Fun fact—It was reported that Robinhood brought in 11,600 users in the last three days, 79% of the new accounts bought Tesla (TSLA).

Talk about the mother of all short squeezes…

These TSLA bears are taking one helluva lashing.

While the “casuals” are buying Tesla stock at these elevated levels…. The pros continue to pound it short…

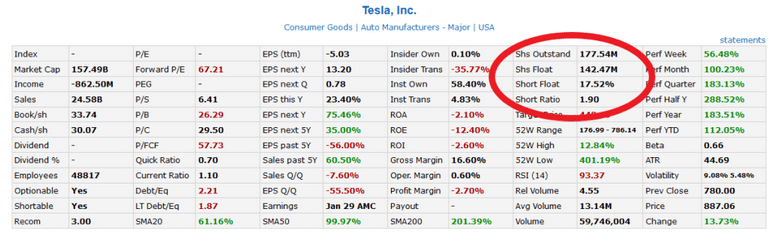

Just look at how hated TSLA is…

Source: Finviz

Source: Finviz

It’s got a 17.5% short float which is astronomical for a stock of this size with approximately $157bn market cap.

Based on market cap, you won’t find a more shorted stock thanTSLA, according to finviz.

![]()

Talk about some serious money being thrown around trying to trade this in the equities space!

So one of the issues with trading high dollar stocks, such as: TSLA, AMZN, AAPL, etc. is that it eliminates the small investor from the game.

So what is a retail trader supposed to do?

Especially, since going short TSLA would be considered extremely foolish, possibly even a bomb that can blow up your account at this point.

What a parabolic move lately! So how do you take advantage of a market move that is this extreme… yet do it safely?

Forget about buying puts or even daring to short the stock…

I’ll walk you through two strategies that can help you sleep at night, and even make a whole lot of money.

Shorting stocks using only options

Shorting stocks can be one of the most exciting parts of trading… and also the most dangerous.

The news media is driving excitement in TSLA over the last few days and causing traders to flock to the name.

… Traders are buzzing around TSLA as sharks swarm around their prey in a feeding frenzy.

It’s mayhem.

So as a trader, how do you keep yourself safe and still participate in a high profile trade like this?

In order to do so, safely… be sure to follow these bearish patterns…

Bearish option spreads for uncertain markets

2 key bearish spreads:

- Credit Call Spread

- Credit Bear Ratio Spread

With the increase in volatility, it is usually not a good idea to purchase a put option when looking to take a bearish trade in a stock.

Why?

Because of the kick-up in volatility these options are usually extremely expensive to purchase.

This is caused by traders looking to go short the stock in the options market and are driving the prices higher.

And as exuberance drives the stock price higher – traders are flocking into call options in hopes to have 10,000% gains overnight from a massive move higher.

So, what do you do if everything is overpriced?

Well, as an options trader that sees this phenomenon occurring it is actually better to sell options instead of buying them!

This is where a credit spread really shines over buying options.

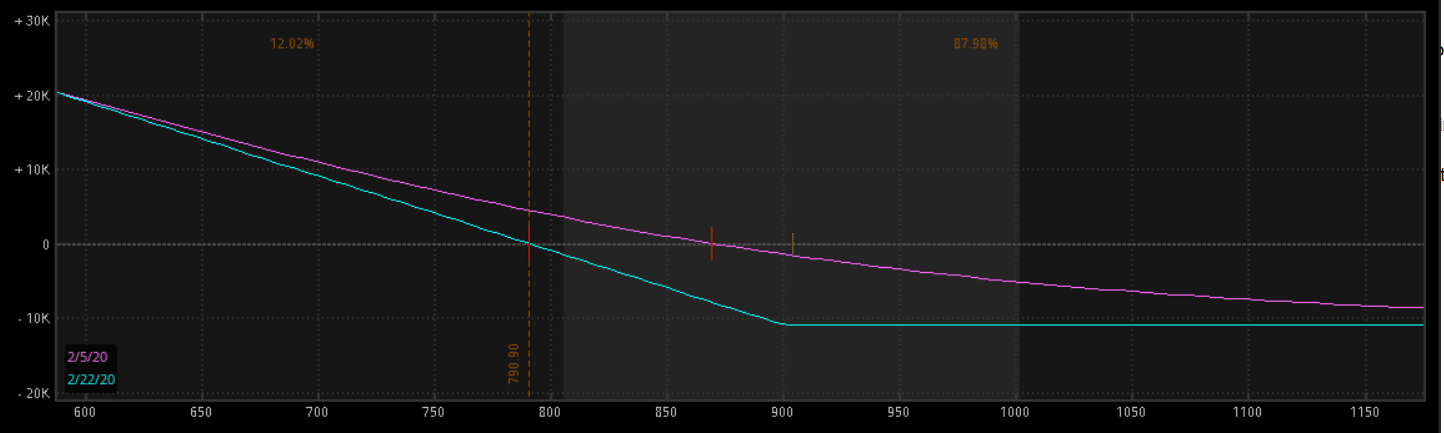

First, let’s take a look at the risk profile for a long put option.

