Many times when you hear about stock traders, they fall into two categories…

The investors and the day traders.

You see, both of these make money but in different ways.

These traders are betting on a direction of a stock based on news, technical analysis, or other pieces of information they have to trade from.

But I don’t care about that stuff

Instead, I care about steady income streams, 75% or higher returns, and a high probability of winning

I care about what the smart money is doing… and by doing this, I’ve been able to rake in consistent profits week over week, month over month, and year over year.*

And I don’t spend more than 10 minutes a day trading and researching my stocks.

For me, trading is a business, just like a coffee shop or grocery store…

But the difference between these companies is I am selling stock insurance.

And with this strategy I’m able to consistently return 50% or more in profits each and every month!*

Still don’t believe me?

I just closed out a position in AAL for nearly 100% gains!

But if you were to trade the stock, you only achieved a lousy 10% on that same position!

So, just give me 2 minutes and I will show you what you’re missing out on in order to step up your trading to bring in steady income week over week and month over month!*

Options Profit Planner

I know you are already nervous about trading options, but I promise you they are not as dangerous as you might have been warned about.

The reality is this…

If you trade your positions with the proper risk management techniques in mind, options are just as safe as any stock trading can be.

In fact, I actually believe that option trading is safer than stock trading.

And what I really love about trading options?

It’s the fact that when a stock trades sideways leaving a stock trader hopeless for profits, I can reel in a cool 100% ROI on my trade without breaking a sweat.

And it’s that feature that is built into every option that makes them perfect for income-style trading.

Now before I go ahead and tell you my most recent winner that I just locked in for some sweet 100% gains, let’s review the basics of options and how they are designed exactly for the way I trade.

Options 101 – The Basics

Options come in many different flavors depending on the strategy the trader wants to use that day.

Without boring you with the endless possible trades you can make, here are the ones that I always turn to.

My go-to strategies:

- Short Put

- Short Put Spreads

- Short Call Spreads

And for me, I found that I need to be selling credit spreads that generate income for my trading business

I knew that casinos and successful traders have a well-defined edge in the markets, and I knew that I had to find the same thing for myself.

So let me ask you these three questions:

- Do you like to generate income for your business?

- Do you want to own a business with the odds of success the same as the casinos?

- Do you need to work part time and want to earn full time returns?

If you said yes to any of these questions, then trading weekly credit spreads is the strategy that you need to start to leverage for your trading business.

Credit Spreads involve selling a high-premium option while purchasing a low-premium option in the same class or of the same security, resulting in a credit to the trader’s account.

While most options traders are focused on debit spreads, this strategy gives traders a unique advantage when trading credit spreads.

The Short Put

One of my favorite trades to place is a Short Put Credit Strategy.

But you see, this is not a trading strategy for the faint of heart.

When trading a short put option strategy, the investor is betting on the fact that the stock will rise, fall (slightly), or stay flat until the option expires. If the put expires worthless, or out of the money (OTM) then the trader is able to keep the entire premium.

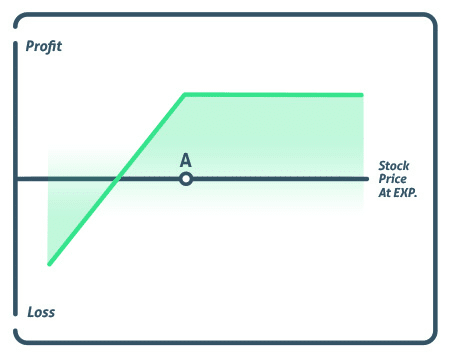

Here is a sample payout diagram on a short put strategy.

Why do I sell puts?

Selling a put option is important for me because it allows me to generate income by collecting premium from the buyers who are betting the stock will fall.

And by using this short put strategy, the trader has to buy the shares of the underlying stock only if the price falls below the strike sold causing the options to go In the Money (ITM)

Now I love trading short puts as they generate some of the highest available premiums.

So let’s take a look at some of the basic risk parameters on this strategy.

Profit / Loss

Maximum Profit = Net Premium Received

The max loss for a short put strategy is limited to the stock going to $0 which is extremely unlikely.

