One thing that I hate is going to the casino and spending money gambling.

There’s no real edge in doing this… it’s pretty much a guaranteed losing strategy.

And if you’re lucky, you might be able to win a couple games or two

… but most likely you won’t win anything consistency

Why’s that?

Because the casinos have the odds stacked in their favor

How do they do it?

Well… let’s take a look

Options Profit Planner

In order for me to put my money to work, I have 3 main requirements:

- Paid upfront for my risk in a stock, I do not want to pay to trade!

- Odds of winning in my favor, I must be the house, not the gambler!

- If I own stock, it must be at a steep discount and I will hold for years if I need to

So, does buying stocks give you those requirements?

No! Actually buying stock doesn’t even give you one of them!

You see, there are many problems with buying stocks instead of trading options.

Let me explain…

The Problem With Buying Stocks

Many beginning traders start with stocks as they are considered to be a single-dimension trading strategy.

This means that if you buy a stock at $50 and the price stays the same for 5 years, you have gained or lost no money.

In other words, trading stocks is a linear relationship, with every $1 dollar change in stock price, you will see a $1 change in your profits or losses.

And if you want to own 100 shares of a $50/share stock, you will have to spend $5,000 to own those shares.

Then what about the average daily expected move? Well, depending on the stock, it might be as high as 5%, or as little as 1%. But the higher cost of a stock, the less it will move on a daily basis.

As a business owner looking to generate wealth in trading, the 1% doesn’t really excite me and is not worth my time to look at.

So that’s why I trade options – since it gives me exposure to a greater quantity of shares in a stock plus bring in a return of 50% – 100% I am seeking on my trades.

And as a seller of options, I can put the house odds to work for me along with a higher chance to return 50% to 100% on my positions.

Selling Options – Being The House

I always choose to sell instead of buying options when it comes to running my stock trading business.

Why?

Because when I sell options I am able to satisfy my 3 main requirements of trading.

- Paid upfront for my risk in a stock – I do not want to pay to trade!

- Odds of winning in my favor over 50% – I must be the house, not the gambler!

- If I own stock, it must be at a steep discount and I will hold for years if I needed

Selling options is a lot like being in a casino. The house has a small but well-defined edge. The long term goal and realize they will sometimes take losses, both small and large.

When correctly utilized, selling options is a sophisticated way of entering into equity trades or generating income for your portfolio.

Let’s take a look at how my options satisfy my trading requirements.

- Selling options allows me to collect income (the credit of the spread) up front.

- Odds of winning are over 60%, since you can win if the stock goes up, down, or sideways.

- Selling options (if assigned on my short puts) allows me to own stock at a huge discount!

So now that it makes a lot of sense to sell options over buying stock, let’s take a look at a couple different ways to trade credit strategies.

Option Credit Trading Strategies

In order to generate steady income, many traders turn to trading short options instead of buying stock.

This is because most options expire worthless and this behavior makes selling options work like running an insurance company.

Since options are risk insurance for option buyers, the option seller holds the responsibility of the “insurance provider”. And for this risk the option seller will charge a premium (the credit on the option) for this risk.

In this article, we are going to focus on the more popular credit trades, the naked put and credit vertical spreads (the credit put spread and credit call spreads.)

Naked Puts

This is the go-to strategy for many option sellers since there is the added advantage of owning stock at a significant discount.

Why trade a short put?

A naked put, or short put, is typically traded when a trader assumes that the underlying security will rise between the time of execution and the expiration date of the option.

The trader will execute this strategy by selling a put option with no corresponding short position in their account. Since there is no additional position, this is considered an uncovered trade, meaning that the trader would be required to own stock if the buyer should exercise their right to the option the seller is holding.

A put option is designed to create a profit for a trader who correctly forecasts the price of the security will fall substantially, past the break-even! But as a put seller, you actually collect revenue on this trade if the option rises, falls, or goes sideways.

If a trader is assigned stock on the short put, the premium collected does somewhat offset the loss on the stock, but the potential for loss can still be substantial. This is why I require a minimum time horizon of 5 years that I require to hold a stock for when it comes to worst-case trade management.

KEY TAKEAWAYS:

- A naked put is an option strategy that involves selling put options.

- When put options are sold, the seller benefits as the underlying security goes up, down, or sideways in price.

- Naked refers to an uncovered position, meaning one that has no underlying security associated with it.

- The risk of a naked put position is that if the price of the underlying security falls, then the option seller may have to buy the stock away from the put-option buyer.

