Studies show that the average millionaire has seven sources of income.

Of course, we can’t be everywhere at the same time, so the real key to building wealth is passive income sources.

And while my Options Profit Planner premium service has not seen a losing trade since its inception—I still only trade about ten minutes a day.

Heck, my trading strategy virtually runs on autopilot, there are days, like yesterday, where I don’t even have to check the market or look at my portfolio.

Do you know what the major difference is between traders who live a good life and those that struggle month to month?

An edge in the markets – The pros have a trading plan that works!

They’ve invested money and time to discover trades with a verifiable edge.

If you’re uncertain of what an edge strategy looks like… you’re in luck… because I’m going to share with you one of my favorite option strategies.

Selling Options

Before we begin…

Did you know that most traders are always trying to score big… driven by the burning desire to hit it big.

They are addicted to the thrill of the game as they continue to look for that next explosive trade.

And then the game is over.

Why?

Because 90% of traders who buy options without having an edge lose money.

It’s a fool’s errand.

Buying options is a lot like gambling at the casino.

You’re betting for a specific outcome with odds of winning a mere 25% to 40%!

This is why it’s the strategy at Options Profit Planner to focus on short options strategies and see get those house odds put into our favor.

So let’s review…

The Problem With Buying Options

Buying options is almost worse than buying or selling stock outright.

When a trader buys a stock, they have time on their side and only have to pick the correct direction.

If a trader buys options they need to have time, direction and distance all chosen correctly with nothing on their side to help them.

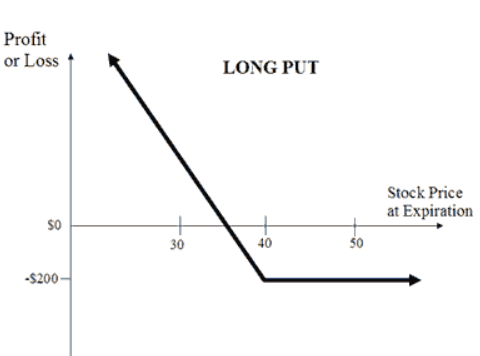

Here is an example payout diagram from a long put option at expiration.

As you can see, the trader can only profit from the trade if the stock decreases in value(direction), before a specific time (expiration), and by a set amount (breakeven).

Factor in commissions, fees, spreads along with other costs to operate your trading business the breakeven is actually much higher.

So what’s the solution? To be the seller of options (the house) instead of the buyer (the gambler)!

This article is going to cover selling deep in the money (ITM) calls.

For a more comprehensive breakdown of the different strategies, Click Here To Read… Selling Options To Boost Your Income

The Problem

One of the most popular short trading methods is selling out-of-the-money (OTM) call options.

Don’t worry – there is nothing wrong with this strategy!

It’s not the right tool for all of the jobs…

Let’s assume this is a trade you want to place on AAPL, or better known as, Apple.

You have a price target on AAPL of $270 ( or lower ) in the next month based on a technical analysis of the stock chart.

How do you capitalize on your idea?

Your Choices

You can select from a variety of different strategies.

But out of the thousands that are available which are the best for me?

Well, first you want to understand the problem you are trying to solve and then narrow down which options strategy works best for you.

It’s ok if it’s overwhelming, For new traders, this is a common problem and it takes some time to become familiar with the strategies available to you.

To make it easier, let’s take a look at the 4 common trades to solve this problem.

- Sell the stock

- Buy a put option

- Sell (credit) call spread

- Sell naked calls

Ok so now we can break these down and see the pros and cons of each.

Sell The Stock

This is the general answer to all questions when you ask someone what to do when you expect the stock to go lower. (For equity traders it’s the only choice they have!)

The Trade:

- Sell 100 shares of AAPL at $284.27

Pros of a Short stock:

- Profit on trade at target $250: $3,435.00

- Profit on overall trade: Unlimited

Cons of Short stock:

- The cost of the trade is $27,000

- Risk on trade: Unlimited

Buy A Put Option

A very common strategy when a trader is going lower is to buy a put option.

This Trade:

- Buy 1 x 21 Feb 20 $280 Put at $8.65

Pros of Long Puts:

- The cost to place this trade is $865

- Profit on this trade at $270 is $1,365 at expiration

- Profit on overall trade: Unlimited

- Risk on trade Limited to $865

Cons of Long Puts:

- Must be right on time, direction and movement before options expire.

Credit Put Spread

Now, this is where things start to get kicked up a notch and get interesting.

Instead of selling a standard credit call spread, let’s take a look at what happens when we sell a deep in-the-money (ITM) call spread.

This Trade:

Note: To maintain a constant risk of approximately $1,000 the size was increased to 10 contracts.

- SELL 10 x 17 Jan 20 250 Call at $35.05

- BUY 10 x 17 Jan 20 270 Call at $16.25

Pros of ITM Credit Call Spread:

- Profit on trade at $250 is $18,800

- Max loss on trade: $1,200

- Covered position

- Reduced margin requirements

Cons of ITM Credit Put Spread:

- Limited upside profits

Naked Call

A final solution to this trade is to sell the expected target price on AAPL.

Since selling calls is a bearish strategy, a trader needs to be absolutely positive that the stock is going to decrease over time.

There are tremendous amounts of risk to the upside if the stock experiences a strong rally.

If confidence is high that stock will fall to $250, then a trader is able to collect the most amount of premium and get short stock at a target price for further profits.

This trade:

- Sell $250 calls at $35.05

Pros of Naked Calls:

- Easy to manage the position

- Sell stock at a target price $250

- Max Profits at $250 : $35,050

Cons of Naked Calls:

- Requires large amount of capital

- Unlimited losses (more so than naked puts)

- Extremely high margin requirements

Final Thoughts

Selling options is always a risk that many traders don’t feel comfortable taking when they start trading them in the markets.

With the proper education and guidance, this is a fear that is shortly overcome.

Selling options truly places the house odds in your favor and this strategy is widely used as it provides a trader with a consistent income stream month over month.

The winner in the contest above is the Credit Call Spread trade.

This position gives the best of both worlds with the added benefits of removing the risk associated with naked calls.

By trading a deep ITM Credit Call Spread, a trader is able to capture a large premium in the option along with reducing all downside risk associated with short stocks and option trading.

Even though the spread does not outperform a naked call directly, it does once you add the risk associated with this trade back into the risk-to-reward profile.

Now it’s time to get out there and turn yourself into the casino – once and for all!

And if you need a trading partner, someone to navigate you, then consider signing up and becoming a paid-up member of my Options Profit Planner service.

Click here to get started

0 Comments