Many traders when they first start out really struggle with two things…picking stocks and when to execute trades

And when you trade without having those two as basic muscle memory, you’re behind the ball and don’t have an edge

Which is when I came up with a plan on how I selected stocks to trade, and by following these steps it can put you into a position to make money

For narrowing down stocks, the best way to pick what I want to trade is by first finding stocks I would own forever!

Now let’s take a look at how I use these key fundamental and technical indicators to hand select exactly what I will trade every week

How I Pick What I Want To Trade

In order to define my edge and trade with confidence, I had to create a strategy that allowed me to trade without emotion

And that’s what I get when using tools to not only find stocks that I should focus on but also cut back on the amount of research I need to do every week.

With thousands of stocks to trade each day, it’s easy to become overwhelmed with selecting what to actually put your money into.

But you won’t stand a chance against the other sharks of Wall St. if you just pick random stocks to buy… you’ll be picked off faster than a seal during shark week.

The key to being successful is having a way to filter down to a handful of stocks to trade without having to search for hours each day.

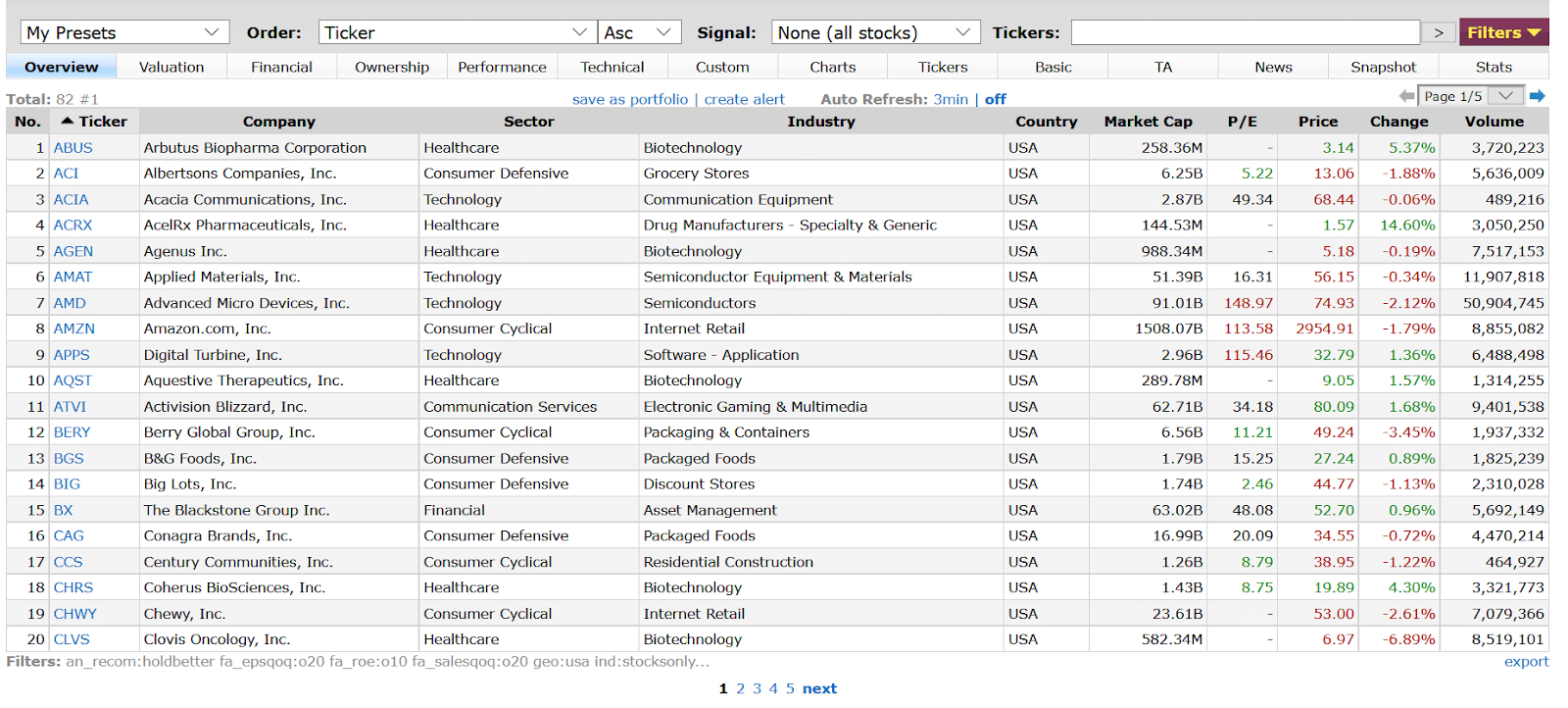

So the first step I take is with by looking at my scanner in Finviz

Source: Finviz.com

And this scanner is absolutely free for you to use so you don’t have to worry about any expensive subscriptions to pay for access!

