Around here, everyone already knows that I like cash flows.

In fact…

I like them so much that I can’t stop thinking about new ways to make cash with my cash.

What separates the rich from the wealthy? Well…

“To get wealthy, you have to be making money while you’re asleep.”

David Bailey

Meaning… you have your money working hard for you!

Right now as you are reading this, I have been making a killing with these types of trades.

Don’t believe me?

Just Click here to see how I went 4 months without a loss trading these exact strategies!

Well I have a new trading strategy that I am sure you have never heard of.

And if you have, maybe you are afraid because it sounds too complicated to trade.

I can guarantee that after reading this, you will have the confidence to start using this new strategy to begin generating extra income for your portfolio.

As early as your next trade!

The Vertical Spreads

The style of trading that I live and die by, is officially called a Vertical Credit Spread.

You might recognize it more commonly referred to as a Credit Call Spread or a Credit Put Spread.

These two trades are extremely versatile for making a directional trade, removing the impact of volatility and “guessing” the exact movement of the underlying stock.

By selling a put vertical spread would be a bullish trade and selling a call vertical spread would be a bearish trade.

As you already know, one key advantage of selling verticals is that your risk is defined.

The risk is limited to the width of the long and short strikes, minus the premium collected.

But this is where we land into trouble.

What if the trade goes against us slightly and we need to roll out our risk and offset losses?

Better yet… How about if your viewpoint on the stock is neutral and seems stuck in a range-bound trading pattern?

Enter the iron condor.

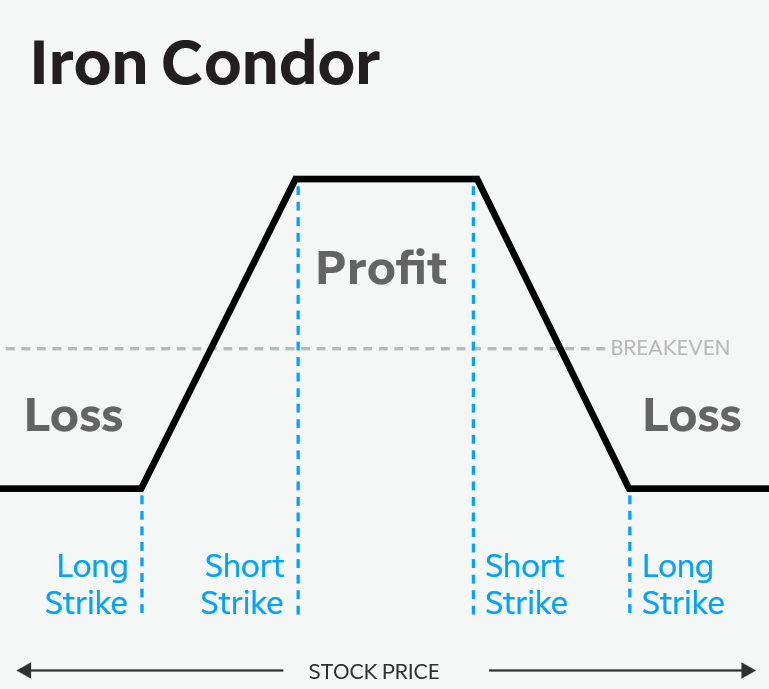

What’s an Iron Condor?

It sounds fancy but it is actually very simple.

An Iron Condor is really a combination of two basic option spreads.

An Iron Condor is created by combining an out-of-the-money (OTM) short put spread (bullish strategy) with an OTM short call spread (bearish strategy) using options that expire on the same date.

By selling two different OTM vertical spreads, you will collect the premiums from both sides of the trade.

There are two outcomes possible.

- If you are wrong? The profits from one spread will offset the loss on the other.

- If you are right? You can ring the register on double the profits!

The Iron Condor – Risk Profile

Let’s take a look at an example risk profile for an Iron Condor.

This might look a little strange at first glance, but it is actually very simple.

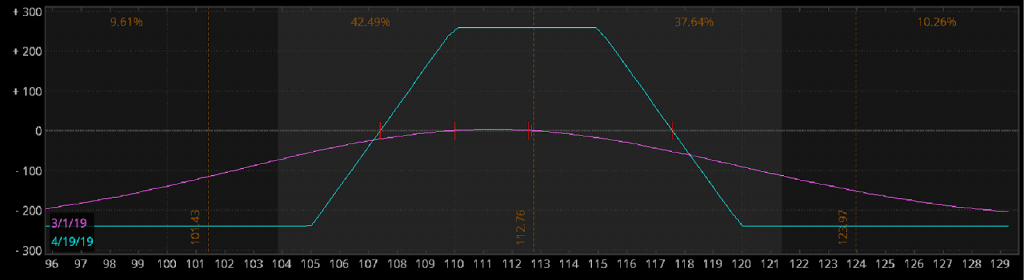

In the chart above, you’ll see a risk profile from a trade earlier in the year and you may notice a few things.

There is a familiar Credit Call Spread (on the right) and a Credit Put Spread (on the right).

Both of these traded at the same time create the 2x profits in the middle.

Separately, this trade only allowed for me to take just about $125 max profit if I was to trade only the Credit Call Spread or the Credit Put Spread.

But when we joined them together, the newly formed Iron Condor allows for me to make a whopping $350 max profit at expiration!

Wait a minute though. Before going out and trading these magnificent option strategies let’s walk through a trade I currently have on.

