Did you know that 90% of the world’s millionaires over the last two centuries got there through real estate investing?

Collecting rental checks and watching the value of their property empire soar.

Now how does that help you?

Well let me tell you, there’s a great income strategy that I think every trader needs to use

It’s a strategy that lets you bag a second paycheck by using a safe, predictable, and repeatable stock income strategy. But it really is depending entirely on how much YOU want to collect…

By “renting out” shares of big, safe, blue chips and scooping up the royalties — without owning a single share of stock.

You probably don’t believe me. I didn’t at first too. But I’m proving it’s all real, and highly lucrative – right here. Free.

Between you and me…

It feels like landing a stake in a 30-story complex and collecting checks just like the uber-rich.

You sit back and watch the income pour in and your wealth compound.

The kind of consistent cash that lets you easily pay down debts. Obliterate most money worries. Even secure yourself an early retirement.

It’s almost unfair once you know how to use this strategy.

I’m setting up to collect another income check by the middle of September!

Care to join me?

All the urgent details you need to collect your first paycheck are right here. And as a reminder, I’ve recently collected $390 and $2,950 by using a stock rental royalty check.

Selling Options As ‘Income Property’

While trading I always try to pick the best strategy for the job at hand…

And if I wanted to go long a stock, I wouldn’t simply buy a call.

Insteads – sometimes it’s best to select from a short put when looking for the most bang for your buck. But there are times when you want to select other strategies.

But how do I do this?

I turned to credit strategies that specifically target the movement I think the stock is going to take and put me in a position where I make money if a stock goes up, down, or sideways.*

So what are these strategies?

- Credit Put Spreads

- Credit Call Spreads

- Credit Puts

- Covered Calls

And for me, I found that I need to be selling credit spreads that generate income for my trading business*.

I knew that casinos and successful traders have a well-defined edge in the markets, and I knew that I needed to find the same thing for myself.

Just check out some of these wins, a strategy that puts the odds of the casino in your favor, and one of the highest-conviction trade idea service produced

So let me ask you these three questions:

- Do you like to generate income for your business?

- Do you want to own a business with the odds of success the same as the casinos?

- Do you need to work part time and want to earn full time returns?

If you’ve said yes to any of these questions, then trading weekly credit spreads is the strategy that you need to start to leverage for your trading business.

Credit Spreads involve selling a high-premium option while purchasing a low-premium option in the same class or of the same security, resulting in a credit to the trader’s account.

While most options traders are focused on debit spreads, this strategy gives traders a unique advantage when trading credit spreads.

Credit Spreads

Credit spread strategies make you money while debit spread strategies cost you money.

And when you are a business owner, you want money coming in and not going out.

But that’s not the only thing that separates the two types of spreads.

A credit spread involves selling a high-premium option while purchasing a low-premium option in the same stock and option type.

A debit spread involves purchasing a high-premium option while selling a low-premium option in the same stock and option type.

The Credit Put Spread

Let’s take a look at a recent trade I took on NFLX…

NFLX: I sold the Sept ’20 $320/310 put spread for $1.25.

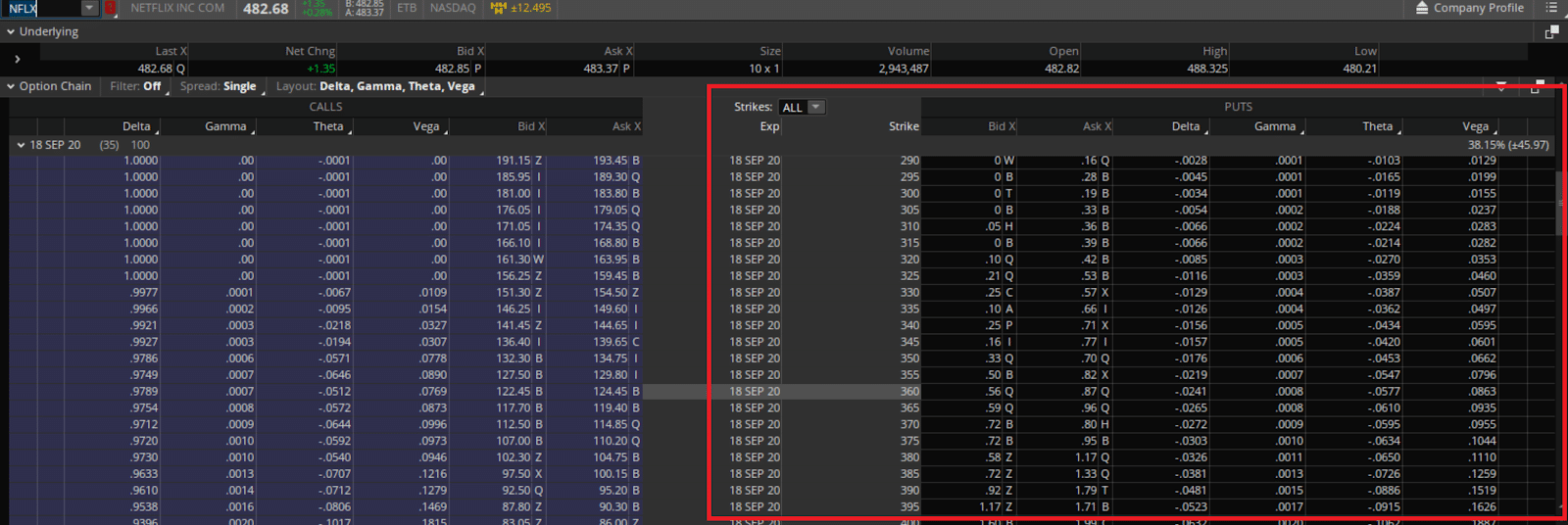

First, when trading a put credit spread you will want to focus on the right-hand side of the options chain.

