With so much uncertainty in the market, volatility is on the rise. While most traders get shook by this action, I look at this volatility and see opportunities. It’ll just take a few minutes out of your day, but I want to show you how to take advantage of all this uncertainty and trade with an edge.

Trading in volatile markets is hard but also very profitable, if you know what to do.

There’s so much uncertainty in the market right now, and it’s risk-off for many traders right now. Of course, it’s safer to wait and see how things shake out.

For me personally, this is the time I want to be on the hunt for opportunities.

You’ve probably heard the saying, “the time to buy is when there’s blood in the streets.”

Buying the dip is possibly one of the most lucrative strategies you can leverage …if your strategy and timing is nearly perfect.

Of course, that’s a bit harder than it sounds…

Having a perfect strategy and timing is… DIFFICULT!

That is why I don’t even attempt to trade stocks with that strategy…

Instead, I want to trade based on the same theory.

Instead, I want to tap into the explosive potential in the options markets, using credit spreads so I can take advantage of an uptick in volatility during the selloff.

Listen, I’m all about teaching you how to attack the market… but you need to learn how to do it safely!

Now let’s take a look at a trade I’ve got on my radar and one that I’ve exited yesterday for over a 70% profit*

Nothing To Fear, But Fear Itself

Many traders have a lot of fears about trading, let alone during one of the most uncertain times in recent US and world history.

As Franklin D. Roosevelt once quoted : “There is nothing to fear, but fear itself”

What I mean is that fear makes things worse!

So when I’m trading, I make sure to keep a cool head and focus on a single strategy that I know and trust.

If you don’t know, volatility is one of the main factors in pricing an option contract, and many times, the market makers do this with great inaccuracy.

And it’s important to remember that volatility is a mean-reverting instrument.

This means that when volatility spikes, there is a good chance it will eventually pull back in. That idea is exactly the opposite of stocks that typically trending instruments.

Think of it this way, instead of buying low, selling high… you are selling high, covering low…

Combine fear into this equation, and you will get increased volatility in the marketplace. This fear causes more volatility which in turn causes options to be more expensive to purchase.

But as an option seller, I take the opposite side of this trade and capitalize on over priced options during times of high volatility.

And as the news calms down the markets, volatility slowly decreases and causes the options price to drop.

Then when volatility is sucked out, news is released, and the markets calm down… I quietly exit my trade.

Now let’s take a look at a recent trade and how I traded around the volatility collapse as the markets calmed.

Trading Credit Spreads

In my opinion, credit spreads are one of the easiest ways to trade when there is high volatility to generate income.

