Do you want the benefits of a long call without having to shell out loads of cash on some long-shot bet with only 20-30% odds of winning?

Unlike trading stocks, utilizing the right options strategy can get you almost any possible combination of bullish, bearish, or neutral exposure.

The good news… you can even do this with credit spreads!

Why are credit spreads important?

Simply… credit spreads put the odds in your favor!

I’m not sure how it feels for you but for me it feels awesome when I put profits into my pockets and not the other guys!

Not a paid-up subscriber of the Options Profit Planner? Click here to change that.

Today, I want to talk to you about one of my favorite option strategies called the ratio spread.

When structured correctly, it gives you some of the best risk-reward returns out there.

Options Profit Planner

Here at Options Profit Planner, I utilize an options trading style focused around credit trading to generate income for my business.

Since trading is a business, I always focus on the money coming in and going out.

Now… I bet you are wondering what credit trading is.

Basically, credit spreads involve selling a high-premium option while purchasing a low-premium option in the same class or of the same security, resulting in a credit to the trader’s account.

Unfortunately, most options traders are focused on debit spreads. These traders seem to forget the untapped potential of a credit spread when they are stuck in a gambling mindset.

Well, without any more distraction, let’s take a look at some of the benefits of trading a 1×2 ratio spread!

1×2 Ratio Spread

A 1×2 ratio spread (with calls) is a trade that is made up of selling a lower strike call and buying two higher strike calls.

This strategy can be established for either a net credit or a net debit depending on various market conditions, such as, time to expiration and implied volatility.

