Ever wonder how to make money in any market condition?

How about how to profit on a stock that just doesn’t move?

At first you might think this is impossible when you trade stocks.

And you’re right!

The thing is, it’s actually very possible if you trade options!

You see, one of the little-known perks of trading options is you can specialize in trading either debit spreads or credit spreads.

And depending on what the markets are giving you, both of them can help put traders in the green.

You see, when I trade credit spreads, it’s as if I’m actually becoming the “casino” in my trades and I can put the odds in my favor.

I’m talking about odds of winning that can exceed 60% and ROI on my trades that get up to 75%!

So let me break down exactly how I use the Iron Condor (the cadillac of credit spreads) to bring down huge returns

Options Profit Planner

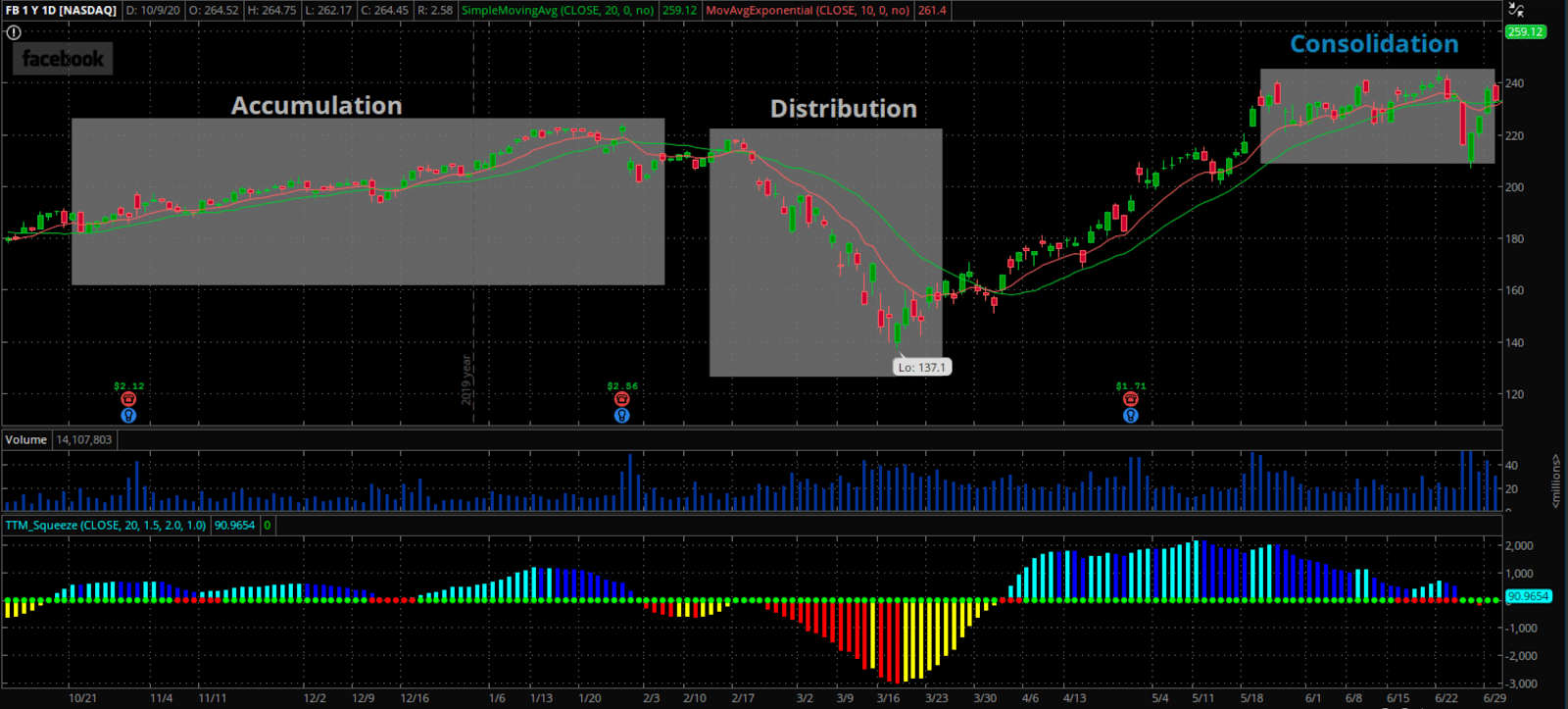

Did you know that a stock’s movement is categorized by 3 different cycles?