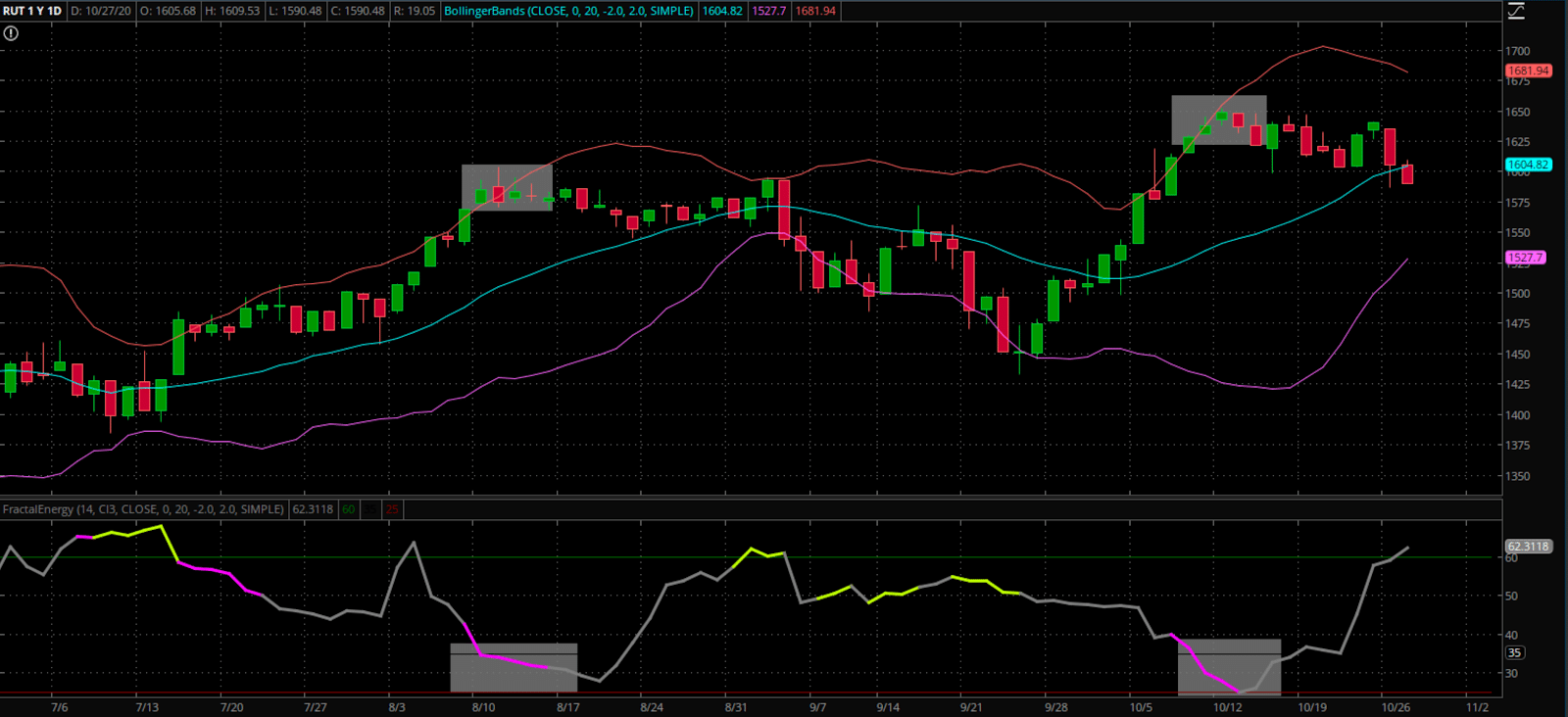

The recent trade I took is a credit spread on the RUT that I was able to collect $1.30 per contract on.

Let’s take a look at what I saw on the RUT and went with trading a credit spread…

Source: Thinkorswim

Since there is a lot of excitement to the upside in RUT, the call options are starting to get a bit expensive.

It’s helpful to keep an eye on the Bollinger Bands and the Fractal Energy when identifying places to trade around. For me, I’ll look to sell credit spreads towards the upper and lower bands, and ignore anything in the middle.

Why are these levels important?

Well, it helps with knowing that a stock is going to mean-revert. This is similar to volatility, as the Bollinger Bands act like ropes in a boxing ring and push prices back towards the middle.

This also identifies where the support and resistance levels are in the stock, helping me with selecting the strikes that I am going to select for my credit spread.

The reason I look to sell a bear credit spread 9call credit spread) instead of buying a put when I believe the stock is going to head lower is because of volatility.

Call options at this point are juiced up from buyers speculating on higher prices. Then I can capitalize on this speculation and increase in options prices by selling call spreads instead of buying puts.

Unlike buying long puts, where you can actually lose 100% of your money, if the stock trades sideways, down, or even slightly higher, I will be able to keep 100% of my credit that I collected at expiration.

This is a huge advantage for options sellers that stock and option buyers can’t take advantage of!

How did this trade play out?

I was able to sell the credit call spread and buy back the position locking in a cool $1.30 per option contract profit on this trade.

While there are plenty of companies that are trading near their Bollinger Bands, I can’t take every trade, and need to be selective in my choosing.

This is why I turn to the power of Fractals to guide me in finding my perfect trade setup.

Even though I have already traded this stock, I want to keep it on my radar for a future trade

