If you trade options long enough—you’ll eventually find your back against the wall.

And that’s exactly where I found myself during the market selloff, forcing me to make some defensive adjustments to my portfolio.

All these ideas were running through my head:

- Should I just close out the position

- Let the trade ride

- Make an adjustment to the trade structure

Making the wrong decision could mean the difference between saving the trade or making it even worse.

Today I want to talk to you about a strategy adjustment I rely on called: rolling the position.

Let me show you how easy and powerful rolling can be.

I’ve broken it down to a few easy steps. Study this, because you never know when you’ll end up having to apply it.

Rolling a position

Before we begin, let’s discuss what does “rolling a position” mean?

An options rolling strategy comes in two different forms, a roll out and a roll up/down. These two adjustments allow for an option trader to buy time on their trade or buy extra room in the event the trade is going against them.

Let’s take a closer look at what a Roll Out strategy and Roll Up/Down strategy can do for a trader looking to adjust their positions in the markets.

The Roll Out

A rollout consists of purchasing an option with a further time until expiration. This simply means that a traders view of the markets did not materialize before the expiration date.

And if the market’s outlook is the same but they are worried it’s going to expire worthless… a trader would consider rolling out an option to gain more time for their trade to move in their favor.

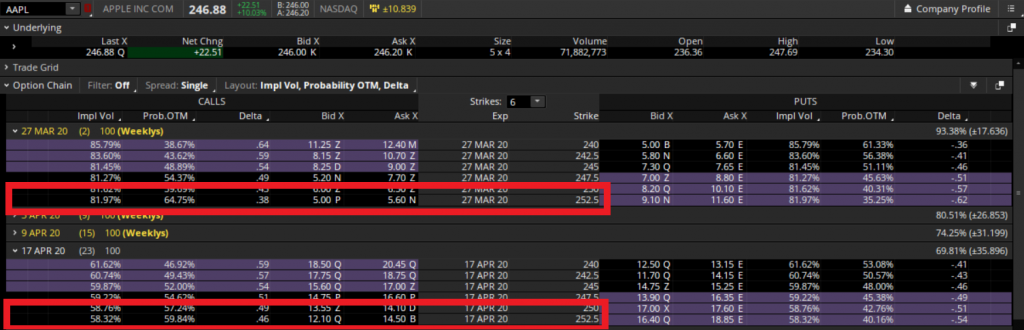

Here’s an example of what a rollout would look like to gain an additional 23 days until expiration on options that are going to expire in 2 days.

Source: Thinkorswim

In this example, a trader would simultaneously

- purchase the 27 MAR 20 252.50 strike calls

- sell the 17 APR 20 252.50 strike calls

This would allow a trader to remain in a similar position but would extend the amount of “life” remaining in the trade, known as days until expiration.

Next…

The Roll Up / The Roll Down

A Roll Up or Roll Down consists of purchasing an option that is further higher or lower than the current strike price.

This would only need to be done if a traders viewpoint has not changed on the stock and needs to avoid their trade going in-the-money due to assignment risks associated with short positions.

The Roll Up

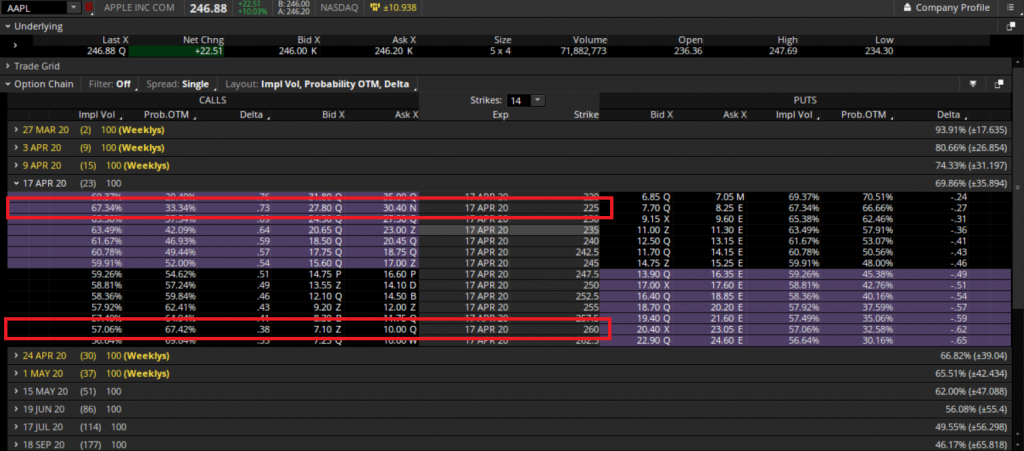

Suppose a trader is short a call option that has gone deep in-the-money. In order to avoid the risk of going short, they would Roll Up their trade.

