Maybe you’ve already dabbled in the world of options

Or perhaps options are even a brand new concept to you.

But no matter who you are, you can benefit from one of the most successful income options trading strategies ever created

So ask yourself, why did you want to become a trader?

Is it for the lifestyle of traveling the globe? Or is it the dream of having a second stream of income to support your family?

As an already successful entrepreneur and business owner, I needed to support my family and continue to grow my sources of income in new ways.

Which is exactly why I wanted to have a stock market rental property income stream.

And that’s why I invested in learning about option trading strategies and how to generate steady and consistent income that I could rely on.

You see, by following a strict set of rules I am able to confidently return a steady income with the odds of success far higher than any other trading strategy I could find.

And when I mastered these basics I was able to return nearly 100% on my trades month over month for steady income*!

Stock Market Rental Property

Selling options for income is much easier than you might think…

You see, it’s one of the few strategies where you can be wrong about the direction a stock trades in and still win.

Warren Buffet, one of the most successful investors of our time, actually uses this time-tested strategy to generate income for his funds.

And although this strategy is easy to understand and easy to execute each week… there are a number of basics you should understand before executing the first options trade.

[ Want to learn more about trading credit options ASAP? Check here to get the Options Profit Planner Guidebook today and start trading options in your spare time ]

What Is An Option

Let’s consider what the word ‘option’ means.

In our everyday life, an ‘option’ is a decision, or choice you can make about everything you do.

And it works similarly when you’re talking about investments.

An option is just another type of security, like a stock.

When you’re investing, an option gives you the opportunity to buy or sell a stock at a certain price on or before a specific date.

Essentially, you are buying the option to buy or sell an underlying stock at a certain price.

And there are two types of options you can trade:

- Call options

- Put options

Depending on which one you chose to trade, you will have the right to either buy or sell an underlying stock at the strike price of that option.

Call Options

A call is a type of option that offers the right (but not the obligation) to buy an underlying stock at a certain date for a specific price.

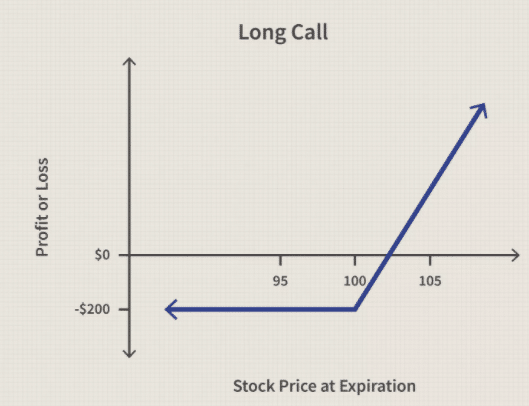

If you buy a call option, you are expecting the value of the underlying asset to increase in price.

Without getting into the option pricing models on exactly how a call is priced to the trader, it’s better to understand what the payout of a long call looks like.

But what you don’t realize is that currently this stock is trading at $60… which means the trader is almost guaranteed to lose money on this trade.

Why?

Because the odds of the underlying stock ralling by 65% or more before expiration is extremely unlikely.

So gambling on call options is not an income generating strategy.

Instead, a trader would want to consider selling a put option.

Now before we discuss a short put as an alternative to a long call, let’s take a look at what a put option is.

Put Options

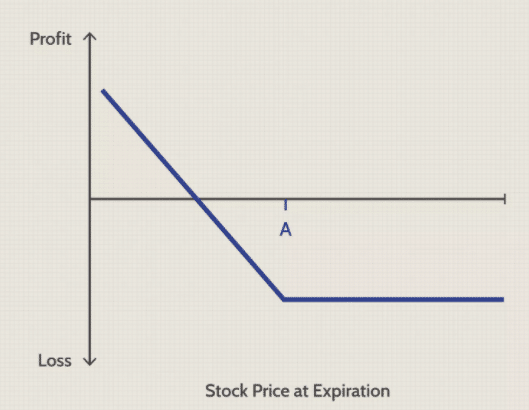

A put is an option that offers the right but not the obligation to sell an underlying stock at a certain date for a specific price.

If you buy a put option, you are expecting that the underlying stock is going to decrease in price. This means you are able to sell a stock at a higher price even if it’s worth less at the date of exercise.

