target option selling strategies.

As options premiums are elevated, it’s best to avoid purchasing options and it might be more desirable to sell.

Some strategies are covered calls, naked puts, short straddles and other various credit spreads.

- When you see options trading with lower Implied Volatility levels, it’s best to target option buying strategies.

As options premiums are suppressed, it’s best to purchase options instead of selling options. Some strategies are buying calls, buying puts, buying long straddles, and other various debit spreads.

Note: as primarily an options seller where I like to generate income for my business, I only focus on credit spread option trading strategies. In my opinion, buying options doesn’t give you the odds of success that you will need to run a successful trading business.

Wrapping up

There are many reasons an option’s implied volatility may deviate from its averages. Some examples include upcoming earnings announcements, fed announcements or an upcoming merger and acquisition.

The key is to recognize when implied volatility is high compared to its historical highs. When it appears to be extended compared to past values, options traders should structure a trade accordingly.

The process of selecting option strategies, an expiration month and strike price, things can start to get complicated very fast.

But one factor you never want to overlook is Implied Volatility on that stock.

It is wise to always gauge the impact of what IV has on selecting your strategies.

There are a few things to remember about Implied Volatility:

- Bearish markets increase volatility

- Bullish markets decrease volatility

- Implied Volatility is a proxy for emotions of the underlying market and can be erratic

- It’s possible to align the underlying stock direction to the IV level to combine stock movement with shorting IV

- Implied volatility trading comes with built in entry and exit prices for your trade.

Want to learn how I trade options?

Since the launch of Energy Trader, I have gone undefeated*. I’m not sure how long this streak will last, so make sure you join me today to join in on this limited market opportunity.

0 Comments