Can you keep a secret between us?

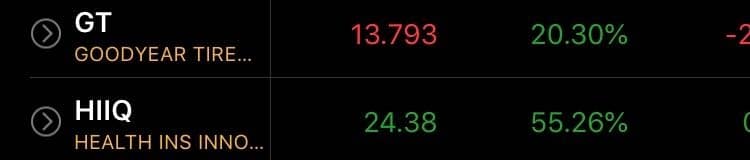

It’s been 6 months now since launching my service, The Options Profit Planner, here at Raging Bull. And what blows everyone’s mind—I have not had a single losing position since it’s launch… a perfect record!

Even throughout these wild markets, nothing can seem to take it down.

Stocks have gone pretty much in a single direction – straight up… and so has my account.

Now, I’m not trying to brag, but instead, teach you how to find trades like this for yourself.

Today, I’m going to discuss one of the strategies that have attributed to my flawless record.

When executed correctly, it allows you multiple ways to win on a trade.

Talk about stacking the odds in your favor…

Options Profit Planner

Here at Options Profit Planner, I utilize an options trading style focused around credit trading to generate income for my business.

Since trading is a business I always focus on the money coming in and the money going out.

Now I bet you are wondering what credit trading is…

Credit Spreads involve selling a high-premium option while purchasing a low-premium option in the same class or of the same security, resulting in a credit to the trader’s account.

While most options traders are focused on debit spreads, this gives traders a unique advantage when trading credit spreads.

Let’s take a look at some of the major differences of credit vs debit spreads

Credit Spreads vs. Debit Spreads

What’s the difference?

Well, on the surface it’s simple.

Credit spread strategies make you money while debit spread strategies cost you money.

And when you are a business owner, you want money coming in and not going out.

But that’s not the only thing that separates the two types of spreads.

A credit spread involves selling a high-premium option while purchasing a low-premium option in the same stock and option type.

A debit spread involves purchasing a high-premium option while selling a low-premium option in the same stock and option type.