With Finviz you can control things such as average volume, stocks or ETFs, price, and fundamental ratios.

Then the next step is to browse through this small list of stocks and see if any one of them fit my favorite patterns

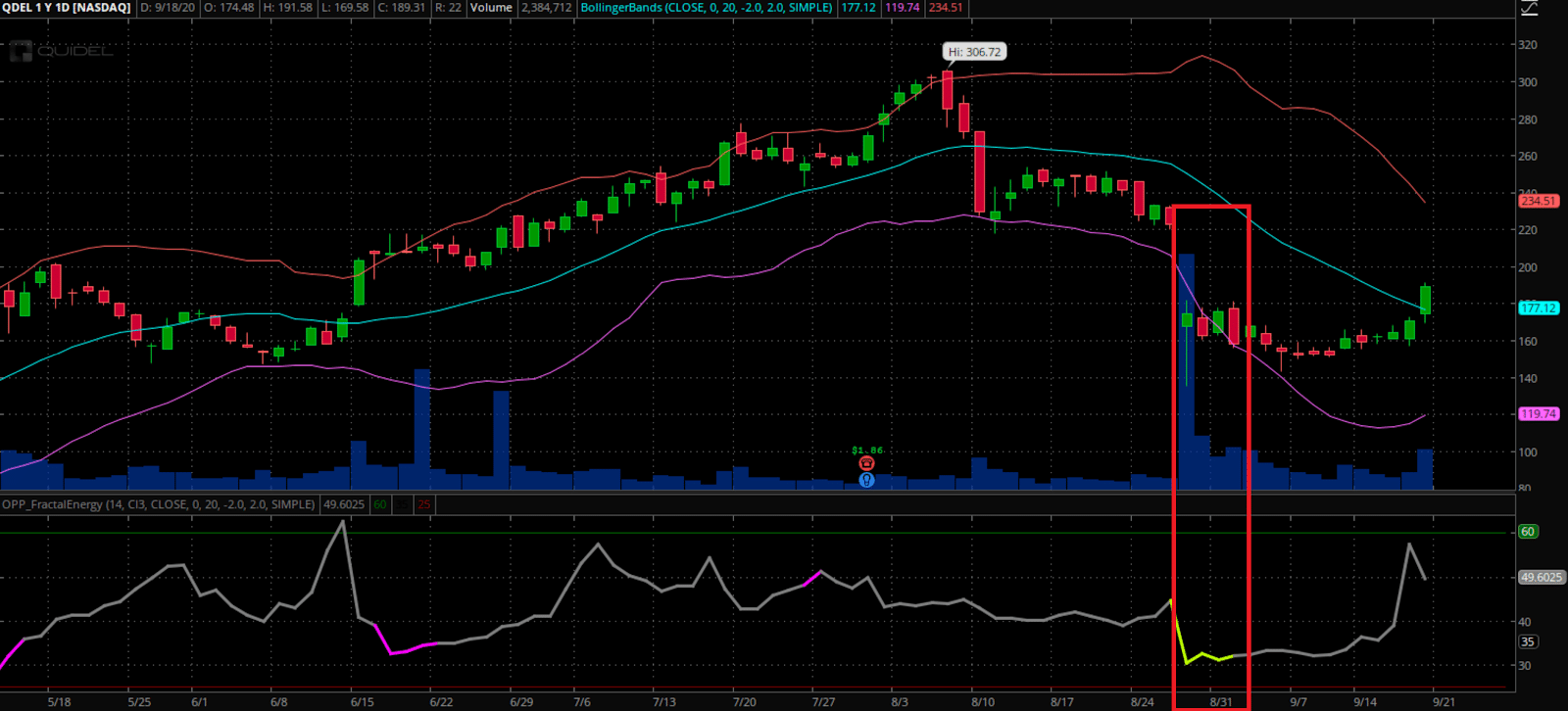

For example, let’s take a look at QDEL that I saw on the list a few weeks ago

Source: Thinkorswim

What I can see from this chart, this stock checks the boxes for two of the best setup patterns.

It’s trading at or below the lower Bollinger Band which is a huge area of support, and the Fractal Energy is charged up and ready to begin the new trend of the stock.

What happened?