Source: Thinkorswim

Next…the right side of the options chain is where the put contracts are listed in this option chain.

And to complete a short put spread, you would look to simultaneously sell a higher priced strike and sell a lower priced strike

One of the biggest problems new traders have with options is selecting the strike price for the position they are building.

The Trade – Credit Put Spread

- Buy : 18 Sept 20 310 @ 0.75

- Sell : 18 Sept 20 320 @ 2.00

Net Credit: $1.25

Max Profit : $1.25

Max Loss : $8.75

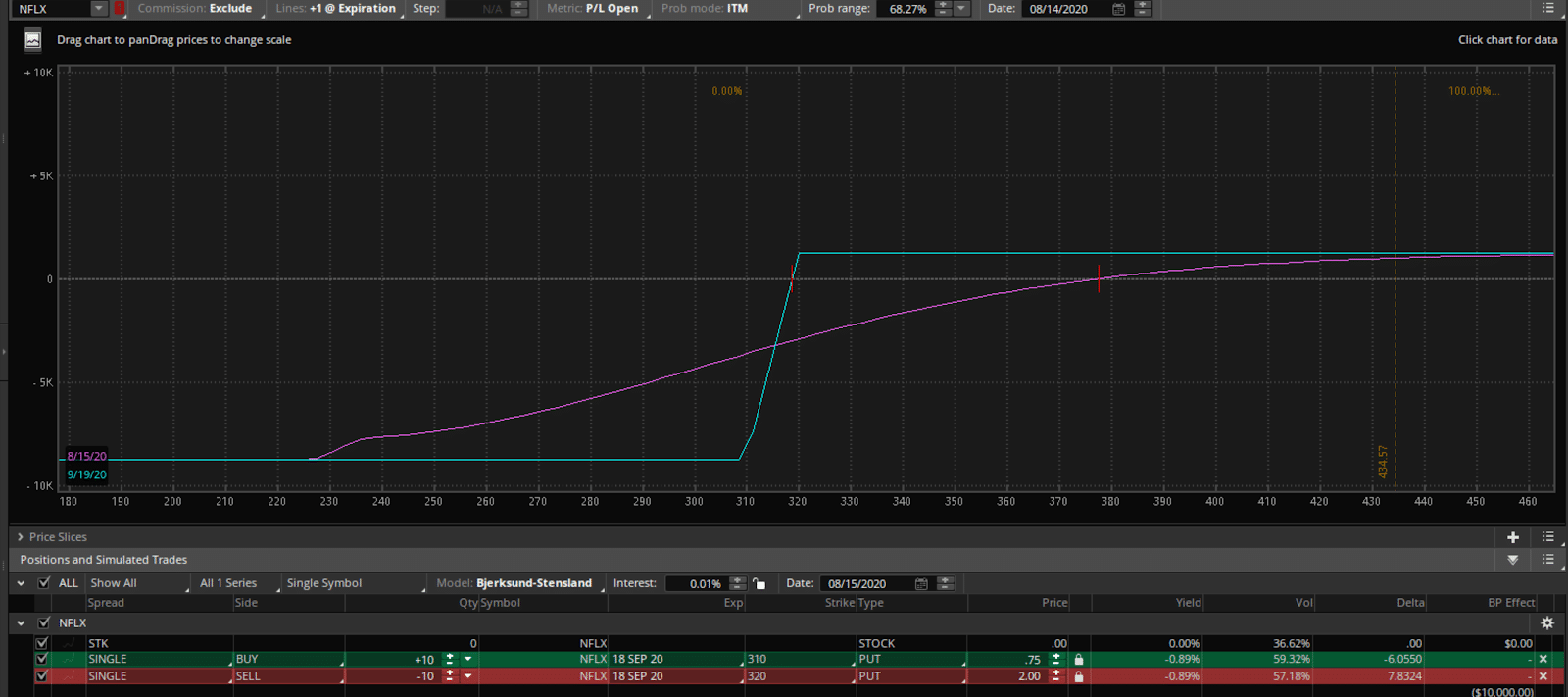

So here’s a risk profile on the credit put spread

Source: Thinkorswim

From the chart above you can see that if the stock stays above its breakeven, you will see a return on your trade. And if the stock stays above the upper strike, 320, you will collect max profits.

I feel confident that you can do trade these strategies successfully for yourself after learning my complete strategy

I knew that casinos and successful traders have a well-defined edge in the markets, and I knew that I needed to find the same thing for myself.

Just check out some of these wins, a strategy that puts the odds of the casino in your favor, and one of the highest-conviction trade idea service produced

So let me ask you these three questions:

- Do you like to generate income for your business?

- Do you want to own a business with the odds of success the same as the casinos?

- Do you need to work part time and want to earn full time returns?

If you’ve said yes to any of these questions, then trading weekly credit spreads is the strategy that you need to start to leverage for your trading business.

To learn the process I use day in and day out to lock in consistent profits, click here to sign up today!

0 Comments