The Credit Put Spread

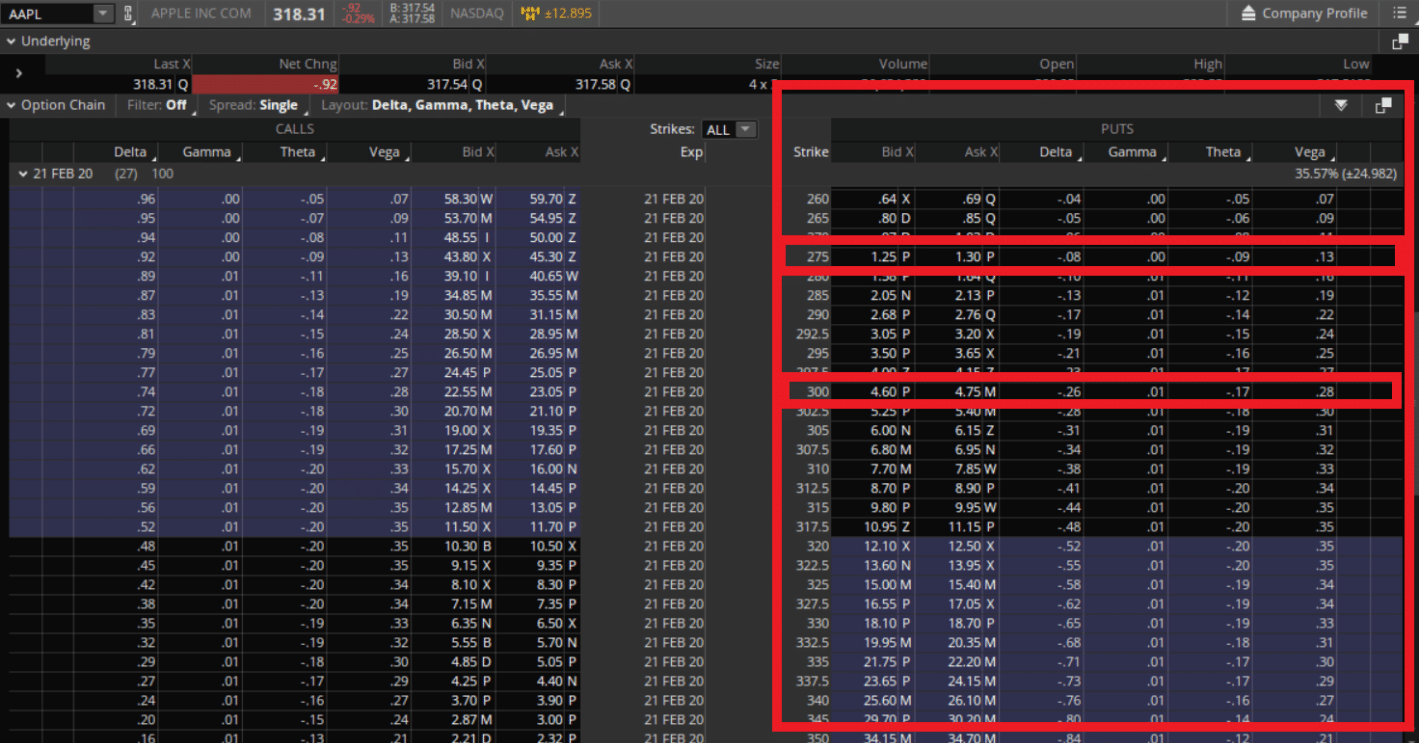

Let’s take a look at an example of a credit spread on AAPL to place the long/neutral biased trade.

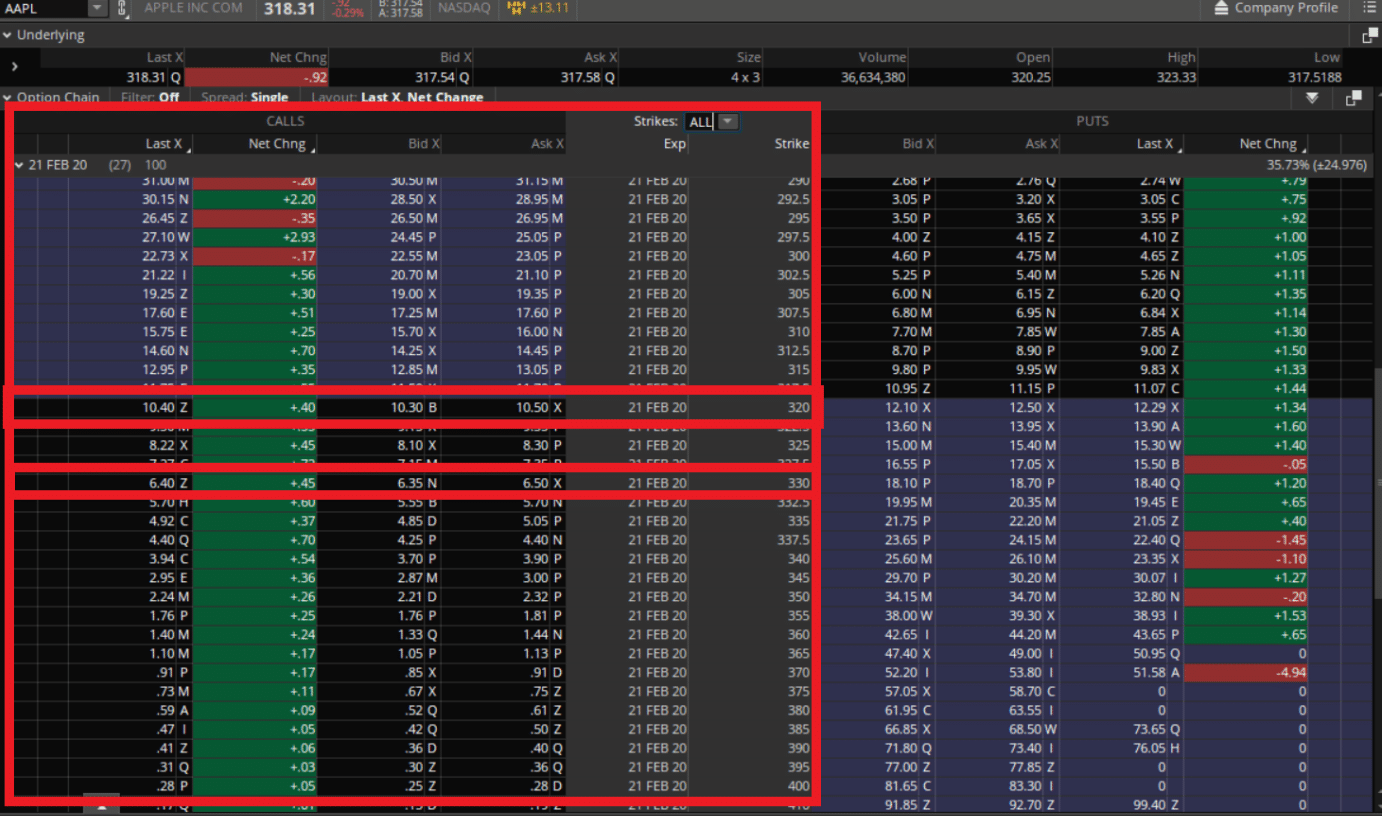

First, when trading a put credit spread you will want to focus on the right-hand side of the options chain.

