Hearing the word “Options” puts fear into the eyes of investors and traders…and it shouldn’t!

New investors and traders believe that options are high-risk betting instruments… but that is not true!

Much of the risk associated with options boils down to one of three reasons: a lack of understanding, a proper education, or enough experience.

Do you think that trading options can be less risky than trading stocks?

Well, it’s true, they can be far less risky than trading stocks.

So, with understanding the basics of how options work, you will soon be able to reap the rewards of owning stock all while limiting risk!

Calls and Puts – Overview

It’s important to understand how options work in order to trade them correctly and know where and when your position is open to risk.

Options contracts are priced using mathematical models such as the Black-Scholes and Binomial pricing models.

Some primary drivers of the price of an option are:

- Current stock price

- Intrinsic value

- Time to expiration or the time value

- Volatility (Historical)

- Interest rates

- Cash dividends paid

Don’t worry – you don’t need to be a mathematician creating the next options pricing model.

As an options trader there are many ways you can structure a trade to take advantage of different factors of the options price.

For example, if you are selling options you might want to closely monitor the time to expiration and the greek Theta that goes along with it.

So.. just remember it’s good to just know these factors and what to keep on the lookout for as you trade options to keep you safe.

Now let’s start off with the basics and take a look at what makes options so much different than stocks.

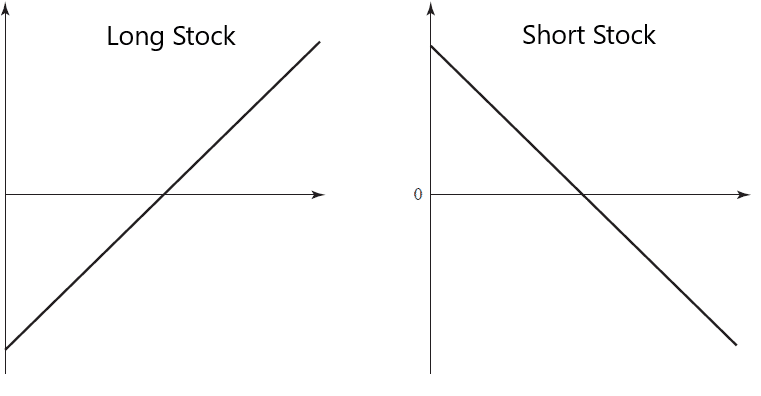

Stock Risk Profiles

Don’t let the false information behind options trading fool you.

As a stock trader, you don’t have “safer” trades than an options trader. Arguably, it’s possible that you have significantly more risk compared to a stock trader. Far more than you might realize.

What do I mean?

Long Stock Example:

- Profits: Unlimited

- Loss: Limited (Stock only goes down to $0)

Short Stock Example:

- Profits: Limited (Stock only goes down to $0)

- Loss: Unlimited

Unfortunately, as a stock trader, you actually have significant losses that you can still have hit your account…

And basically, stocks can be equally as risky as options!

Let’s take a look at the above example but as a payout diagram of a long and short stock and see what the risk looks like.

As stated above… The long stock position has the potential for unlimited gains as a stock can go up indefinitely and limited losses by the stock going to $0.

Alternatively, a short position has the potential for unlimited losses as a stock can go up indefinitely and limited profits by the stock going to $0.

So… by using options, you can start to do a number of different things to protect your assets while making money.

For example, you can hedge your long or short stock position to minimize risk, speculate on a stock direction, or a combo of each.

All while maintaining a tight risk management strategy for your account.

Let’s take a look at some example trading strategies with buying and selling options.

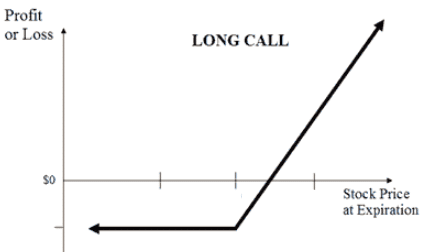

Long Call Options – Bullish Strategy

Call options are a contract that gives the buyer the right to buy a specific amount of stock, at a specified price, and before a certain date.

These three basic criteria are known as:

- Quantity

- Strike

- Expiration

When you buy options, you are betting that the stock price will rise in the future before the expiration date.

Let’s take a look at the payout diagram for a long call option.

Long Calls:

- Profits: Unlimited

- Losses: Limited

This appears to be a strong argument to start buying call options instead of going long stock… And that’s what a lot of traders do!

But there are many more benefits to a long call option than it’s unlimited profit potential.