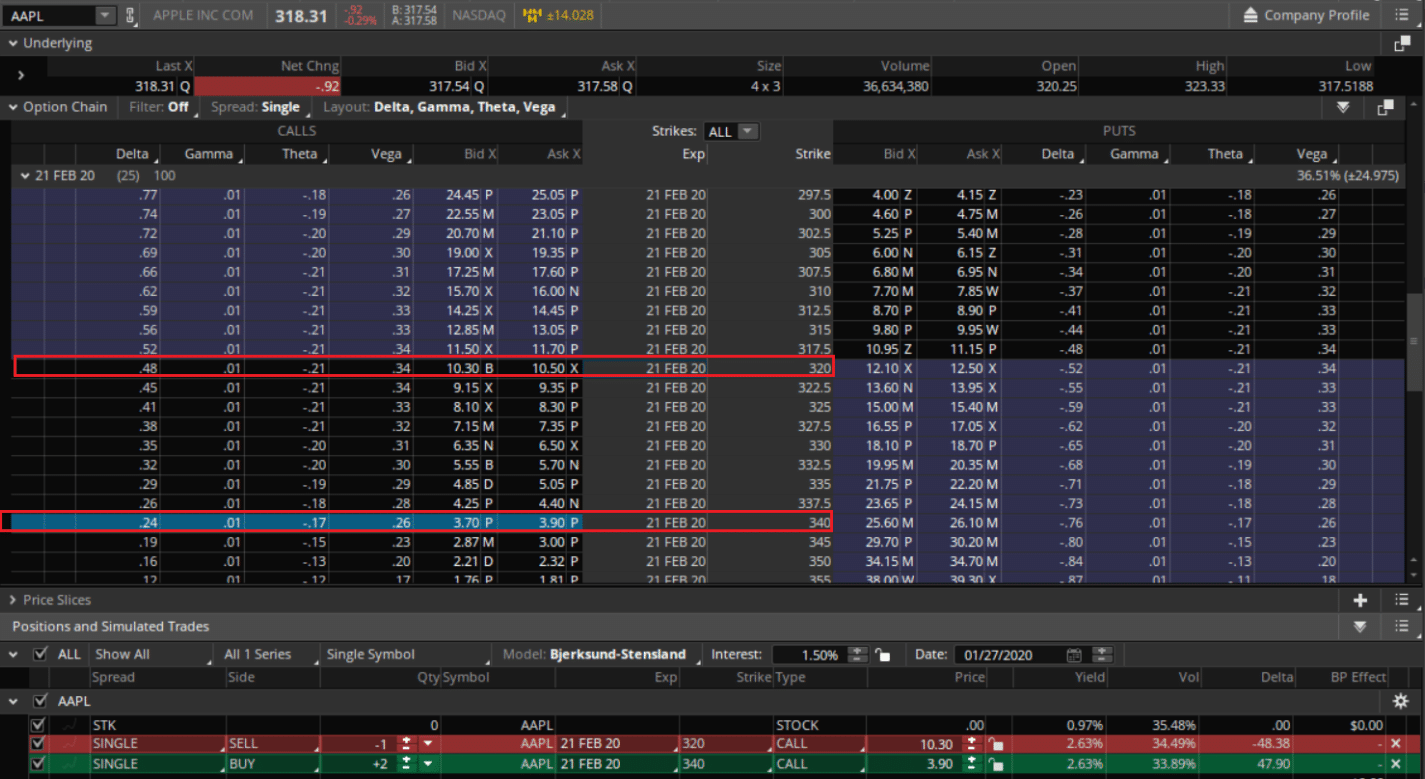

Here is an example of a sample 1×2 ratio spread:

Source: Think-or-Swim

Next… you want to focus on the call side to buy and sell the options contracts to complete the 1×2 spread.

By selecting these strikes, we turn a debit spread into a credit spread.

One of the biggest problems new traders have with options is selecting the strike price for the position they are building.

Having problems with finding the strike price? To learn more about which strike prices to choose, click here

For example:

