When starting out with my first trading account… I found myself just staring at a pre-made quote list of the most popular stocks that my broker gave me.

TSLA, NFLX, MSFT, P ( when it existed ), and many others have come and gone since then

And I just sat there wondering what I should trade…

Then I was overwhelmed with choices and ended up couldn’t pick anything.

Which is when I came up with a plan on how I selected stocks to trade, and by following these steps it can put you into a position to make money

For narrowing down stocks, the best way to pick what I want to trade is by first finding stocks I would own forever!

That’s right, I would have no problem owing any of the stocks I trade

And that’s how I teach everyone who trades options to think about picking stocks!

Now let’s take a look at how I use these key fundamental and technical indicators to hand select exactly what I will trade every week

How I Select Stocks To Trade

With thousands of stocks to trade each day, it’s easy to become overwhelmed with selecting what to actually put your money into.

But you won’t stand a chance against the other sharks of Wall St. if you just pick random stocks to buy… you’ll be picked off faster than a seal during shark week.

The key to being successful is having a way to filter down to a handful of stocks to trade without having to search for hours each day.

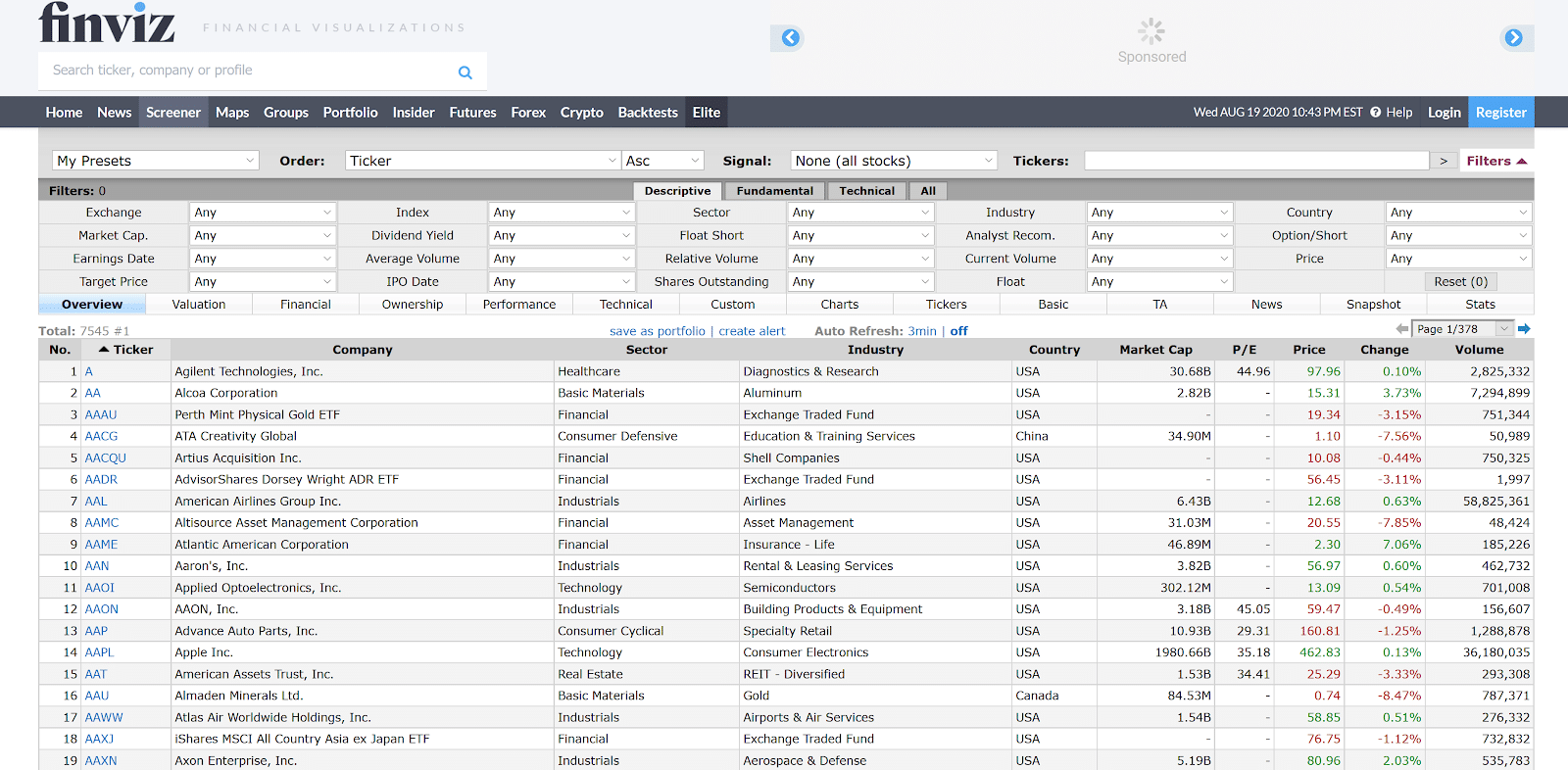

So the first step I take is with by looking at my scanner in Finviz

Source: Finviz.com

And this scanner is absolutely free for you to use so you don’t have to worry about any expensive subscriptions to pay for access!

