Last night Dow futures were down by 400 points after it was reported that rockets were fired at an Iraqi air base housing American troops.

However, by the time most of us woke up this morning, the futures were nearly flat.

I think we can agree that choppy markets are a common occurrence in the markets.

In fact, these flat patterns occur everywhere, in any stock, on any timeframe.

Choppy market conditions are among the most difficult to trade.

For example, if you attempt to buy the breakouts, the stock just falls and rolls over. If you try to short into the news—you are just one tweet or headline away from watching that position get ruined.

There are traps EVERYWHERE.

At this point I bet you are wondering…

What is a trader supposed to do during these sloppy conditions?

Is there a magic formula for trading choppy markets?

Which indicators work best for increasing your chances of winning?

Well… you are in luck.

Because today I’m going to cover how to trade the chop—so you can be profitable in even the muddiest waters.

Learn to identify a sideways market

The first step might seem straightforward and obvious but is often ignored by traders.

A sideways market is one where price action will not trend in one direction or another and is fluctuating inside a tight price range.

This up and down price action through the tight price range reflects major indecision in the markets with the bears and bulls unable to take control of the stock.

What is consolidation?

Consolidation is a sideways pattern in the market that is extremely difficult to spot as the pattern is forming.

Once the pattern is formed and a breakout occurs, a consolidation is easy to spot but then it is too late to trade.

So what is a trader to do?

This takes practice, and many losses, before you can get the hang of how to trade a consolidation pattern as it is occuring.

Usually after a loss on a breakout trade does the trader then believe the markets are consolidating and not breaking out.

One characteristic of sideways markets is periods of short and sharp price movements, but upwards and downwards caused by bulls and bears attempting to control the stock.

Contrary to a trending market, a sideways market will often be comprised of brief periods of strong price action in one direction that will reverse shortly after, usually off short term support and resistance levels.

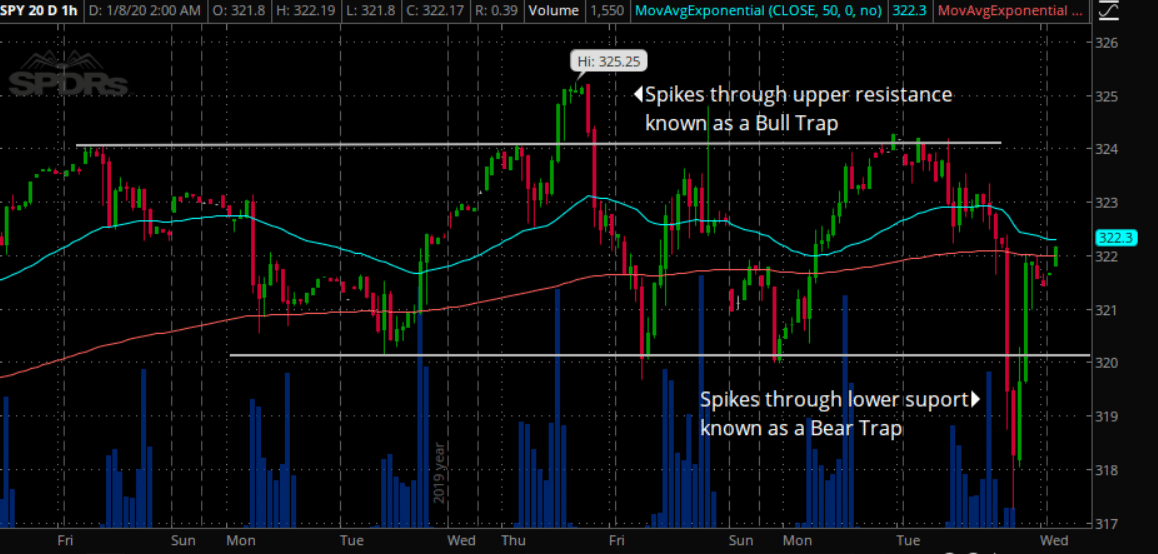

This is an example in the SPY’s of a sideways market with sharp price action in both directions.

As you can tell, there are sharp price action pushing through both the support and resistance levels as traders are trying to fight for the new trend breakout.

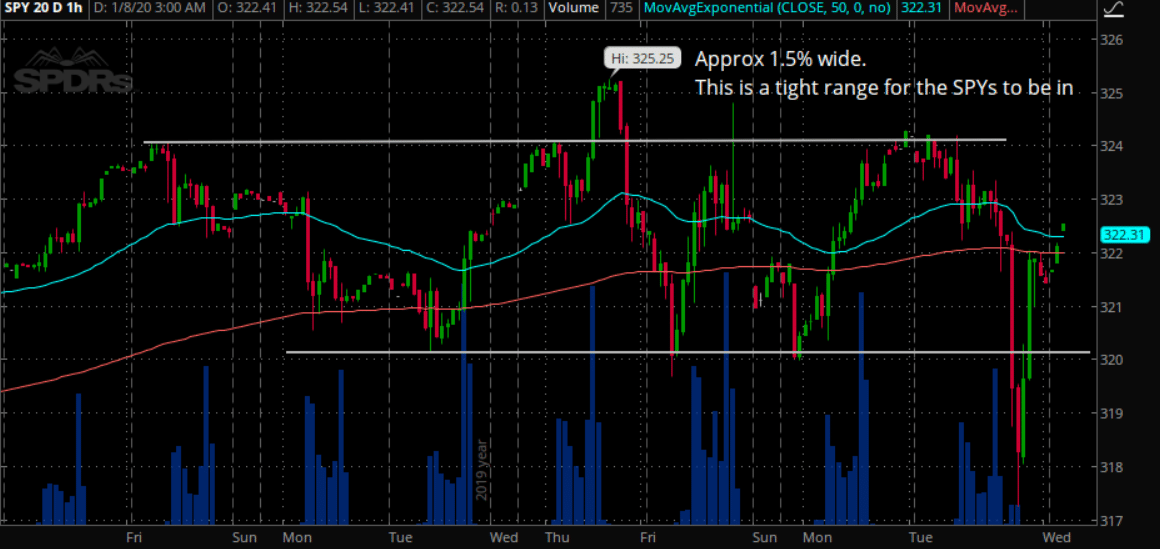

Define the range

Once you have identified that the markets are in or have entered a consolidation phase, one of the first things you want to do is to begin marking the consolidation ranges.