- Sell 1 x 320 21 Feb 20 Call @ $10.30

- Buy 2 x 340 21 Feb 20 Call @ 3.90

Credit: Short Calls – 2 x Long Calls = Credit

Credit: 10.30 – (2×3.90) = 2.50

Max Loss: 340-320 -10.3 +3.9 + 3.9 = 17.50

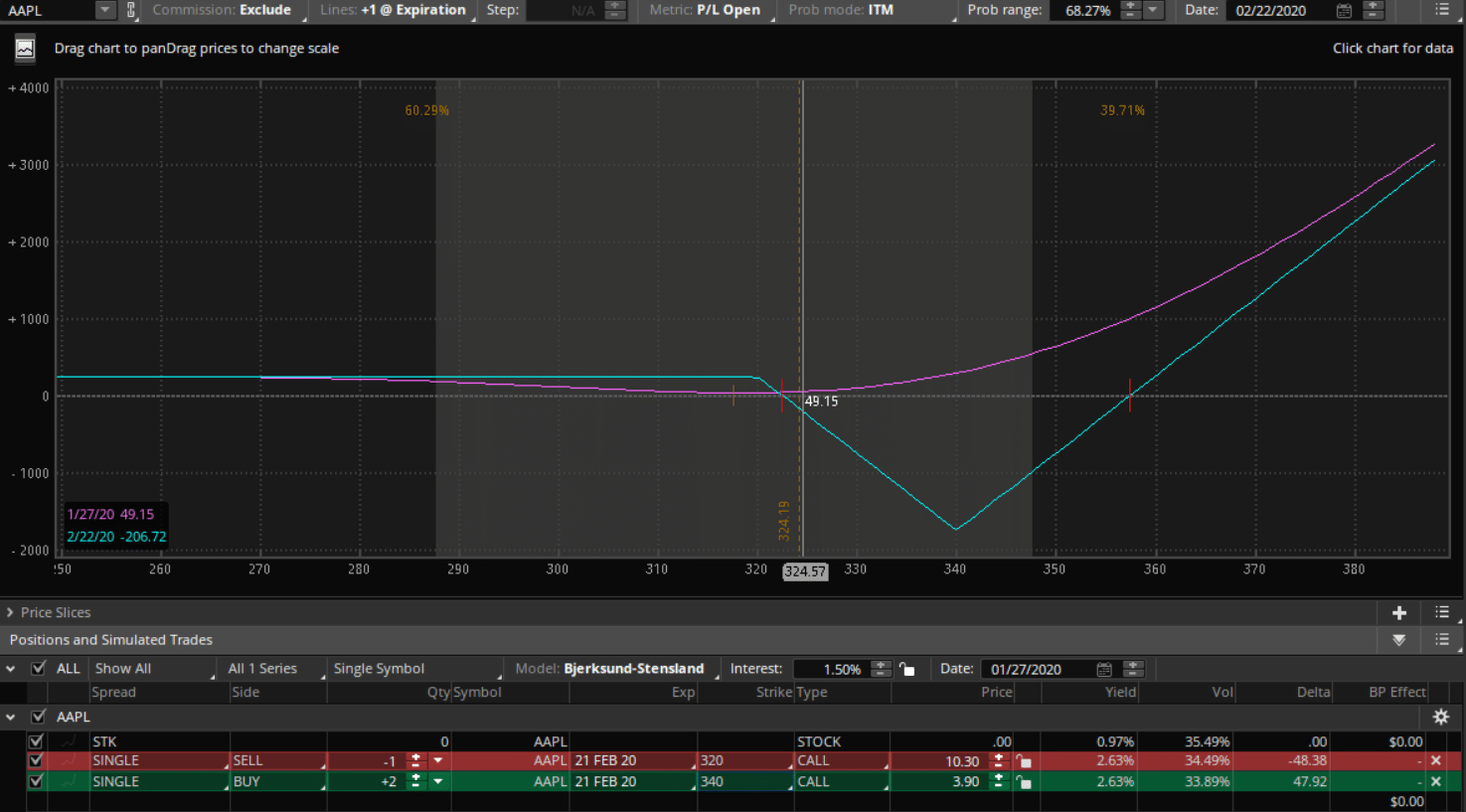

This is a sample risk profile of a credit 1×2 spread:

Source: Think-or-Swim

This means that a trader can collect a credit on a bearish-to-neutral position while participating in unlimited upside gains like the debit options traders can enjoy.

As a technical trader I like to structure my trades around patterns and psychological levels to give me the best shot of a winning trade.