The strike the trader is short is the 17 APR 20 225 calls.

Here is an example of how a trader would roll out a short call trade.

Source: Thinkorswim

In this example, a trader would simultaneously

- purchase the 17 APR 20 225 strike calls

- sell the 17 APR 20 260 strike calls

This trade would allow a trader to remain in a similar position but would remove the risk of early assignment on the trade by selling calls that are further out-of-the-money that do not have any risk of assignment.

The Roll Down

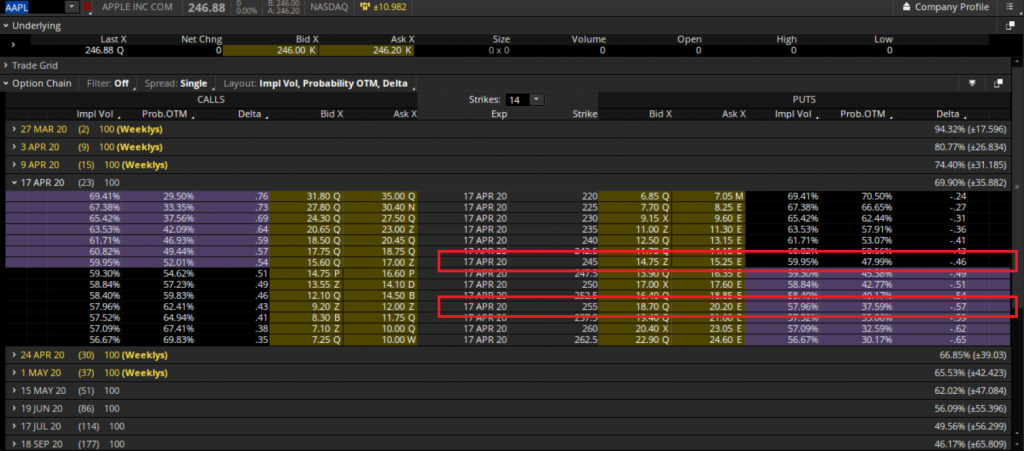

Suppose a trader is short a put option that has gone deep in-the-money and they want to avoid assignment risk on their position. They would want to Roll Down their strike price in order to get their trade back out-of-the-money and get more room on their trade.

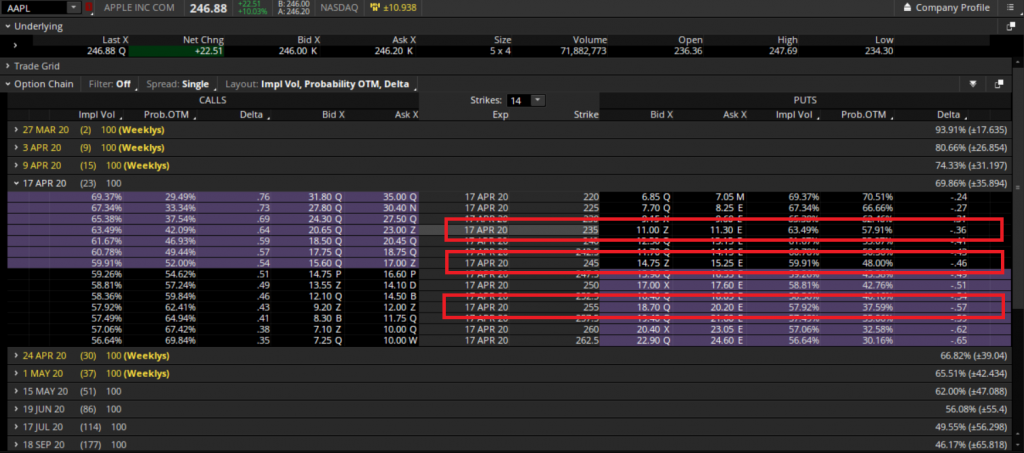

Here is an example of how a trader would Roll Down their trade:

Source: Thinkorswim

In this example, a trader would simultaneously

- purchase the 17 APR 20 255 strike calls

- sell the 17 APR 20 225 strike calls

Now that we can see the advantages of rolling single options, let’s look at how this is applied to rolling a spread, like a put spread.