These zones are:

- Accumulation

- Distribution

- Consolidation

Accumulation

The first cycle is every trader’s favorite – and it’s known as accumulation. Accumulation is when a stock is being picked by buyers and they are outweighing the sellers.

This buying or accumulation is what creates the classic uptrend in the stock and is pretty easy to trade.

You can buy the stock, buy a call, short a put, or any other strategy that takes advantage of a bullish market will be profitable.

Distribution

The next cycle is distribution.

This cycle is when sellers finally get the upper hand on the buyers and start to push a stock lower. The distribution is known as the top of the mountain where the stock starts to “roll over” as the buyers are selling their shares out to capture profits.

Similarly to accumulation, distribution is easy to trade. As a trader, you can short sell a stock, buy a put, or sell a call, etc to take advantage of the downward momentum.

Consolidation

The last phase of the cycle is known as consolidation. Consolidation is when buyers and sellers reach the equilibrium price, and the stock just moves sideways.

And without buyers or sellers overwhelming the other party, there is no direction the stock can trade in.

But what makes this problematic is that the sideways movement will happen over a range. But usually by the time when you notice it’s sideways, it’s too late to trade.

So in order to take advantage of a consolidation cycle, a trader usually needs to “predict” when this is going to happen, and that is an extremely risky trade to take.

Here’s an example of the 3 stages of a stocks lifecycle

Source: Thinkorswim

How Do You Make Money On A Range Bound Stock?

