Do you find yourself buying options just to watch them expire worthless… even when the stock move in your intended direction?

Well, that’s what happens to most traders who buy options.

In many cases, being a seller of options makes the most dollars and SENSE.

Now, if you are a stocks only trader, and haven’t gotten into options yet, listen up, because I’m going to walk you through a strategy that might change the way you view your investments.

But first, let me explain to you this about options…

Options give a trader two distinctive advantages over trading normal stocks.

- The power to dictate what price you will pay for a company and at what discount.

- The ability to get paid to wait for the stock to come to the price level.

Options traders can take advantage of the many great opportunities that are normally off-limits to equity traders.

So let’s take a look at how options traders can get paid to own stock by utilizing this one simple options strategy.

What is an option?

An option is a financial tool that is based on the value of the underlying stock.

An options contract offers the buyer the opportunity to buy or sell the underlying asset.

There are two types of options:

- Call Options – Allow the buyer to buy the asset at a specific price on a specific date.

- Put Options – Allows the buyer to sell the asset at a specific price on a specific date.

All option contracts all have specific expiration dates by which the trader must exercise their option.

There are two types of option traders, a buyer, and a seller.

- Option Holder has the right to buy or sell the underlying asset at a specific price.

- Option Writer is obligated to buy (or sell) the underlying asset if the contracts are assigned.

Call and put options are the two foundations to a wide range of strategies designed for hedging, income, or speculation.

The Short Put

Selling options is a lot like being in a casino and is the go-to strategy for selling options for many professional traders.

In this example, we are going to be focused on selling put options to generate income.

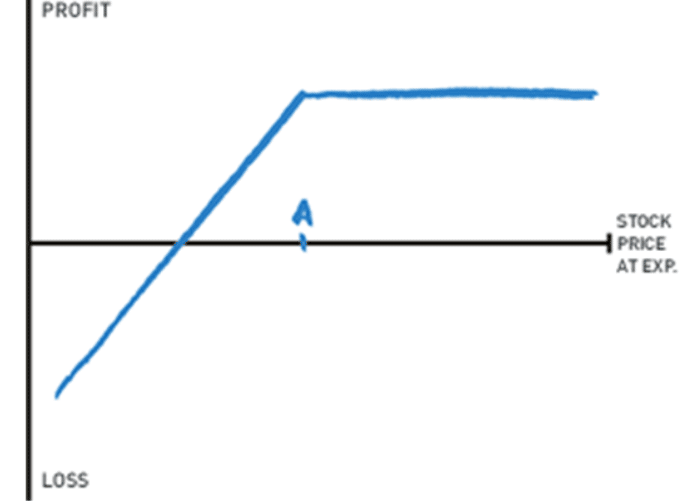

A short put is also known as a “naked put” and is a way to take a neutral to long position in a stock.

Selling naked puts has one distinct advantage for the trader.

Naked puts allow traders the opportunity to purchase a stock at a discount.

Even though the chart looks like unlimited losses, the value of the asset going to $0 is the theoretical max loss.

Now…Let’s take a look at how a naked put looks on a stock such as AMZN.

Trade Breakdown

So let’s take a look at a sample trade on AMZN and how a short put works.

By looking at The Fractal Energy it seems like AMZN is going to be trending high as the energy builds in the stock.

Source: Thinkorswim

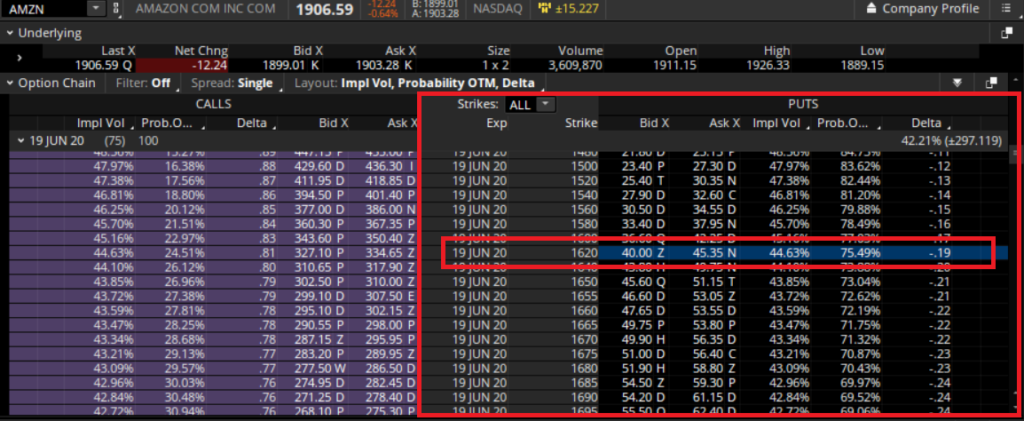

Since we don’t think AMZN is going to fall below its 1626 low, let’s take a look at selling puts at (or below) these levels.

