In case you don’t know, I really like cash flows.

And I like cash flows so much I dream of new ways to make cash with my cash.

Do you know what separates the rich from the wealthy?

“To get wealthy, you have to be making money while you’re asleep.”

David Bailey

Meaning – you need to put your money to work and have it generate more money for you! Even when you sleep!

Well, I have a new type of trade that I have been working on that you may never heard of. And if you have, it’s possible you are afraid to trade it because it sounds too complicated.

There is nothing you need to worry about with taking on a new trading strategy.

It offers some of the best-risk reward out of any options strategy out there.

After reading this, you will have the confidence to start using this new technique to begin generating extra income for your portfolio as early as your next trade!

Credit Spreads

The style of trading that I live and die by, is called a Credit Spread. You might recognize this as a Credit Call Spread or a Credit Put Spread.

These two trades are extremely versatile for making a directional trade, removing the impact of volatility and “guessing” the exact movement of the underlying stock.

And as you already know, one key advantage of selling verticals is that your risk is defined.

But what if you don’t want to take a direction in the market but maintain a neutral position?

This is where an Iron Butterfly will help.

The Iron Butterfly

An Iron Butterfly is a combination of two basic option spreads, a put spread and call spread.

This position is created by combining an Out-Of-The-Money (OTM) short put spread (bullish strategy) and a short call spread (bearish strategy) on the same stock with the same expiration.

In this strategy, a seller is targeting two different OTM vertical spreads with the short strike common among both sides. This will allow the trader to collect the premiums from both sides of the option chain.