Breakeven

The breakeven on a short put option is calculated by subtracting the premium from the strike price.

If a stock is trading at $100 and an investor wants to sell a 90 strike for $2.0, then the breakeven is $88.

Simple right?

Now if you aren’t thrilled about the “unlimited” loss, let’s take a look at the next strategy, a credit put spread that keeps your losses limited to a specific amount.

Credit Put Spreads

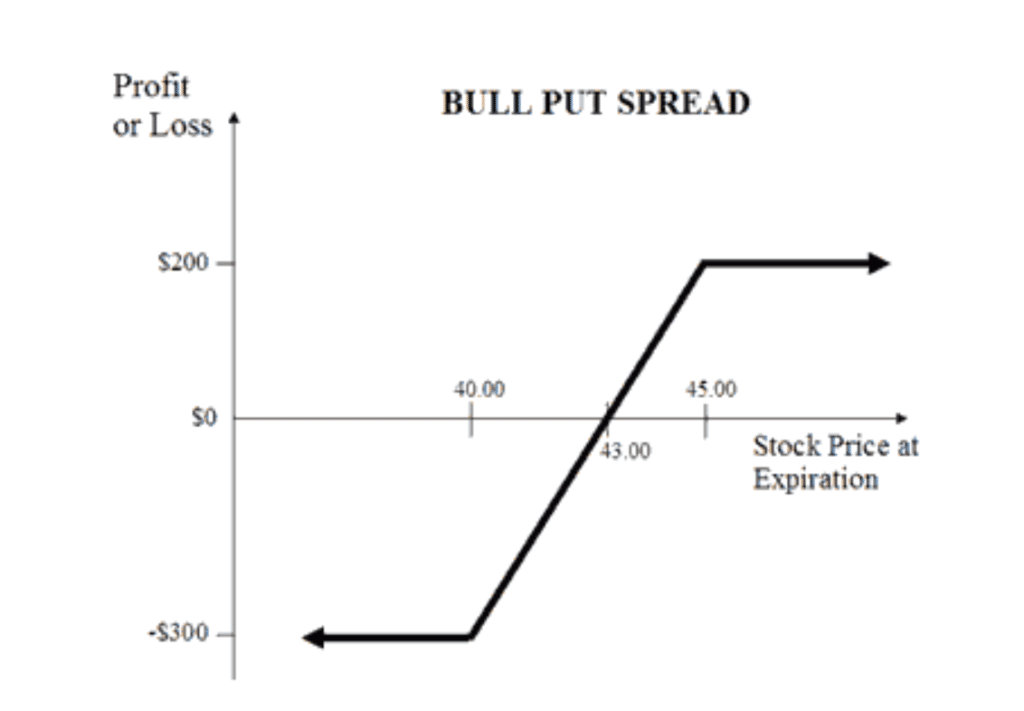

The bull put spread option trading strategy is employed when the options trader thinks that the price of the underlying asset will go up moderately in the near term. The bull put spread options strategy is also known as the bull put credit spread as a credit is received upon entering the trade.

Bull put spreads can be implemented by selling a higher striking in-the-money put option and buying a lower striking out-of-the-money put option on the same underlying stock with the same expiration date.

Max Profit

If the stock price closes above the higher strike price on expiration date, both options expire worthless and the bull put spread option strategy earns the maximum profit which is equal to the credit taken in when entering the position.

The formula for calculating maximum profit is given below:

- Max Profit = Net Premium Received – Commissions Paid

- Max Profit Achieved When Price of Underlying >= Strike Price of Short Put

Limited Downside Risk

If the stock price drops below the lower strike price on expiration date, then the bull put spread strategy incurs a maximum loss equal to the difference between the strike prices of the two puts minus the net credit received when putting on the trade.