Credit Vertical Spreads

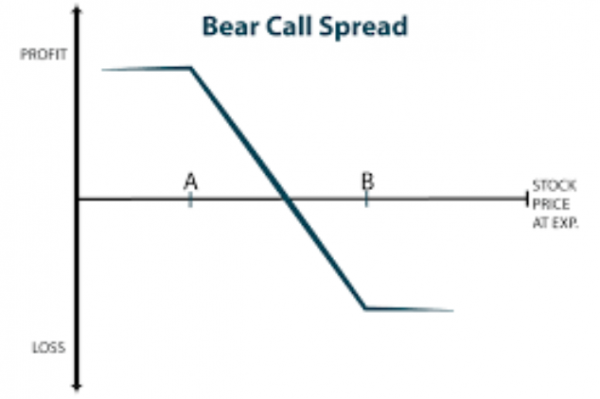

Credit Call Spread

A credit call spread is a type of credit option strategy that is used when a trader expects a decrease in the value of an asset.

The credit call spread is equivalent to going short the stock, except there is no unlimited risk potential.

The credit call spread is placed by simultaneously purchasing a call option at a higher strike price and selling a call option at a lower strike price in the same expiration month.

This is considered a limited-risk trade since the selling of the call option is covered by the purchasing of a higher-strike call option.

Risk parameters of a Credit Call Spread are:

- Max Gains : Net premium received

- Max Loss : High strike – Low strike – Net premium received

- Break-even : short call strike + net credit received

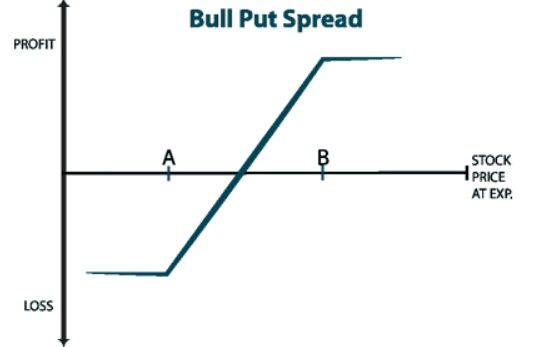

Credit Put Spread

A credit put spread is a type of credit option strategy that is used when a trader expects an increase in the value of an asset.

The credit put spread is equivalent to going long the stock, except there is no unlimited risk potential.

The credit put spread is placed by simultaneously purchasing a put option at a higher strike price and selling a put option at a lower strike price in the same expiration month.

This is considered a limited-risk trade since the selling of the put option is covered by the purchasing of a lower-strike put option.

Risk parameters of a Credit Call Spread are:

- Max Gains : Net premium received

- Max Loss : High strike – Low strike – Net premium received

- Break-even : short put strike – net credit received

Pros vs. Cons

Depending on the type of trader, there are many benefits to both buying and selling options. There are many different option strategies to choose from and each has unique risk associated with it.

Pros to selling options

Smooth Return Stream

Selling options is one of the most reliable and stable sources of returns in the markets.

Premium selling strategies tend to have extremely high win rates and are a great way to grow trading capital over time.

Winners Mentality

Most traders tend to feel better when they are winning rather than losing. This makes sense that traders would benefit from a system that has them winning a high percentage of trades.

This boosts confidence and leads to less “second guessing” the trade. This confidence tends to lead to smaller losses compared with traders who are buying “lotto tickets”.

Cons to selling options

No “Grand Slam” trades

Selling options tends to be “singles and doubles” type of trading. The knowledge that a big grand slam is right around the corner keeps traders coming back to their screens every day, waiting for that huge opportunity in the markets.

Unfortunately, option sellers won’t have this rush of excitement like hitting it big at the casino.

Potential of large losses

Another huge negative is the potential for large losses. While this is a remote possibility, it does still exist depending on the underlying security traded.

Traders can mitigate their risk to large losses by trading credit spreads rather than naked options. This is the “best of both worlds” as the trader can play the house odds while maintaining a controlled and limited risk profile for their account.

Final Words

To summarize, premium selling is known to generate a wildly profitable and extremely smooth equity curve.

- There is the risk of an occasional large loss, but this is mitigated with the use of credit spreads instead of naked options.

- The return of a premium selling options book is that of a mean reversion stock trading system, with a large number of small wins with the occasional ‘fat tail’ trade.

- Selling Naked Puts is one of my favorite strategies since it allows me to purchase stocks at a discount and get paid doing so!

0 Comments