Spread Rolling Example

Rolling a spread strategy is similar in concept to rolling a short call or short put option, but instead involves 4 legs instead of 2.

Since the spread consists of two contracts instead of just one, rolling a spread allows a trader to have many more possibilities.

Not only can you roll the spread up or down, but you also increase or decrease the spread (adjusting the risk) on the trade.

For example, you might want to roll an existing spread up or down if the underlying price has moved significantly in one direction placing an option deep in-the-money.

Another reason to roll a spread is perhaps you want to roll the spread out to a further expiration in order to give the underlying stock more time to make its desired move higher or lower.

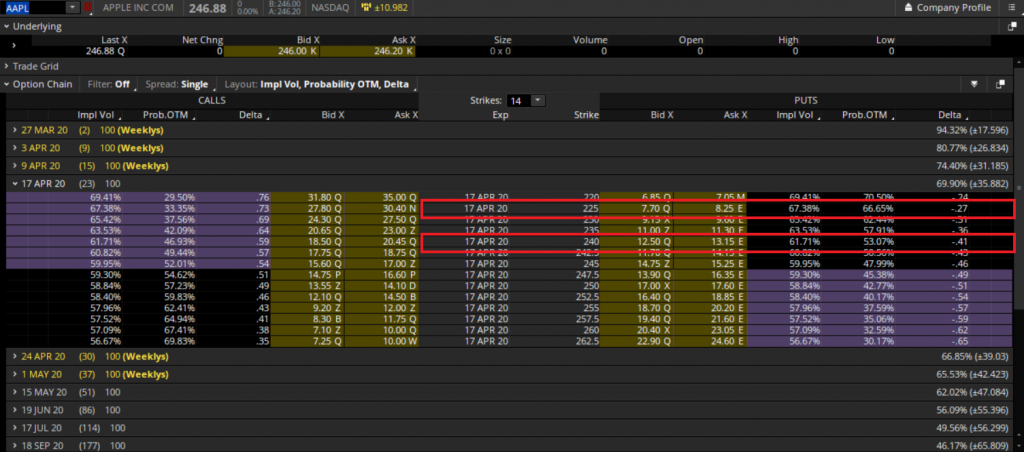

Let’s look at the original Short Call Spread that needs to be rolled to avoid exercise risk on the deep in-the-money short call option.

The initial trade :

- Sold 1 AAPL 17 APR 20 225 Call 20.20

- Buy 1 AAPL 17 APR 20 245 Call 15.25

Source: Thinkorswim

In this trade, the deep in-the-money call options are at risk of exercise, placing you short the stock at the higher strike price.

To avoid this risk, the options trader would want to roll the spread down to strikes that are out-of-the-money.

Let’s look at an example of a roll on the Short Call Spread:

- Sold 1 AAPL 17 APR 20 240 Call 13.15

- Buy 1 AAPL 17 APR 20 225 Call 8.25

Source: Thinkorswim

Benefits Of Rolling A Position

There are many benefits that come with rolling a position you may have on your books.

Some examples of benefits you may get from rolling your trade are:

- Decreasing risk per trade if needing to change distance between strikes on spread trade

- Increasing time required (increasing days until expiration)

- Increasing the amount of room needed to remove exercise risk

Since a roll is considered to be a defensive strategy, it’s not typically utilized for trades that are profitable.

Changing The Position

In this example with the Bear Call Spread, let’s take a look at how we could change the position entirely into a new strategy with just one more option added to the trade.

Source: Thinkorswim

Instead of rolling down the deep in-the-money position, you may be able to buy an additional put out-of-the-money, while selling an additional contract of the middle strike.

This roll will effectively change your bear put spread into an at-the-money butterfly position adding (or possibly removing) very little risk to your trade.

Wrapping up

As an options trader there are many times where you may find yourself with your back up against a wall.

And deciding to close out a position, letting a trade ride, or changing the options structure entirely, there are almost an unlimited number of choices available to you.

While you could end up doing nothing with your trade but close it out, sometimes there may be an alternative strategy you could utilize that you might not know about until exploring ways to roll your options position.

0 Comments