The formula for calculating maximum loss is given below:

- Max Loss = Strike Price of Short Put – Strike Price of Long Put Net Premium Received + Commissions Paid

- Max Loss Occurs When Price of Underlying <= Strike Price of Long Put

Credit Call Spread

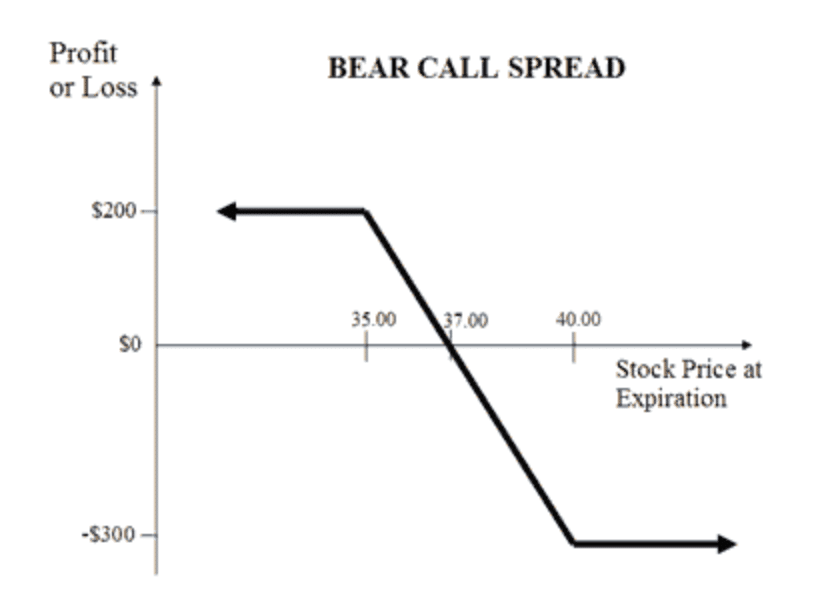

The Credit Call Spread (or Bear Call Spread) is a bearish to neutral options trading strategy.

It aims to capitalize on both downward price movement of the asset and theta decay.

Credit call spreads work extremely well in both directional and sideways markets as the options will expire worthless at the end of the trade, leaving the premium for the trader to collect on.

What does that mean exactly?

It means that you receive the cash upfront!

That’s right, you get paid to take that trade!

Another huge benefit of this trade is that it has a lower max loss compared to selling calls and even purchasing put options.

As a seller of options, we can still make money even in a sideways market!

This is such a great strategy since it allows me to trade a short call and have a max loss on the trade.

A credit spread like this is a must to capitalize on premium decay … and this strategy helps to reduce the impact of implied volatility and incorrect market direction on a trade.

Now let’s take a closer look at the details of using this strategy and what to expect from it.

Credit Call Spreads – The Details

Remember , the goal is to profit from a neutral to bearish price action in the underlying stock while minimizing the impact of volatility and time decay.

What is this made up of?

This strategy consists of one short call with a lower strike and one long call with a higher strike.

Max Profit

The bear call spread is a net credit received, and you will get paid up front to take this trade. If the stock closes below your lower strike, you will be able to keep your entire credit received.

The potential profit is limited to the net premium received from placing the trade.

Max Profit = Net credit received

Max Risk

The maximum risk on this trade is limited, unlike naked calls, or short stock.

The maximum risk is calculated as the difference between strike price minus the net credit received.

Max Risk = strike higher – strike lower – net credit received

The maximum risk is realized if the stock price expires at or above the long call at expiration.

Breakeven

Like trading most trading strategies, there’s a breakeven that a trader needs to consider on this trade.

Dreakeven = strike price -the short call + net credit received

Now that you know these three basic calculations, let’s take a look at some of the factors that impact this strategy.

Wrapping Up

Option sellers take maximum advantage of the option time decay theory, commonly known as Theta Decay.

OTM options lose value quickly and become worthless at expiration.

This allows traders to not have to worry about correctly predicting the market direction or timing the market perfectly to generate income.

Option sellers can take advantage and be the house with odds in our favor on every trade

Don’t forget that an option buyer needs to be right about direction and time!

Key Points:

- Credit Call Spreads profit if the stock goes down, stays the same, or goes up

- Limited risk vs naked calls

- Puts the house odds in your favor

- Allows you to get paid to take risk on a trade

0 Comments