It’s true.

The market has enjoyed a substantial rally since the March lows.

However, volatility is still historically high.

Why does that matter?

Because if you know how to trade options, there are plenty of opportunities to make money utilizing conservative strategies.

More specifically, strategies that offer high probability outcomes and exceptional returns.

Today I’m going to be talking about some of the basics of options trading, one of my favorite strategies, as well as, a case study that puts it all together.

What is an Option?

Options are financial tools that are based on the value of the underlying stock. These contracts offer buyers the opportunity to buy or sell the underlying asset at an agreed upon price and date.

There are two types of options:

- Call Options – Allow the buyer to buy the asset

- Put Options – Allows the buyer to sell the asset

Note: All option contracts all have specific expiration dates by which the trader must exercise their option as long as they are at least 0.01 in-the-money (ITM).

There are two types of option traders, a buyer and a seller. Depending on whether or not you trade a put or a call, your obligation will vary.

Here is a comparison of the responsibilities of an option buyer or seller.

|

Buyer’s Right |

Seller’s Obligation |

|

|

Call Options |

Buy the underlying stock from the seller at a specific price on or before the expiration date |

Sell the underlying stock to the buyer at the strike price on or before expiration of the option |

|

Put Options |

Sell the underlying stock to the options seller at a specific price on or before the expiration date |

Buy the underlying stocks from the options buyer at the strike price on or before expiration of the option |

For options traders, the call and put options make up the foundations to a wide range of strategies designed for hedging, income, or speculation.

The Short Call / Short Call Spread

Selling options is a lot like being the casino owner, always staking the odds in your favor in order to win more than you lose.

In this example, we are going to be focused on selling call options to trade stock direction while generating income.

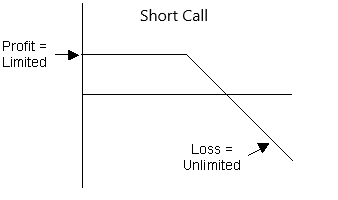

A short call is also known as being “naked” and is regarded to be a bearish trade pattern.

Unfortunately, selling calls has one major disadvantage, and that is the potential for unlimited losses to your trading account.

Unlike a short put, you don’t have a natural floor built into your stock that can only go to $0, (ignoring the fact crude oil went negative for the first time in history).

And because of the risk of unlimited losses, it’s actually highly recommended to trade a vertical spread instead for short call positions.

Now… let’s take a look at the “how and why” I traded a Credit Call Spread in AMZN.

The Credit Call Spread

Confused as to why we are selling calls to get short the stock? Don’t worry!

As we break down the trade on AMZN you can start to see why the short calls make sense to trade.

But this trade is not smart, nor safe to place… and has an ominous name, the “Widow Maker” trade.

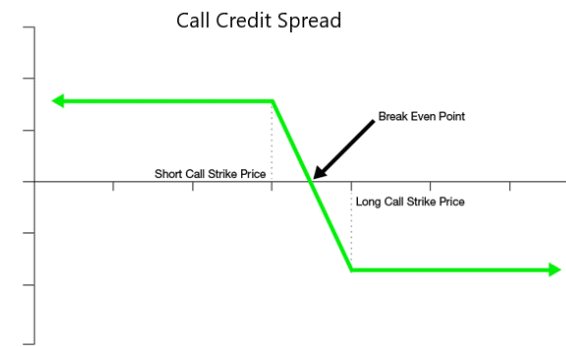

One way to get around the risk that is associated with a naked call is to sell a Call Spread.

As you can tell Call Credit Spread, or Bear Call Spread has one main advantage over the naked call, and that is the risk is limited to the upside.

It can still be substantial, but it will not be unlimited losses when trading the spread compared with a naked call.

The Trade Breakdown

So let’s take a look at how we can take a Credit Call Spread and trade AMZN short.