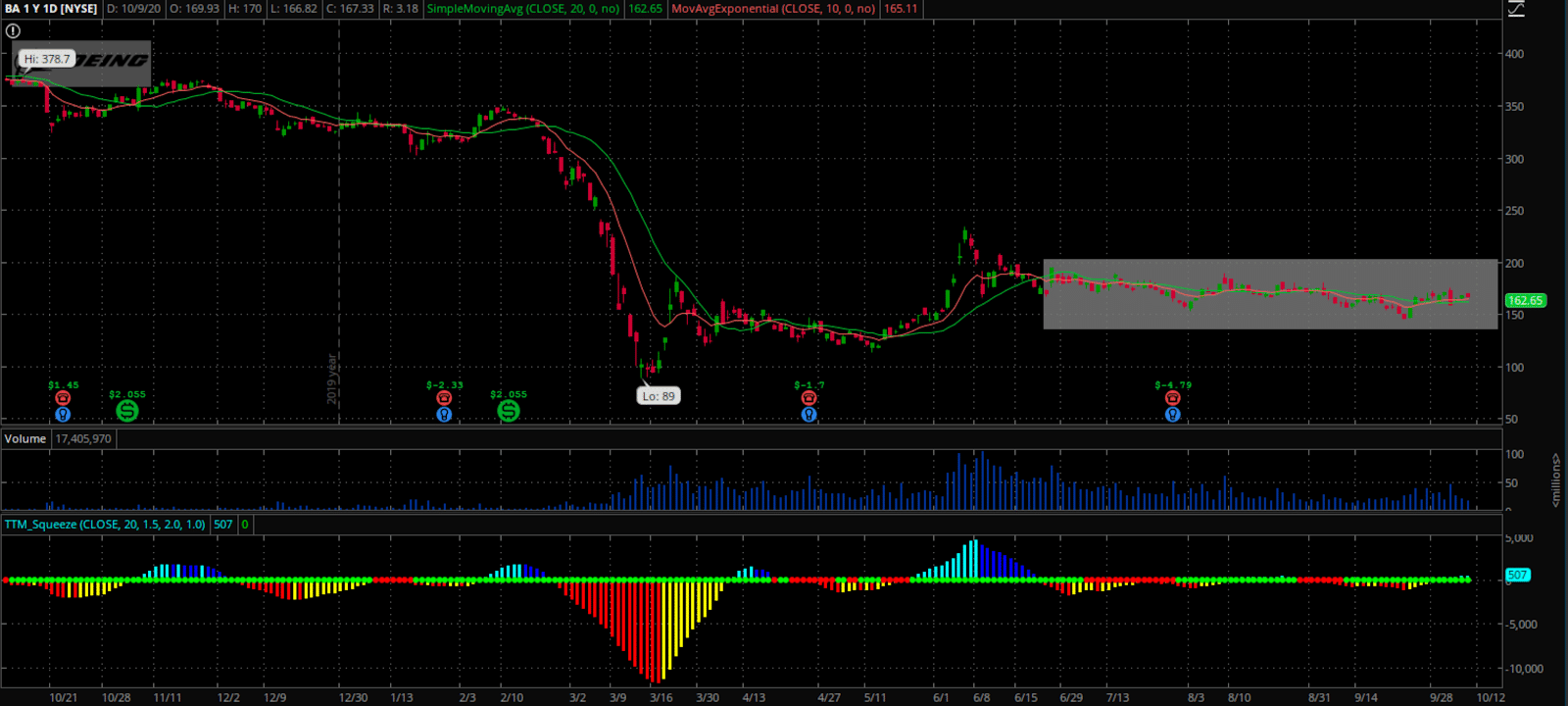

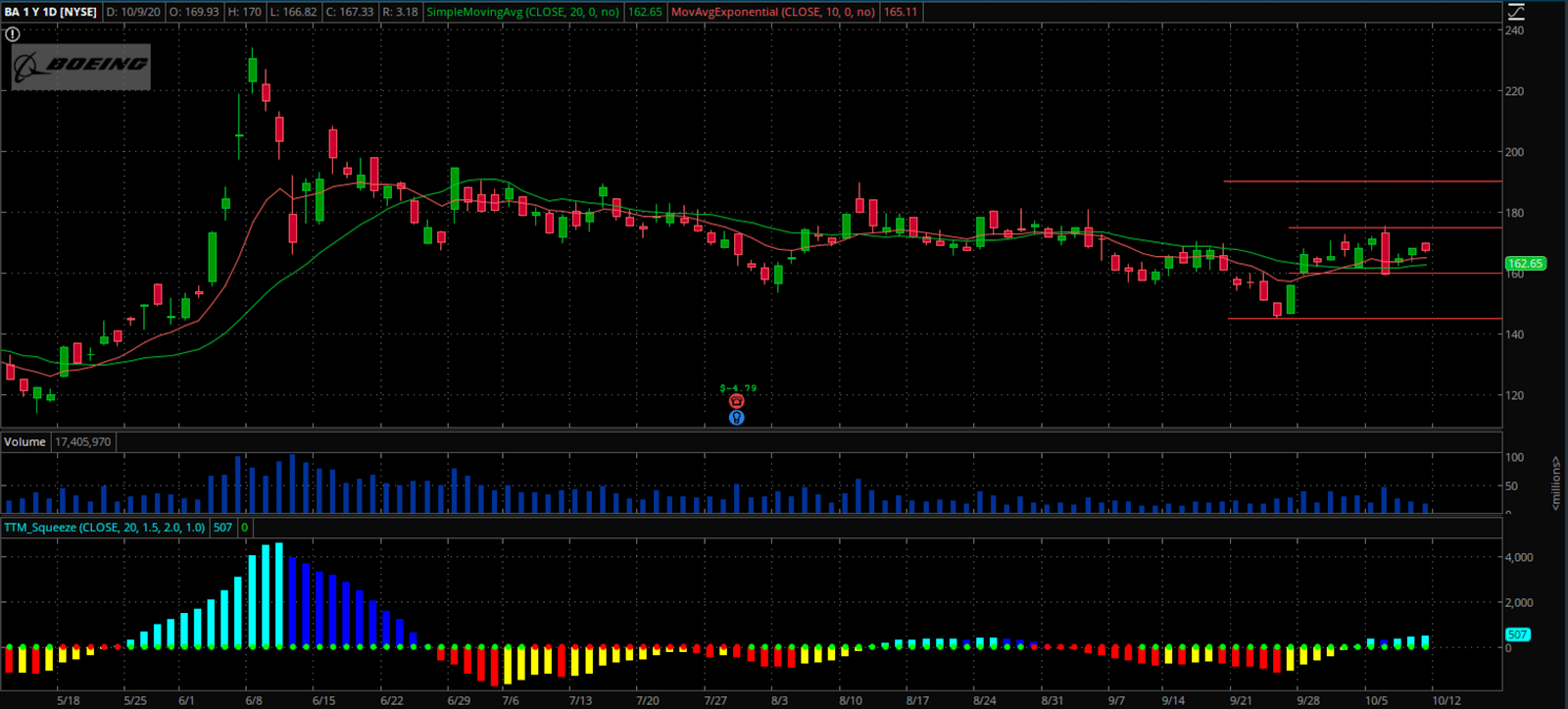

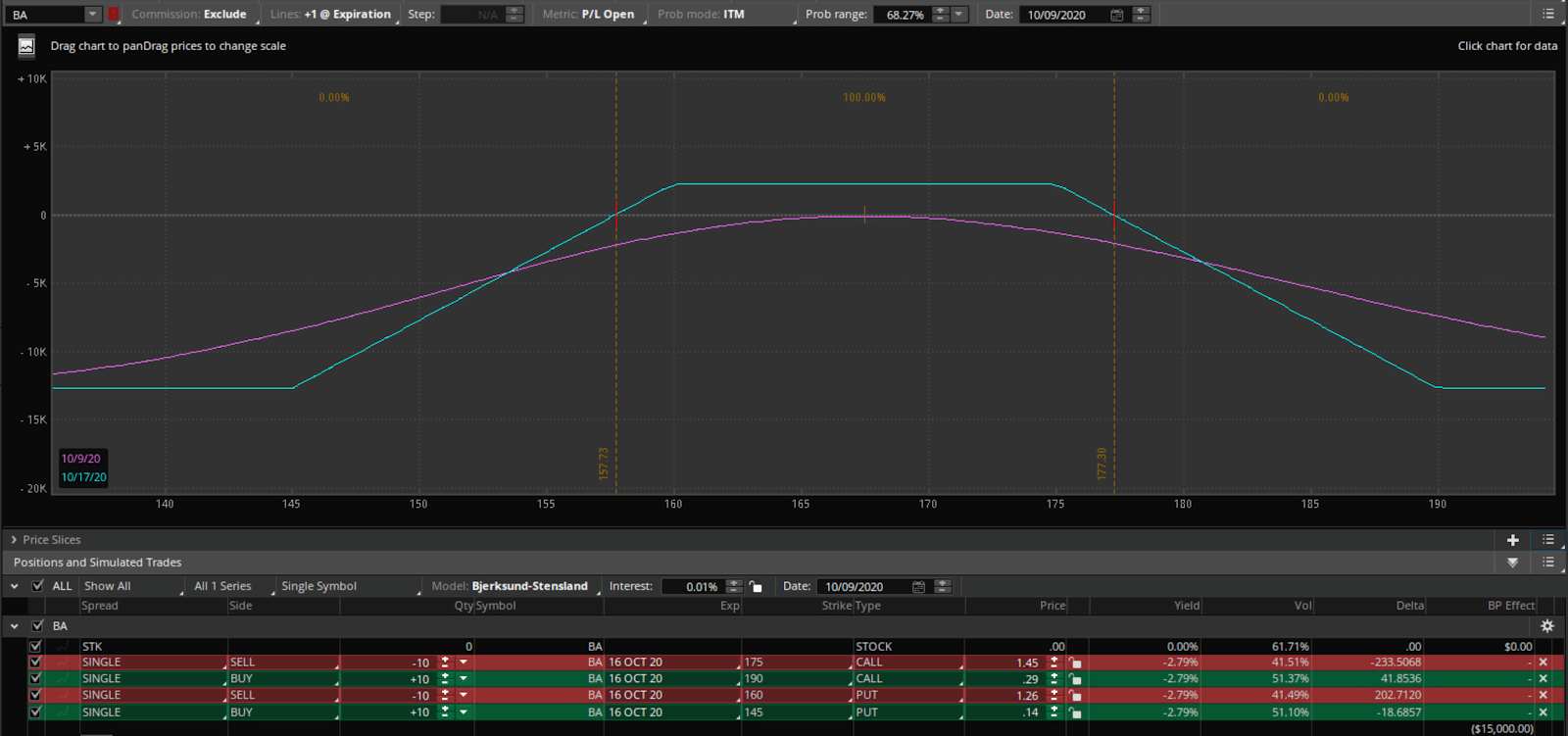

Now let’s take a look at the range bound trading pattern seen on BA (NYSE) Boeing

Source: Thinkorswim

Iron Condors are an intermediate options strategy since they require the use of multiple legs, traditionally four legs.

And what makes these trades especially difficult to trade is that they require constant monitoring and adjusting of the positions.

But they are great strategies if you can find a stock that does not move or is expected to stay in or be in a tight range for an extended period of time.

What Is An Iron Condor

An Iron Condor involves simultaneous selling both a put and call spread.

Now this may sound difficult but it’s quite easy. The more you trade this strategy the more comfortable you will become and with a little practice, you’ll master it in no time!

Iron Condors are a fantastic way to generate a credit instead of paying to trade stock. The best part is you are paid up front instead of having to shell it out when you start the trade.