Benefits of a long call option

When talking about options, there are two main reasons stock traders will jump to trading options.

They are:

- Risk-to-Reward Ratio

- Leverage

Risk-To-Reward Ratio

Unlike stocks, trading long options can provide some of the best Risk-To-Reward ratios in the markets.

Think of your “lotto ticket” trades… you know, the ones where your options are worth $0.10.

Then out of thin air, and because of some news report, you wake up the next morning and you’re a newly minted millionaire from your options being worth $20.00.

Those stories exist, and they occur more frequently than you might think… Which is why so many people buy stock options!

Leverage

Another reason that buying options is extremely popular is due to the build-in leverage the trader received from the contracts.

Generally speaking, each single options contract holds the buying power of 100 stock.

For example, you are a trader looking to buy a stock at $320 per share and you trade at 100 shares increments.

You have 2 choices:

- To buy the stock and spend $32,000 for 100 shares of the stock

- To buy the 1 call option and spend $6.15, or $615 per contract!

You see… options can give you incredible leverage and allow you to hold the same buying power in stocks. Coupled with defined risk, it’s no wonder buying options is favored with both small and large investors.

Now hold on. I know you are about to run off and start buying call options on every stock in the market.

But that’s the problem! These call options are developed to expire worthless! Every last one of them that is OTM will go to zero value by time expiration comes.

It’s very similar to playing the lottery or betting at the casino. The odds just are not in the traders favor no matter how much you think they are.

Except… There is one way to flip the script and put the house odds in your favor.

And I don’t know about you, but I sure hate gambling…

Next…

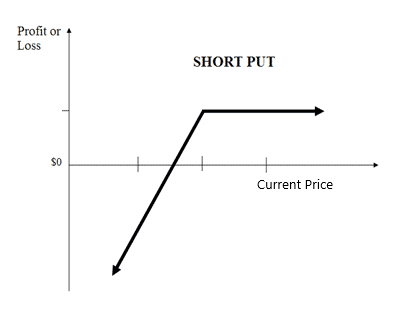

Writing Put Options – Bullish Strategy

Even though the long call options have the potential to make unlimited profits, the reality is that very few, if any, actually make money.

This is where writing put options come into play… so instead of having 33% chance of winning per trade, we are well over 50%, up to 66%, or more!

How does selling a put work?

Well, one way to look at it is that options are nothing more than insurance policies from an insurance company.

The insurance companies (market makers) write (sell) many insurance policies, and generate revenue (premium) each and every month (monthly expirations) as people pay their policy bills.

And the same goes for options… They are written insurance policies to hedge against adverse market moves for underlying stock holders.

So options traders can put this to work for them by being the writer of option contracts and generate revenue as they do this.

Now…

Instead of buying a call, a trader would look to write (sell) an option that is out of the money (OTM).

Let’s take a look at a sample payout diagram of a short put which is a bullish trading strategy.

Writing a Puts:

- Profits: Limited

- Losses: Unlimited

Now at first, it might seem like a high-risk trade, but it’s not.

I like to think about my risk to being the same as buying stock, and if I end up making a purchase, it will just be at a discount.

Basically… a short put trader will have the opportunity to buy a stock at a lower price than it’s currently offered on the market. And you will be getting paid upfront to wait for it to drop to your price!

Advantages to writing a Put:

- Consistent Returns

- Traders are able to generate some of the most stable and consistent returns compared to buying stocks or options.

- Significant Returns

- Traders are able to achieve 100% returns on all investments.

- Immediate Returns

- Traders can generate returns on your capital quickly, as soon as 1 week.

Wrapping up

So there you go… how you have a few tools at your fingertips to get out there and start putting the odds in your favor to win on your trades.

Remember…

Buying calls have 2 main advantages over short calls:

They are:

- Best risk-to-reward ratio in the entire market

- 100x leverage with 1 contract = 100 shares

But those advantages come with a major downside, which is that every only 30% of the options are ever profitable and 90% of them expire worthless!

Which means slow-and-steady with writing (selling) puts is a much better way to go.

There are 3 major advantages of writing puts instead of buying calls.

They are:

- Consistent Returns

- Depending on your business income, a steady stream of revenue is the most important way to keep the lights on and the doors open.

- Significant Returns

- Traders are able to achieve 100% returns on all investments as options expire worthless over 90% of the time.

- Immediate Returns

- Options as quick as weekly give traders access to immediate returns on their investment accounts. Even though this is a marathon and not a sprint, it feels good to start placing winning trades in as little as 5 days.

0 Comments