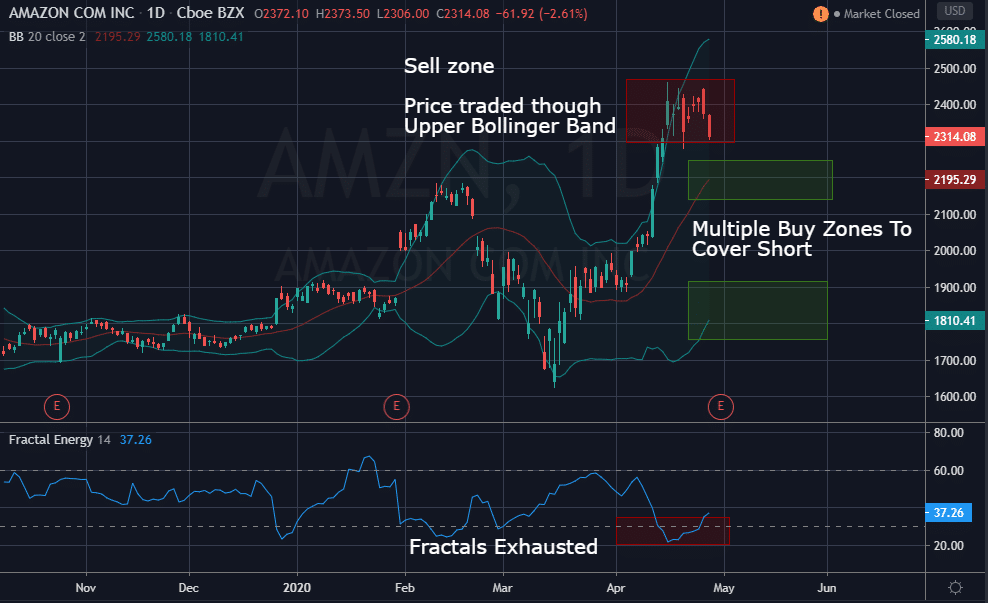

First, let’s take a look at the chart pattern and see if it is something we can work with.

Source: Tradingview

The projected outlook:

AMZN has a low fractal energy reading as it’s piercing the upper Bollinger Bands. This is signaling that the stock is exhausted in its move and is needing to either trade sideways or drop lower in order to regain its energy for higher prices.

Now, as we looked at earlier, you have 3 trades that you can place.

3 Trades are:

- Short stock

- Short call option

- Short call spread

And the only one that makes sense to trade is the short call spread to keep trading capital safe in the event the stock was to gap higher on us. (Truth be told, this is highly unlikely to the upside in a large name such as Amazon.)

Now, if we were that confident that the stock would fall, why not just sell the underlying security in the first place?

Pros / Cons of Selling Options

Well, there are a couple reasons for this… such as option selling generates returns in sideways, down, and slightly up stock movement, and you can generate 100% returns instead of 1-5% returns on a stock with the way options are created.

Let’s review some of the pros and cons of selling options to get a better understanding of this concept.

Pros to selling options

Smooth Return Stream

Selling options is one of the most reliable and stable sources of returns in the markets.

Premium selling strategies tend to have extremely high win rates and are a great way to grow trading capital over time.

Winners Mentality

Most traders tend to feel better when they are winning rather than losing. This makes sense that traders would benefit from a system that has them winning a high percentage of trades.

This boosts confidence and leads to less “second guessing” the trade. This confidence tends to lead to smaller losses compared with traders who are buying “lotto tickets”.

Cons to selling options

No “Grand Slam” trades

Selling options tends to be “singles and doubles” type of trading. The knowledge that a big grand slam is right around the corner keeps traders coming back to their screens every day, waiting for that huge opportunity in the markets.

Unfortunately, option sellers won’t have this rush of excitement like hitting it big at the casino.

Wrapping Up

When it comes to selling puts or put spreads there is one thing you can have comfort in – the fact a stock can’t trade below $0.

But when selling calls, a stock can rise to any unimaginable number it had to, and this is not more apparent than with volatility trading.

If used properly, selling options is known to generate some of the most stable and profitable returns out there.

And selling options like the credit call spread can be done safely and still leave plenty of profits in your pocket over trading a naked position.

Want more proof that selling options is the only way to consistently make money?

0 Comments