Without getting into the option pricing models on exactly how a put is priced to the trader, it’s better to understand what the payout of a long put looks like.

Similarly to a call option, the long put option is a strategy at which the trader (gambler) will bet on the future price of the asset.

In this case, the trader is expecting the value of an asset to decrease over time and is going short the stock without having to hold the underlying stock.

For someone who is trading short a stock, this is a far safer bet than shorting stock directly because of the capped risk to the upside compared with stocks.

So gambling on put options is not an income generating strategy.

Instead, a trader would want to consider selling a call spread to get short a stock to allow them to generate income on their position.

Why Does Warren Buffet Use Options Income Strategies

One of my favorite credit option trading strategies is a put-selling strategy.

A credit put strategy is one of the most effective options income strategies you can trade.

Even the most famous investor in the world, Warren Buffet, uses a credit put strategy for his own funds. And Buffett made huge sums of money in the wake of the 2008 financial crisis using options to generate income on top of buying stocks.

Not only did he buy stock directly when he felt the stock was undervalued, Buffet also sold options when the options were overvalued.

Selling overvalued puts allowed Buffet to rake in large premiums from his buyers trying to buy downside market insurance.

This effectively made Buffet a stock market insurance provider.

How To Trade Short Put Options As An Income Generating Strategy

Trading short put options for income is a relatively simple strategy if you have the basics covered.

But keep in mind that you should only execute this strategy if you’re ready to own the shares of the underlying stock you’re selling the options for.

Let’s say I am interested in buying GS at $180 but it’s currently trading over $200 per share today.

Source: ThinkOrSwim

Of course I won’t buy it at this price but if it came back down to $180, maybe I would like to own the stock.

So instead of waiting, I will want to sell a 180 Put option for GS for $12.

What does this trade look like?

Source: Thinkorswim

As you can see, as long as GS stays above $180, I will be able to collect the full premium on this trade.

And if the price falls below $180, I’ve already established that I would be happy to purchase shares at $180. If the price is $180 or above by 16 Apr 21, I will get to keep $12 per share premium.

This means that GS could remain unchanged or even drop nearly 15% and I will still make money!

The key to this strategy is that I want to own the shares when they are less expensive… and I am willing to receive income if the price does not drop to my entry level!

The best part of this strategy?

It’s a win-win!

Whether I buy the stock at a reasonable price or keep the premiu, from the buyer who is buying insurance, I will get something I want at the end of this trade

Recap: Make Money Selling Puts

Selling puts allows you a unique opportunity to set the strike price of a stock at what you would like to buy it for.

Selling puts is even more attractive than selling covered calls or call spreads because you do not have to post the capital needed to purchase shares or spend money buying upside protection.

But there are a few steps you should take before selling puts:

- Be sure to find a stock you actually want to buy! [I like to use a credit strategy stock scanner to find the best stocks to own]

- Always decide on an entry price you would be comfortable buying the underlying stock for. Be careful to understand a stock’s fundamental and technical levels first before placing your trade.

- Evaluate the Fractal Energy on higher time frames to determine the future outlook of the stock

- Set risk parameters as a backup in case you need to exit the trade.

And once you have understood the basics of put options and how to sell a put for income and stock ownership – you’ll be on your way to selling options for income generation in no time!

A Credit Strategy To Generate Income And Go Short The Stock

Now, there are times when short puts are not the right answer, and a trader needs to go short a stock.

Instead of selling calls, a trader would want to sell a credit call spread instead to remain protected to the upside.

So let’s review what a credit spread is and how you could use these to trade for income.

What Are Credit Spreads

Credit spread strategies make you money while debit spread strategies cost you money.

And when you are a business owner, you want money coming in every month consistently.

A credit spread involves selling a high-premium option while purchasing a low-premium option in the same stock and option type.

A debit spread involves purchasing a high-premium option while selling a low-premium option in the same stock and option type.

There are 4 types of credit strategies, with 2 single-legged and 2 multi-legged options.