TSLA 1 x 21 Feb 20 900 Put @109.05

Max Loss = Cost of option

Max Loss = $10,905 / contract

Breakeven = 900 – 109.05 = 790.95

And this is the risk profile for the put option.

Source: Think or swim

Source: Think or swim

This means that TSLA would have to fall to 790.95 before expiration just to not lose on this trade!

And you don’t even make any money even though you picked the direction correctly!

In other words, TSLA would need to sell off more than 10% before you realize profits.

Now I know you are shocked. I know I am.

And you are probably thinking… how does this happen!?

Well, this is a great example of how Implied Volatility impactings the options pricing.

1 – Credit Call Spread

Instead, let’s use something called a Credit Call Spread to take advantage of overpriced call options and avoid the trap of buying overpriced put options.

What does this trade look like…

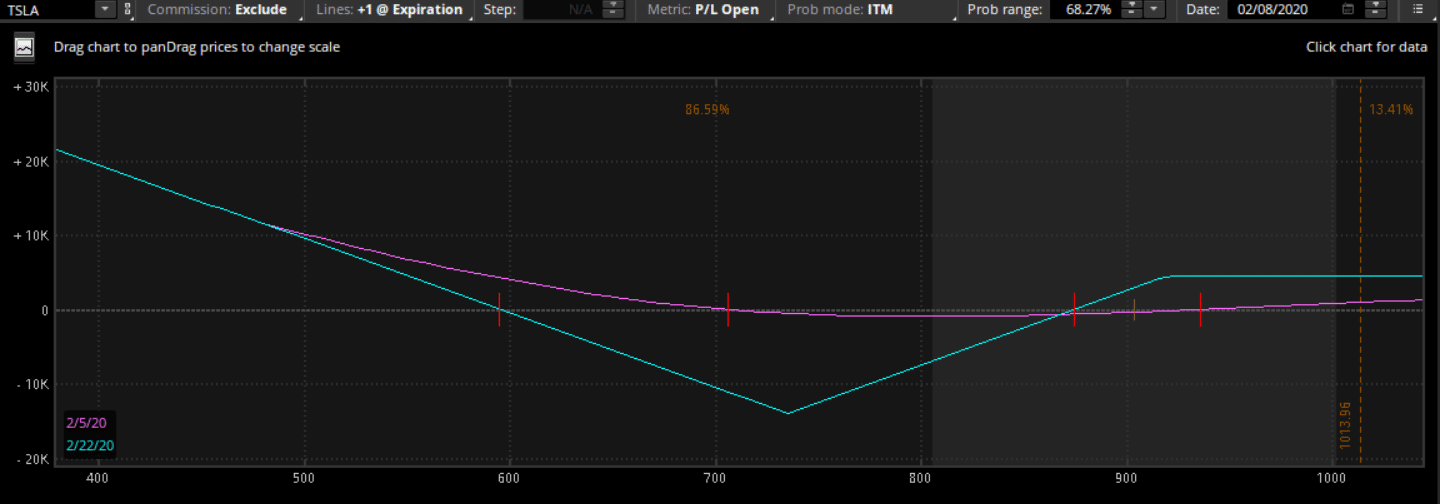

The spread:

Buy 1x TSLA 21 FEB 20 1100 CALL @ $47.90

Sell 1x TSLA 21 FEB 20 1000 CALL @ $62.00

Max Profit = $1,410

Break even = $1,013.96

Source: Think or swim

Source: Think or swim

Here is the option risk profile for the TSLA credit call spread.

As you can tell, we will begin collecting income without any price movement.

Why?

Well the way credit spreads are designed, they allow traders to capture profits if the stock goes up slightly, stays neutral, or turns bearish.

This way, if TSLA experiences a sell off at any size, you will be making money. Whereas the put buyer would need TSLA to drop over 10% or further to get back to breakeven.

2 – Credit Bear Ratio Spread

This is a more advanced trade strategy, but it allows for a trader to have their cake and eat it too.

The Credit Bear Ratio Spreads will let a trader receive a credit for the trade if the underlying stock stays neutral to bullish.

In the event of a massive sell-off, the trader will have unlimited downside profits.

And for the “middle” of the chart, depending on how fast the stock sold off, you may never realize the max loss as increased implied volatility will keep your losses under control.

The trade:

Sell 1 x TSLA 21 FEB 20 920 put @ 110.20

Buy 2 x TSLA 21 Feb 20 735 put @ 32.55

Payoff:

If the stock stays neutral to bullish, you will receive max credit on the spread

Max credit profit = $45.10 per contract

Max loss = $139.00 per contract

Max Profits = unlimited

Source: Think or swim

Source: Think or swim

Wrapping up

Shorting stocks can be one of the most exciting parts of trading… and also the most dangerous.

As a trader, how do you keep yourself safe and still participate in a high profile trade like this?

In order to do so, safely, it’s best to learn how to use bearish options strategies .

By following the two examples of credit spreads, you will have a more safe way to capitalize on a short TSLA trade than selling stock.

Also these two examples are great ways to turn Implied Volatility (IV) to work in your favor and also allow you to get paid to place the trade!

To learn more about credit spreads and how to harness the power of options without spending an arm and a leg…

0 Comments