With Finviz you can control things such as average volume, stocks or ETFs, price, and fundamental ratios.

Then the next step is to browse through this small list of stocks and see if any one of them fit my favorite patterns

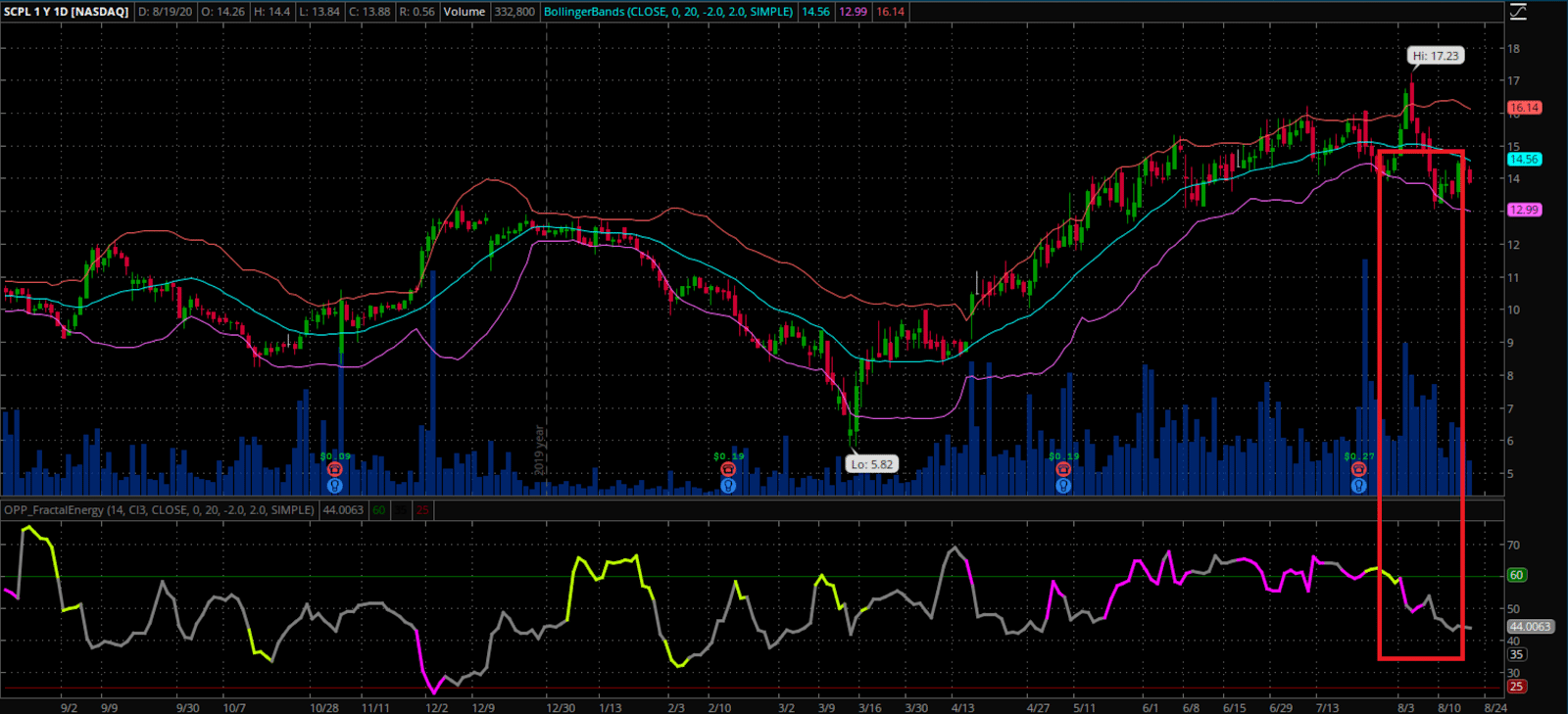

For example, one stock that is interesting is SCPL

Why?

Source: Thinkorswim

What I can see from this chart, this stock checks the boxes for two of the best setup patterns.

It’s trading at or below the lower Bollinger Band which is a huge area of support, and the Fractal Energy is charged up and ready to begin the new trend of the stock.

What happened?

Well, 4-5 days after the signal, I have started to place defense on this trade as it trades higher and trends into the middle of the Bollinger Bands.

This process seems simple, right?

Filter for stocks to trade, identify a pattern, put on a watchlist, and develop a credit strategy to trade around it.

You’ll want to join me for when I pull back the curtains on my start money options trading strategy

In this you will earn my techniques to hunt down stocks to trade, and the credit trading strategy I use time and time again for massive returns

0 Comments