Have you ever been stuck in a trade that went against you just to wish you have never taken it in the first place?

You know what I mean… when you’re staring at your screen in disbelief, just watching your position move against you…

As a stock trader, you are left with few choices… you could double-down your trade and hope for the best, or close out your trade.

But as an options trader you could turn a losing trade into a profitable one with just one trade.

And unlike other debit strategies, selling an iron condor puts cash into your account right away.

Then if it goes in your favor, you could keep all of that credit.

So let’s review exactly what an iron condor is and how you can use it in a variety of market conditions… and also a way to turn that losing trade into a winner.

The Iron Condor

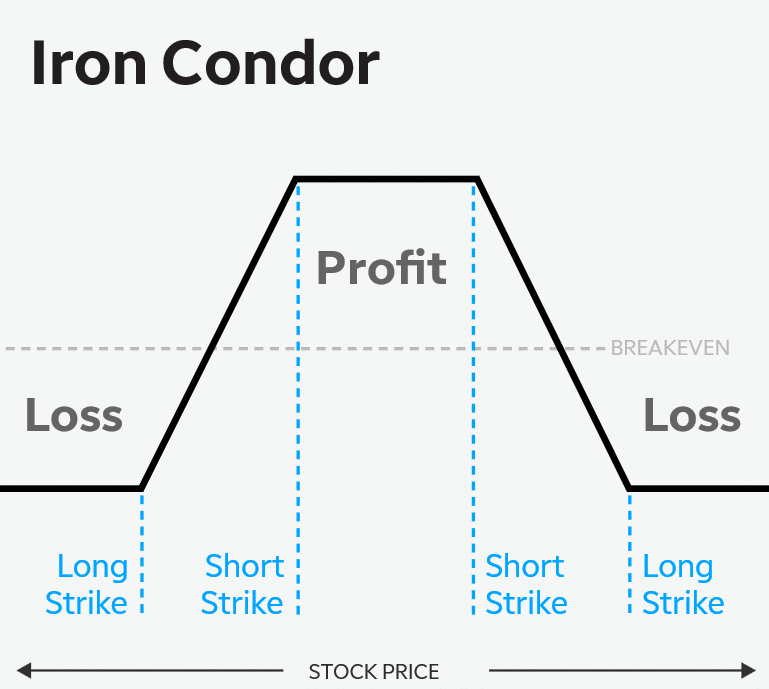

An iron condor is an options strategy created with four options…two puts (one long and one short) and two calls (one long and one short).

This strategy uses four strike prices, all with the same expiration date. The goal is to profit from low volatility in the underlying asset.

An iron condor is essentially just the combination of a bull put spread and a bear call spread.

And since each spread of the iron condor is a net credit, this trade is considered to be a net credit and you are paid up front for this position.

The goal is that the underlying doesn’t move much around the strikes you selected, and then the options expire worthless.

And when the stock didn’t move this would allow you to keep the money you earned from the iron condor position.

What’s an Iron Condor?

It sounds fancy but it is actually very simple. An Iron Condor is really a combination of two basic option spreads.

An Iron Condor is created by combining an out-of-the-money (OTM) short put spread (bullish strategy) with an OTM short call spread (bearish strategy).

It is important that you are using options that expire on the same date.

By selling two different OTM vertical spreads, you will collect the premiums from both sides of the trade.

There are two outcomes possible:

- If you are wrong? The profits from one spread will offset the loss on the other.

- If you are right? You can ring the register on double the profits!

The Iron Condor – Risk Profile

Let’s take a look at an example risk profile for an Iron Condor.

This might look a little strange at first glance, but it is actually very simple.