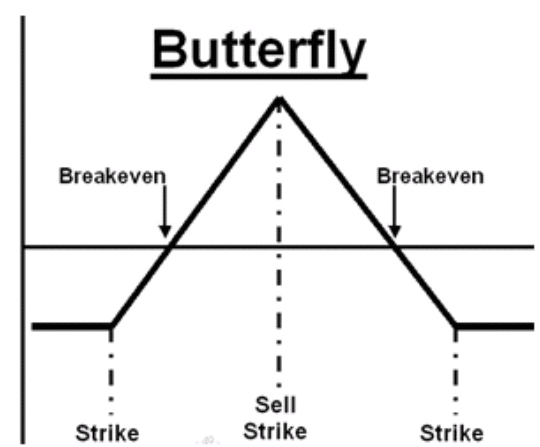

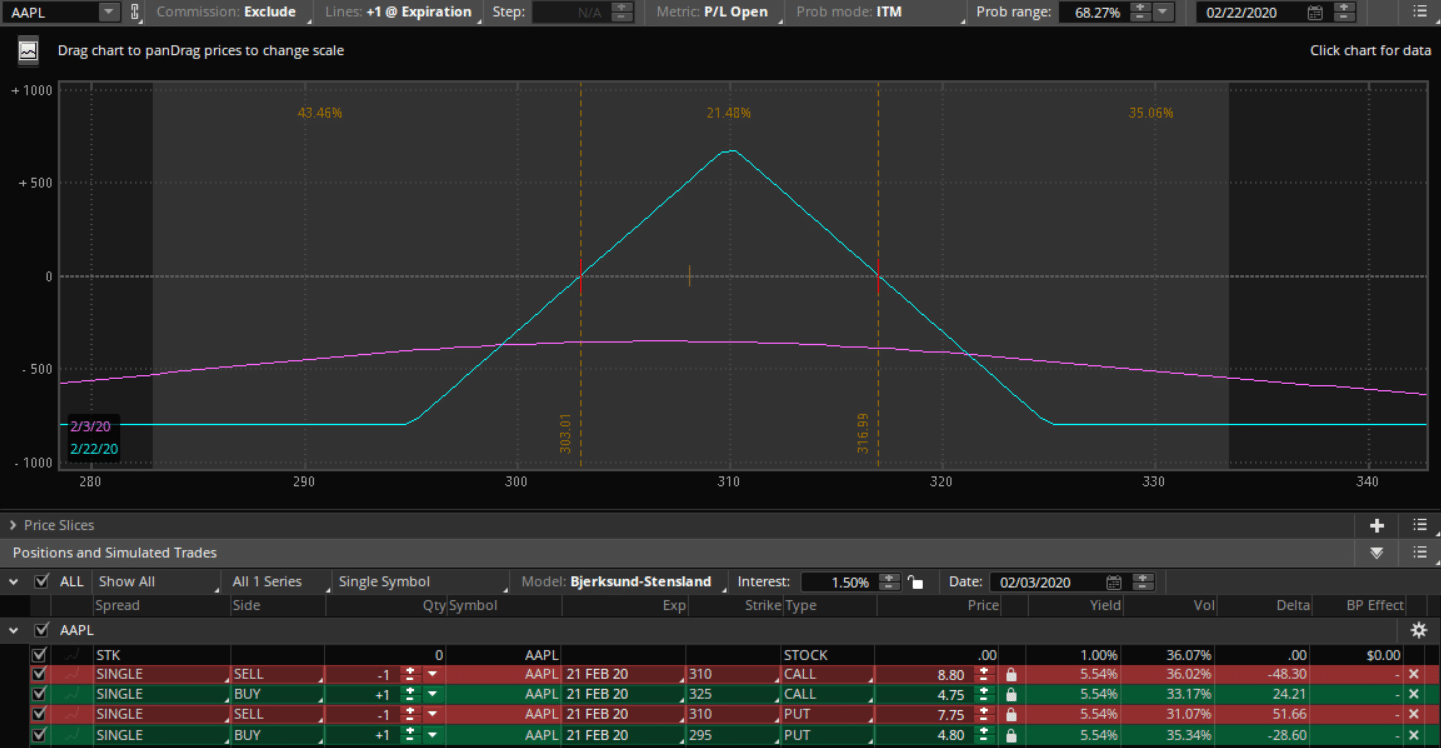

Here is a sample risk profile on an Iron Butterfly.

There are two outcomes to this trade that are possible for the trader:

- If you are wrong? The profits from one spread will offset the losses from the other.

- If you are correct? You can ring the register on double the profits!

Risk and Reward:

Maximum Risk:

- Limited. Max risk = difference in nearby strikes – net premium collected.

Maximum Reward :

- Limited to the net premium collected when the underlying stock is at the middle strike price at expiration.

- Max gain = net premium collected

Breakeven :

- Upside Breakeven = Middle Strike + Net Premium Collected

- Downside Breakeven = Middle Strike – Net Premium Collected.

The Iron Butterfly – Example

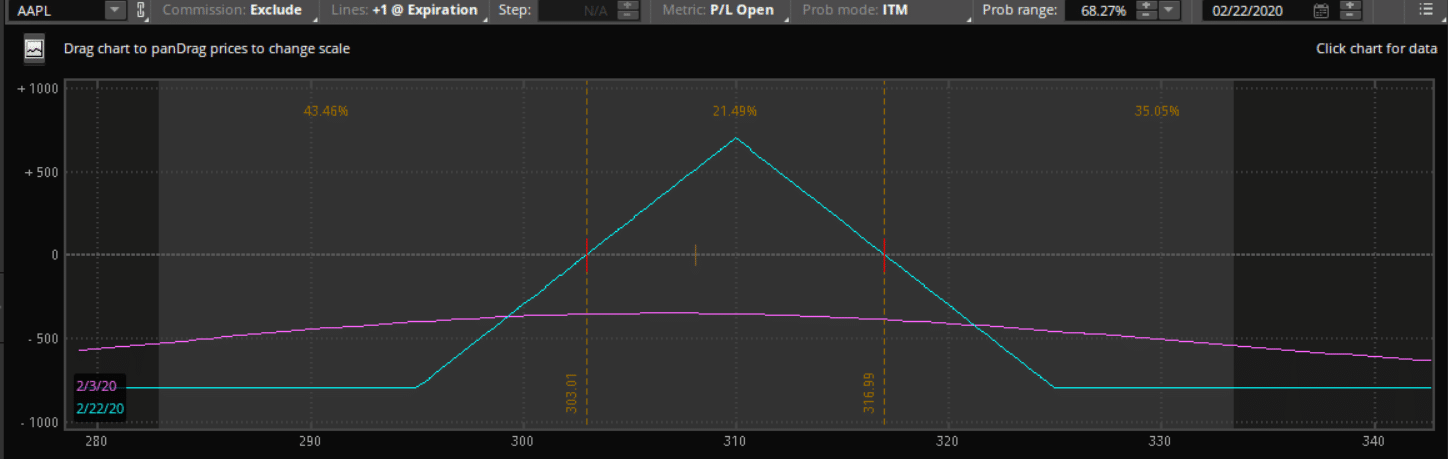

Let’s take a look at an example risk profile of an Iron Butterfly trade.