Well, shortly after the signal, I have started to place defense on this trade to lock profits in as it trades higher into the middle of the Bollinger Bands.

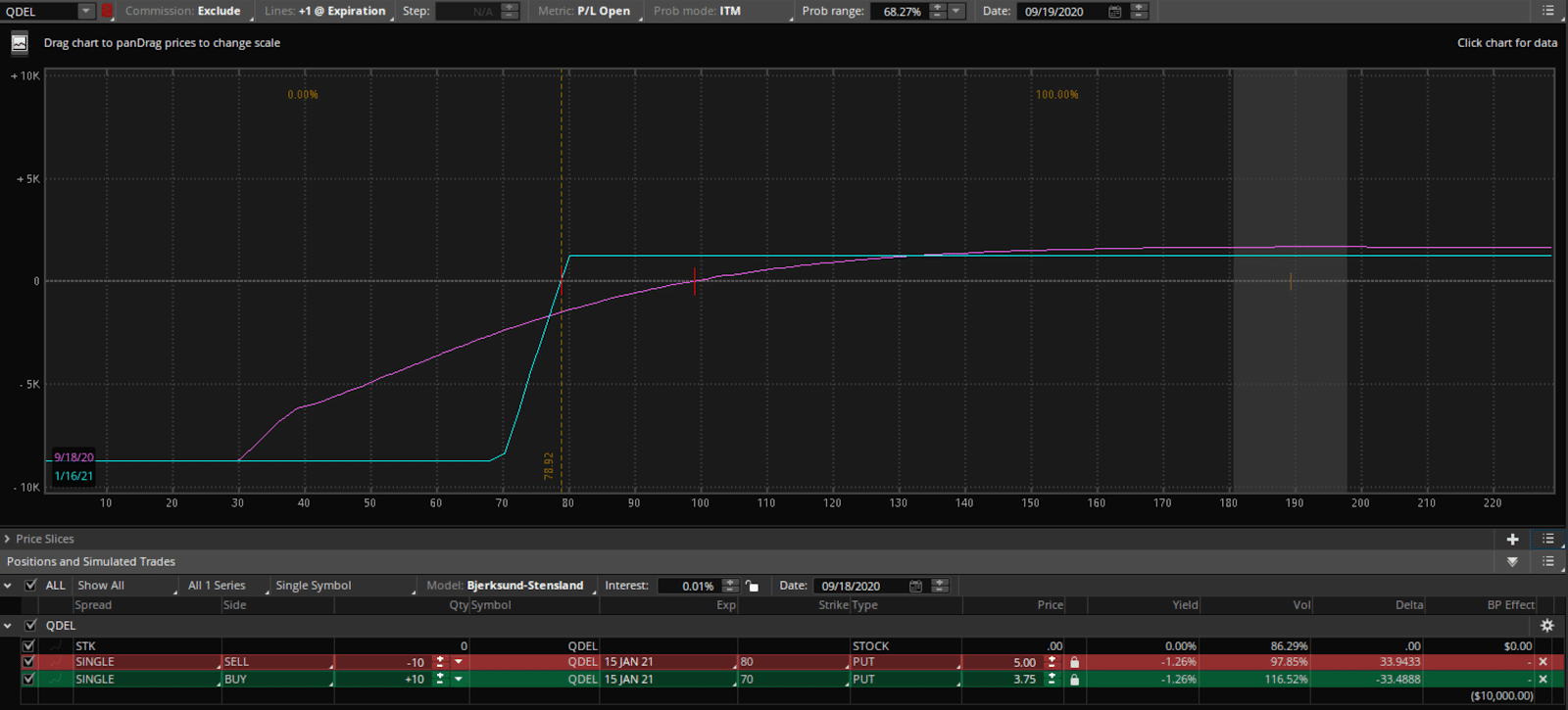

And what does the position look like?

Source: Thinkorswim

Now why did I pick those strikes?

Well, I want to make sure that I feel comfortable owning a stock at the price I trade the options at.

And as a business owner and trader, I want to make sure that most of my trades will expire worthless and I can keep 100% of the profits on every position.

In order to be a profitable trader, I focus on reliability of my trade scanner, stability with my income with an income generation strategy, and keeping the odds of winning in my favor.

This process seems simple, right?

Filter for stocks to trade, identify a pattern, put on a watchlist, and develop a credit strategy to trade around it.

You’ll want to join me for when I pull back the curtains on my start money options trading strategy

In this you will earn my techniques to hunt down stocks to trade, and the credit trading strategy I use time and time again for massive returns

0 Comments