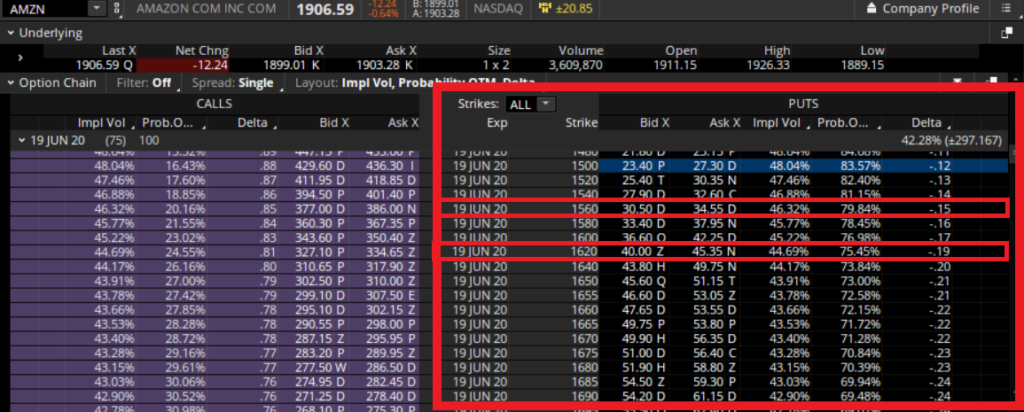

Source: Thinkorswim

By selling 1 x 19 Jun 20, 1620, Put @ 45.35 – a trader can get long the stock and collect $4,535 per contract if the stock rallies.

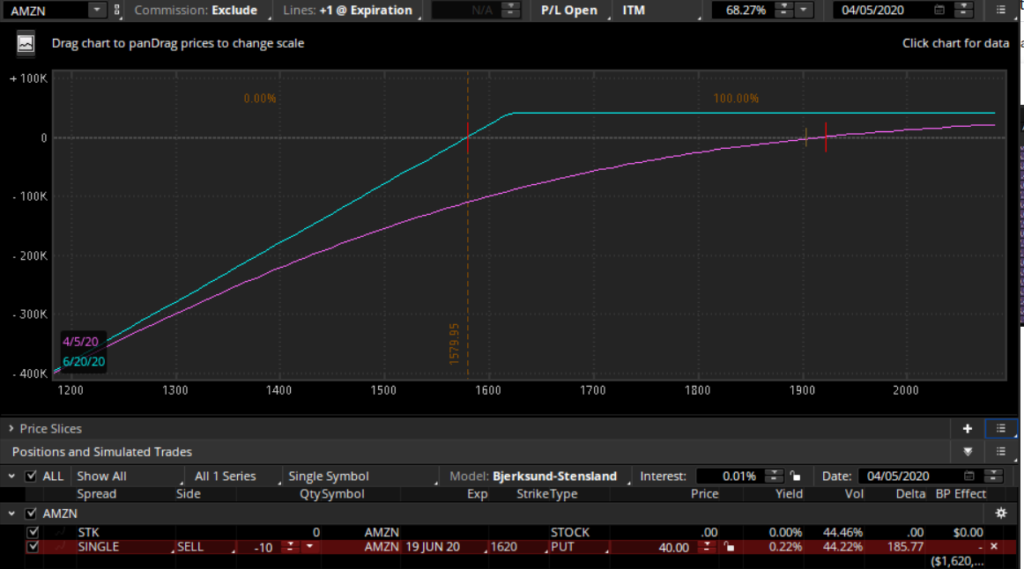

And here is a risk profile similar to the other sample plot above…

Source: Thinkorswim

And as you can see the losses could be substantial…

But it’s not really as bad as it looks.

That is due to the built-in stock ownership advantage naked put sellers have built into their strategy. This means that if they were to expect this short term decrease in price to send stocks higher in the future, they would let their short put be exercised. This means they would be assigned stock of Amazon at the strike price.

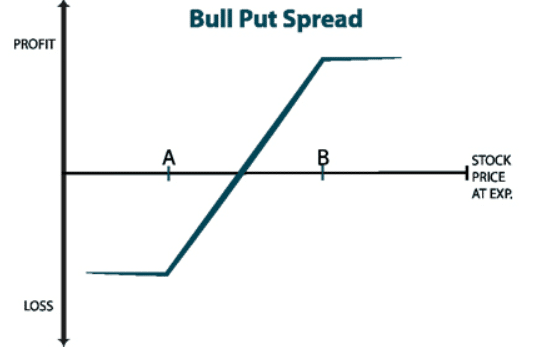

Alternative to Naked Puts – Credit Put Spread

Don’t want to risk unlimited loss and not wanting to get long a stock at a discounted price?

An alternative strategy you might want to trade instead of a naked put is a credit put spread.

This allows you trade in the same direction as the Naked Put but without the risk of owning stock or having it trade to zero.