This might look a little strange at first glance, but it is quite simple once you look at it a little closer.

In this example, there is a credit call spread and a credit put spread that are combined at the short strike.

Both of these trades are placed at the same time and allow a trader to return two times the profits at the short strike price.

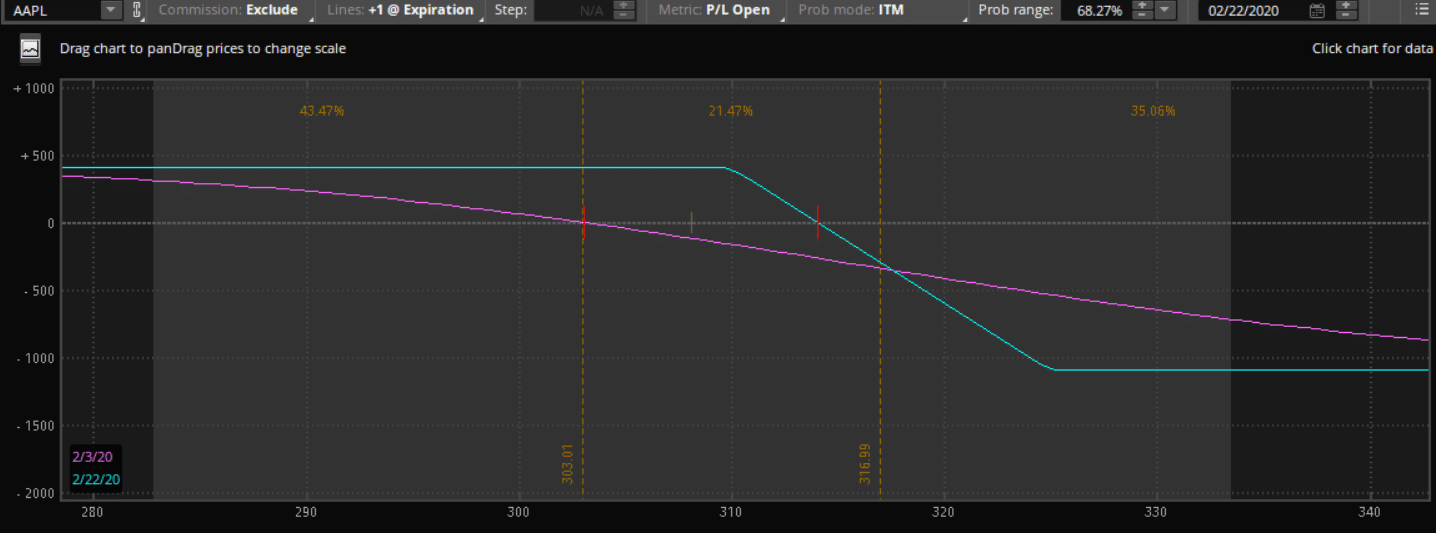

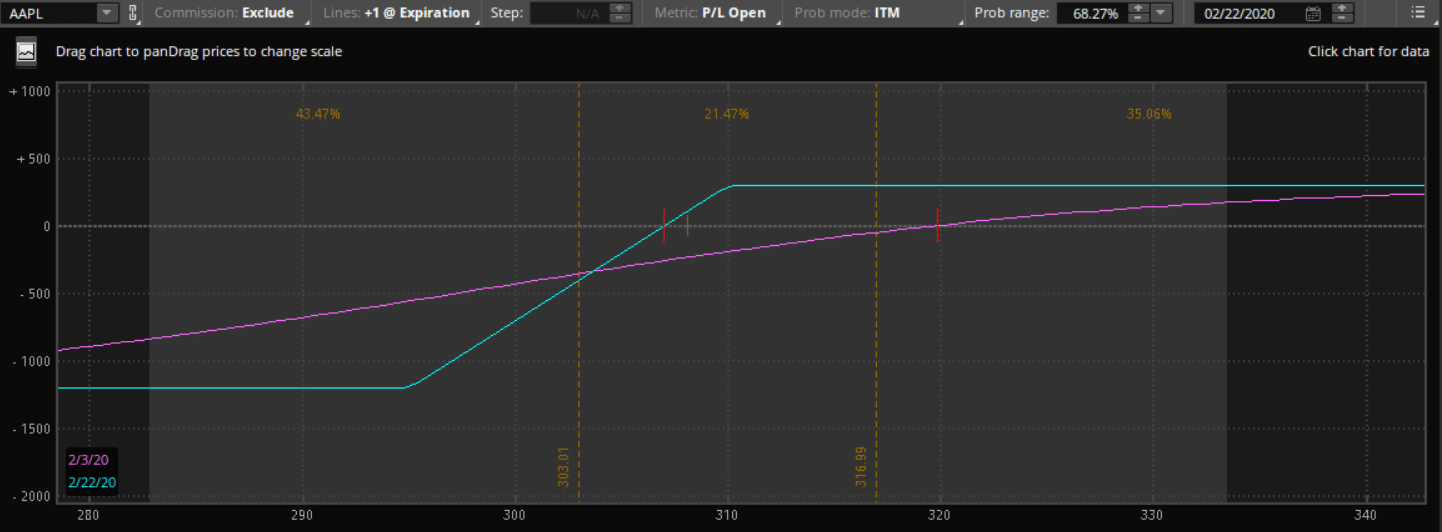

Let’s take a look at the profit/loss of each separately.

Call spread : Profit $405 / Loss $1095

Put spread : Profit $295 / Loss $1205

Iron Butterfly: Profit $700 / Loss $800

When combined, this new position to create the Iron Butterfly created approximately 2 times the profits as the original positions. And it even decreases the max loss too!

When To Use An Iron Butterfly

Now that you know what the Iron Butterfly is, it’s probably best to understand when to use it.

The objective: To capitalize on sideways markets or range bound markets rather than in a certain direction.

The solution: Use an Iron Butterfly to collect on additional premium while decreasing dollar risk!

Like every option strategy, there are a bunch of pros and cons that come with each. Let’s take a look at how this strategy stacks up against the rest.

Pros:

- Capture profits in sideways markets

- Over 2x the profits of a standard vertical spread

- Limited risk

- Reduced losses compared to vertical spread

- Captures profits from Implied Volatility

Cons:

- Limited profits

- Potential for large bid-ask spread with increased volatility

- Higher commissions

How To Build An Iron Butterfly

The construction of the strategy is as follows:

- Buy 1 out of the money put with a strike price below the current price of the underlying asset. The out of the money put option will protect against a significant downside move to the underlying asset.