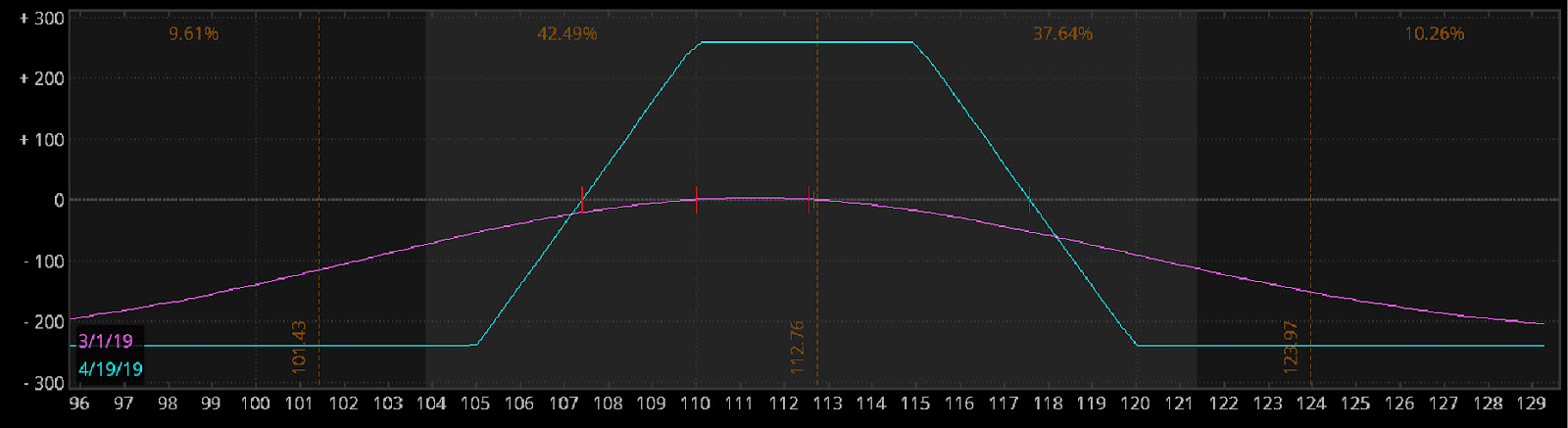

In the chart above, you’ll see a risk profile from a trade earlier in the year.

There is a familiar Credit Call Spread (on the right) and a Credit Put Spread (on the right). Both of these traded at the same time create the 2x profits in the middle.

Separately, this trade only allowed for me to take just about $125 max profit if I was to trade only the Credit Call Spread or the Credit Put Spread.

But when we joined them together, the newly formed Iron Condor allowed me to make a whopping $350 max profit at expiration!

Wait a minute though. Before going out and trading these magnificent option strategies let’s talk about when you should utilize this strategy in the first place.

When To Utilize The Iron Condor

Typically, you want to put on an Iron Condor strategy when you think that the underlying asset is going to be range-bound or have a period of low volatility.

Volatility is simply the term that describes how “active or excited” a stock is. The faster a stock moves, then it’s considered to be more volatile compared to a stock that is slowly moving.

It’s generally best to stay away from stocks that have a higher IV reading when trading an iron condor.

Why?

Because the ideal situation in an iron condor is that the stock trades at about the same point it was when you opened the trade, to ensure all options expire worthless and you keep your max profit.

Now that you know what the Iron Condor is, it’s probably time to understand when to use it.

If you think the market is going to either stay in a tight range or move in a certain direction, then a basic short vertical spread might be the strategy to go with.

If you think the market will stay within a range and you have no directional bias, maybe using an iron condor to bring in additional premium without increasing your dollar risk.

To recap, use an Iron Condor when :

- Volatility is low and you expect the stock to be range bound for a period of time

- To add 2x the profits to a current profitable trade

How Does An Iron Condor Work?

First, you want to identify the stock you are going to be trading and that a range-bound market is projected for the near future.

Next, you want to start by selling an out-of-the-money call and put spread.

To do this, you have 4 simple trades to place

- Sell put below strike price

- Buy put further below strike price

- Sell call higher than strike price

- Buy call further above current strike price

It’s important to make sure that each option has the same expiration date, ideally 30-90 days until expiration.

Pros / Cons of an Iron Condor

Pros:

- Limited risk – Your risk is limited because of using spreads. This means the long/short combination will cover you if the underlying skyrockets.

- Quick cash – One big advantage to a credit trading strategy is that you are able to collect cash right away.

Cons:

- Significant losses are still a possibility when it comes to trading spreads.

- Limited Profits – you are capped to the max profits on the trade from your credit spread.

Wrapping up

Now if you are in the mood for a limited risk / limited profit trading strategy, the one strategy that is hard to beat is the Iron Condor.

But not only is it great for adding profits in a range bound market, it can be used as a lifeline to rescue a losing trade and turning it into a winner.

In fact, I might have to utilize this exact strategy to turn my underwater SPY trade into a winner.

From risk mitigation to capitalizing on sideways markets, there is little that the Iron Condor can’t do that you will need to know

Now to get the iron condor to work for you …

0 Comments