The two multi-legged options are:

- Short Put

- Covered Call

- Credit Call Spread

- Credit Put Spread

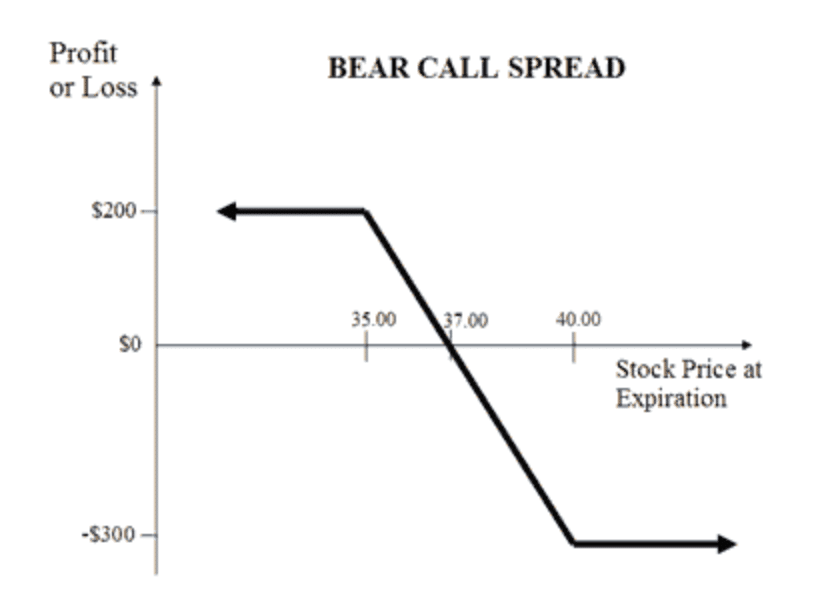

If you want to short the market without selling stocks or buying puts, you should trade the Credit Call Spread trading strategy.

The Credit Call Spread (or Bear Call Spread) is a bearish to neutral options trading strategy.

It aims to capitalize on both downward price movement of the asset and theta decay.

Credit call spreads work extremely well in both directional and sideways markets as the options will expire worthless at the end of the trade, leaving the premium for the trader to collect on.

What does that mean exactly?

It means that you receive the cash upfront!

That’s right, you get paid to take that trade!

Another huge benefit of this trade is that it has a lower max loss compared to selling calls and even purchasing put options.

As a seller of options, we can still make money even in a sideways market!

This is such a great strategy since it allows me to trade a short call and have a max loss on the trade.

A credit spread like this is a must to capitalize on premium decay … and this strategy helps to reduce the impact of implied volatility and incorrect market direction on a trade.

Now let’s take a closer look at the details of using this strategy and what to expect from it.

Credit Call Spreads – The Details

Remember , the goal is to profit from a neutral to bearish price action in the underlying stock while minimizing the impact of volatility and time decay.

What is this strategy made up of?

This strategy consists of one short call with a lower strike and one long call with a higher strike.

Let’s review the max profits, max losses, and breakeven of these trade strategies.

Max Profit

The bear call spread is a net credit received, and you will get paid upfront to take this trade. If the stock closes below your lower strike, you will be able to keep your entire credit received.

The potential profit is limited to the net premium received from placing the trade.

Max Profit = Net credit received

Max Risk

The maximum risk on this trade is limited, unlike naked calls, or short stock.

The maximum risk is calculated as the difference between strike price minus the net credit received.

Max Risk = strike higher – strike lower – net credit received

The maximum risk is realized if the stock price expires at or above the long call at expiration.

Breakeven

Like trading most trading strategies, there’s a breakeven that a trader needs to consider on this trade.

Breakeven = strike price -the short call + net credit received

Now that you know these three basic calculations, let’s take a look at some of the factors that impact this strategy.

Selling Options For Income

Whether you are selling put options or call spreads, the goal of this trading strategy is to generate weekly and monthly income for your trading business.

But my personal favorite trading strategy is a credit put strategy.

Selling puts allows you to win whether the market moves up, down, or sideways at nearly 100% ROI or get to own a stock at a great price, it’s a win-win no matter what happens!

But once you are comfortable with the risks of trading, this is one of the most lucrative option strategies you can learn.

Did you know according to the Chicago Board of Options Exchange (CBOE), selling options is one of the few strategies that outperforms a buy and hold strategy over time!

There are many ways to make money in this market and selling options is one of my absolute favorite go-to strategies.

Click here to stay up to date with my porfilio and what I’m selling for monthly income this week!

0 Comments