There are several ways a trader can go short the market…

They can:

- Sell stock

- Buy puts

- Buy a bear ETF

- Buy a volatility ETN

But you know what?

Each strategy has its limits…

And whenever you short something…

You better be aware of your risk exposure…

That’s why I utilize a better strategy to get short…

One that is safe and yields some amazing results.

Options Profit Planner

Options Profit Planner is focused on the use of technical analysis and Fractal Energy but there’s a handful of trading strategies that still need to be studied.

Typically if a trader is interested in going short and using the options markets, the first thing that comes to mind is to purchase a Put.

A purchase of a put option does two main things for a trader. It allows a trader to benefit from the decrease in the price of the asset and it limits or decreases the amount of loss they may incur.

This is much less risky than shorting the underlying asset and the trader can use the leverage of options to increase their gains as well.

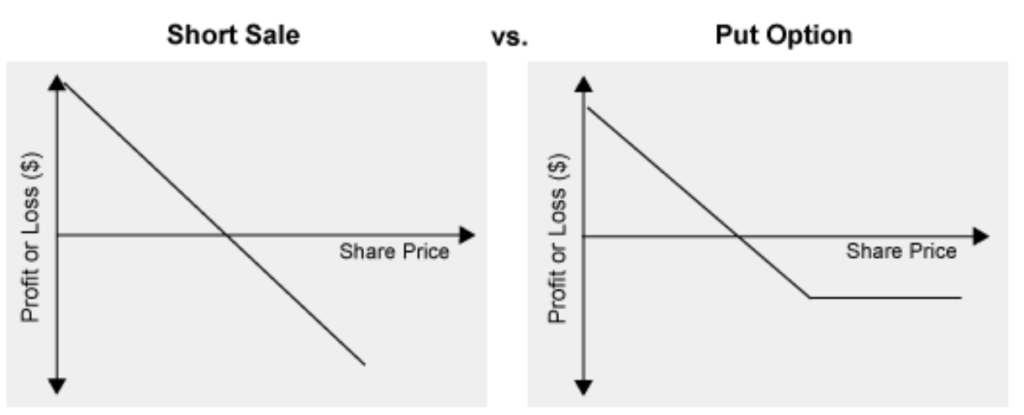

Here is a payout diagram for both a short stock and put option.

The diagram on the left shows a traditional short sale of a stock. With this, there is an unlimited loss as the share price increases!

The diagram on the right shows the purchase of a put option. With this, there are limited losses as the share price increases!

Pro Tip: If you want to short a stock and you are aggressive with the direction, buying at the money puts gives you the most bang for your buck.

So what’s the benefit of using this strategy?

- There is limited risk if you get the trade wrong

- There is unlimited upside gains if you get the trade right

Now… there is something I must remind you of…

If you are wrong on the timing, your options may expire and you will still lose the trade.

And a solution is a strategy called a Credit Call Spread.

The Short Call

An alternative to buying a put is to sell a call.

This is usually described as a “naked call” and is one of the most terrifying trades anyone could place. Just ask one of the many hedge funds that blew up from this trade.

It works… until it doesn’t.

Why?

Because unlike naked puts, the naked call strategy has unlimited upside risk potential.

The Credit Call Spread

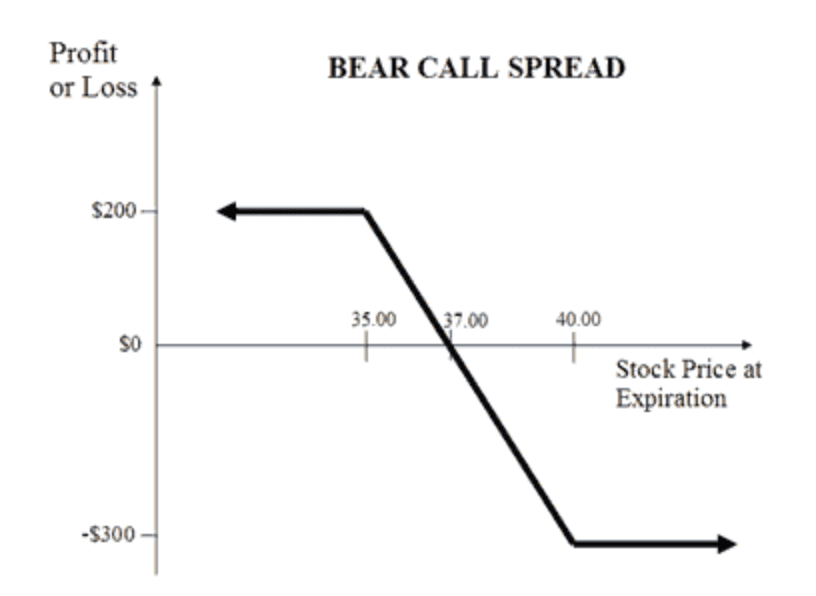

The Credit Call Spread (or Bear Call Spread) is a bearish to neutral options trading strategy.

It aims to capitalize on both downward price movement of the asset and theta decay.

Credit call spreads work extremely well in both directional and sideways markets as the options will expire worthless at the end of the trade, leaving the premium for the trader to collect on.

What does that mean exactly?

It means that you receive the cash upfront …

That’s right, you get paid to take that trade!

Another huge benefit of this trade is that it has a lower max loss compared to selling calls and even purchasing put options.

As a seller of options, we can still make money even in a sideways market!

This is such a great strategy since it allows me to trade a short call and have a max loss on the trade. This is a must to capitalize on premium decay and also market direction on the trade.

Wrapping Up

Option sellers take maximum advantage of the option time decay theory, commonly known as Theta Decay.

OTM options lose value quickly and become worthless at expiration. This allows traders to not have to worry about correctly predicting the market direction or timing the market perfectly to generate income.

We can take advantage and be the house with odds in our favor on every trade

Don’t forget that an option buyer needs to be right about direction and time!

There are many ways to make money in this market and selling options is one of my absolute favorite go-to strategies.

Key Points:

- Credit Call Spreads profit if the stock goes down, stays the same, or goes up

- Limited risk vs naked calls

- Puts the house odds in your favor

- Allows you to get paid to take risk

0 Comments