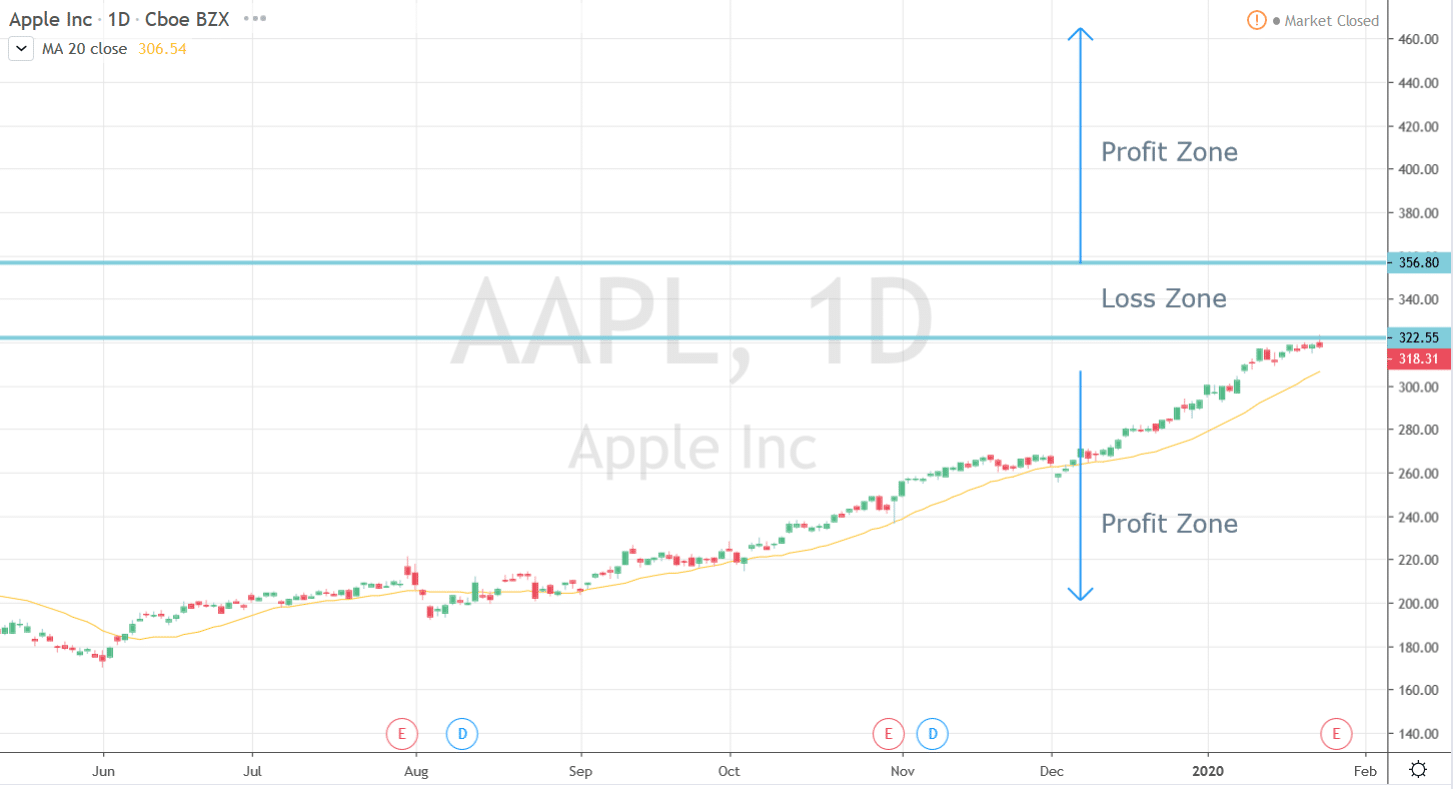

Let’s see how this looks on the stock chart.

Source: www.tradingview.com

As you can tell from the chart above, the chance of winning is significantly greater than the chance of losing!

The best part?

It’s a credit spread that still makes it rain like a raw call option!

Market Forecast

A 1×2 ratio spread realizes its max loss at expiration at the long call strike price of 340 for a loss of $17.50.

Therefore, in order to avoid the large loss at the higher strike price, it is best to only trade this stock when expecting either a neutral-to-bearish outlook or a strong-bullish bias.

There is also an important element of Implied Volatility that needs to be accounted for as well.

For example, it’s best to consider a situation in which earning reports or other company announcements are about to be made.

When the announcement is made, that causes a collapse of volatility and would cause significant losses if the stock is trading at the higher strike price.

But that is not bad. Since if the announcement is bad for the company and the stock sells off significantly, you will get to keep your premium on the trade.

Other things to consider when trading a 1×2 ratio call spread are the impacts of time and assignment risks at expiration.

Assignment Risk

There is the potential of assignment risk when trading a 1×2 ratio call spread.

The position at expiration depends on the relationship of the stock to the strike prices.

There are 3 outcome types:

- No Assignment

- Assigned Stock

- Called Stock

No Assignment

If the stock price is at or below the strike price of the short call, all options will expire worthless and there is no assignment risk.

Called Short

If the stock price is above the lower strike but not above the higher strike, then the short call is assigned and the long calls will expire. Assignment of the short call causes stock to be sold at the stock price if they are in the money.

If a trader does not want a short position, the short calls must be closed (purchased) prior to expiration.

Assigned Stock

If the price of the stock is above the higher strike price then the short call is assigned.

This means that 100 shares are sold and 200 are purchased resulting in a net position of 100 shares.

Wrapping up

As a reminder that here at Options Profit Planner, I utilize an options trading style focused around credit trading to generate income for my business.

Since trading is a business, I always focus on the money coming in and going out.

Since many options traders are focused on debit spreads,this gives credit traders a unique advantage when trading credit spreads as they have multiple market conditions they can take advantage of.

And this is no different using the 1×2 ratio call spread!

Want to know how I implement this strategy in real-time to outperform the market?

0 Comments