A credit put spread is an options strategy that is used with traders that expect a rise in the price of an asset.

This spread is placed by simultaneously purchasing a put option at a higher strike price and selling a put option at a lower strike price in the same expiration month.

This is considered a limited-risk trade since the selling of the put option is covered by the purchasing of a lower-strike put option.

The main advantage of a credit call spread is the reduced risk of losses compared with both a naked put or long stock trade.

Here is the same trade as earlier but now we are adding the long put below the short put strike to reduce losses.

Trade Breakdown

Let’s take a look at how we apply that to the AMZN short put from earlier.

Source: Thinkorswim

Now instead of only selling 1 x 19 Jun 20, 1620, Put @ 45.35, a trader would also purchase 1 x 19 Jun 20, 1560, Put @ 30.50.

When combined, this trade will create a Credit Put Spread for the trader to profit if AMZN rallies and only take limited losses if the trade does not go in their intended direction.

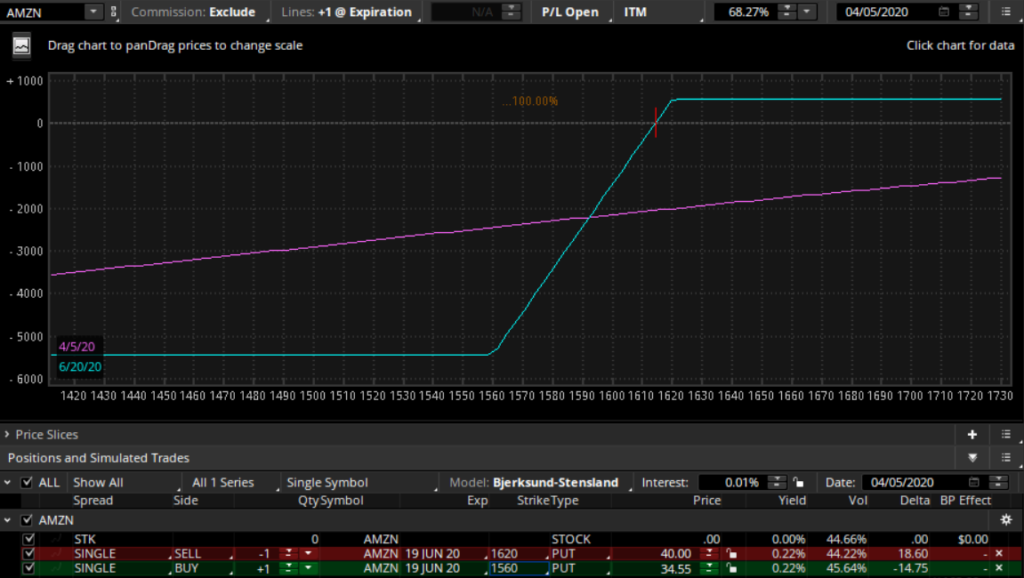

Here is what the payoff diagram will look like on the new trade.

Source: Thinkorswim

As you can see, the advantage of a credit put spread is that the downside risk is limited.

But one of the disadvantages is that you give up the ability to own the stock if you trade this position. For many income and investment style traders that trade-off is not worth the taking.

Now… let’s talk about the pros and cons of an options selling strategy.

Pros to selling options

Smooth Return Stream

Selling options is one of the most reliable and stable sources of returns in the markets.

Premium selling strategies tend to have extremely high win rates and are a great way to grow trading capital over time.

Winners Mentality

Most traders tend to feel better when they are winning rather than losing. This makes sense that traders would benefit from a system that has them winning a high percentage of trades.

This boosts confidence and leads to less “second-guessing” the trade. This confidence tends to lead to smaller losses compared with traders who are buying “lotto tickets”.

Cons to selling options

No “Grand Slam” trades

Selling options tend to be “singles and doubles” type of trading. The knowledge that a big grand slam is right around the corner keeps traders coming back to their screens every day, waiting for that huge opportunity in the markets.

Unfortunately, option sellers won’t have this rush of excitement like hitting it big at the casino.

Potential of large losses

Another huge negative is the potential for large losses. While this is a remote possibility, it does still exist depending on the underlying security traded.

Traders can mitigate their risk to large losses by trading credit spreads rather than naked options. This is the “best of both worlds” as the trader can play the house odds while maintaining a controlled and limited risk profile for their account.

Final Words

To summarize, premium selling is known to generate a wildly profitable and extremely smooth equity curve.

But it has many benefits that are associated with a strategy like this one.

Three of the best are:

- There is the risk of an occasional large loss with selling a naked put, but this is mitigated with the use of credit spreads.

- The return of a premium selling options book is that of a mean reversion stock trading system, with a large number of small wins with the occasional larger-loss trade.

- Selling Naked Puts is one of my favorite strategies since it allows me to purchase stocks at a discount and get paid doing so!

Want more proof that selling options are the only way to consistently make money?

0 Comments