Source: Think-or-Swim

Next… you want to focus on the put options to buy and sell as part of the credit put spread.

One of the biggest problems new traders have with options is selecting the strike price for the position they are building.

Having problems with finding the strike price? To learn more about which strike prices to choose, Click here

For example,

Credit Put Spread

- Sell 300 21 Feb 20 @ 4.60

- Buy 275 21 Feb 20 @ 1.30

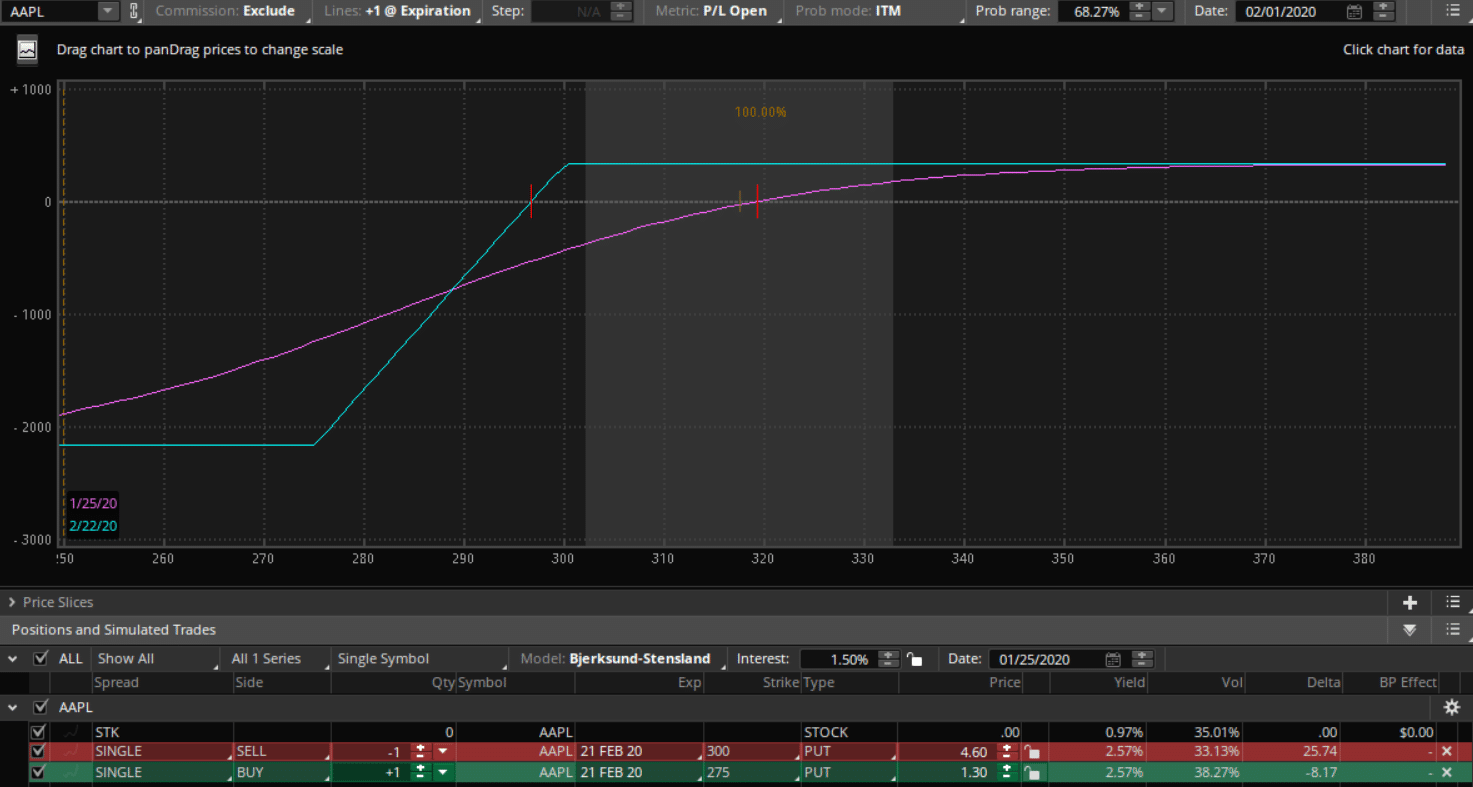

This is what a risk profile looks like on the put credit spread…

Source: Think-or-Swim

From the chart above you can see that if the stock stays above the short strike price of $300, you will receive the max credit of the spread.

