As we drive deeper into 2020, we have certainly had our share of excitement.

From the Markets In Turmoil on CNBC to cardboard fans starring in sporting arenas, it’s hard to even guess what could come next.

But for me, there’s one thing that I know will always be consistent

Even though credit spreads are consistent… many traders still fail to even know when to place their trades in the first place

So what typically happens is traders then flock to all the typical indicators they see being used

Although this works, many times these indicators actually give you the wrong trade signal and put you on the wrong side of the trade

Now it doesn’t have to always be that way

By following my simple process, you can analyze stocks like a pro

So let me show you what two indicators you must focus on in order to take your trading to the next level

Indicators Give You An Edge

I’m not trying to try and figure out what the retail traders will do

But instead I’m going to show you how you can read exactly what the internals of a stock want to do

And the easiest way to get ahead of the markets is by understanding a stocks internal energy and cashing in

How do I do this?

By using my proprietary Fractal Energy Indicator

Although I get an insiders look at what the internal energy is doing in a stock, I don’t know exactly what direction the move is going to be in

Which is where I combine this with a popular indicator, Bollinger Bands

This hot combo gives me the ability to now predict when a move is going to happen and usually the direction it’s going to head in!

Sound like something that can take your trading to the next level?

Do Technical Indicators Predict Future Prices

When it comes to identifying a trading opportunity, I have an indicator that handles all of the heavy lifting for me

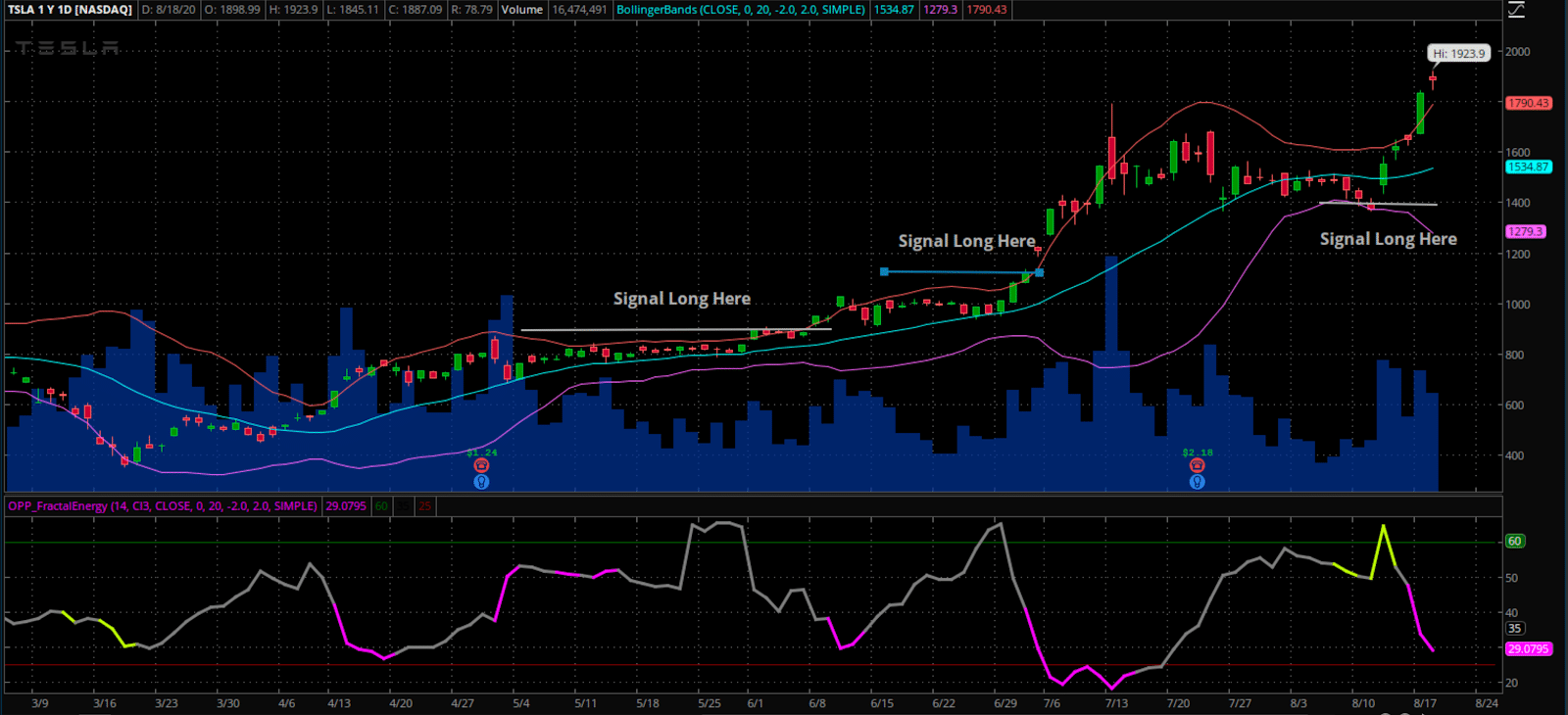

Only a few days ago this setup came into view on one of my favorite stocks, TSLA, and it got me excited!

Why was this trade so exciting when I found it came across my screen?

For these two reasons:

- Fractal Energy has signaled that TSLA was fully charged and ready to make an explosive move in some direction

- Bollinger Bands are supporting the movement is going to be higher and not lower

In other words, this was going to be a bullish trade that we are going to have to take

Souce: Thinkorswim

But what if I told you buying stocks was the not right trade to take

Instead, the smart money is trading one of these strategies that take advantage of volatility and market direction

The Winning Strategy

The winning strategy that is being used by the smart money traders is a system that mimics the odds of a casino’s gambling methods

What I mean is that when trading this strategy you actually have the upper hand against the dumb money traders

And although there are times when you could be right on the direction and still lose on the trade because of other factors such as Implied Volatility decreasing the price of the stock on you.

One strategy you might not have heard of is a credit call spread, and that’s the trade we are going to focus on when looking to short the stock.

And at Options Profit Planner, I want the house odds in my favor as the business owner and expect to have steady money coming in, not going out!

A credit spread involves selling a high-premium option while purchasing a low-premium option in the same stock and option type.

As a credit trader you have 4 strategies to generate income for your business if you want to go long a stock. (Each strategy has its own aggressiveness to the direction of the underlying move as noted below.)

These trades to long the markets are:

- Short Put – Aggressive Long

- Short Call – Moderate Long

- Short Put Spread – Aggressive Long

- Short Call Spread – Moderate Long

Now I believe that smart money is trading this stock the right way… so I look at trading either a short put or short put spread strategy for this stock.

These two indicators I am focused on really put the odds in my favor to know when a stock is ready to make it’s breakout move along with the direction.

So if you want to learn more about how I use this information and indicators to my advantage even more…

Check out this material on fractal energy and how I read it’s key values

0 Comments