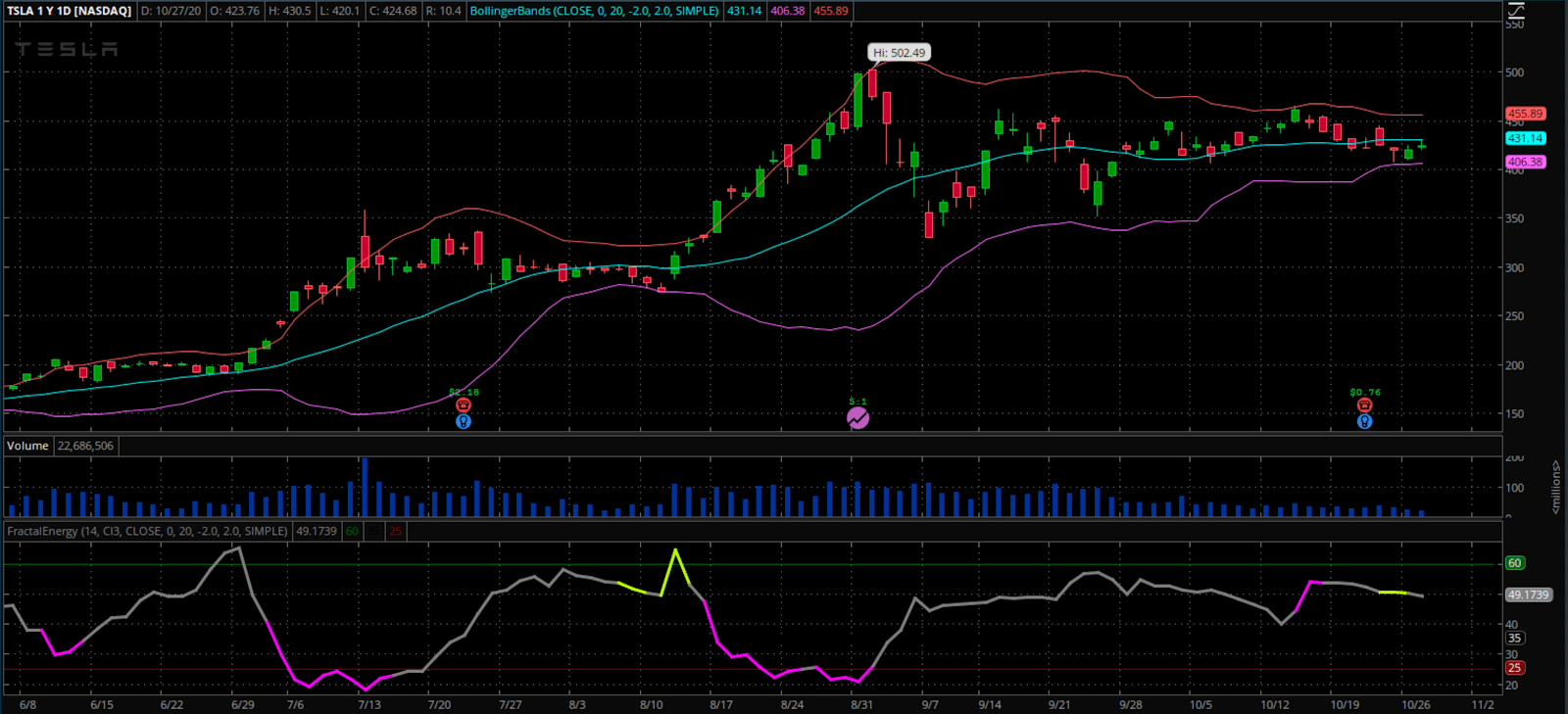

Source: Thinkorswim

Now, looking at TSLA, I see a few things that are starting to catch my attention.

First, I noticed that the Fractal Energy is strong and the stock is charged for a move. Now, I don’t know the move direction, but it seems the stock is ready to breakout in any direction in the near future.

So that’s why I turn to Bolligner bands…

I notice that the stock is trading near the lower Bollinger Band, meaning the stock might look to trade higher back towards the middle of the bands or even towards the upper bands.

But I won’t be trading this stock right away… but instead I will put it on my watchlist until I see the perfect setup play out in the charts.

Only my paid subscribers will be alerted in real-time once I place this trade!

Make sure you don’t miss out and join today!

Start Learning How To Trade Credit Spreads Today

In this market environment, it helps me to stay focused and only trade my perfect setups.

This way I don’t chase stocks in speculation playing into the hand of the market makers during periods of high volatility and uncertainty.

And now I’ve got my eye on a different sock that has a setup that is forming now and that I will look to trade if the Fractals tell me it’s time to enter.

*Results presented are not typical and may vary from person to person. Please see our Testimonials Disclaimer here: https://ragingbull.com/disclaimer

0 Comments