Max Profits = Credit received from the short strike – Debit paid from the long strike,

Max Profits = $4.60 – $3.30 = $3.30 per contract

Now, why did I pick this strategy to go long Apple?

I choose to use credit spreads over debit spreads because I get paid upfront to execute the trade.

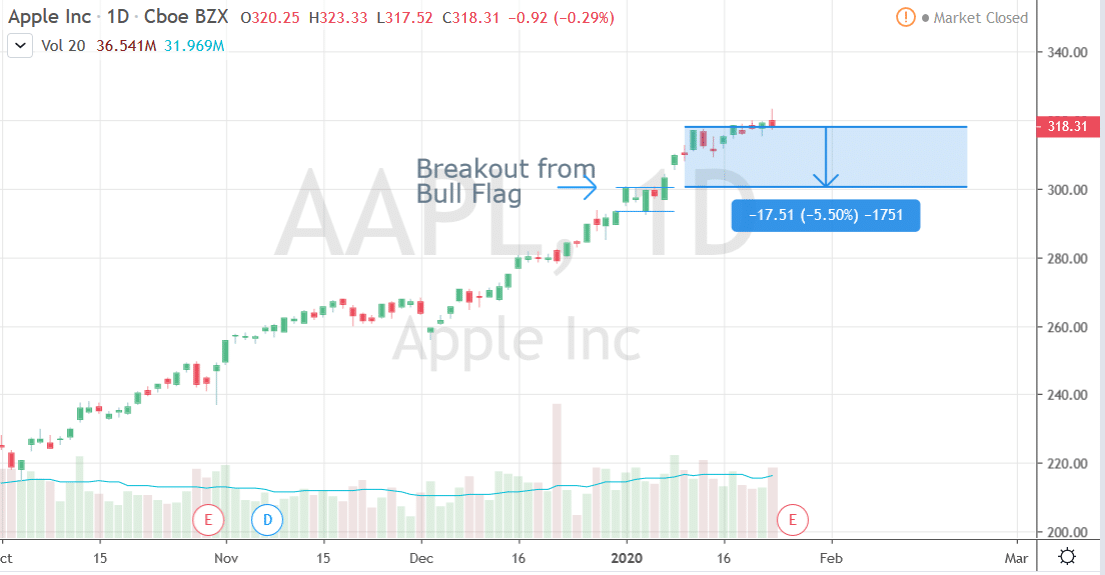

What does this look like on a chart?

Source: Tradingview.com

As a technical trader I like to structure my trades around patterns and psychological levels to give me the best shot of a winning trade.

In this example trade, the short call aligns with the breakout from a prior bull flag breakout.

What does this give me?

There are three things going in my favor for this trade.

- There is continued momentum from the breakout trade. Since the stock rallied the options prices are elevated at this point for an additional premium that can be collected.

- The breakout level should act as a support level for future prices. This means that if the stock did sell-off over the course of the next month, the breakout price should keep the stock above the short call.

- Looking at AAPL over the course of the last 4 months, it doesn’t appear to have a significant selloff over 5%, giving us added confidence that AAPL will be able to support these price levels.

Now, I know what you are thinking. Can’t we just buy calls and do this same thing?

Let’s take a look at how a debit call spread differs from the credit put spread…

The Debit Call Spread

Ok, one alternative trade is to buy options using a debit call spread.

So let’s take a look at how to trade a debit spread on AAPL to place a long based trade similar to the credit call spread.

First, when trading a debit call spread you will want to focus on the left-hand side of the options chain as seen below.

Source Think-or-Swim

Next… you want to focus on the call options to buy and sell part of the debit call spread.

One of the biggest problems new traders have with options is selecting the strike price for the position they are building.

Are you having problems with finding the strike price? To learn more about which strike prices to choose, Click here