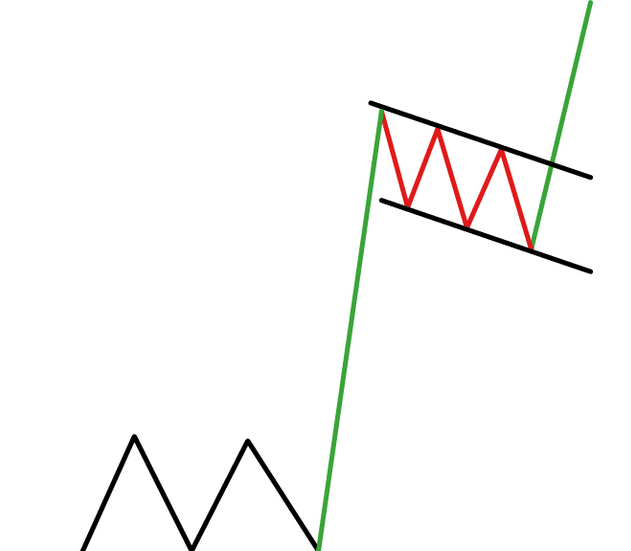

Usually the phases are well defined and formed by a flag or channel forming from other recent patterns.

As you can see, the consolidation or channeling markets in the bull flag (outlined in red) is the range that is in question.

In the case of the consolidation channel on the SPY’s, the range is tight at approximately 1.5% from top to bottom of the channel.

Sometimes a consolidation phase will be too tight to make it not worth trading at all. Other times the range can be wide enough to allow you to trade with caution and tight stops.

The wider the range, the more space you technically have to take and manage your trade in, but also the more risk you inherently take with your stop levels.

By defining ranges, it gives you a more clear perspective of the broader market trends. WHen you know the upper and lower limits of the trading range this allows you to watch the range itself and even position your trades for a breakout movement.

This is extremely useful when the top and bottom levels of the consolidation phase are defined by trend lines that form a well defined consolidation or wedge pattern that is slowly constricting.

Trading this pattern will guarantee an inevitable breakout and is the highest probability trade a trader can take.

Prepare for spikes

Even though you may think you are trading a consolidation where prices should be restricted and contained, many times prices will spike through support and resistance levels.

Pro tip: Don’t let the spikes fool you as a new trend. It’s usually a trap and prices revert back into the channel.

This uncertainty calls for a conservative trading style. This pattern requires placing tight hardstops instead of mental stops on all your trades and using trailing stops and looking for target prices to lock in profits at.

Why?

Because when you’re in a consolidating market, price can reverse suddenly and wipe out all your profits before you know what happened.

This is one of the primary reasons many traders struggle to effectively trade in sideways markets. The inability to use quick exits, and different stop types lead to traders giving back profits or being caught in the wrong direction on the trade.

This is especially true for trend traders who are not used to the choppy markets as they are typically able to ride long and smooth trades.

In this example, you can easily see how quickly the stock price reversed when it went outside the channel support levels.

This is why a trader wants to make sure they have quick exit logic for trading consolidation and sideways markets.

Balance aggressive and conservative trading

While its extremely important to not be overly aggressive when trading a sideways market, it’s equally as important to not be ultra conservative either.

In fact, when trading a strong trending market it might actually be better to be conservative in your approach.

One major difference between trend traders and chop traders is the use of target exits. As a trend trader, you let the market take you out of your trades instead of removing yourself from the trade. This is done by using trailing stops instead of targets for your exits.

In a sideways market since the market sentiment is weak, managing the trade too tight can result in a smothered trade as your prices whipsaw around on your quickly.

This also means that when you are trading a range bound market it is best to take profits quickly and use targets to take advantage of the quick price action.

In a sideways market using trailing stops is not recommended as you will not have enough profits to “trail” effectively and quickly.

Additionally, being extra conservative is also not recommended either when you trade a sideways market.

For instance, if you are a trader that likes to move a stop to breakeven as soon as the trade moves sideways or profits go in your favor, you will be very disappointed.

Why is this a bad thing?

Well because you will end up with a lot of small no-loss-no-gain results for a lot of your trades.

This strategy is a great safeguard in trending markets but is a terrible strategy for sideways markets.

So therefore, being ultra conservative in a sideways market is also not recommended for profitable trading.

Wrapping it up

It is easy to see how trades set up in sideways markets after the patterns are identified and are extremely difficult to trade them as they are being formed.

For the traders who wish to sharpen their skills in sideways market trading, it is crucial to find the balance between aggression and conservation when it comes to trade management,

Unfortunately, it may not be a straightforward solution and varies widely among different stocks and markets, the strategy the trader deploys, and the risk tolerance they have for sudden change in trade direction.

However, trading sideways markets can be an extremely lucrative trading style if executed properly. By knowing the range of the trade pattern, keeping a close eye on false breakouts, and using targets instead of trailing exits, a trader can use this strategy for quick and substantial profits.

Are you looking for a system that can generate profits daily selling options?

How about having a 6 month of steady returns and no losses?

0 Comments