The Roll Out

Well what if you get in trouble?

This trade is extremely dynamic by nature to allow you to adjust as you go.

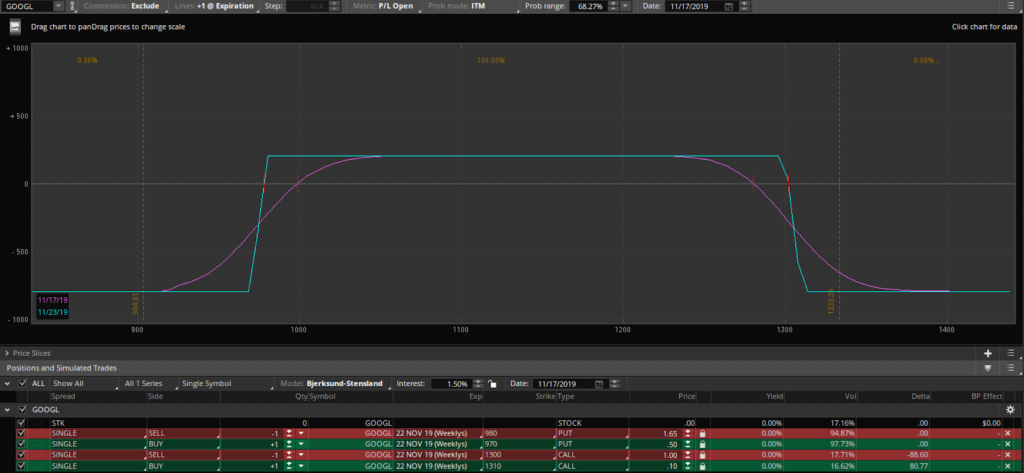

Let’s take a look at a current GOOGL.

Back in May, subscribers got an alert in their inbox for:

GOOGL : Sold the Nov ’19 $980/$970 put spread for $1.15

At this point, I am sure you are noticing that this not an Iron Condor… But why?

Well, this trade actually started off as a credit put spread.

At first, I was bullish on the trade and collected the income on the Credit Put Spread.

But I wanted my 2x income!

Now that GOOGL made its move and the charts looked like it was going to be stalling out, maybe it’s time to start looking for the opposite leg.

So I went ahead and made this trade next to turn it into an Iron Condor.

GOOGL : Iron Condor Defense: We sold the Nov ’19 $1300/1310 CALL spread for $.90 to create our Iron Condors on our Nov put spreads.

Let’s take a look at the risk profile for this Iron Condor:

You may have noticed, GOOGL is trading $1333.54.

The Iron Condor is in trouble.

Now what do we do?

Adjusting the Iron Condor

You only have 2 choices:

- Close it out and take the reduced loss on the failed Credit Call Spread

- Roll out the Credit Call Spread and see if we can buy some time

We are going to do 2 and roll out the Iron Condor. By doing so, we can widen the spread and give the trade some breathing room. As an added bonus, it seems like we can actually make extra profits from this trade.

GOOGL: Buy back the November ‘19 $980/$970 for $0.10.

GOOGL: Roll the November ’19 $1300/1310 call spread to the March ’20 $1360/1380 call spread for a credit of $.30.

The good news?

We now have more time and extra room for this GOOGL trade to work for us!

Since there is more time in the trade, GOOGL is almost at a point of where it should pull back.

Once it does, there should be another opportunity to add another Credit Put Spread to the trade and get back our Iron Condor for 2x the profits!

When To Use?

Now that you know what the Iron Condor is, it’s probably time to understand when to use it.

If you think the market is going to either stay in a tight range or move in a certain direction, then a basic short vertical spread might be the strategy to go with.

If you think the market will stay within a range and you have no directional bias, maybe using an iron condor to bring in additional premium without increasing your dollar risk.

To recap, use an Iron Condor when :

- Volatility is low and you expect the stock to be range bound for a period of time.

- To add 2x the profits to a current profitable trade.

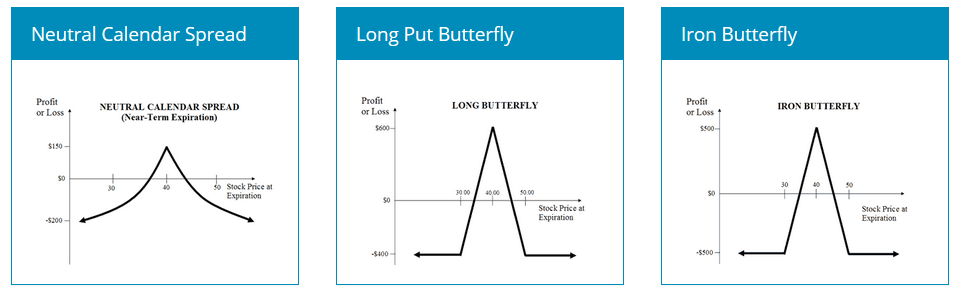

Similar Strategies

There are similar strategies a trader can implement if they are expecting low volatility or a range-bound market.

These trades share similar risk profiles of an iron condor in that they have limited profit potential and limited risk.

The Iron Condor is such a versatile strategy and allows for a lot of creativity from the trader.

Remember trader, options strategies are about trade-offs.

What trade you put it all in comes down to your objectives and risk tolerance.

If you want to find trades like these and stay alerted to all of the Option Profit Planners income generating signals just click here to sign up for more trades like this!

0 Comments