Markets raged higher to kick off the last month of 2020, this morning major indices were pulling back…

And while some traders see this as a potential top and want to avoid all this “uncertainty”…

Everywhere I look, there is a trade I can place…

And, in my opinion, if you can identify the right chart matters and understand how to trade credit spreads, it’s possible to find handfuls of trades to take each day.

Now, this is not a time to become complacent with my risk management.

In actuality, I need to be more selective than ever, and I’ve been leaning on Fractal Energy to filter out the noise

It’s my go to strategy that gives me the edge I need to be competitive in this industry.

So I want to show you how valuable having Fractal Energy in your arsenal can change the game for you, potentially.

This Could Be The Perfect Trade

If you are reading this message, chances are you just missed a trade my Options Profit Planner subscribers were part of.

You see, each week I send out trade alerts to my members, and I give them updates to what stocks I’m going to be trading.

And I teach them this strategy I use because it can give them the edge they need to be successful in this industry.

Now, I just closed out what I would consider to be a picture-perfect trade… let me explain

Now, there are two things that I target in this trade… the Fractals and technical indicators for support and resistance.

This allows me to identify the support and resistance levels of the stock to make a determination about how a charged fractal energy will impact the stocks new trend.

In this situation it’s all about the 52-week low and the Fractal Energy.

Why?

Because the 52-week low is a major physiological trading level for every investor and trader. And there are a lot of buyers at these levels, which can cause a stock to reverse direction with a lot of momentum.

And the Fractal Energy is telling me that buyers are piling into the stock as the values climb above 60.

Once I saw this I knew I had to get into the trade.

On Oct 18th 2020 here’s what I sent Options Profit Planner subscribers…

PSX: I sold the Feb ’21 $42.50/40 put spread for $.60. PSX ended the week at $50.58.

And I closed the trade out on Dec 1st 2020

PSX: I will buy back my Feb ’21 $42.50/40 put spread for $.10 or less.

That landed me almost a 90% ROI on this trade…

But, now you might not be all that impressed…

If you bought the stock, you would have only made 15% returns on this trade

And if you bought the call options, you would have lost 100% of their value on the sell off to $43, and closing out your trade for a loss.

You see, selling options really is the safest way to trade options for an income that put the odds of the casinos in my favor.

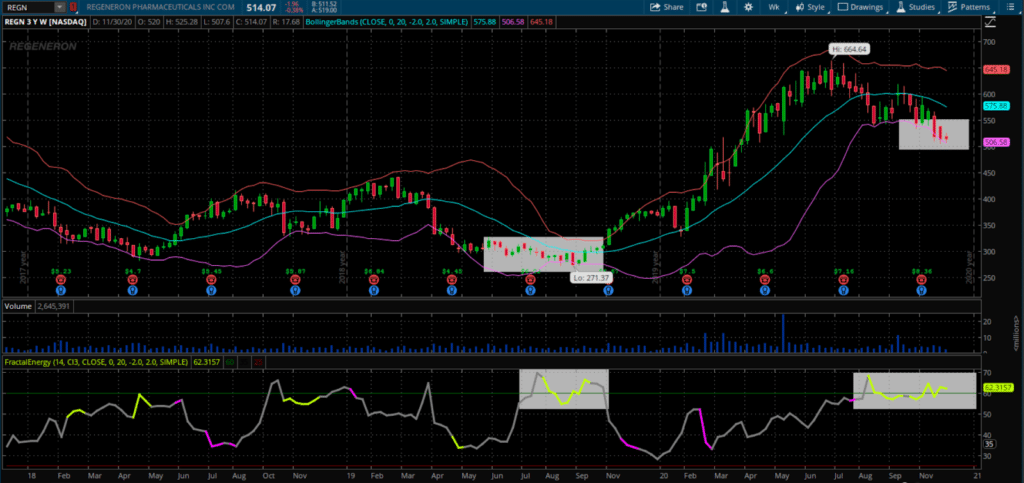

Why REGN Is Setting Up To Be A Perfect Trade

Now that there is a real possibility of a vaccine coming out for COVID in the near future, I’m expecting other biotech companies to start to make breakthroughs in this as well.

And over the weekend, I sent out a list of stocks that I was going to be watching for a possible trade.

One of the trades that hit my list was REGN… and it’s looking like it’s shaping up to be one of my A+ setups

Of course I am not sure what the future is going to bring, but one thing I do know is that I’ve designed a strategy that works for me and will put me on the right side of the trade most of the time.

It’s that edge I need to feel confident in trading the stock market every week.

And for REGN, I saw a few things that signaled the stock was setting up for a huge move

You see, there are two key things I spotted on REGN

Previously, there was only one time where the Fractal Energy got to these elevated levels for a period of time.

This shows me that energy is charging on the stock which means it’s building up the power to have a strong trend

But you see, I don’t necessarily know the direction the trend is going to head in… which is why I turn to technical indicators to give me that heads up

The Bollinger Bands are a frequently used technical indicator that gives me an idea of where the stock wants to head in.

Now the Bollinger Bands act as the ropes in the boxing arena, where they push the stock back into its center.

And that’s why it’s on my radar and possibly one of the two biotechs that I enter into this week.

If you want to find out if I actually ever trade REGN, make sure you sign up here for Options Profit Planner.

And I wouldn’t want to wait too long, because if it’s a stock I plan on trading, you won’t be hearing about it unless you’re a member of Options Profit Planner where you receive my active alerts.

Don’t wait too long – sign up here

P.S. My service Energy Trader has recently launched, and I’ve gone undefeated in this strategy since the first trade… You don’t want to miss out on this opportunity to trade weekly options with sniper accuracy. Click here to sign up now

0 Comments