This means you are given a little cushion in your account every time you place a trade, and if the stock price is in your range, you get to keep that full credit on the trade.

The amount of time it takes to keep your credit on the iron condor is due to a phenomenon called Theta Decay and can change your trading forever if you master it!

How To Set Up An Iron Condor

Setting up an Iron Condor is always the hardest part about this trade.

But it’s much easier than it sounds.

Let’s take a look at the Boeing (BA) chart above and how we can create an Iron Condor around it.

Source: Thinkorswim

As an options trader, you have many things to consider and think about when you’re setting up your trades.

Some of the top two concerns are:

- Strike selection

- Expiration / Timing

Luckily, the strike selection is the easiest option, since the stock chart is going to give this to you.

Remember, we are using an Iron Condor because the stock is trading inside a range. So we are going to want to set up our strikes to be at or slightly outside that range. If you want to be more conservative with your trading, you will want to select the strikes that are slightly outside of the range to give you a higher probability of success on this trade.

Timing of Iron Condors is going to be a bit more difficult since nobody knows exactly when a stock is going to break out of its range.

One aspect to a stock’s sideways movement is the lack of volatility. Volatility is the technical term that governs a stocks movement. This means that a higher volatility a stock has, the more movement is expected in the price.

So now, let’s talk about expiration.

When selecting options to trade, I highly recommend to go a little further out than you normally would for selling stocks.

For me, I would recommend 40-80 days out as the “sweet spot” for selling options.

Why so far out?

It won’t be my intention to hold it that long, but it’s a place to start in case we need that extra time. This will allow us to manage and adjust the trade if needed without closing or rolling out the spread for more time.