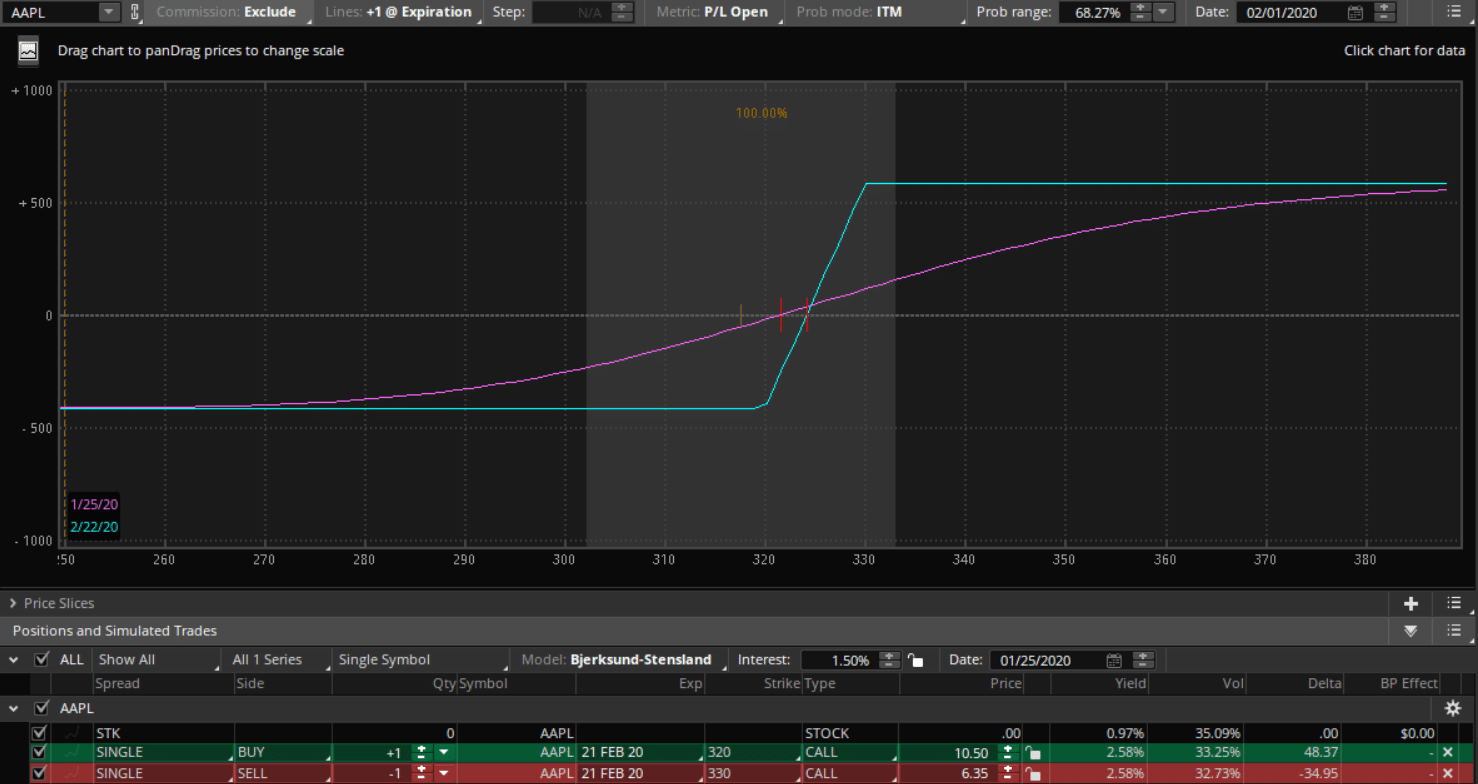

For example…

Debit Call Spread

- Buy 320 21 Feb 20 @ $10.50

- Sell 330 21 Feb 20 @ $6.35

This is what a risk profile looks like on the debit call spread.

Source Think-or-Swim

From the chart above you can see that if the stock stays above $300, you may not actually make any money at all.

In fact, you need to be correct about time, direction, and price.

For this trade to work, AAPL needs to rally above $324.19 before you can break even on your trade…

This means that the stock needs to move almost 2% from the current price before you even start to make money!

Max Profits = Strike price upper – Strike Price lower – net cost

Max Profits = 330 – 320 – 4.15 = $5.85

Unlike credit spreads, I would actually need to PAY UPFRONT to execute this trade.

See the difference?

Wrapping Up

Here at Options Profit Planner, I utilize an options trading style focused around credit trading to generate income for my business.

Since trading is a business I always focus on the money coming in and the money going out.

Now I bet you are wondering what credit trading is…

Credit Spreads involve selling a high-premium option while purchasing a low-premium option in the same class or of the same security, resulting in a credit to the trader’s account.

Credit spreads give unique advantages to traders when trading credit spreads, with the most important being that you are paid upfront to place a trade!

And as a business owner, I want to make sure I know how much money I have coming in and out each and every month.

Since running a trading account is actually a business and not a trip to the casino!

To learn the process I use day in and day out to lock in consistent profits, click here to sign up today!

0 Comments