- Sell 1 out of the money put with a strike price below the current price, but closer to it than the put option bought in step one.

- Sell one out of the money call having a strike price above the current price of the underlying asset.

- Buy one out of the money call with a strike price further above the current price of the underlying asset than the call sold in step three. The out of the money call will protect against a substantial upside move.

First, Sell a credit call spread:

Next, Sell a credit put spread:

The final trade will look like this:

As you can see in the image above, the shorts are combined at the 310 strike.

Additionally, Iron Butterflies are completed with calls being bought at 325, and puts being bought at 295 that complete the additional spreads required for this position.

Conclusion

The Iron Butterfly is such a versatile strategy and allows a way for a trader to boost their returns in sideways or consolidating markets.

If used properly, this strategy can give a trader some of the best risk-reward ratios possible.

Unfortunately, like all option strategies, Iron Butterflies have trade-offs that may or may not be worth accepting when you are looking to place a trade.

Like every trade, it comes down to your objectives and risk tolerance when selecting a strategy.

To recap, use an Iron Butterfly when:

- Volatility is low and you expect the stock to be range bound or consolidating for a period of time.

- To add 2x the profits and reduce your risk by almost 50%

P.S. I’ve gone over 6 months without a losing trade by using credit spreads. This has been bringing in consistent returns even during uncertain market conditions such as the one we are in now!

0 Comments