Now, many traders were told that time decay speeds up the closer you get to expiration. And if time decay is on our side, wouldn’t we want to trade stocks that are under 14 days to expiration (DTE)?

This is wrong! Not let me explain why

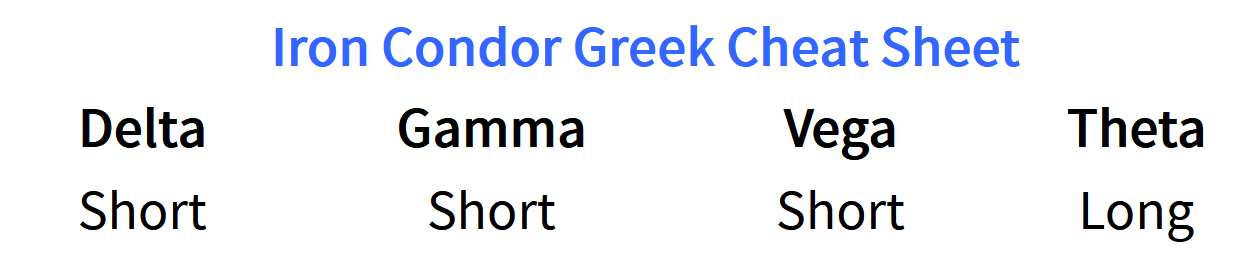

You see, there is a greek that you might not be familiar with, and it is called “Gamma”

Gamma is the measure of how quickly things are going to move.

And the closer we are to expiration, the higher the Gamma becomes for a stock.

Now remember, as an Iron Condor trader, we want things to remain quiet and steady, not active and with a lot of movement.

So this means we need to reduce our Gamma in our trades.

This means by using options that are further dated, our Gamma will be lower and therefore more likely to remain within our zone.

Now, the strike selection…

Ideally, you will want to select what the chart is giving you, but sometimes you have flexibility to select this as you feel works for your trade.

Deep out-of-the-money options will typically lose the highest percentage of their value between 30-50 days until expiration. This is why it’s best to select trades that are 50-60 days until expiration. It’s important to be in the play and ready for its rapid loss in value.

Setting up the Iron Condor with the right type of volatility can make the difference between a great trade and a not so great trade.

There are two types of volatility measurements:

- Implied Volatility – the measure of how much traders believe a stock will move in the future

- Realized Volatility – the measure of how much the stock has moved in the past

What does this mean?

Our goal here is to find a stock that is stuck in a range, so little movement is ideal. In order to find a stock that has little movement, we want to find a stock that has lower Implied Volatility before placing a trade.

Higher Implied Volatility means that people are predicting the stock is going to move around and has a higher realized volatility.

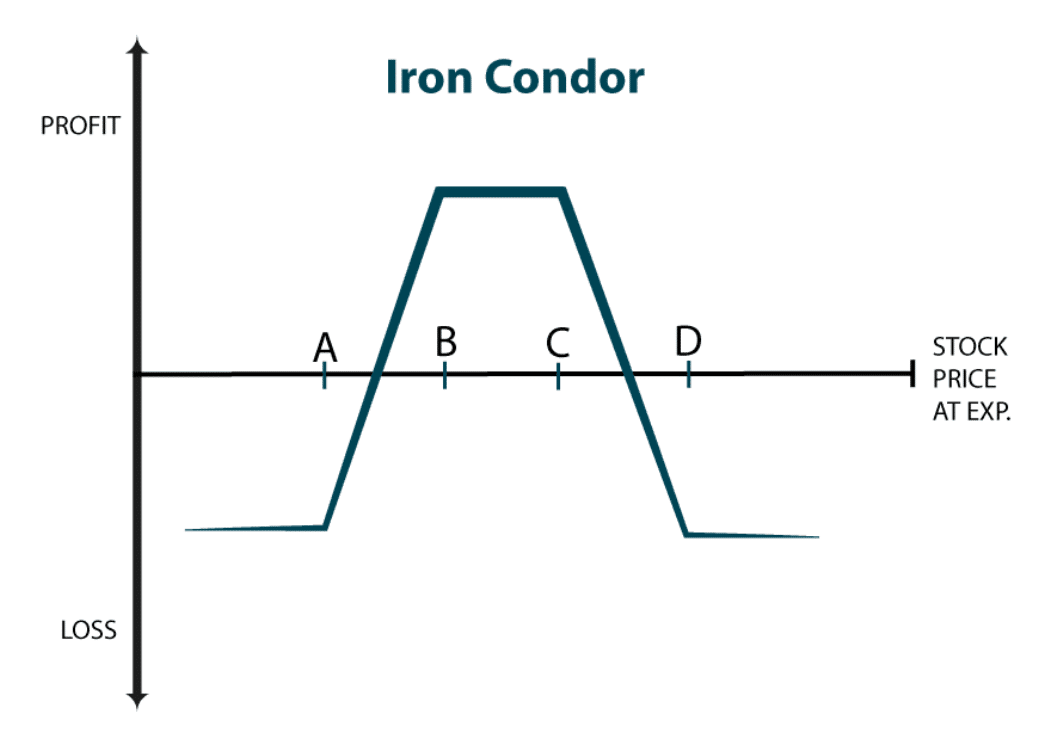

What This Trade Looks Like

Now that you understand what the Iron Condor is supposed to do, let’s take a closer look at the risk diagram of the stock to become familiar with it’s structure.

Source: Thinkorswim

As you can see, the breakeven prices are slightly higher and lower than the strikes selected.

This gives us that “buffer” we are seeking when trading those options around the price range determined by the technical analysis of the stock.

When Do You Call It Quits On The Trade

As mentioned earlier, these are not trades you will want to hold until expiration.

It would be difficult to find a stock to sit in one range for two months, so ideally you want to capture the “sweet spot” of these options, and take them off once the profit is achieved.

Typically, a rule of thumb about exiting these trades is to target 30 days until expiration. Once a position has 30 DTE left in it’s life, it’s time to remove the trade since it doesn’t make any sense to keep on the books beyond that.

Remember, you want to hold this position when it loses most of its value through time, so there is no point in keeping it after that to get a few more percentage points.

And of course, it doesn’t always work so cleanly, so aiming for 50% profits is a great place to start on an Iron Condor.

This means that if the entire trade would give a 10% return, bringing in a 5% return would be a 50% ROI payday.

And who would be upset about returning 50% of their money on the trade?

Rule of thumb: Don’t get greedy with the idea of Iron Condors paying 100% ROI! Sometimes they do, but the Option Greeks typically prevent this from easily happening.

I know this is confusing but let me walk you through it.

Even though you think you are neutral, you are actually short delta due to volatility. Short delta is indicating an inverse relationship in the stock movement. This means that if a stock price moves lower, you will profit. Remember, you don’t want a lot of movement in the stock, so the Iron Condor is considered a Short Gamma strategy. And since we want volatility to drop or remain low, that is why we are seeing a short vega on this chart. Plus with long theta, the passing of time will generate increased profits for the trade.

Conclusion

Iron Condors are ideal setups when you find a range bound stock with falling or low volatility.

But they are not a “set it and forget it” easy bake oven strategy.

Plus Iron Condors must be consistently monitored and even adjusted to make sure you are properly aligned with the market outlook over the course of the trade life.

Now before entering the trade, remember to figure out your profit targets, the 50% overall credit, the max loss, or half of the overall credit, and any adjustments that might be necessary.

So if you feel like you have identified a consolidating stock and one that will be trading in a range over the course of the next month or two but never knew what to do with this trade…An Iron Condor might actually be the trading strategy you have been searching for.

Click here to sign up for Options Profit Planner here to learn what Iron Condors that are lining up for next week’s trades.

0 Comments